If you’re like me, you’ve probably been riding the rollercoaster of 2024’s stock market highs with a mix of thrill and mild panic. The S&P 500’s been flexing its muscles, AI stocks are still the darlings of Wall Street, and everyone’s got an opinion on what 2025 might bring. But here’s the thing, I can’t shake this nagging feeling that maybe, just maybe, we’re due for a reality check. So, I did some digging into seven potential warning signs that could spell trouble for the US stock market in 2025. Grab a snack, settle in, and let’s declutter these issues together.

Spoiler alert, it’s not all doom and gloom, but there’s definitely stuff worth keeping an eye on.

1. Rising Interest Rates

Higher rates acts as a profit squeeze.

Let’s assume that you’re a company that’s been borrowing cheap money for years to fuel growth. Life’s good, right?

Then bam, interest rates start climbing, and suddenly, that debt’s a lot heavier.

That’s the vibe I’m getting for 2025.

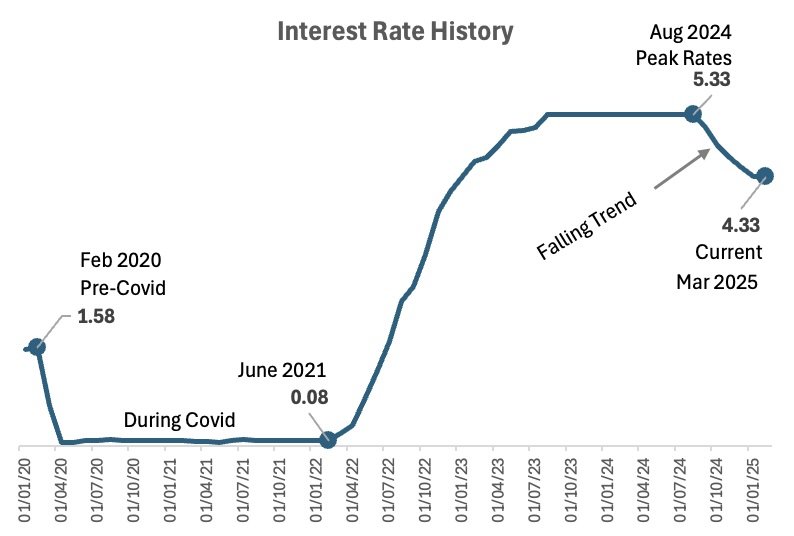

The Federal Reserve’s been cutting rates lately (we’re at 4.25% – 4.5% as of early 2025), but there’s chatter that if inflation ticks up, say, from Trump’s proposed tariffs or sticky wage growth, they might slam on the brakes or even hike rates again.

Higher borrowing costs hit corporate profits hard, especially for smaller firms or those leveraged to the hilt.

I mean, look at 2022, when the Fed jacked rates up over 500 basis points, the S&P 500 tanked nearly 20%.

Could we see a repeat? Maybe not that dramatic, but it’s a red flag if rates start creeping up faster than expected.

2. Inverted Yield Curve

The yield curve is like the market’s crystal ball, and it’s got a spooky track record.

When short-term Treasury yields (like the 2-year) outpace long-term ones (like the 10-year), it’s called an inversion, and it’s historically screamed recession ahead.

It flipped back in 2022 and stayed that way for ages, but it uninverted late last year, phew, right? Not so fast.

Just this February, the 10-year yield (4.317%) dipped below the 3-month yield (4.324%) again, and folks are buzzing.

Sure, it’s not a perfect predictor (we dodged a recession after the 2019 uninversion), but with growth slowing, GDP was a measly 1.3% in Q1 2025, it’s like a smoke alarm going off.

Keep your ears peeled for labor market data; if jobs start drying up, this could get real.

3. High Inflation

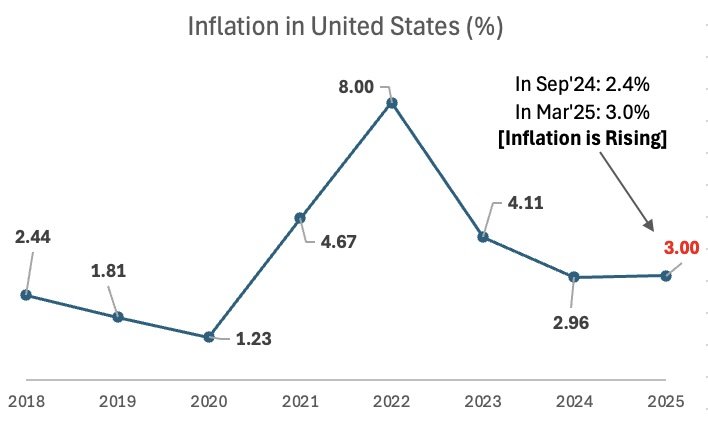

Inflation’s been the word on everyone’s lips since 2022’s 9.1% peak, and while it’s chilled out to around 2.4% by late 2024, it’s still not at the Fed’s 2% happy place.

Now, imagine Trump’s tariffs kick in, 10% across the board, 60% on Chinese goods. Prices for everyday stuff could spike, squeezing consumers like you and me. Less spending comsumers means companies see slimmer profits, and poof, stock prices feel the pinch.

I chatted with a buddy who runs a small retail business, and he’s already sweating higher import costs. If inflation creeps past 3.25% in 2025, watch out, investors might ditch stocks for bonds, thinking the Fed’s about to get tough again.

4. Overvalued Stocks

Ever feel like the market’s partying too hard? I do.

The S&P 500’s up 10% year-to-date as of March 2025, and tech stocks, looking at you, Nvidia, are still riding the AI wave with insane valuations.

Some analysts, like Jeremy Grantham, are waving red flags, calling it a potential “cataclysmic decline” waiting to happen. The Shiller P/E ratio’s hovering around 35, way above the historical average of 17.

Sure, earnings are strong, but if growth slows or AI hype cools off, those sky-high prices could crash back to earth.

It’s like buying a designer bag on credit, you hope it holds value, but if the trend fades, you’re stuck.

5. Excessive Corporate Debt

Debt’s like that friend who keeps borrowing cash but never pays you back, fine until it’s not.

US companies are sitting on a mountain of it, especially those who gorged on low rates pre-2022. Now, with rates still higher than the pre-pandemic norm, refinancing’s getting pricey.

If sales dip (thanks, inflation or slowdown), some firms might struggle to cover even the interest payments.

Think zombie companies, barely alive, propped up by debt.

A buddy of mine in finance says junk bond yields are creeping up, a sign investors are nervous. If defaults spike in 2025, it could drag the market down with it.

6. Global Economic Slowdown

The US doesn’t live in a bubble (though sometimes Wall Street acts like it).

China’s economy’s sputtering, low demand’s keeping oil prices tame despite Middle East chaos, and Europe’s barely growing at 0.5%.

If global growth tanks, US exports take a hit, and multinational giants like Apple or Ford feel the pain. Plus, Trump’s trade war vibes could make it worse, tariffs might protect some US jobs but could tank demand for our goods abroad.

I saw a stat that global GDP’s expected to limp along at 2.7% in 2025. Not disastrous, but not the robust backdrop stocks love either.

7. Geopolitical Tensions

Let’s be real, 2025’s starting with a bang, and not the good kind.

Russia-Ukraine’s still a mess, Middle East conflicts are simmering, and Trump’s “America First” rhetoric’s got everyone on edge.

Just look at January, Canada’s PM resigned over budget drama, and markets twitched. Geopolitical shocks spook investors faster than you can say “sell-off.” Remember 2020’s pandemic plunge?

Uncertainty’s the enemy of confidence, and if tensions escalate, say, China makes a move on Taiwan, stocks could take a nosedive as folks flock to safe havens like gold or Treasuries.

So, what’s the Verdict?

Alright, deep breath. These seven signs aren’t a guaranteed crash prediction, they are more like yellow lights on the dashboard.

The market’s got a lot going for it, corporate earnings are solid, tech’s still innovating, and the Fed’s trying to nail that soft landing. But these risks? They’re real, and they’re interconnected.

Rising rates could tip the yield curve, inflation could fuel overvaluation fears, and geopolitical drama could amplify a global slowdown.

It’s like a Jenga tower, one wobbly piece might not topple it, but a few at once? Yikes.

Conclusion

Here’s where we get practical, because I’m not about to leave you hanging.

- First, diversify, don’t bet it all on tech or growth stocks. Mix in some value stocks or dividend payers; they’re less sexy but steadier.

- Second, keep some cash handy, not so much you miss out, but enough to swoop in if prices drop.

- Third, watch the data like a hawk, unemployment ticks, inflation reports, Fed speeches. I’ve got Google Alerts set up for yield curve and CPI, nerdy, but it works.

- And finally, don’t panic. Markets dip all the time; it’s the long game that counts.

So, what do you think? Are you feeling bullish, bearish, or just ready for a nap after all this?

Drop me a comment, I’d love to hear your take.

For now, I’m keeping my popcorn ready and my portfolio balanced. 2025’s gonna be a wild ride either way.

Have a happy investing.