In recent news, global consumer goods giant Unilever has announced plans to spin off its $8.6 billion ice cream business, a move aimed at streamlining its operations and focusing on core businesses. This decision has raised questions about its implications for Hindustan Unilever Limited (HUL), its Indian subsidiary. Let’s delve into the details and analyze the potential impact on HUL’s stock performance.

Hindustan Unilever Limited (HUL) is India’s biggest FMCG company. They sell everyday consumer goods. They’re a subsidiary of Unilever UK. Their products reach a massive 9 out of 10 Indian households.

Founded in 1931, HUL has a long history and strong brand presence with popular names like Lux, Dove, Lipton, and Horlicks.

In the last FY, the company reported a revenue of Rs.58,154 Crore. Its profit after tax was Rs.9,962 Crore. In the last five years, its EPS has grown at a rate of around 10% per annum.

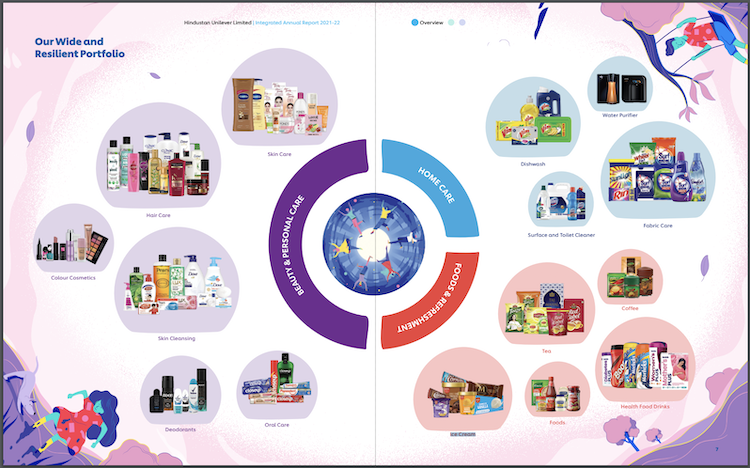

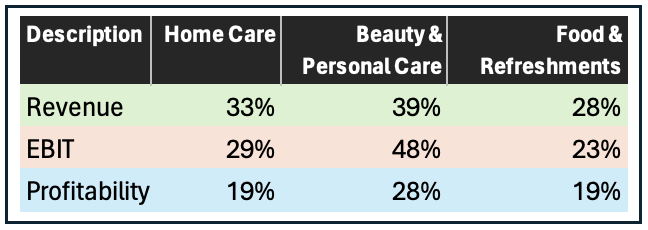

HUL operates across three main segments: Beauty & Personal Care, Food and Refreshments, and Home Care.

39% of revenue comes from their beauty and personal care business. The balance of 61% is split between home care (33%) and food & refreshments (28%).

Within the food and refreshments segments following businesses are further segmented:

- Culinary products,

- Foods,

- Health Food Drinks,

- Tea & Coffee,

- Ice cream and Frozen Desserts.

At present, Unilever wants to sell its Ice Cream & Frozen Desserts segment. It is a point worth noting that, earlier in July 2022, Unilever sold its Tea business but HUL retained its Tea business.

#1. Unilever’s Ice Cream Spin-Off: Rationale and Implications

Unilever’s decision to divest its ice cream business stems from its sluggish growth and lack of synergies with core operations. The move is expected to make Unilever a more focused and agile company. However, this strategic shift raises concerns about the fate of HUL’s ice cream business, which forms a small but rapidly growing segment of its portfolio.

Unilever’s decision to spin off its ice cream business could have significant implications for HUL’s revenue stream. Ice creams contribute about 3% of HUL’s total sales of Rs 59,144 crore (FY23). The separation of this segment could potentially impact HUL’s overall financial performance.

Additionally, the restructuring at Unilever, which includes a loss of 7,500 jobs, may lead to operational changes and restructuring costs that could indirectly affect HUL’s operations.

#2. HUL’s Dilemma

The dilemma for HUL is whether to follow or forge an independent path for itself.

As Unilever charts its course towards divesting its ice cream business, HUL finds itself at a crossroads. The Indian subsidiary must decide whether to align with Unilever’s strategy or pursue an independent path. This dilemma echoes past instances where HUL faced conflicts arising from Unilever’s global decisions.

If at all, HUL has to go Unilever’s way, potential scenarios available for HUL’s ice cream business are as follows:

- Merger or acquisition: HUL could merge with leading Indian ice cream players like Vadilal or Mother Dairy. This way it will gain market share and distribution muscle. But will it be practically implementable, is a big question mark.

- Joint venture: HUL can partner with a private equity firm or a strategic investor. They could provide HUL with the capital and expertise to grow the ice cream business as a standalone vertical.

- IPO: D-merger of the ice cream business as a separate listed entity could unlock shareholder value. It will attract investors who want to benefit from the high-growth potential of the Indian ice cream market.

What’s listed above are three alternatives for HUL post-Unilever UK’s take their Ice Cream Business. But I’m not sure if HUL needs to take these extreme steps. HUL’s ice cream business is doing well.

#3. Contrasting Growth Trajectories

Unilever’s strategy of shedding non-core assets aligns with its aim to enhance profitability by focusing on core businesses. However, this strategic shift contrasts with HUL’s growth trajectory, particularly in the ice cream segment.

HUL’s ice cream business presents a compelling growth opportunity within the Indian market. This growth story is driven by factors such as evolving consumer preferences and favorable market dynamics.

As HUL continues to capitalize on these growth prospects, the divergence in growth trajectories between Unilever and its Indian subsidiary comes as a challenge. Here is a need to tailor strategies to specific market contexts while balancing short-term profitability with long-term growth objectives.

It will not be an easy pick for HUL to go Unilever’s way. For an investor in HUL Stocks, I think this divergence from its parent company shall be a piece of good news. But we’ll have to wait and see what the HUL board decides in times to come.

#4. Evaluating Options for HUL’s Ice Cream Business

HUL’s ice cream business, comprising brands like Magnum and Kwality Walls, contributes a small percentage to its overall sales but demonstrates robust growth potential. Amidst intense competition and evolving market dynamics, HUL faces the task of evaluating its options for the future of its ice cream segment. This decision-making process demands careful consideration of market trends, competitive landscape, and shareholder interests.

HUL’s response to Unilever’s decision involves evaluating various options for its ice cream business. This assessment includes discussions with the HUL Board and Unilever management to finalize the approach.

The company’s robust cost savings program, known as Symphony, will likely play a crucial role in mitigating any adverse effects of the spin-off. HUL aims to assimilate global initiatives under Unilever’s productivity program to enhance its cost efficiency and fuel growth initiatives.

#5. Analyzing Market Response and Investor Sentiment

The announcement of Unilever’s decision to spin off its ice cream business has triggered a flurry of activity in the financial markets. Investors are closely scrutinizing the implications for Hindustan Unilever Limited (HUL). Market response to such corporate restructuring initiatives is often swift and discernible. They clearly reflect investors’ reactions to the perceived impact on the company’s financial performance.

Following Unilever’s announcement, HUL’s stock experienced heightened volatility. Investors are recalibrating their expectations. Though it is not clear what will be the stance of HUL, investors are anyways assessing the implications. If HUL decides to go Unilever’s way, earnings potential and growth trajectory will be impacted.

The uncertainty surrounding the future of HUL’s ice cream business has led to divergent views among market participants. Some are expressing concerns about the potential disruption to revenue streams and profitability. Few others view the restructuring as an opportunity for HUL to streamline its operations and focus on higher-growth segments.

Analysts and industry experts have been actively monitoring developments. Key considerations include the extent to which the spin-off will affect HUL’s revenue composition, operating margins, and overall competitive positioning within the consumer goods industry. Additionally, analysts are assessing the company’s ability to effectively reallocate resources and capitalize on emerging opportunities in the wake of the restructuring.

How Do I See HUL as a Business?

Strengths of HUL:

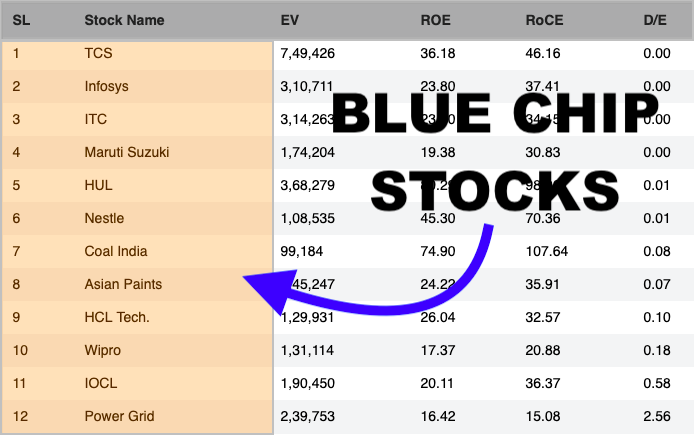

- Strong brand portfolio and market leadership: HUL enjoys a dominant position in the Indian FMCG market. There are a few strong brand names like Horlicks, Surf, Dove, Rin, Boost, Bru, Red Lalbel, Kwality Walls, Magnum, Lipton, Kissan, Domex, Ponds, Vim, Pepsodent, etc. There are very few companies in India that can boast of a product basket as diverse as HUL’s.

- Focus on innovation: The company’s commitment to launching new products and campaigns highlights its growth potential.

- Robust cost management: HUL’s “Symphony” program focuses on cost savings, which can improve profitability.

- Long-term growth prospects: The Indian FMCG market is expected to experience significant growth, benefiting HUL.

Uncertainties:

- Impact of Unilever’s ice cream spin-off: The future of HUL’s ice cream business and its impact on revenue remains unclear.

- Market competition: HUL faces intense competition from Ice Cream Brands like Amul, Vadilal, and Mother Dairy. In other product categories, HUL’s competition comes from other popular brands like Nestle, Dabur, Colgate-Palmolive, Patanjali, Emami, Gillett India, etc.

What I’ll do as a prospective investor:

- Investment horizon: If one has a long-term investment horizon (over 5 years), HUL’s strong brand presence and growth potential make it a quality blue-chip stock.

- Risk vs Value: The uncertainties surrounding the ice cream business are causing further pressure on HUL’s already-falling stock price. But I think these are times when such quality companies trade at value levels. There is risk but this is what is also creating value for the shareholders (new and old).

- Portfolio diversification: HUL could be a good addition to a diversified portfolio. Here the focus will be on Indian consumer staples.

Conclusion

As Unilever embarks on its strategic transformation journey, the implications for its Indian subsidiary, HUL, remain uncertain. The contrasting growth trajectories and strategic priorities of both entities pose challenges and opportunities for HUL’s future trajectory. Investors and stakeholders await further clarity on HUL’s strategic decisions amidst the evolving landscape of the consumer goods industry.

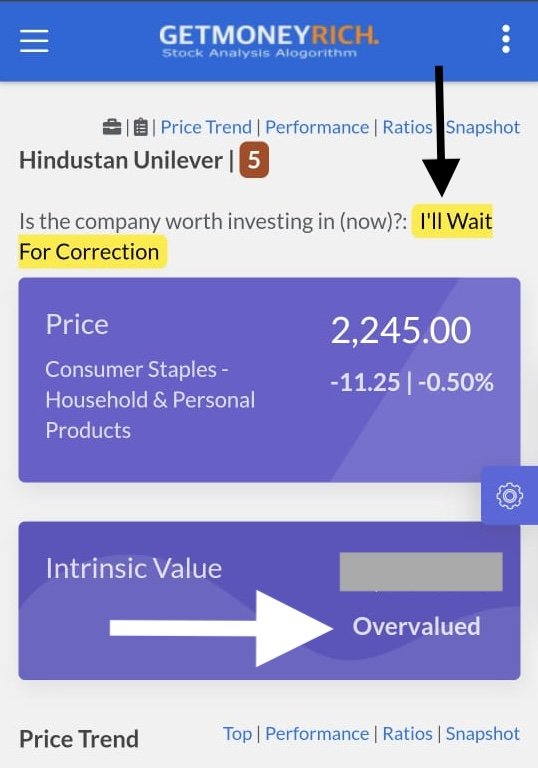

At current levels of Rs.2245, HUL share is trading very close to its 52W Low levels. Traditionally, this stock has always traded at very high P/E multiples (PE50+ Levels)

My Stock Engine is still showing HUL as undervalued. But my experience tells me that a 10% correction (in the last 1 Year) in a stock like HUL is good enough. Another 4-5% price fall will bring it to Rs.2,150 levels. At those levels, its valuation becomes very attractive for me. At those buy levels, I think, a 10-12% CAGR growth in price for a holding time of 5 years becomes a practical assumption.

Have a happy investing.

Suggested Reading: