Let’s dive into the mind of Howard Marks to decipher the flows of investment cycles. Who is Howard Marks? He is an American investor, writer, and co-founder of Oaktree Capital Management. We will know about what Howard Marks describes as the underlying themes that shape market movements. It will give us insights and build our strategy to navigate between market optimism, risks, and capital availability.

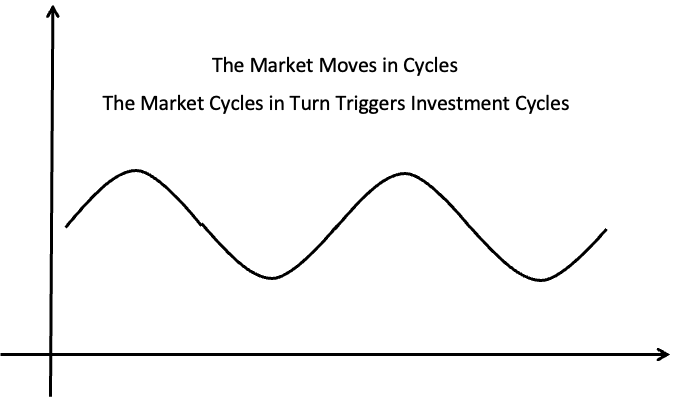

In this article, we’ll try to understand the rhythm of investment cycles. Markets sway between optimism and caution. This is what we called as volatility and is driven by human emotions. Understanding these patterns can help to predict the market’s highs and lows.

We can learn from history and can craft strategies for ourselves to handle market volatility. We can use the concept of market timing and disciplined decisions.

Success lies in mastering the process of establishing a balance between risk and reward while investing in equity (mainly direct stocks).

Let’s dig deeper into the investment cycles.

Introduction to Investment Cycles

Investing is like a wave with ups and downs. Howard Marks shows us the steps of how to comprehend and manage the ups and downs of the market. In this article, we’ll uncover why understanding these steps matters. Howard Marks, a finance expert, has studied these moves for fifty years. He says that these cycles aren’t just a fancy concept; they’re vital tools for smart investors.

First, let’s grasp the importance of these cycles. We’ll see patterns in how markets move, like stars in the sky. Then, we’ll reveal the secrets behind successful moments in markets, called bull markets. A Bull Run is like a powerful music piece that makes markets rise and dance to its tune.

There will be more. We’ll dive into the investor’s sentiments. We’ll know why people act differently when markets are high or low. It’s like changing our mood when we listen to happy or sad music. And as we continue, we’ll keep unveiling the secrets of the market movements (the investment cycles).

Stay with us as we journey through the fascinating world of investing.

Topic #1: What Drives A Bull Market

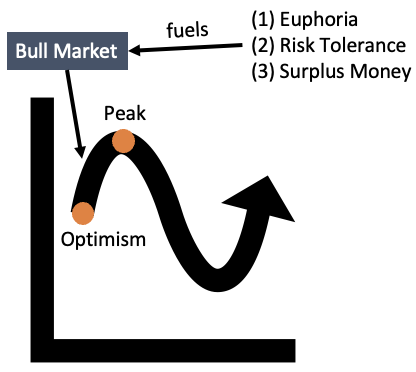

Imagine the world of investing like a thrilling performance. Bull markets are like the exciting high points, where three strong forces work together: euphoria, risk tolerance, and available money.

Let’s break them down:

- Euphoria: Positive feelings among the investors (FIIs, DIIs, and Retail Investors) make markets go up. The top management of companies observes closely the market euphoria as it also a reflection of current demand. When the demand goes up, companies are likely to see growth and also drive economic expansion.

- Risk Tolerance: People swing between being very careful and very brave. When markets are high, people feel brave and take more risks. As during a bull market, the general trend is upward, it’s easier for a majority to guess the upcycle. This clarity increases the risk tolerance of even small retail investors. It eventually results in audacious decision-making that fuels the upward trajectory of asset prices.

- Surplus Money: When there’s lots of money, people get excited and want to invest. This rush of money can make markets soar. With ample capital at one’s disposal, investors rush to the market to make it grow further. This ignites a frenzy of demand and propels markets to new heights.

By understanding these three things, we start to unlock the secrets of bull markets. As we keep going, we’ll learn even more, about the investment cycles.

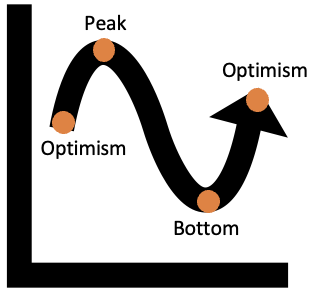

Topic #2: Peaks and Valleys

Think of investing like a rollercoaster ride. Sometimes, we reach high points (peaks) and sometimes we dip down (valleys). These moments are like our feelings – when we’re excited, the market goes up, and when we’re unsure, it goes down. Let’s dive into these emotional moments to understand how they affect our investing journey.

Imagine being on a mountain’s highest point or in a deep valley – that’s how markets feel. People’s thoughts (psychology) become super important. Human emotions influence investment decisions.

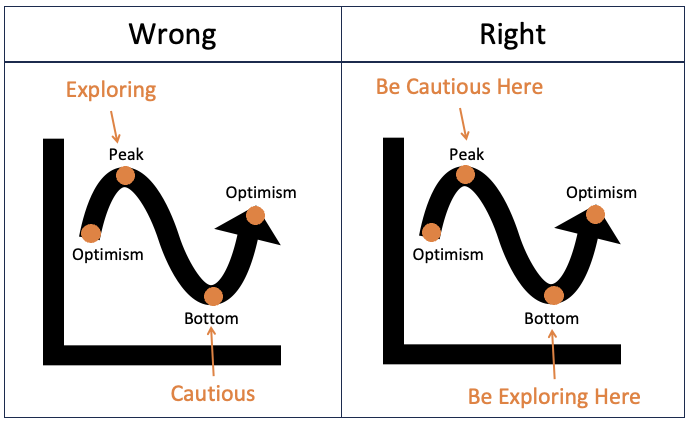

- Peaks (Highs): When the market is high, we can get too excited and make carefree choices. It’s like getting carried away by a fun game and forgetting to be careful. This can lead to making choices we might regret later.

- Valleys (Bottoms): the market bottoms are characterized by despondency and fear. Our fear of losses can overshadow logical reasoning. It can prompt investors to become too risk-averse. It is within these moments of despair that golden opportunities beckon. During these times, stock prices plummet to levels below their intrinsic value.

So you can see, general human emotions make us cautious in a bear market and exploring in a bull market. But as a good practice, we should do the opposite.

One must keep caution as a crucial companion when markets are high (bull). It will remind us to tread carefully amidst the intoxicating atmosphere of optimism. It is during these times that the allure of profit must be tempered by a measured assessment of risk. Conversely, the depths of market valleys (bulls) offer a chance to seize undervalued stocks.

As an investor, we must remember that market peaks are treacherous and valleys are promising and not the other way round.

Let’s unfurl additional layers of insight.

Topic #3: Lessons From History

There is a profound truth in Mark Twain’s timeless wisdom: “History doesn’t repeat, but it rhymes.” It means that while events might not happen exactly the same way again, there are similarities and patterns that we can recognize. In the context of investing, it suggests that while markets and situations may not play out exactly as they did before, we’ll experience recurring themes. We can learn from the past and use it to anticipate future trends.

There have been past cycles that bear striking resemblances to their future happenings. By recognizing these rhymes, we gain a unique vantage point. We can use this position of advantage to anticipate and interpret the future movements of the market.

Basically, there are two major themes we must keep in mind, crash/corrections (leading to market bottom), and recovery (leading to peaks).

Let’s take examples.

Dot-Com Bubble of 2001

In the late 1990s, there was a global technology boom. We remember it as the “dot-com bubble.” The Indian stock market also experienced a surge in technology-related stocks during this period. Many investors were driven by optimism and invested heavily in technology companies. It eventually lead to soaring stock prices.

However, by the early 2000s, the bubble burst, and stock prices plummeted as investors realized that many of these companies were overvalued.

Fast forward to more recent times (2020 and 2021), we’ve witnessed a similar surge in technology-related stocks, driven by the growth of digital services and e-commerce in India. But from 2022 onwards, we are seeing a slump in the same stocks.

While the specific companies and technologies involved are different, the underlying theme of investor enthusiasm and subsequent correction is a rhyme with the dot-com bubble.

Market Corrections and Recoveries

The Indian stock market has faced various corrections over the years due to factors like economic slowdowns, geopolitical tensions, and global financial crises. Each correction is unique in its causes and circumstances. However, what tends to rhyme is the cycle of fear and panic among investors during a downturn, followed by a gradual recovery as markets stabilize and confidence returns.

For instance, during the global financial crisis of 2008, Indian stock markets experienced a significant decline. Similarly, during the COVID-19 pandemic in 2020, the market faced a sharp drop. In both cases, the initial fear and uncertainty led to market sell-offs. However, over time, as economic conditions improved and measures were taken to address the issues, the markets eventually recovered.

These examples showcase how historical events in the Indian stock market may not repeat exactly, but they exhibit similar patterns and behaviors. By recognizing these rhymes, we can gain insights into market dynamics and potentially make more informed decisions.

Topic #4: Mastering the Investment Cycles

Trained investors can predict the twists and turns of the market. But to do it, one must first learn to comprehend the underlying patterns. Once the pattern becomes obvious, strategies can be built to take advantage of it.

A combination of these three indicators: optimism, risk tolerance, and capital availability shape a bull market and vice versa. If one can learn to watch the balance between these three indicators, market movements can be forecasted. This should be the basic strategy that allows us to be prepared for what is coming next.

However, what is even more important is a sound understanding of human psychology. Our emotions play a key role in our investment decisions. The way we perceive opportunity and threat shapes our actions. The thing that we called rationality can be completely wrong if we wrongly interpret the conditions.

For example, the bull market is a time to be cautious. But what majority do during such times? They invest heavily during this time. Similarly, when the market is bearing and nearing its bottom, it is a time to be most enthusiastic. But in the doom and the gloom of the market, we behave otherwise.

We must learn to channel our emotions. To do it we must first train ourselves to read what is an opportunity and what is a threat. If we can do it, we can ride the tides of the investment cycles like a pro.

Conclusion

Our adventure has shown us the steps of investment cycles, from the exciting bull markets to the low points. Think of optimism, caution, and available money as bright stars, showing us the way to success.

Peaks and valleys, shaped by our feelings, remind us to be careful and excited at the right times.

History is like an old friend, giving us hints about what might happen next. We can build an understanding to decipher the rhythm of market ups and downs. The majority of people behave irrationally during the market’s highs and lows. Hence, if we build correct rationales, we can take advantage of the market cycles.

The idea is to correctly match our investment cycles with the market cycles.

We must be ready to write our investment story with wisdom and strategy, dancing to the rhythm of investment cycles.

Have a happy investing.

Suggested Reading: