Maharashtra Scooters Ltd (MSL) presents a fascinating case study in corporate strategy and financial structure. Its business model is distinct, positioning itself as a Core Investment Company (CIC) rather than a traditional manufacturing entity. For niche financial observers, the company’s operations and financial metrics reveal an intriguing story of high margins coupled with surprisingly low return ratios.

In this blog post, I’ll try to explain what Maharashtra Scooters do and what makes it unique.

Maharashtra Scooters (MSL) is primarily an investment company, not a manufacturer of scooters. Let’s dig into its business model.

Preface

Today, I got a query from one of the subscribers of the Stock Engine related to this company. The person got confused because the Stock Engine’s algorithm was showing this company as a “monopoly.” But as its ROE was in fractions (below 1%), it sounded contradictory. This was his detailed query:

In this blog post, I’ll try to answer this query in short but with reasonable clarity.

To answer this query, I must first highlight the business model of Maharashtra Scooters to explain why it is a monopoly in its own unique industry. Second, I’ll also explain why this company being such a low ROE stock can still qualify as a monopoly.

The Business Model

MSL operates primarily as an unregistered CIC, exempt from Reserve Bank of India (RBI) registration requirements. Its primary mandate is to allocate at least 90% of its assets to investments in the Bajaj Group.

These investments include holdings in companies like Bajaj Auto, Bajaj Finserv, and Bajaj Holdings, which generate stable returns through dividends and capital appreciation.

The remaining surplus funds are deployed in debt securities, favouring highly rated instruments (AAA or AA+).

This kind of capital allocation ensures a balance between yield and capital preservation.

Despite being classified as a CIC, MSL continues to engage in limited manufacturing operations, producing pressure dies, castings, and related components for industries such as automotive, telecom, and renewable energy.

However, this manufacturing arm is insignificant, operating at a loss and facing ongoing viability challenges.

Financial Performance

1. High Margins

MSL reported a staggering Net Profit Margin (NPM) of 89.16% in FY2024.

This exceptional profitability stems from its investment operations, where dividend income and capital gains dominate the revenue stream.

Investment income, which constituted over 94% of total revenue in FY2024, involves minimal direct costs, resulting in extraordinary EBIT and net profit margins.

2. Low Return on Equity (ROE)

In contrast, the company’s ROE stood at a mere 0.87%.

This anomaly arises because the equity base is disproportionately high relative to earnings.

As a CIC, MSL retains substantial equity, bolstered by accumulated reserves and unrealized gains on its investments.

However, these reserves do not directly contribute to operational revenue generation or profitability, leading to a diluted ROE.

Key Insights on MSL’s Financial Nature

- Capital Allocation: MSL’s business model emphasizes asset allocation over operational productivity. Its equity-heavy structure and focus on holding group investments create a financial moat but limit active returns.

- Efficiency Metrics: Traditional efficiency metrics like ROE or ROCE are less relevant for CICs like MSL. The primary goal of the company is capital preservation and steady income from investments.

- Manufacturing Segment: The loss-making manufacturing arm serves as a legacy operation, contributing negligible revenue while eroding margins at the operational level. Its discontinuation, as discussed in management reports (in the FY24 annual report of the company), seems inevitable.

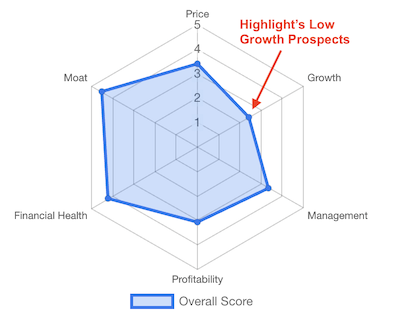

- Stability vs. Growth: As a CIC, MSL offers stability for long-term investors but lacks the dynamism of growth-driven companies. Dividend flows from Bajaj Group companies ensure predictable cash inflows, but organic growth prospects remain limited.

Why High Margins Don’t Translate to High Returns

The contrast between high margins and low return ratios highlights the unique nature of CICs.

While the company enjoys significant profitability on its revenue, the lack of leverage and active reinvestment restricts returns on shareholder equity.

Consider this: MSL’s investment income is derived from dividends and capital gains, which, although substantial, do not scale with operational efficiencies or market expansions.

With a vast equity base, these returns appear muted when viewed through the lens of conventional financial metrics.

Conclusion

Is it a niche opportunity for long-term investors?

Maharashtra Scooters Ltd exemplifies the trade-offs inherent in a Core Investment Company.

- For investors seeking stability and indirect exposure to Bajaj Group companies, MSL offers an appealing proposition. Its high margins reflect the efficiency of its investment operations.

- Its low ROE underscores the constraints of its equity-heavy structure. Moreover, it is not a company which grown-focused long-term investors shall consider.

As the company considers discontinuing its manufacturing segment, it is likely to align even further with the investment-focused CIC model.

This transition would cement its identity as a niche player in the financial ecosystem. It is a stock that should appeal to patient investors who value predictable income over high-growth ambitions.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.