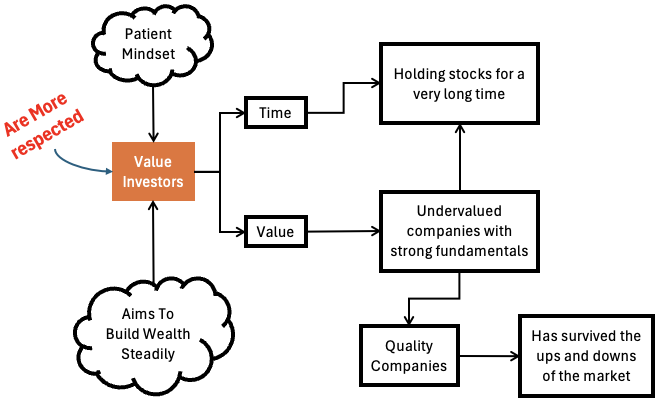

In stock investing, long-term value investors are like wise sages. They patiently seek out hidden gems in the stock market. They’re not in it for quick gains. Instead, they believe in the power of time and value. These investors look for undervalued companies with strong fundamentals. They aim to hold onto their stock holdings for the very long haul.

Learning from these professional value investors is like gaining access to tons of wisdom. They’ve weathered market storms, seen bull runs, and learned valuable lessons along the way. By studying their strategies, we can avoid common pitfalls and practice informed stock investing.

Value investors prioritize fundamental analysis over short-term market fluctuations. They focus on understanding a company’s business model, competitive advantage, and management quality. This approach allows them to identify opportunities others might overlook. So what? This method of picking stocks can often lead to substantial returns over time.

Unlike speculators chasing hot trends, long-term value investors have a patient mindset. They’re not swayed by market hype or panic-selling. They stick to their investment thesis as a discipline. They stay true to their principles and thereby build wealth steadily over the years.

I’ve been stock investing since 2007-08. During these 16 years, I’ve seen that that value investors earn the respect of peers and newcomers alike.

Understanding Value Investing

Long-term value investing is about the long game. It’s about finding undervalued companies with strong potential for growth.

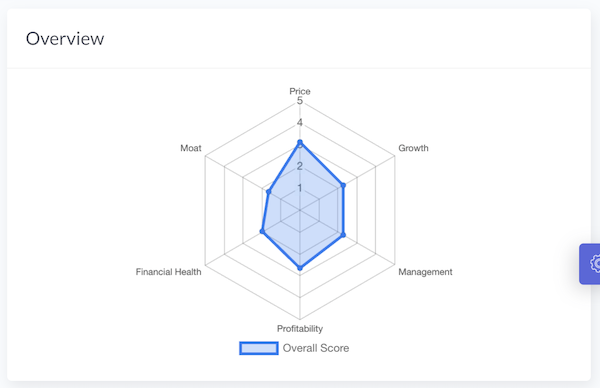

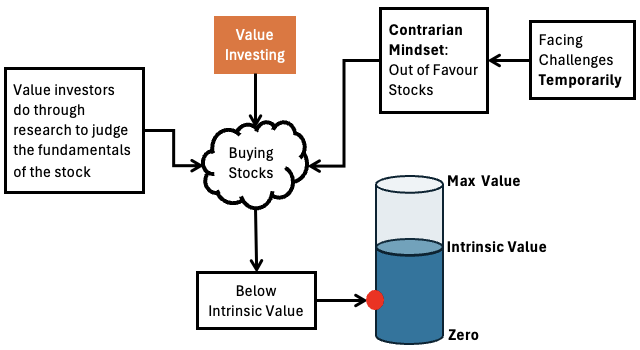

At its core, long-term value investing is about buying into businesses that are trading below their intrinsic value. Investors look for companies with profitability, stable cash flows, economic moat, and strong financials. These factors set them apart from their peers.

These investors are diligent researchers. They conduct thorough analyses to understand the companies they invest in. They also look beyond the numbers to assess the quality of a business’s management team. Warren Buffett is a value investor who gives a lot of importance to a company’s moat.

Value investors generally have a contrarian mindset. What does it mean? They’re not afraid to go against the crowd. They often invest in out-of-favor stocks that others do not want to invest in at the moment. They invest in these companies believing that the demand for this stock will come back when the situation changes.

The contrarian approach is about seeking out opportunities in out-of-favor companies that are temporarily facing challenges. They recognize that market sentiment can sometimes lead to mispricing. Such events provide opportunities for patient, long-term investors.

Finding Value Stocks

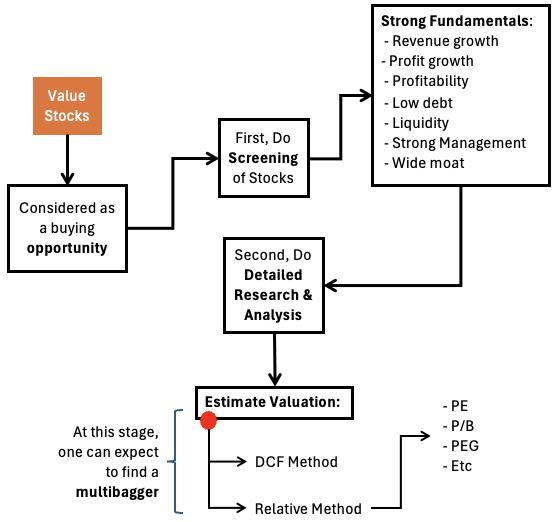

Identifying investment opportunities with long-term potential is the main goal of value investors. How do they do it? By screening potential stocks and then conducting detailed research and analysis on the selected few stocks.

Their focus is always on companies with strong fundamentals. When they say fundamentals they mean solid revenue and profit growth, low debt levels, high profitability, and reasonable liquidity. Investors like Warren Buffett also give extra emphasis on the quality of management and the competitive moat of companies.

By identifying companies with these characteristics, value investors increase their chances of finding a multibagger.

Value investors use various valuation metrics to estimate the intrinsic value of stocks. One of the most used valuation models is the Discounted Cash Flow (DCF). People can also use the relative price valuation technique (which is also easier) to estimate if a stock is undervalued or not. Here, investors can use metrics such as price-to-earnings ratio, price-to-book ratio, PEG ratio, etc to do the valuation assessment.

Key Takeaways

Implementing lessons from long-term value investors in our investment approach can significantly enhance our chances of success in the stock market. Here are some practical takeaways from this article:

- Focus on Intrinsic Value: Assessing the intrinsic value of a company is important. Never rely solely on the market price to make buy decisions. Conducting thorough research to understand the underlying fundamentals and growth prospects of potential companies is key.

- Patience and Discipline: Adopt a patient and disciplined approach to investing. Be ready to wait for a long time for stock prices to correct and fall below their intrinsic value. Once such stocks are in our portfolio, we must aim to keep them undisturbed for years. We must avoid making impulsive decisions based on short-term market fluctuations.

- Quality Over Quantity: One must prioritize quality over quantity when selecting stocks to include in the portfolio. Instead of chasing after numerous opportunities, one must focus on identifying a few high-quality businesses with strong competitive advantages and growth potential.

- Diversification: Building a diversified portfolio to mitigate risk is also crucial. Spreading our investments across different sectors, stocks, and asset classes is essential. This will reduce the impact of market volatility on our portfolio when the market is doing badly.

- Stay Disciplined During Market Volatility: Maintaining a calm and rational mindset during periods of market volatility is key. One must avoid making emotional decisions. Sticking to our long-term investment plan, focusing on the fundamentals of the businesses that we’ve invested in can do a world of good.

Challenges and Considerations

Value investing presents several challenges and considerations that investors must navigate effectively to succeed in the stock market. Here is a list of a few of them for our quick attention:

- One of the key challenges is maintaining discipline and patience throughout the investment journey. Investors must resist making impulsive decisions based on short-term market fluctuations.

- Another challenge is identifying undervalued opportunities amidst market noise and volatility. Conducting thorough research and analysis is essential to distinguish between temporary setbacks and genuine investment opportunities.

- We should also be mindful of their circle of competence. We must avoid investing in businesses we don’t understand.

- Investor’s psychology and behavior can also pose challenges. Emotional reactions to market corrections (Panic), fear of missing out (FOMO), and herd mentality can lead to irrational investment decisions. Overcoming these psychological biases requires discipline and self-awareness. We must focus on long-term fundamentals rather than short-term noise.

- Value investors need to consider macroeconomic factors, regulatory changes, and industry trends that could impact their investment thesis. Staying informed and adaptable to changing market conditions is essential in stock investing.

Maintaining a long-term perspective and sticking to a well-defined investment strategy can help investors overcome these challenges.

Conclusion

Long-term value investing embodies a disciplined approach to wealth accumulation. It has an emphasis on patience, thorough research, and fundamental analysis. What I’ve shared here are a few understandings I’ve picked from seasoned value investors (reading and watching their talks).

These are basic principles of value investing. We can use these to identify undervalued opportunities with long-term growth potential.

While challenges such as market volatility and emotional biases may arise, maintaining discipline and sticking to a well-defined investment strategy is paramount.

Building a diversified portfolio and staying informed about market trends can help investors navigate uncertainties and mitigate risks.

Ultimately, the key to success lies in adopting a long-term perspective, remaining patient during market fluctuations, and focusing on the intrinsic value of quality businesses.

Have a happy investing.

Suggested Reading: