I saw an interesting stock screener on the Yahoo Finance portal. It is a pre-built screener which can filter high EPS growth stocks whose P/E and PEG ratios are low. This Yahoo Finance pre-built screener filters stocks whose trailing P/E is < 20, PEG is < 1, and 1-Year EPS growth is 25% or above. The screener displays the filtered stocks listed on NYSE and Nasdaq. I found this screener interesting and thought that my own Big Screener of the Stock Engine can do a similar filtering of Indian stocks.

The Yahoo Finance screener used the above filters to screen and display a list of stocks with its following price related data.

- 1D Chart: In a graphical form it shows the price trend of the filtered stocks in the last trading day.

- Price (Intraday): It shows the latest price of the stocks.

- Change: It shows the change (USD) in the stock prices in the absolute terms.

- Change %: It shows the change (USD) in the stock prices in the percentage terms to get a clearer perspective of the price movement.

- Volume: It shows number of shares of a stock traded during the last trading day.

- Volume (3M): It shows average trading volume of of a stock traded during the last 3 months period.

- Market Cap: It shows the total value of the stock’s outstanding shares. It is a direct indicators of the size of the company.

- P/E Ratio (TTM): It is the ratio of the stock’s current price and TTM (Trailing Twelve Months) EPS data. It is one of the indicator of the price valuation.

- 52 Week Range: It shows graphically how the currect price of stocks is positioned compares to their 52W low and 52W High price data.

The Result of the Yahoo Finance Undervalued Growth Stocks Screener

A few US stocks that passed the above filters were the following:

| SL | Name | Market Cap ($) | P/E Ratio (TTM) |

|---|---|---|---|

| 1 | General Motors Company | 51.351B | 7.33 |

| 2 | Energy Transfer L | 67.828B | 15.48 |

| 3 | Kinross Gold Corp | 14.822B | 20.10 |

| 4 | Synchrony Financial | 25.397B | 7.63 |

| 5 | Baker Hughes Co | 46.617B | 15.81 |

These are a few good (top 5) stocks which are listed above. I could see that the Yahoo’s screener was displaying about 152 number stocks.

Seeing this huge list of stocks, I wondered how many quality Indian stocks would comply with the above filtering criteria of Yahoo?

While I was observing the Yahoo’s screener, I thought, the users of our Stocks Engine can also create a similar custom-made filters inside the Big Screener. Hence, I though, why not write a blog post about it showing how the Big Screener can be programmed by the users to create their own “Undervalued Growth Stocks Screener” like Yahoo’s.

So let’s dive into the details.

Creating The Undervalued Growth Stocks Screener using the Big Screener

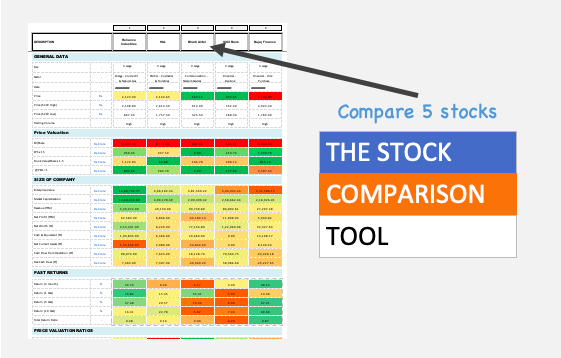

For people who are new to my Stock Engine app, there are two themes to screen stocks inside the app: (1) The Big Screener and (2) The Screener Themes.

- Big Screener: The Users can use the Big Screener to create their own custom stock screening themes. For example, if you want to know which large cap stocks who Market Cap is above Rs.1,00,000 crore, has a P/E ratio of below 20, and has a maximum FII’s holding. You can use the Big Screener to create such a filter and save it in you login. Next time, when you login, you can directly access this saved filter to review any changes. If you want to know more about the Big Screener, check this article.

- Screener Themes: If you are not comfortable creating your own stock screeners, you can directly enter this section of to access the pre-built stock screener themes for you. Here you will get themes like undervalued stocks, growth stocks, Monopoly stocks, etc. All in all there are about 20+ number pre-built screening themes here.

Undervalued Growth Stocks Screener

Now, let’s see how to create a custom Yahoo Finance type undervalued Growth Stocks screener inside the Big Screener.

Step #1: Access Side Bar

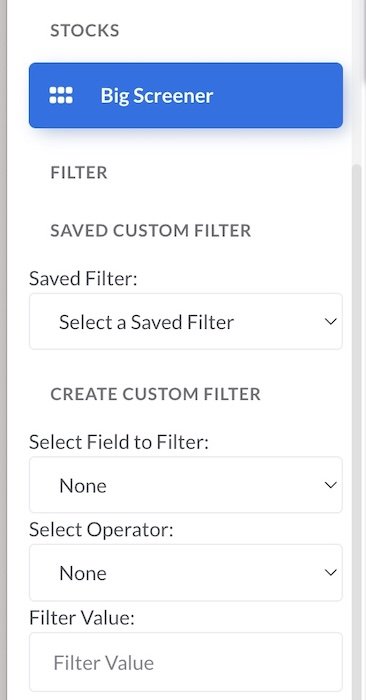

In the sidebar you will see two main sections, the first is the “Saved Custom Filters” sections. In the drop-down menu of this section, you fill your saved filters. If you are a first time user, the drop-down menu will be black. It will show “Select a Saved Filter” prompt.

The second section is “Create Custom Filter”. This is the are which can be used to create new screeners. Inside this section there are three sub-sections with drop-down menus.

- Select Field to Filter: To create your Yahoo Finance like undervalued growth stock screener, click on the drop down menu and scroll down to the Ratios section where you will find the metric “Price To Earning (P/E)”. Select it. Now, go to the sub-section

- Select Operator: Here, recall what filters you are creating. In this example, now we are creating a filter for those stocks whose P/E is less than 20. So, in this section we’ll select an operator “<=”. Access the drop-down menu, it will open a list of six operators. Out of those six, select “<=”, it is read as “less than or equal to”. Now, we can go t the next sub-section.

- Filter Value: Here, we select the filtering value. What is our objective, we was to filter stocks who P/E is <= 20. So in this section, will manually enter our number “20”.

After you have done the above entries, make sure to click on the “Submit” button.

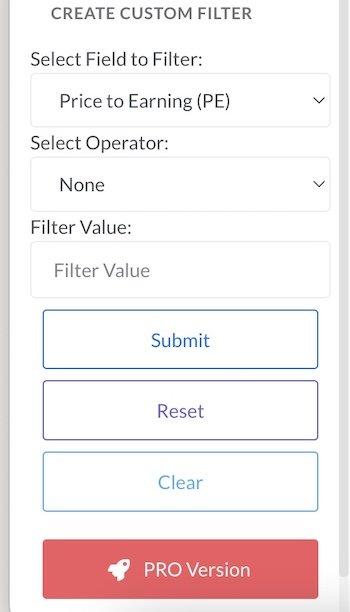

Now, you will also have to do the same three steps for the following filtering criteria’s as well. Every time, remember to click on the “Submit” button to apply the new filter.

- PEG <1: Use the drop down filter to select the metric called “PE to growth (PEG) 3 Years.” Then go and select the operator “<=.” Then, enter the number 1 (one) in the third sub-section. Finally, click on the “Submit Button.

- EPS Growth > 25%: Use the drop down filter to select the metric called “Earning Per Share Growth Rate (EPSG).” Then go and select the operator “>=.” Then, enter the number 25 in the third sub-section. Finally, click on the “Submit Button.

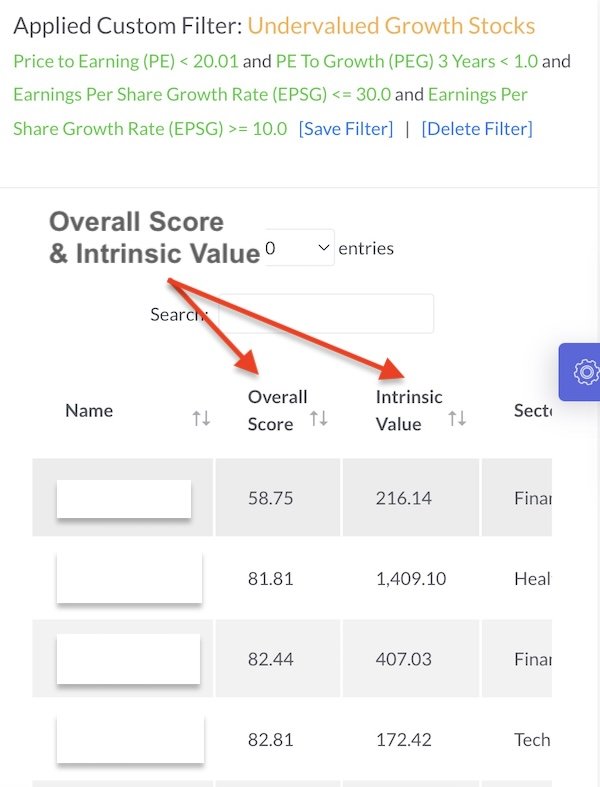

After you’ve applied all the three filters as explained about, what you will on the screen is a message that will read like this:

Click on the [Save Filter] link to save your custom screener. This will open a new message box. Enter a name for your new custom stock screener, and then click save.

So, you can see how easily you have created your own Yahoo Finance type undervalued growth stock screener for yourself.

Final Words

You can create multiple number of custom filters inside the Big Screener. There are more then 40 numbers of metrics to select from. Using a combination of these 40 metrics, there are like endless opportunities of creating custom filters.

You can also edit your custom filter by adding new metrics or removing some old metrics.

Do you know what is the best part of the Custom Filters of the Big Screener? It will not only show you the list of filtered stocks, it will also show the “Overall Score” and “Intrinsic Value” of the stocks. You can use these two data to identify, within your list of filtered stocks, those stocks whose Overall Score is above 75 and is also undervalued (Intrinsic Value less than its price).

I hope you like his article on how to create a Yahoo Finance type stock screener inside the Stock Engine app. If you like it, consider giving your feedback in the comment section below.

Have a happy investing.