I am sure you must also have pondered that which is a better investment, ULIP vs Mutual Fund SIP?

Unfortunately, not much reliable information is available on internet related to ULIP vs Mutual Fund SIP.

In this article, what is presented is more from my personal experience I gathered while dealing with ULIP and mutual fund SIP.

Hence, I think this blog post will clear a lot of cloud for the needy.

One day I called the relationship manager of my bank.

The purpose of the call was varied.

The main intention was to start a Systematic Invest Plan (SIP) for long term investment.

I wanted my relationship manager to suggest me few good funds.

My idea was to start SIP in diversified fund or in a balanced fund.

I shared this with the relationship manager.

When the relationship manager came to meet me, he suggested few best performing mutual funds.

But he also suggested few ULIP’s.

I noted that he was putting more effort to convince me to buy a ULIP.

I was not prepared to consider ULIP for long term investment. I didn’t knew much about the ULIP.

My relationship manager informed me few things about the ULIP.

He told me that ULIP has dual benefits.

It provides life insurance cover plus capital appreciation.

My goal was to invest money for capital appreciation.

So ULIP was providing both, insurance cover and capital appreciation.

So this way, ULIP must be a fantastic product, right?

I was not sure. There was a doubt?

ULIP – the next big thing in investment?

Frankly speaking, the packaging of an insurance product as a capital appreciation vehicle does not blend together.

Insurance products (like term plan and endowment plan) are known for their zero to low returns.

And the products which offered capital appreciation (like stocks, equity based mutual funds) are no where linked with insurance plans.

But here there was a product which was a insurance product and still promising high returns.

The thing that was making me uncomfortable (because I was not properly informed about ULIPs) was the word “insurance”.

Insurance is an insurance, how it can earn me high returns?

To answer this confusion, my relationship manager was ready.

He explained me why a ULIP is referred as a “unit linked plan”.

He said that, as ULIPS are allowed to invest their funds in stock market.

Hence they will be able to give good long term capital appreciation.

This explanation, at that moment of time looked very reliable.

It is true that, as stocks are linked with ULIPs, long term returns can be higher.

This cannot be a hoax.

But I have burnt my fingers with INSURANCE. I didn’t wanted to make the same mistake again.

This is the reason why, in my personal life, I never mix Insurance with Investment.

This was my personal rule. But ULIP was going completely against my rule.

The question was, is my rule outdated? Is ULIP a product that will be the NEXT BIG THING of investment world?

I had no answers to this. Neither my investment manager was more convincing.

I was not ready to accept an insurance product as a long term investment vehicle.

I didn’t want to be rude on the relationship manager.

But without knowing which is better between ULIP vs mutual fund SIP I cannot take the final call.

So I decided to do some fact finding…

The fact about ULIP vs Mutual Fund SIP that I learnt in later days, I thought, was worth sharing with my readers. Hence this article.

I am very thankful that I did my study of ULIP vs SIP.

So lets see one by one what I learned about ULIP….

#1. Liquidity of the invested fund in ULIP vs SIP

A typical equity based Mutual funds provide full liquidity.

Every penny invested to buy equity mutual fund units can be redeemed any time the investor wants.

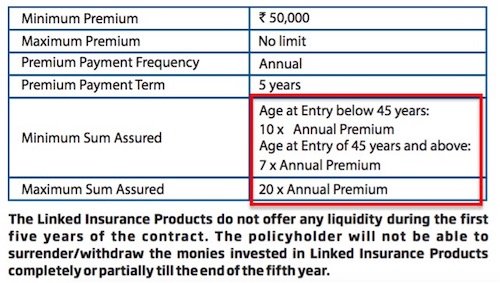

ULIP’s do not provide any liquidity for the first 5 years. What does it mean?

It means, the investor would neither be able to surrender not withdraw his money invested in ULIP.

It means, in ULIP the money is locked for full 5 years.

For a person, who wants to invest for capital appreciation, would certainly like to keep his money invested for 5 years.

But, I should have control over my money.

I will not allow any ULIP Manager to keep MY money locked for 5 years for his benefits.

I will instead, invest my money in a equity based mutual funds. Which is also investing in equity and promises to give same returns.

So, my dear ULIP fund manager, can you please explain why you want my funds to be locked for 5 years?

I know you will tell me blah blah about equity risk and returns.

But my dear friend, this lock-in thing is more prevalent in insurance sector.

If I am not wrong, you are keeping my money locked not giving me higher returns.

But it done to cover your insurance costs in the initial years, right?

I will go for equity linked mutual funds. Bye bye ULIP.

#2. Life Cover provided by ULIP

Mutual funds do not provide life cover, but Ulips provide life cover.

So here, even if I do not like, I must say that ULIP has a distinct advantage.

But for an investor like me, who wants to invest money for capital appreciation, why I should care for life insurance?

Probably I already have a sufficiently big term plan protecting my family.

By the way, how much life cover ULIP’s provide? Is it sufficient?

Lets take my example to understand if the insurance cover provided by ULIP is sufficient or not.

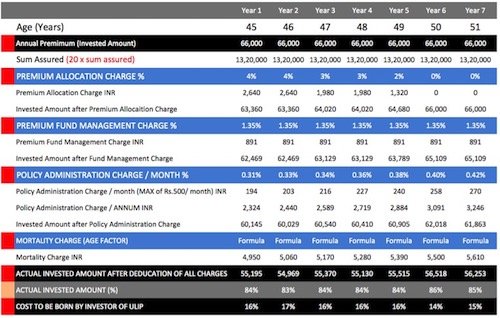

I was interested to invest Rs.5,500 per month (Annual: Rs.66,000) in equity fund as SIP.

Idea was to earn long term capital appreciation.

Lets assume for a moment that I decided to buy an ULIP with annual premium of Rs.66,000.

What will be the maximum cover that I get from ULIP (my age is below 45 years)?

As per the snap shot of a typical ULIP provided above, the life cover that a ULIP will provide will be:

- Minimum: 10 x annual premium = 10 x 66,000 = Rs.06,60,000

- Maximum: 20 x annual premium = 20 x 66,000 = Rs.13,20,000

Lets assume that I happened to get the maximum sum assured as per rules.

But even then, the life cover is only Rs.13,20,000. Is it sufficient?

I will say it is not even one tenth of what is required.

So here, you were trying to sell a ULIP to a person who wanted capital appreciation.

You confused him by saying that, as ULIP also provides life insurance cover, hence it is good.

It have dual benefits, right? But what is the reality?

The life cover is not even one tenth of what I/my family will need.

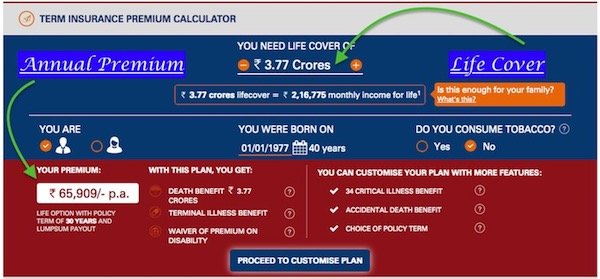

If I would have bought a term plan with annual premium cost of Rs.66,000, I would have got a life cover of close to Rs.3.7 Crore.

I know this is not a fair way to compare a ULIP with a term plan.

But just for the visual understanding I am giving this exaggerated example.

I just want to make not a point that ULIP may not provide sufficient life cover.

#3. Charges/Cost – ULIP vs SIP

I thought I nailed it in point number #1 and #2 itself.

But point number #3 was even more alarming (against ULIP).

I already feeling bad about ULIPs.

When it comes to ulip vs mutual fund SIP, perhaps this is where the MOST DISTINCT difference lies.

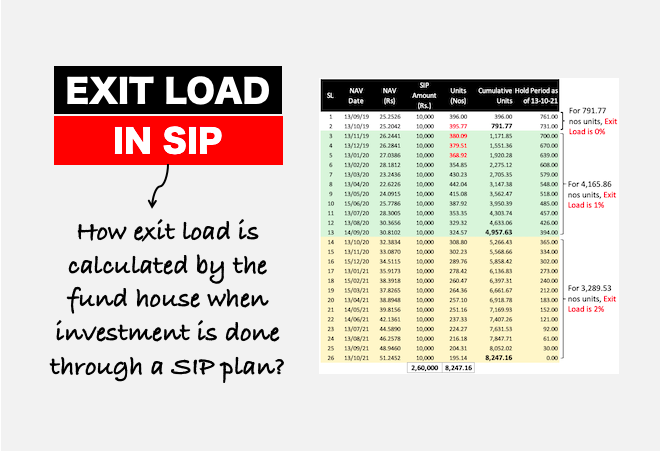

Generally speaking, in a typical equity based mutual fund, the cost for an investor are either:

- (a) exit load-1%(applicable only if redeemed within 1 year) or,

- (b) expense ratio-2.5%(for good, big funds this can even go below 2%).

That is all the cost that our investment will have to bear in equity based SIP’s.

But in ULIP, the cost to an investor was not only huge but also extremely complicated.

Again, this is a typical of an insurance plan.

When I was reading a sales brochure of a ULIP, it was clear, Ok.

But it was long and complicated.

I am not sure why, my relationship manager didn’t tell me about the plethora of charges/costs that was applicable with ULIP.

But thanks to him that he didn’t explain me these costs across the table.

He actually spared himself from seeing a client banging his head on the table.

The list of charges that comes with ULIP are as follows:

- Premium Allocation Charge

- Fund Management Charge

- Policy Administration Charge

- Mortality Charge

- Partial Withdrawal Charge

- Discontinuation Charge

The premium allocation charge is the major.

It is maximum in the initial years and lower in the subsequent years.

Premium allocation charge of a typical ULIP is as shown below:

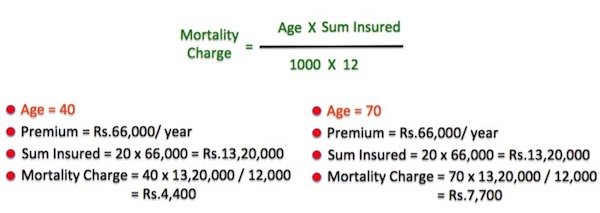

Another charge that has potential to eat away your returns of ULIP is called mortality charge.

In a normal insurance plan, we pay a premium. In case of ULIP, the insurance premium is called as ‘mortality charge’.

The mortality charge will be maximum for an aged person, and it will be minimum for young person.

Hence, all aged people, beware, ULIP is not for you all. Why?

Because mortality charges are deducted from our invested money each month.

A calculated amount / 12 is adjusted each month.

This is done by de-allocating units from your purchased ULIP.

How mortality rate is calculated is shown below:

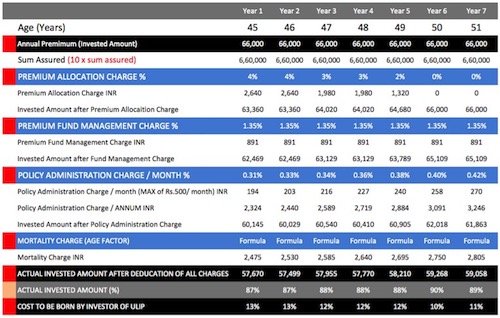

So coming back to our main focus on COST. What is the cost of ULIP?

Remember: mutual funds are much cheaper.

If one stays invested in mutual fund for a period of more than 12 months, the cost will be around 2.5% (expense ratio).

Means, out of all the invested amount, 97.5% will be utilised to buy mutual fund units.

But in case of ULIP, the overall cost is as high as 10% to 12%.

Means, out of all the invested amount, only 88%-90% will be utilised for investment.

I find it hard to believe that, a fund whose cost itself is so high, how it can ever compete with a traditional mutual fund?

These days in India, people find it hard to earn a consistent return of 12-15% per annum.

In this scenario, what returns ulip will generate when their upfront cost itself is close to 10-12%?

Anyways, I have my own reservations for ULIP.

By the way, here are my calculations explaining how ULIPs cost is close to 10%-12%.

Please have a look and decide for yourself.

Case-1: Sum Assured is 10 Times the Annual Premium

Case-2: Sum Assured is 20 Times the Annual Premium

Now this is very interesting. But unfortunately again it is going against ULIP.

Why people wanted us to buy ULIP?

Because it provided a dual advantage of investing plus insurance, right?

But above are two examples. In Case-1, the person got approval for sum assured equivalent to only 10 times the annual premium.

In this case his cost of ULIP is hovering around 10%-12%.

In case-2, the the person got approval for sum assured equivalent to 20 times the annual premium.

In this case his cost of ULIP will actually go up (14% to 16%).

What should I conclude with this outcome?

ULIP is actually penalizing a person if he got more life cover? Is this a good insurance product?

No, because it costing us more if we go for higher life cover.

Anyways, the life cover that we get from ULIP is not enough.

Is this a good investment product?

No, because if its cost is ranging from 10% to 16%. I have a serious doubt what returns it can promise even in long term.

After fifth year, where the premium allocation charge become zero, even there the overall cost of ULIP is above 10% for a person who is 45+ years of age.

So, in terms of cost, ULIP is again a Big NO.

#4. ULIP Allows Income Tax Benefits

If one invests in ULIP, the proportion of principal paid towards insurance coverage can be used for income tax saving u/s 80C.

Even the overall income generated from ULIP is non-taxable u/s 10(10D).

If objective is insurance + tax saving + better returns then ULIP can be considered as one of the options.

But there are better insurance products available in the market.

If objective is investment + tax saving + best returns then mutual fund SIP score better.

Traditionally mutual funds do not help investors in tax saving.

But ELSS schemes allow income tax saving as well.

So, even in tax saving, mutual fund scores over ULIP.

This further proves my understanding related to ULIP.

ULIP is more a insurance option with some added benefits.

Final Words…ULIP vs mutual fund SIP, which is better?

To sum it up, I have prepared a small comparative which will highlight the main difference between traditional Life Insurance Plans, ULIP, and Mutual Fund.

Check this link to get a detailed comparison in a tabulated form…

ULIP is a good insurance product? No.

Perhaps insurance companies wanted to boost their sales further, and hence their decided to launch a product like ULIP.

What I mean to say is that, ULIP is a product which is probably not built to make money for its investor.

Instead, it is a typical insurance product.

For an insurance product, the objective is never to make money for the policy holder.

Their objective is always to bring-in as as many policy holders as possible.

This they do so that after payment of all the valid claims, their fund size remains HUGE.

Insurance is product which makes money only for the issuer.

Public must know that INSURANCE is not an investment vehicle.

So ULIP is a insurance product? It doesn’t do even this job better.

ULIP is a good investment product? No.

Please see the cost of ULIP for its investor.

After payment of such costs, it is like impossible for any investor to earn above average returns.

Then why ULIPS are promoted as investment products? I think this is a sham.

If ones focus is investment, they must go for traditional investment products like mutual fund SIP etc.

Even today, ULIPS are largely miss-sold by agents. People buy it as an investment vehicle.

Agents sell it like this because they earn commissions.

I believe, when it comes to long term investment, equity linked mutual fund SIP’s are a better alternative than ULIP.

really all points are valid,

but here is proper answer

(1) real power of compounding comes with lock in period only, it gives you dicipline, also ulip is not ment for normal people but for hni.

(2) it is not for insurance, insurance is just a showcase, if you want insurance go to term plan

(3) in longer run the same charges is lower than others, because percentage of charge is based on premium and not fund value

Premium Allocation Charge

Fund Management Charge

Policy Administration Charge

following charges are zero in many ulip

(4) when you are in 30% bracket due to your fds only, this is much better options in case of safe return

(5) final word.

if you understand market and can make switches properly, ulip can surpass anything in return, dont take out money from ulip for long term and than you can see return

My insurance agent sold me a 10k/year policy for a dream of retiring at 45 years, maturing “now” with 5L. Options are to start pension immediately, maybe 2-3k per month from either 100% annuity or 67% annuity (33% lump sum = 1.7L, i.e., investment of 17 years).

What should I do? My age is 45 and without term-life insurance. I want to purchase a lump-sum one, as available.

1. Start pension 100% amount (to invest in a monthly sip of equity mutual fund),

2. Start pension 67% amount(to invest in monthly sip and lump-sum used for getting term-life insurance or something can you suggest?),

3. Differ pension,

4. Top-up (no way after reading your lucid and best analysis)

Deferred pension to grow corpus, though it allows till 70 years but took it for five years (can break before or extend many times again till 70 years, also can change investment% in equity/debt four times a year, with no penalties). Would you suggest any better option, please?

This is a great analysis, Thank you. I am 25 years old and this has helped me. Please reshare the comparison sheet as it is no longer available