Recently, the UK government introduced a new policy called the “grocery tax.” It has raised a lot of debates. While this tax is aimed at reducing packaging waste. It is a way to help UK achieve its net-zero goals. But it is also true that this new tax will add significant pressure on household budgets. If you’re in India, you might be wondering, “What does this have to do with me?” Well, this kind of policy could inspire similar moves in India as well. As governments around the world look for ways to reduce waste and encourage sustainability, rules like Grocery tax may become a new norm in times to come.

Let me explain what this grocery tax is all about and why it matters.

What is the “Grocery Tax” of UK?

The grocery tax is formally known as the Extended Producer Responsibility (EPR).

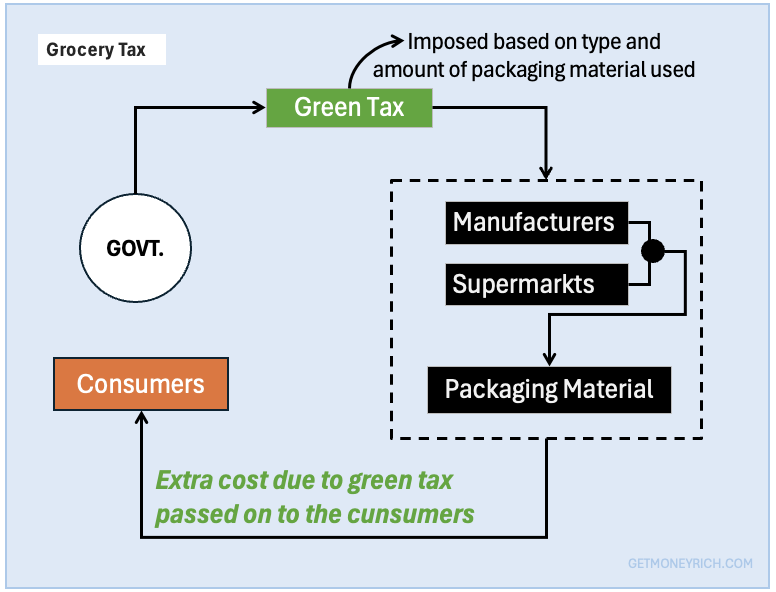

It’s a green tax that will be charged to businesses (like supermarkets and manufacturers) based on the amount of packaging waste they produce.

The idea is simple: the more packaging material a company uses, the more they will pay.

This includes materials like plastic, paper, and cardboard.

For example, if a company uses plastic wrapping for their products, they’ll be charged a higher rate (around £485 per tonne) than if they use paper or cardboard (around £215 per tonne).

These extra costs, unfortunately, are expected to be passed down to the consumers (like us).

It means, the consumer’s grocery bills will likely increase.

How Will It Affect The Shopping Bills?

The government’s impact assessment suggests that this tax will cost UK shoppers an additional £1.4 billion per year.

This will increase household grocery bills by about £28 to £56 annually, depending on various factors.

It might not sound like much at first, but when you consider the overall rising cost of living, this extra cost could add up quickly.

And here’s the kicker: the policy is expected to increase inflation by 0.07%, further adding to the pressure on families.

Now, you might be thinking, “Why should I care (in India)?

This is happening in the UK.” True, it’s not directly affecting us in India… yet.

However, similar policies could make their way to India in the future as sustainability becomes a global concern.

I think it’s crucial to understand these trends because they can impact our investments and personal finances in the long run. What is the learning?

We as citizens must start using how to reduce the usage of plastics, paper packets, etc. Every carry bad that we dispose after first use, let’s take a pledge that we will use it at least 5 times, before disposing. Moreover, we must start using fabric bags. Strive for zero use of plastics.

Why Is the Government Introducing This Tax?

The grocery tax is part of the UK’s plan to tackle net-zero emissions and reduce packaging waste.

Net-zero means that the country aims to balance the amount of greenhouse gases it produces with the amount it removes from the atmosphere.

Reducing packaging waste is a key part of this goal.

By charging businesses for packaging waste, the government hopes to encourage companies to use more sustainable packaging and reduce their environmental impact.

It’s similar to how governments in many countries are imposing taxes or penalties on companies that pollute or harm the environment.

While the goal is admirable, there are unintended consequences, higher costs for consumers and increased administrative burdens for businesses.

Why Is This Controversial?

While the policy sounds good on paper, it has drawn a lot of criticism.

Retailers and businesses argue that these new taxes will push up their operating costs. The British Retail Consortium (BRC) believes that the actual cost of this tax could be closer to £2 billion a year, much higher than the government’s estimate of £1.4 billion.

Businesses also argue that this will make it harder for them to keep prices affordable, which will be passed on to consumers.

In fact, critics say this tax is just another burden on already struggling households.

Inflation has been rising in many parts of the world, and food prices are already at record highs.

For example, in the UK, food inflation has been making headlines. The grocery tax will only make things worse, adding to an already tough financial situation for families.

Conclusion

We must try to understand the long-term consequences of such policies.

On the surface, the grocery tax may seem like a small increase in costs, but it signals a larger shift toward more sustainability-focused policies.

In the long term, these kinds of taxes could start to spread across the globe as more countries push for sustainability.

So, how does this impact you?

- Impact on Businesses: Retail stocks or companies that produce packaging, this policy could affect their profits. Higher operational costs could reduce margins. If businesses pass on these costs to consumers, there will be a slowdown in sales.

- Inflation and Cost of Living: High inflation is something we deal with in India on regular basis. Whether it’s rising food prices or higher transportation costs, inflation hits us all hard. As these policies gain traction in other countries, we might see similar price hikes. Groceries and vegetables rely heavily on packaging, costs of these items will rise.

- Sustainability Investments: These policies are also giving an hint to the investors. This is what the future has in store. Investors must look to explore the green economy. Companies focusing on sustainable packaging, recycling, and waste reduction could benefit from these new regulations.

While the UK’s “grocery tax” is a concern for consumers, it also presents opportunities and challenges for investors.

As countries around the world focus more on sustainability and climate change, we could see similar policies emerge in other countries.

Don’t just think of this as a UK issue. It’s part of a larger global shift towards sustainability. We in India must also try to understand how this tax is affecting people in UK (investments and savings).

Keeping a close eye on such trends is good. It will help us to stay ahead in this evolving world where environmental pollution will take center stage in times to come.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.