Canada’s economy is in the news for slowing down, and many are debating what the Bank of Canada (BoC) should do next. Let’s break this down into simple terms while exploring why this is happening and what lessons it offers for us in India.

1. What’s the Situation?

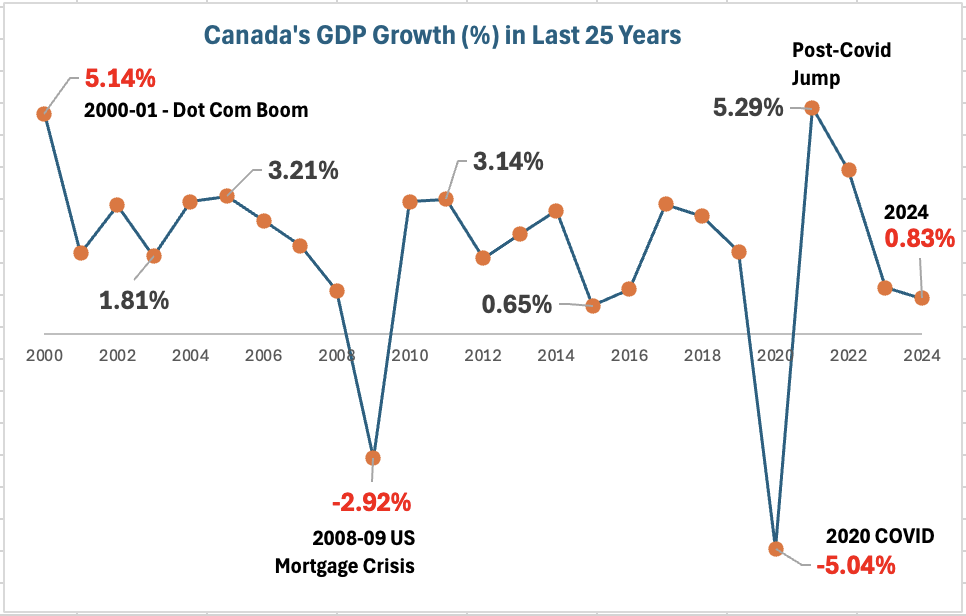

Canada’s economy grew by just 1% in the third quarter of 2024. Too view this 1% growth in perspective, let’s look at the Canada’s last 25 years GDP growth rate:

On an average, in the last 25 years, the Canada’s GDP has grown at a rate of 1.98% per annum.

In Q3 2024, its grew at about 1%. To put it into context, this growth rate is like getting a “C” grade when the teacher expected you to score a “B.” The Bank of Canada had hoped for 1.5% growth but missed the mark.

Here’s what’s interesting:

- On a per-person basis (per-capital GDP growth), their economy has been shrinking for six straight quarters. This means that while the total economy is growing slowly, it’s not keeping up with population growth. As a result, living standards are falling.

- In simpler terms, imagine earning more pocket money but realizing it buys you fewer groceries because prices of essential food items have gone up.

2. Why is This Happening?

There are three key reasons that stand out which are causing a slow GDP growth and depreciating per-capita GDP.

- High Interest Rates: The Bank of Canada raised borrowing rates in the past to fight inflation. While inflation is now under control (at their target of 2%), those high rates have made it expensive for businesses to invest and for Canadian people to borrow. This is slowing down economic growth.

- Weak Business Investments: Companies are cutting back on spending. For example, investments in new machinery or office buildings are dropping. This is like a steel plant cutting its budget to buy raw materials. It will eventually slow down in revenue growth (total income and hence profits).

- Global Challenges: Trade and exports have also taken a hit. For instance, exports of goods and services fell again this quarter. Add to that global uncertainty, like potential U.S. tariffs, and businesses are even more cautious.

3. How is Canada Reacting?

To give the economy a boost, the Bank of Canada is cutting interest rates.

They’ve already reduced it by 1.25% since June, bringing it to 3.75%. Now, they’re debating how much to cut further:

- Some experts say a jumbo cut of 0.5% is needed to speed things up.

- Others argue for a smaller 0.25% cut, since inflation is already under control and savings are rising.

4. What’s Working Well in Canada?

Despite the challenges, there are some positive signs:

4.1 Household Savings:

People in Canada are saving more. The savings rate reaching a three-year high of 7.1%. This happened because incomes are rising faster than spending. It’s a good buffer for families during uncertain times.

Just to give you a perspective about this 7.1% number, here are the approximate savings rate in the following countries:

| Country | Per Capita Income (in USD) | Savings Rate | Comment |

| Canada | 55,818 | ~7.1% | Moderate savings rate, reflecting a relatively high per capita income  . |

| India | 2,389 | ~19% | High savings rate due to cultural and economic emphasis on saving . |

| USA | 75,180 | ~4% | Low savings rate despite high per capita income, showing higher consumption habits . |

| UK | 52,231 | ~10% | A relatively high savings rate compared to similar economies, indicating cautious consumer behavior . |

| Australia | 64,570 | ~13% | High savings rate, supported by strong economic conditions . |

| China | 12,970 | ~30% | Very high savings rate, driven by economic policies and cultural tendencies . |

You can see how these figures differ between country to country. It highlights a stark differences in savings behavior and economic structures across regions.

4.2 Consumer Spending and Government Support:

Household spending in Canada is a key driver of its economy.

Recent data indicates that consumer spending accounts for over 50% of Canada’s GDP. It includes significant expenditures on housing, utilities, transportation, and recreation.

In 2023, consumer spending in Canada amounted to approximately CAD 1.25 trillion. Spending patterns have shown resilience, supported by government measures like inflation-adjusted social benefits and tax credits during economic challenges .

This spending acts like a stabilizing lifeboat for the economy, especially during periods of uncertainty or downturns. By maintaining demand for goods and services, it helps businesses sustain operations, which in turn supports employment and GDP growth.

Household spending is a crucial economic indicator, and its role varies significantly across countries. Here’s a comparison of household spending in Canada with other major economies:

| Country | Per Capita Income (USD) | Household Spending as % of GDP | Comments |

| Canada | ~45,000 | 56% | Strong government support and resilient consumer spending. |

| USA | ~70,000 | 68% | Consumer spending is a major driver of U.S. GDP. |

| UK | ~50,000 | 60% | Household spending resilient despite inflationary pressures. |

| Australia | ~55,000 | 55% | Strong consumer spending, aided by social transfers. |

| China | ~12,000 | 40-45% | Household spending growing, but still low relative to GDP. |

| India | ~2,500 | 60% | Household spending plays a significant role, but income inequality and lower per capita income limit broader growth. |

5. What We Indians Learn From This?

5.1 Balance Inflation and Growth

Canada’s struggle to balance inflation and economic growth offers valuable lessons for India.

Like Canada, the Reserve Bank of India (RBI) must manage interest rates carefully. When rates are high, it can slow down India’s already struggling growth, but if rates are too low, inflation can rise rapidly, affecting the cost of living.

Canada’s experience shows how difficult it can be to get the balance right. Too much of one can cause harm to the other.

For India, this means that the RBI’s policy decisions should be carefully calibrated, particularly as the economy grapples with both inflationary pressures and the need for sustainable growth.

A similar approach, focusing on both inflation control and fostering economic expansion, could help India achieve a more stable growth path.

India’s economy is growing at a rapid pace, but inflation is also a significant concern.

The key takeaway is that a vigilant and flexible monetary policy is a must for India.

5.2 Diversify Economic Strengths

Canada’s reliance on exports and resource-based industries, like oil and natural resources, makes it vulnerable to global price fluctuations.

In contrast, India’s economy benefits from a more diversified base, including manufacturing, services, and agriculture. This provides India with greater resilience in times of global economic uncertainty.

For India, this highlights the importance of further strengthening our manufacturing and services sectors while maintaining agricultural stability.

Diversification can act as a shield against global shocks. It will mak India less reliant on a few industries and helping ensure more stable economic growth.

5.3 Savings Matter

Canada’s higher savings rate provides its citizens with a buffer in times of economic stress. It helpsg them remain financially stable during slowdowns.

Indians, who already have a strong savings culture, can continue prioritizing savings, especially in uncertain times like these.

For India, this underscores the importance of building personal financial resilience through savings and investments.

By strengthening financial habits now, we can better weather future economic challenges and ensure long-term wealth accumulation.

Lesson Learnt For Stock Investors

For investors, Canada’s situation reminds us of the importance of watching global trends.

Indian companies with export exposure or trade links to North America may feel indirect impacts.

However, this is a great time to focus on strong fundamentals companies with consistent demand, manageable debt, and diversified operations. In times of economic uncertainty, companies with strong fundamentals are more likely to weather economic downturns. These businesses have stable cash flows and can adapt to changes in market conditions. Their strong balance sheets and diversified revenue streams reduce the risk of significant losses.

For example, companies in essential sectors like healthcare, utilities, or consumer staples, where demand remains consistent, tend to perform better during tough times.

Also, firms with manageable debt are less vulnerable to rising interest rates, which is critical in a high-inflation environment like Canada’s.

Diversified companies spread risks across various products or regions, making them more resilient to sector-specific or geographic downturns.

This focus on fundamentals helps protect investments and ensures long-term growth even in volatile markets.

Conclusion

Economic slowdowns happen everywhere, but how a country handles them matters.

Canada is using tools like interest rate cuts and encouraging savings to stabilize things.

For us in India, it’s a reminder to stay prepared, manage our finances well, and focus on long-term goals.

What’s your take? Share your thoughts in the comments! 😊

Have a happy investing.

![If A Bank Closes What Happens To The Deposits? [DICGC]](https://ourwealthinsights.com/wp-content/uploads/2021/06/If-a-bank-closes-what-happens-to-deposits-image2.png)

![How to Hedge Your Investments When the US Dollar Weakens [Practical Strategies] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/03/How-to-Hedge-Your-Investments-When-the-US-Dollar-Weakens-Practical-Strategies-Thumbnail-768x462.png)