Stock market investors often seek a guiding philosophy to help them practice stock investing. Warren Buffett is one such guide whose investment principles can be our lighthouse. Renowned for his astute value investing approach and long-term perspective, Buffett’s methodology is something I rely on completely. Check this list of Buffett-type stocks.

As an Indian investor, I’m always on the lookout for Warren Buffett-type Indian stocks. Over the years, my desire to accumulate more of such stocks has only become more pronounced. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

What exactly constitutes these stocks? How can we discern the hallmarks aligning with Buffett’s famed investment philosophy within the Indian context?

In this article, I’ll share a few key characteristics that define Indian stocks worthy of Buffett’s approval. What Warren Buffett likes in his stocks are consistent earnings, economic moats, strong management, low debt levels, etc.

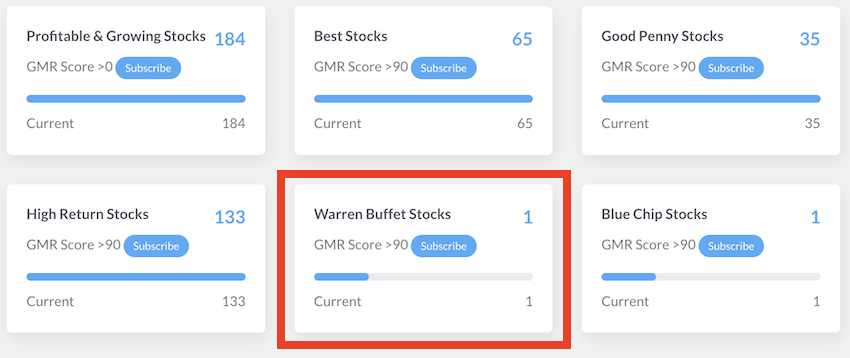

Using Buffett’s logic as my benchmark, I wrote an algorithm (for my Stock Engine) that can filter Warren Buffett-type Indian stocks for me. Over time, this algorithm has seen several updates, but its core remains the same. In this article, I’ll also share a peep into this algorithm with you.

The bigger idea is to gain insights into how to navigate ourselves from a host of below-average stocks and spot credible opportunities. To achieve this target, my filtering algorithm uses the timeless principles espoused by Warren Buffett.

There are 10 key characteristics that Warren Buffett likes in his potential companies (stocks). Out of the 10, four (4) are quantitative, and six (6) are qualitative characteristics.

List of Warren Buffett Type Indian Stocks [2025]

(Updated on January 03, 2025)

| SL | Name | Industry | Price | Market Cap(Cr) | ROE (TTM) | OPM (TTM) | RevenueG (5Y) | D/E (TTM) | GMR Score |

|---|---|---|---|---|---|---|---|---|---|

| 1 | MAHSCOOTER:[500266] | Motorcycles & Scooters | 9,719.00 | 11,107.52 | 0.59% | 82.49% | 14.27 | 0.00 | 89.80 |

| 2 | OBEROIRLTY:[533273] | Real Estate Development | 2,253.75 | 81,812.31 | 16.70% | 56.17% | 35.48 | 0.32 | 89.73 |

| 3 | FINEORG:[541557] | Speciality Chemicals – Diversified | 4,504.90 | 13,839.74 | 22.98% | 22.81% | 27.10 | 0.02 | 89.41 |

| 4 | PIDILITIND:[500331] | Adhesives | 2,927.50 | 1,49,150.30 | 22.96% | 19.47% | 20.18 | 0.02 | 88.90 |

| 5 | Hawkins Co:[508486] | Household Durables – Diversified | 8,958.00 | 4,736.82 | 33.88% | 13.28% | 14.33 | 0.15 | 88.56 |

Point #1. Four Quantitative Characteristics

I’ve been investing in stocks using the principles of Warren Buffett since my starting days. I was fortunate to know about his stock rules before the 2008-09 market crash. Since then, I’ve found his investing style complements my investment psychology.

Among the bedrock of Buffett’s investment philosophy lie four quantitative factors. Each plays a pivotal role in his discerning approach to the stock market.

Let’s unravel why Buffett holds these quantitative factors in such high esteem and how they contribute to his unparalleled success.

1. Consistent Profits and Predictable Cash Flow

Stock investing is akin to owning a piece of a business. What is most important for a business? Consistent profits and predictable cash flows. Why these two quantitative metrics are critical?

Consistent profits provide a measure of financial stability. It is reflective of the company’s ability to generate profits over time. It is one of the crucial indicators of its operational health.

Predictable cash flow, on the other hand, is the lifeline of any business. Cash flows ensure that a company is meeting its financial obligations. The same cash flow is used to invest in growth opportunities and yield return value to shareholders (dividends). Read more about cash flow ratios.

In Buffett’s eyes, companies with these two quantitative strengths are better equipped to weather economic storms. Hence, they are suitable for long-term investments.

2. Low Debt Levels

When it comes to investing in companies, Warren Buffett does not base it on leverage. Generally, he used the cash available in his balance sheet to add companies to Berkshire’s investment portfolio. Buffett’s aversion to excessive debt is deeply ingrained in his value investing philosophy. This is the reason why he invariably prefers companies carrying minimal debt on their balance sheets.

Quantitatively, this manifests in scrutinizing a company’s debt-to-equity ratio and interest coverage ratio.

Why does Buffett shy away from heavy indebtedness?

High debt levels amplify risk, especially during economic downturns. A company burdened with debt may struggle to meet interest payments, potentially leading to financial distress (bankruptcy).

By favoring companies with low debt levels, Buffett seeks entities with the financial flexibility to navigate challenges. Such companies can seize opportunities and maintain stability in the face of adversity.

3. Intrinsic Value and Margin of Safety

At the heart of Buffett’s investment strategy lies the concept of intrinsic value. The intrinsic value is a measure of the true worth of a company. Factors such as profit growth, dividends, and future cash flows are considered to estimate it.

Buffett describes intrinsic value as the “discounted value of the future cash flows that can be taken out of a business during its remaining life.”

Comparing the current price with the estimated intrinsic value tells us if the stock in consideration is undervalued or overvalued.

The margin of safety is a concept closely tied to intrinsic value. It ensures that even if our estimates of the intrinsic value are slightly off, the investment remains secure.

This quantitative approach underscores Buffett’s commitment to preserving capital and minimizing downside risk.

4. Dividend History

In Buffett’s eyes, dividends are not just cash payouts to shareholders. Dividend payments are a way to demonstrate that the company is keen on ensuring that it respects the concept of shareholder value.

A consistent and growing dividend history signifies financial health and stability. It indicates that a company generates sufficient cash flow not only to sustain operations and growth but also to reward shareholders.

Our preference for stocks with a strong dividend track record shall be more straightforward. The compounding effect of dividends plays a crucial role in our wealth creation.

Point #2. Six Qualitative Characteristics

Warren Buffett has become synonymous with successful long-term investing. Beyond the numbers and financial metrics, Buffett places immense importance on qualitative factors when assessing potential investments. Let’s delve into why Buffett holds these six qualitative factors in such high regard and how they contribute to his investment philosophy.

1. Economic Moat

When a business is building an economic moat, it is creating a fortification of competitive advantage for itself. To know in detail about economic moat, check this article.

An economic moat represents a company’s sustainable competitive advantage, acting as a protective barrier against competitors. Buffett’s appreciation for economic moats is deeply rooted in the understanding that companies with enduring advantages are better positioned for long-term success.

Here are a couple of reasons why investors must appreciate companies with an economic moat:

- Resilience to Competition: Businesses with economic moats can withstand challenges from competitors. This way they can maintain their market share and profitability.

- Pricing Power: A strong moat often allows a company to command premium pricing for its products or services. This price advantage contributes to higher and stable profit margins. Read more about pricing power.

2. Strong Management

If a company is like a sailing ship, the captain of the ship matters.

We must place equal emphasis on the qualitative aspect of leadership. Strong management is like an able captain steering the ship. Warren Buffett believes that capable and shareholder-friendly management is paramount for a company’s success.

Here are a couple of reasons why investors must learn to recognize and appreciate companies with strong management.

- Capital Allocation Skills: Buffett values managers who allocate capital judiciously. He looks at how the company is investing in projects that generate long-term value for its shareholders.

- Transparency and Communication: Effective communication and transparency build trust between shareholders and management. It eventually fosters a long-term partnership between the investors and the company. Just compare the annual reports of say Tata Steel, Nestle, etc with their average counterparts. The way quality companies share details in their reports speaks volumes about the quality of their management.

3. Long-Term Future Prospects

Warren Buffett is not solely focused on short-term financial results or immediate market fluctuations. Instead, he looks at the broader picture, considering the long-term trajectory of a company.

Buffett likes the enduring nature of well-established businesses. By focusing on the long term, he aims to invest in companies that can weather economic cycles, industry shifts, and changes in consumer behavior.

Short-term market fluctuations and quarterly earnings reports can be influenced by various factors, including market sentiment and short-term events. Buffett’s investment philosophy avoids being swayed by these short-term dynamics. Instead, he makes decisions based on a company’s intrinsic value and long-term potential.

Factors to consider to judge the long-term prospects of companies:

- Industry Trends: Buffett recognizes that certain industries undergo long-term growth trends. For example, his liking for the insurance industry is known. As the population age and their affordability increases, they tend to buy more insurance services. This way, there are other industries like consumer goods etc that grow with time.

- Technological Advancements: There is a transformative impact of technology on industries. Buffett has historically been cautious about investing in technology companies. But his investment in Apple in recent years demonstrates an openness to tech. These days, when he sees a company with a strong brand, predictable earnings, and a significant economic moat, he will go for it even if it is from the tech sector.

- Sustainable Competitive Advantage: Coca-Cola is a classic example of Buffett’s focus on sustainable competitive advantage. The company’s strong brand, global distribution network, and customer loyalty, contribute to its strong long-term success.

In short, we must assess a company not just by looking at its current financial health but by evaluating its ability to grow consistently over time.

4. Simple and Understandable Businesses

In stock investing, the importance of embracing the power of clarity is paramount. How to practice it?

By buying stocks of companies about whose business we have a better understanding. Suppose, you work in a construction company. Your understanding of such companies will be better than other people who know less about this industry. Similarly, a person who works in a pharmaceutical company can comprehend other pharma business better.

Investing in stocks of companies is about accurate estimation of the company’s ability to yield future cash flows. No one can predict the future accurately, but our accuracy will be higher for industries about which we have deeper insights.

How to build deep insights? Either we can work and gather experience in that industry or we can read and learn about it. This is what is called investing within our circle of competence.

Buffett has often said that he likes investing in companies whose businesses are straightforward and have understandable operations.

Here are the two immediate benefits of investing within our circle of competence:

- Risk Mitigation: Understanding the business model reduces the risk of misjudgment. It allows for a more accurate assessment of a company’s intrinsic value.

- Consistency in Decision-Making: Simplicity often leads to more consistent and rational decision-making. In companies whose operations are complicated, the chance of a mistake is high. As an investor, my first choice is stocks of simple businesses.

5. Resilience in Economic Downturns

Buffett likes companies that have a history of weathering storms in the past. In Buffett’s style of valuing stocks, companies can navigate challenging economic environments emerge stronger, and get extra points on valuations.

Warren Buffett places a significant emphasis on the ability of a company to withstand economic downturns. This is rooted in the belief that businesses with resilience not only survive during tough times but have the potential to thrive and emerge stronger when economic conditions improve.

A Few Examples:

- The Coca-Cola Company: Coca-Cola is a classic example of a resilient company. Even during economic downturns, consumer demand for beverages like Coca-Cola tends to remain relatively stable. Coca-Cola’s brand strength, global presence, and consumer loyalty have allowed it to weather economic downturns successfully. In the Indian context, I think Colgate-Palmolive has a similar brand image and product demand.

- The Goldman Sachs Group: During the 2008 financial crisis, many financial institutions faced severe challenges. Goldman Sachs weathered the storm and, with strategic moves, emerged stronger on the other side. In the Indian stock market, I think HDFC Bank has shown a similar resilience in the past.

Resilient companies typically have strong balance sheets with manageable debt levels. This financial strength enables them to withstand economic shocks without facing severe financial distress.

Looking from an investor’s perspective, resilient companies are better equipped to protect investors’ capital at all times. It ensures a smoother ride for long-term shareholders.

Economic downturns often present buying opportunities in such companies. Hence, in turbulent times, investors in such companies do not panic, instead, they are engaged in a buying spree.

6. Ethical and Transparent Practices

Warren Buffett believes that only those companies that are investible and carry out their business are never in a trust deficit. Buffett places a premium on ethical business practices and transparent corporate governance.

Why Ethics and transparency is important? Ethical business practices mitigate the risk of damaging scandals and controversies, preserving the company’s reputation. Stocks of brand names that are recognized for their ethical practices and trust are always in demand. One such brand name is the Tata Group of Companies (like TCS, Tata Motors, Tata Steel, Titan, etc).

Warren Buffett’s affinity for these six qualitative factors reflects a holistic and patient approach to investing. While financial metrics provide a foundation, qualitative factors ensure a company’s character and resilience.

Buffett’s investment philosophy is not just about buying stocks; it’s about becoming a part owner of businesses. We do not like to become owners of weak or shady companies, right?

This is the reason why when we are buying stocks, we must think as if we are buying the whole business and not just a few stocks. With this kind of mindset in our mind, our whole perspective will change about which stocks we can buy and what to avoid.

Point #3. How to Identify Buffett-Type Indian Stocks

My Stock Engine has a pre-built screener that users can use to filter Warren Buffett-type Indian stocks.

I’ve tried to code the algorithm of this screener in line with Buffett’s idea of quality stocks. Though Buffett extensively uses qualitative factors to identify his potential investments, my algorithm tries to use multiple quantitative metrics that try to replicate them.

Allow me to give you a peep inside the algorithm and metrics it used to filter Buffett-type Indian stocks:

3.1 Market Share (Revenue Based)

A substantial market share indicates a competitive advantage and enduring customer demand. It aligns with Buffett’s preference for businesses with wide economic moats. How?

Companies with a dominant market position often enjoy pricing power, scalability, and the ability to weather industry downturns. My algorithm believes that a robust market share reflects a business’s ability to consistently attract and retain customers. It thereby contributes to its long-term profitability.

By investing in companies with significant market share, we can align with the principle of owning businesses with a durable competitive advantage. These companies position themselves for sustained success in the ever-changing market landscape.

3.2 Return on Equity (ROE)

Warren Buffett places significant emphasis on Return on Equity (ROE) as a key indicator of a company’s analysis. ROE measures a company’s ability to generate profits from shareholders’ equity. It represents how efficiently it utilizes investor funds.

A consistently high ROE is a reflection of both, the management’s efficiency and the inherent quality of the company. A consistent and high ROE is a hallmark of a well-managed business with a durable competitive advantage. When a company allocates capital effectively, only then it can lead to a robust ROE.

In Buffett’s investment philosophy, a strong and consistent ROE is a fundamental metric that reflects the strength and resilience of a company’s business model.

3.3 Gross Margin (GM)

My algorithm places considerable importance on the gross margin of companies. It is a key indicator to screen Warren Buffett-type Indian stocks. Gross margin, representing the percentage of revenue retained after deducting the cost of goods sold. Gross margin reflects a company’s pricing power and cost efficiency.

Buffett values businesses with a wide economic moat. A healthy gross margin often indicates the presence of a competitive advantage leading to a wide moat.

A strong gross margin suggests that a company can maintain profitability while covering production costs. Such companies have a better ability to withstand industry competition.

My algorithm assumes that a consistent and favorable gross margin signifies the company’s ability to deliver value and maintain pricing flexibility. Such companies are better positioned to deliver on their promises to ensure shareholder value.

3.4 Operating Profit Margin (OPM)

My algorithm considers both operating margin (OPM) and gross margin (GM) to do the analysis.

OPM measures the efficiency of a company’s core operations, factoring in additional expenses beyond the cost of goods sold. For Buffett, a healthy OPM indicates effective cost management and operational efficiency. It highlights a company’s ability to generate profits from its day-to-day activities.

OPM complements GM by providing insights into a company’s overall profitability and its capacity to convert sales into operating income.

Buffett’s focus on businesses with enduring competitive advantages is reinforced by a strong OPM. It reflects a company’s resilience and efficiency in navigating industry challenges while maintaining profitability.

| Metric | Gross Margin | Operating Margin |

|---|---|---|

| Revenue Streams | Gross Margin is calculated using the total revenue generated by a company. | Operating Margin considers the revenue from the core operations. This excludes income from other sources. |

| Expense Considered | The cost of goods sold (COGS) is subtracted from the total revenue to arrive at gross profit. | Operating Margin considers all operating expenses, which include costs related to sales, marketing, research and development, and general administrative expenses. |

| Calculation Formula | [(Revenue – Cost of Goods Sold) / Revenue] x 100 | (Operating Income / Revenue From Operations) x 100 |

| Purpose | Reflects pricing power and cost efficiency in production | Measures efficiency of core operations beyond production |

| Important for assessing a company’s profitability at the production level | Important for assessing a company’s profitability at the production level | Important for assess a company’s profitability at the production level |

3.5 Revenue Growth

My algorithm acknowledges the significance of a company’s revenue growth. Buffett recognizes that consistent and moderate revenue growth can be indicative of a competitive advantage and a wide economic moat.

For Buffett, a company with a widening moat (a durable competitive edge) can translate its advantages into steady, long-term growth. Fast revenue growth, when sustainable, suggests that a company possesses qualities that set it apart in the market.

The company that displays such a characteristic does so based on strong brand recognition, customer loyalty, or technological leadership.

This aligns with Buffett’s focus on businesses with enduring strengths, as they are better positioned to withstand competitive pressures. Thereby, they can generate sustained value for shareholders over time.

3.6 Debt To Equity Ratio (D/E)

The algorithm places significant emphasis on the debt-to-equity ratio (D/E) as a critical indicator in his company analysis. This ratio assesses a company’s financial leverage by comparing its debt to shareholders’ equity.

Buffett generally favors companies with a low or conservative D/E ratio. A low D/E ratio signifies prudent financial management and a lower risk of insolvency. A low D/E ratio indicates that the company relies less on external debt for financing its operations, reducing the potential financial strain during economic downturns.

A conservative capital structure aligns with his focus on businesses with enduring competitive advantages. A prudent D/E ratio reflects Buffett’s emphasis on risk mitigation and stability, crucial elements in his long-term investment strategy.

3.7 Free Cash Flow Margin (FCFM)

Free Cash Flow Margin (FCFM) represents the percentage of revenue a company converts into free cash flow after meeting operational and capital expenditure needs.

Warren Buffett, who values consistent and growing free cash flow, a healthy FCFM is indicative of a company’s financial strength and ability to generate surplus cash.

Buffett seeks businesses that can allocate capital efficiently, and a robust FCFM demonstrates a company’s capacity to do just that. Companies with ample free cash flow have the flexibility to reinvest in the business, pursue strategic acquisitions, and return value to shareholders through dividends or share buybacks.

A solid FCFM aligns with Buffett’s focus on economic moats. Companies capable of generating excess cash consistently often possess enduring competitive advantages.

Overall Significance of The Above Seven Metrics

Collectively, these metrics offer a comprehensive perspective on a company’s financial well-being, competitive standing, and potential to yield consistent returns over the long term. This holistic view is crucial in understanding the various facets of a business that can qualify to be a Warren Buffett-type company.

These metrics align closely with Warren Buffett’s core investment principles. The emphasis on economic moats, efficient capital allocation, and financial strength mirrors Buffett’s preference for businesses possessing enduring competitive advantages and robust fundamentals.

These principles are core to Buffett’s approach to investing in companies that can withstand market fluctuations and thrive over the years.

Additionally, the chosen metrics contribute to risk mitigation, a cornerstone of Buffett’s investment strategy. Factors such as low debt levels and robust cash flow margins are key indicators that a company is better positioned to navigate challenges. This way the company is poised to preserve capital and avoid unnecessary risks.

Overall, the utilization of these metrics in a stock screener reflects a systematic effort to identify companies with qualities and characteristics favored by Warren Buffett in his discerning investment approach.

Conclusion

The emphasis on economic moats, efficient capital allocation, and financial strength provides a nuanced understanding of a company. By delving into aspects such as market share, ROE, and FCFM, investors can uncover businesses that exhibit resilience, competitive advantage, and the ability to generate sustainable returns.

The chosen metrics by my algorithm not only offer a holistic view of a company’s financial health but also contribute to effective risk mitigation. This is a cornerstone of Buffett’s investment strategy.

Employing these metrics in our analysis provides a systematic and principled approach to identifying companies that align with the time-tested philosophy.

Have a happy investing.

Suggested Reading:

![Compare Indian Banks: A Quick Fundamental Analysis [2023]](https://ourwealthinsights.com/wp-content/uploads/2021/05/Compare-Indian-Banks-Image4.png)