Check a Company’s Pricing Power

Enter a company name (optional) and score each question from 0 to 5 to see if it has pricing power! (0 = Not at all, 5 = Absolutely)

Summary:

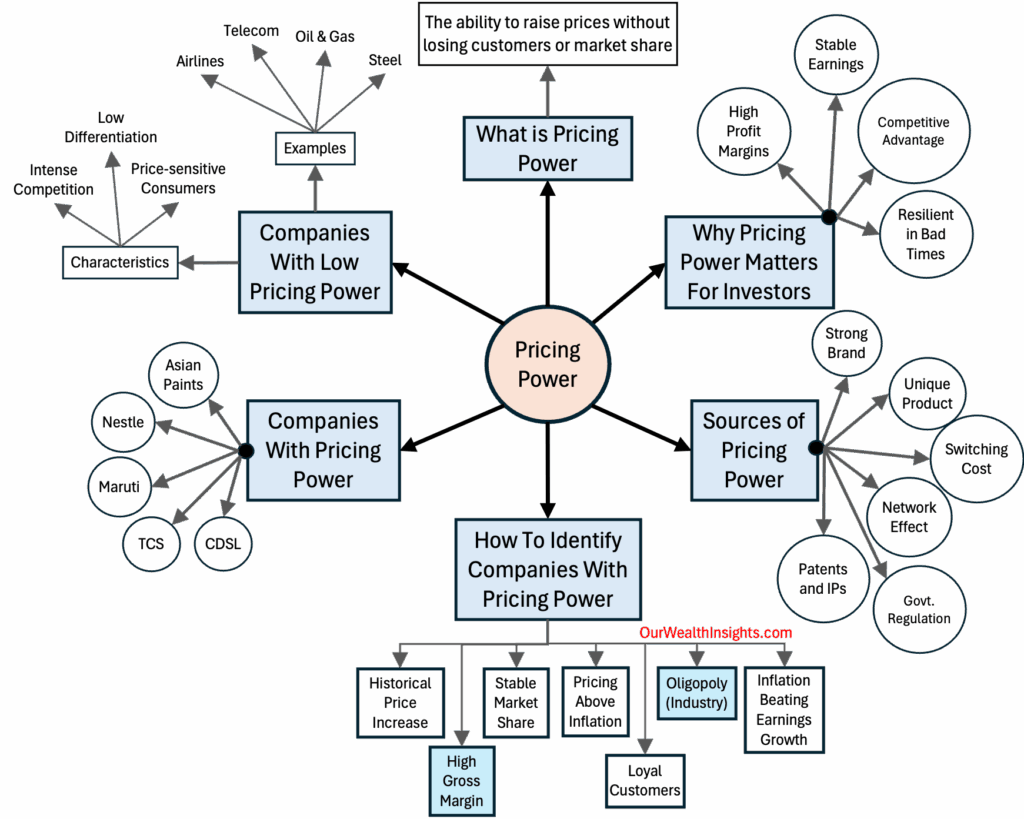

- In this post we’ll explores pricing power, a key factor in identifying strong companies for stock investing in India, offering practical tips and examples to help investors make smarter decisions. Check this mind map for instant clarity.

Introduction

Let’s talk about a concept that can really help us (investors) make better choices when investing in stocks. It’s called pricing power. If this term is sounding a bit fancy, trust me, it’s not that complicated. By the time we’re done, you’ll see why pricing power is such a big deal for finding great companies to invest in.

Note, Warren Buffett loves to invest in companies with strong pricing power.

What Exactly is Pricing Power?

Imagine you run a small shop selling biscuits.

If you increase the price of your biscuits by Rs.5, and suddenly no one buys them anymore, that’s a problem, right?

But what if you raise the price, and people still keep buying?

That’s pricing power.

It is the ability of a company to increase its prices without losing its customers or market share.

For companies, this is like having a superpower. It means they have something special, maybe a strong brand or a product that’s hard to replace. For example:

- No matter what, people who use Macbooks as their laptop device will never switch to Windows.

- People who love eating maggie will not eat Tom Ramen or Yippie Noodles.

- People who use Pampers for their kids (diapers) will not buy anything else.

- People who invest in stocks will inadvertently use CDSL as their depository.

For us as investors, this is a signal that the company might be worth our money. Let’s explore why this matters so much.

Why Should We Care About Pricing Power as Investors?

To understand it, think about it like this:

When a company can raise prices without worrying about losing customers, what happens to its profits? They go up. Higher prices mean better profit margins.

And better margins mean the company continues to make profits even if its costs go up, like during inflation. In terms of companies, this is an incredible power. For us investors, such companies shall be our main focus.

Now, let’s look at another side.

Companies with pricing power are often more stable. If there’s an economic downturn, they can still make money because people keep buying their products. This makes their earnings more predictable.

For someone like me, who doesn’t want too much risk, this is a big plus.

And then there’s more in these companies.

Pricing power often shows that a company has a strong competitive advantage. We also called it as company having a side economic moat. It’s like a protective wall that keeps competitors away.

And the big thing is this, even big investors like Warren Buffett look for this (pricing power in companies) when picking stocks. If it’s good enough for Buffett, it’s definitely worth our full attention.

Where Does Pricing Power Come From?

So, how does a company get this ability to raise prices?

For sure it is not magic.

It comes from a few key things.

- First, a strong brand can do wonders. Take Hindustan Unilever, for example. Their brands like Dove and Surf Excel are so trusted that even if they increase prices a bit, we still buy them. Why? Because we know their quality.

- Another way is through product differentiation. If a company offers something unique, customers don’t have many alternatives. Asian Paints is a great example. Their paints are top-notch, and they’ve built such a strong name in India that people prefer them over others, even if the price is higher.

- Sometimes, it’s about the industry itself. In markets where there are only a few big players, like an oligopoly, companies can control prices better.

- Also, if a company has patents or special technology, like some pharma companies do, they can charge more because no one else can make the same product.

A combination of these factors (sometimes even one factor is enough) make a company strong and give it a strong pricing power.

How Can We Spot Companies with Pricing Power?

How do we find these companies when we’re looking at stocks? In my Stock Engine, there is a pre-coded stock screener that can filter “Warren buffett Type Indian Stocks.” This screener is based on the concept of economic moat (pricing power).

If you do not want to use a tool like this, it’s not so hard to identify these stocks on your own.

A ways to check if the company has the pricing power or not are listed below:

- If the company has been able to raise prices in the past without losing customers? If they’ve done this consistently, that’s a good sign.

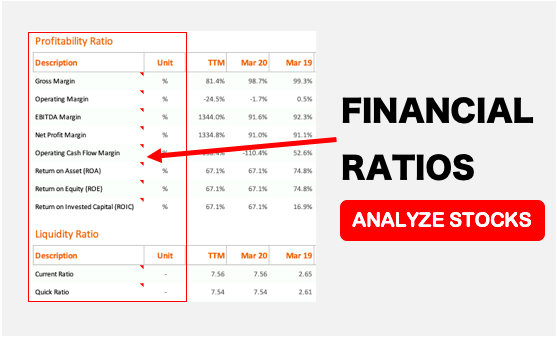

- Another thing to look at is their gross margins. If a company’s margins are stable or growing, even when their costs go up, it means they’re passing those costs to customers. Maruti Suzuki is a good example here. They dominate the Indian car market, and even when they raise prices to cover higher costs, people still buy their cars. Why? Because Maruti has a huge network and trust that others can’t match.

- We can also look at the industry. If a company operates in a sector with high competition or price-sensitive customers, it might struggle to raise prices. But if it’s in a sector with fewer competitors or loyal customers (like that of Tata Consultancy Services in IT services), it can charge more without worry. TCS has such a strong reputation that its clients stick with them, even if fees go up.

- Finally, consistency matters. If a company can keep its earningsgrowing for years, not just during good times, it’s a sign they’re truly special.

So, when you’re researching a stock, dig into these details. It’ll help you separate the best from the rest.

Indian Companies That Show Strong Pricing Power

Let’s talk about some Indian companies that have this pricing power. I’ve picked a few that I’m really confident about.

- First up is Hindustan Unilever Limited. They make everyday products like soaps and detergents. Their brands are so strong that even if they increase prices, we don’t think twice before buying. I mean, who doesn’t use Dove or Lux?

- Then there’s Asian Paints. If you’ve ever painted your house, you’ve probably heard of them. They’re the biggest in India’s paint market. Even when raw material costs go up, they raise prices, and people still choose them. That’s the kind of trust they’ve built.

- Maruti Suzuki is another one. They make the cars we see everywhere on Indian roads. With over 40% of the market, they can increase prices without losing buyers. I remember my uncle buying a Maruti car last year—he didn’t even look at other brands because he trusts them so much.

- And let’s not forget TCS and Infosys. In the IT world, they are giants. They work with big global clients, and because their services are so good, they can charge premium rates. These companies are proof that pricing power can make a business really strong.

Indian Companies That Struggle with Pricing Power

But not every company has this advantage. Let’s look at the other side, companies with weak pricing power.

- Take the telecom sector, for instance. Companies like Reliance Jio, Bharti Airtel, and Vodafone Idea are always fighting to offer the cheapest plans. If one of them raises prices, customers switch to another. It’s a tough business to be in.

- The airline industry is similar. IndiGo and SpiceJet compete so much on ticket prices that they can’t afford to charge more. If they do, people might just take a train instead. I’ve seen this myself, last time I booked a flight, I picked the cheapest option without even thinking twice.

- Then there’s the power sector. Companies like NTPC and Tata Power don’t have much control over prices. The government sets the rates for electricity, so they can’t increase them even if their costs go up.

- And in the steel industry, companies like Tata Steel and JSW Steel face global price pressures. Steel is a commodity, so they have to match market rates, or they’ll lose customers.

Seeing both sides helps us understand why pricing power is so important.

It’s the difference between a company that thrives and one that struggles.

Conclusion

So, what’s the lesson for us?

When we’re picking stocks, we should look for companies with pricing power. They’re the ones that can grow their profits, stay stable during tough times. Only such companies can give us better returns over the long term.

It’s like choosing a stronger boat to sail through a storm. You want one that won’t sink easily in dominant storms.

But we also need to be careful. Companies without pricing power can be risky.

Their profits might take a hit if costs rise or competition gets tougher.

That’s not what we want when our hard-earned money is on the line, right?

Pricing power isn’t just a fancy term, it’s a practical tool for us to find great companies (check the above online tool).

Whether it’s Hindustan Unilever’s strong brands, Nestle’s global reputation, or HUL’s wide product mix, these companies show us what to look for.

At the same time, sectors like telecom and airlines remind us what to avoid.

Next time you’re researching a stock, ask yourself, Can this company raise its prices without losing customers? If the answer is yes, you might have found a winner.

Investing is all about finding businesses that can grow stronger over time, and pricing power is one of the best ways to spot them.

Have a happy investing.

Can you suggested stock for long term like 7 to 10 years

Thanks Mani…good to see your blog operational after a gap of almost 10 days. The above article was really interesting however can you list some of the Indian companies having pricing power apart from Eicher Motors?