The Indian rupee’s performance in 2024 has been nothing short of a disheartening. By the close of the year, the rupee depreciated by approximately 3% against the US dollar. While this may seem like a minor number to some, its implications are far-reaching. It influences everything, from the cost of imported goods to the returns on investments.

For an economy like India, where imports, particularly crude oil, form a substantial part of expenses, even small currency fluctuations can have a ripple effect. Additionally, global events like geopolitical tensions, rising interest rates in the US, and FIIs outbound activity has added to the rupee’s challenges.

I believe it’s crucial to break down these developments.

Currency movements might seem complex, but they directly impact our savings, household budgets, and even travel plans.

I’ll try to explain what happened, why it matters, and how we can prepare for the future under these situations.

What Happened to the Rupee in 2024?

Think of currencies as runners in a global race. The Indian rupee didn’t win outright, but it also didn’t perform the worst.

In 2024, while the rupee depreciated by 3% against the US dollar, it managed to outperform other major currencies like the euro and the Japanese yen.

This mixed performance tells a lot about how complex and interrelated global economies have become.

Key Events That Shaped the Rupee’s Fall

- Global Factors: Geopolitical tensions like the ongoing Russia-Ukraine war and the crisis in the Middle East caused significant disruption in global trade. The US dollar, considered a “safe haven” during uncertain times, grew stronger as investors worldwide sought its stability. Trade disruptions such as the red sea attacks, also impacted emerging market currencies, including the rupee.

- Domestic Challenges: India’s trade deficit widened, putting pressure on the rupee. This means the country spent significantly more on imports than it earned from exports. To make matters worse, Foreign Institutional Investors (FIIs) withdrew around Rs.1.7 lakh crore from Indian equity markets between October and December. This lead to a sharp demand for the dollar and further weakening the rupee.

- Oil Imports: Crude oil imports make up a major part of India’s import bill. With rising oil prices in 2024, India had to purchase more US dollars to pay for oil. This type of activity further increases the demand for dollars and reduced the value of the rupee in comparison.

Despite its challenges, the rupee’s depreciation was relatively mild compared to the severe declines seen in other emerging market currencies.

The Indian rupee performed better against other currencies like the euro and the Japanese yen. Specifically, the rupee gained value by 5% against the euro and 8.7% against the Japanese yen. This shows that despite the overall challenges, the rupee was able to hold its ground or improve compared to some other major global currencies.

However, consistent external and domestic pressures kept the rupee on the back foot throughout the year.

Why Did the RBI Intervene?

When the game gets turbulent, the RBI steps in to restore order.

In 2024, the RBI actively intervened to prevent the rupee from experiencing a sharp and uncontrolled decline.

Let’s try to understand in more detail why & how RBI stepped in.

1. Stabilizing the Rupee

The rupee faced intense pressure due to a combination of domestic and global factors, including FII outflows and rising crude oil prices. To avoid a free fall, the RBI sold US dollars in the forex market to stabilize the rupee’s value. Without this intervention, the depreciation could have been much steeper.

2. Intervention in the NDF Market

The RBI also intervened in the Non-Deliverable Forward (NDF) market. This market operates offshore and allows traders to bet on the future value of the rupee without physical currency exchange.

Think of it as a financial playground outside India’s direct control. The bets placed here influence the rupee’s value in the domestic market.

By intervening in this market, the RBI aimed to reduce speculative pressures that could worsen the rupee’s decline.

3. Impact on Forex Reserves

While these measures stabilized the rupee, they came at a cost.

India’s forex reserves dropped from a record $704.89 billion in September to $644.39 billion by December.

This decline reflects the RBI’s heavy dollar sales and the impact of fluctuations in other currencies like the euro and yen within the reserves.

The RBI’s role is to ensure stability without exhausting reserves or creating undue market panic.

Its actions in 2024 showcased a balancing act to protect the rupee while navigating a challenging global economic landscape.

What Does This Mean for Us?

Currency fluctuations, though seemingly distant, have a direct impact on our lives.

Here’s how the rupee’s fall in 2024 may have affected us and what we can expect going forward:

1. Higher Import Costs

A weaker rupee means India needs more rupees to buy the same amount of US dollars. This makes imported goods like electronics, fuel, and essential raw materials costlier. For example, crude oil, which forms a significant chunk of our imports, directly impacts petrol and diesel prices. Additionally, for students studying abroad or those planning to send money overseas, higher exchange rates increase expenses. A rupee depreciation adds strain on household budgets for these categories.

2. Impact on Investments

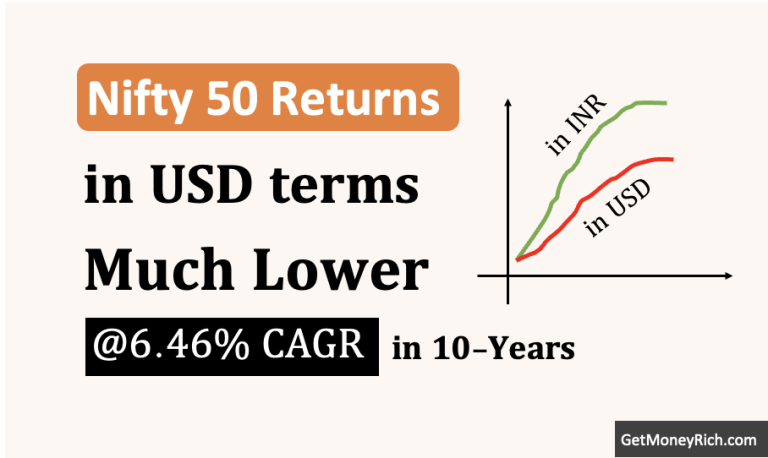

Currency fluctuations can have a significant impact on equity investments.

- When the Indian rupee weakens, FIIs starts to pull their investments out of the country. This outflow of funds creates selling pressure on stocks. It then leads to a decline in stock prices. As a result, retail investors holding equity mutual funds or individual stocks may see their portfolio values drop.

- Additionally, the market becomes more volatile, as the value of the rupee can influence investor sentiment.

Different sectors in the economy are impacted in various ways by currency movements.

- For example, a weaker rupee can benefit export-driven sectors like information technology (IT) because their earnings are in foreign currencies. It increase when converted to rupees.

- On the other hand, sectors that rely heavily on imports, such as consumer goods or manufacturing, face higher costs. They need to pay more for imported raw materials and components. This can squeeze their profit margins and hurt their stock prices.

Therefore, currency fluctuations add an element of uncertainty to the stock market. Volatile currency makes it harder for investors to predict returns.

3. Increased Travel Expenses

Planning an international trip?

A depreciating rupee makes foreign travel significantly costlier. Flight tickets, accommodations, and shopping expenses abroad increase, as every dollar or euro now costs more in rupee terms.

These impacts remind us that currency changes are not just economic statistics, they shape our spending, savings, and financial planning in profound ways.

Outlook for 2025

As we step into 2025, the outlook for the Indian rupee appears much like 2024 (volatile).

Experts forecasting a trading range of Rs.82 to Rs.87 per US dollar.

There are several factors could still influence the rupee’s performance.

1. Interest Rates in the US

A key element that could shape the rupee’s future is global economic policy, particularly the actions of the US Federal Reserve. If the Fed reduces interest rates or eases its tightening measures, it could lead to a weakening of the US dollar.

A softer dollar would benefit emerging market currencies like the rupee.

Global factors like trade relations, geopolitical tensions, and oil price fluctuations will also play a part in determining the rupee’s stability.

2. Domestic Growth

India’s projected GDP growth of 6.5% to 7.5% in 2025 is expected to support the rupee.

Strong economic growth often bolsters investor confidence. It reduces the capital outflows and help the currency.

However, the impact of the upcoming budget and the RBI’s policy measures, such as managing inflation, interest rates, and foreign exchange reserves, will be crucial in maintaining rupee stability.

Conclusion

As we navigate the unpredictability of currency fluctuations and global economic shifts, it’s essential to adopt a proactive approach to safeguarding our financial well-being.

Here are a few strategies I recommend:

- Increase Stake in Alternative Investments: The key to managing uncertainty is diversification. By spreading our investments across alternative asset classes (non equity) like physical gold, real estate, cryptocurrency, etc can reduce the risk of being overly exposed to only Indian Rupee. Allocating some funds to international markets can also be a good choice in situation where our own currency is weakening.

- Focus on Domestic Opportunities: India’s economic growth story is still strong. Sectors like finance, technology, renewable energy, and infrastructure are expected to outperform. These areas offer great long-term investment opportunities. Investing in companies positioned to benefit from these sectors could be a smart move to take advantage of India’s growing economy.

- Build an Emergency Fund: Given the potential for inflation due to a weaker rupee, having a robust emergency fund is essential. This fund will help protect us from rising prices and unexpected financial shocks. It can give us a peace of mind when times are uncertain.

Final Words

Currency movements reflect a nation’s economic health. But they also highlight its resilience.

Despite a challenging 2024, the rupee has managed to remain less volatile compared to its peers.

As individuals, we can’t control these macroeconomic forces, but we can adapt our financial strategies to stay ahead.

The year 2025 might bring a mix of challenges and opportunities. With the right financial habits, we can navigate them effectively.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

![Indian Rupee Hits Record Low: A Historic Dip [2024]](https://ourwealthinsights.com/wp-content/uploads/2024/11/Indian-Rupee-Hits-Record-Low-Thumbnail-768x436.png)