What does it mean by fundamentally strong stocks? These are stocks that have a strong underlying business. As an investor, what parameters we must investigate to determine whether a business is strong or weak? This is what we’ll discuss in this article. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

List of Fundamentally Strong Stocks in India

Updated: January 03, 2025 Check The Stock Engine

| SL | Name | Price | Market Cap(Cr) | OP. Rev Growth (%) | Current Ratio | GMR Score |

|---|---|---|---|---|---|---|

| 1 | DATAPATTNS:[543428] | 2,484.15 | 13,910.60 | 27.20 | 4.00 | 78.22 |

| 2 | SAFARI:[523025] | 2,651.40 | 13,022.74 | 17.85 | 3.50 | 78.22 |

| 3 | POLYCAB:[542652] | 7,180.00 | 1,07,940.36 | 15.36 | 2.44 | 77.28 |

| 4 | NMDC:[526371] | 67.66 | 19,833.39 | 12.74 | 2.56 | 77.23 |

| 5 | CERA:[532443] | 7,527.25 | 9,711.61 | 8.96 | 3.74 | 77.23 |

Introduction: What Makes A Business Strong?

Fundamentally strong stocks represent companies that will continue to do business even in the worst of times. Some inherent traits of their businesses make them stand tall even in tough weather.

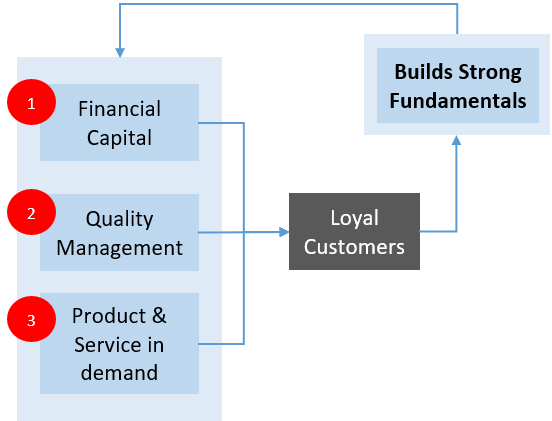

What helps them to do business even in adverse times? What is essential for companies to continue doing business? Three things – financial capital, quality management, and in-demand product or service. These three things in combination build a loyal customer base that eventually gives a business its fundamental strength.

On a macro level, a company that is run by quality management can build its fundamentals even from scratch. I’ve written a separate article on the quality of management. It talks about how we (retail investors) can judge the quality of management from the financial reports.

On a micro level, a company that has sufficient financial capital to fund its operations and growth requirements is fundamentally strong.

But for a business to stay strong, only capital will be insufficient. It must also have an attitude to survive and grow. From where this attitude will come? It will come from the characters and personality of its top management. We can also call it a leadership personality.

Building such a character and personality is easier said than done. It cannot be built in a day. Years of smart work and training help people to grow from being an employee to a leader.

The Capital

Suppose there is a company that is owned by wealthy people like Jeff Bezos, Warren Buffett, or Mukesh Ambani. Such companies will ever run out of fuel (capital)? It is unlikely.

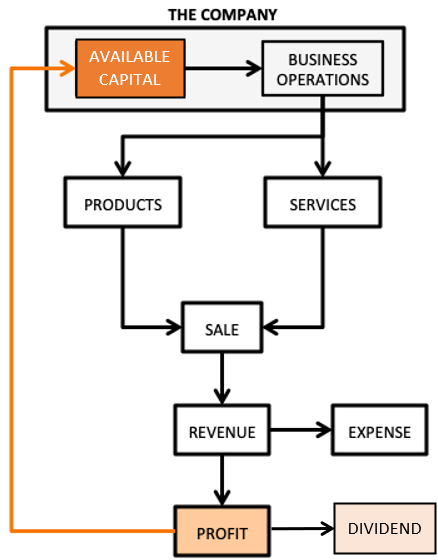

Similarly, a company that is generating its own capital (fuel) to do business, is necessarily a company with strong fundamentals. In business terms, the capital used to fund a company’s ‘business operations’ is called “total capital“.

The company uses its capital to do the following:

- Pay for all current expenses – to generate current revenue.

- Fund its capital purchases – to ensure future growth.

- Other activities.

Total Capital vs Debt

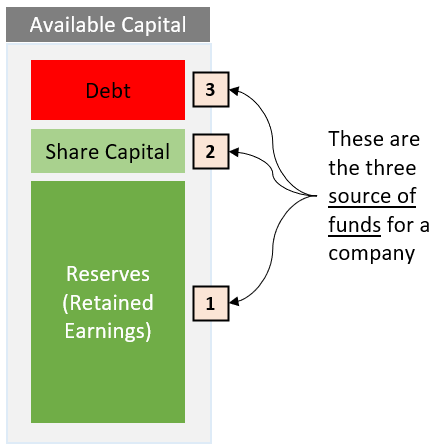

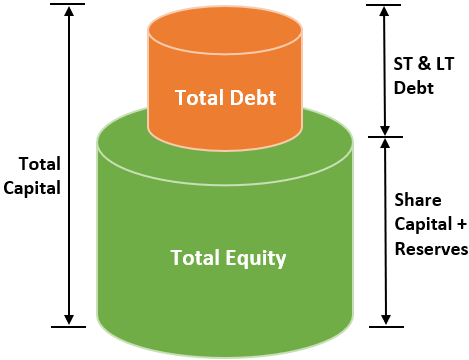

The above is a schematic representation of the break-up of total capital. It highlights the three sources of funds available for a company to raise capital for its business. In terms of formula it will look like this:

Total Capital = (Share Capital + Reserves) + Low Debt – (i)

How to read this formula? A fundamentally strong company is one that can run its operations from its “share capital” plus “reserves“. It needs only low debt to do its business. It means, the company has low debt dependency. The lower will be the debt the better.

The factor of “low debt dependency” is very important from a shareholder’s point of view. Why? Because it makes the company more self-reliant and less risky. How? Please continue reading, this point will be further exemplified.

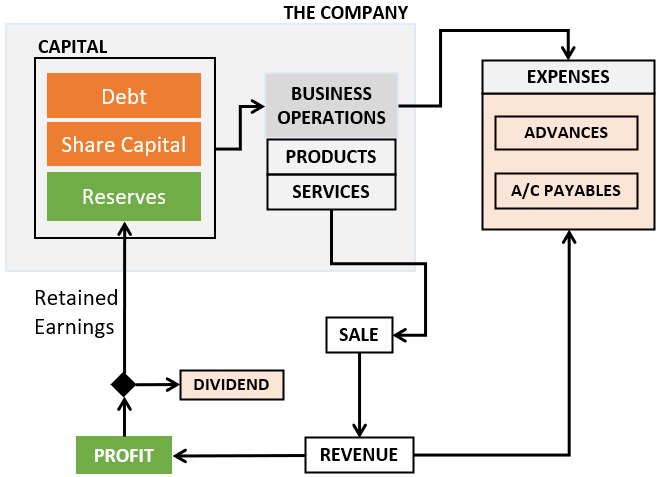

Total Capital vs Expenses

There is another formula that must be used in conjunction with the above formula (i). This formula highlights the importance for the companies to keep their ’total capital’ greater than their total expense requirement.

Total Capital > Total Expense – (ii)

What does this formula signify? Suppose there is a company that operates in low debt [see formula (i) above]. [Its Total Capital = Share Capital + Reserves + Low Debt.]

But whether the total capital is sufficient or not. How to know this? By using this formula (Total Capital greater than Total Expense Requirement). Let’s understand the utility of this formula using the below 3 parameters:

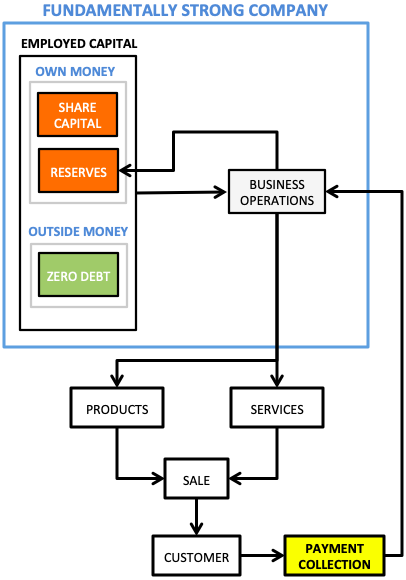

- Use of Total Capital: The companies use their capital to finance their “total expense requirements”. The company expends money to produce “goods and services“. These goods and services in turn generate revenue.

- Equity Financing: Share capital plus reserves is called equity. Before the revenue is generated, the company must first spend money from its pocket. How much corpus is there in the company’s pocket? Share Capital plus Reserves (equity). If the equity component is enough (more than the total expense requirement), the company will continue to produce “goods and services”, and earn revenue. Read more about how to calculate Return on Equity (ROE).

- Use of debt: If equity is not enough, there will be a shortfall of funds to run operations. Hence revenue will fall. A fall in revenue due to a shortage of funds is a clear sign of “bad fundamentals”. Hence those companies which cannot fund their “capital needs” from their pocket, take debt. Read more about whether the debt is good or bad for companies.

It is essential for investors to realize the effect of debt (positive or negative) on companies’ fundamentals.

The Debt Component

If a company does not have sufficient money in its pocket, it can take debt. So in this case the employed capital will be, Share Capital + Reserves + Debt.

Resorting to debt is not always a bad thing for companies. But for many companies, debt is like a short-term relief and long-term burden.

- How it’s a short-term relief: It immediately provides liquid cash for the company. This enhanced liquidity helps in managing immediate working capital needs.

- How it’s a long-term burden: All the debt that is availed by the company needs to be paid back (principal + interest). This is an extra expense. How to pay? From the company’s profit. Read more about the analysis of debt-free companies.

So generally speaking, the lower the debt dependency of the company, the higher will be its net profits. Hence this generalization will not be wrong that “low debt companies tend to be fundamentally stronger“.

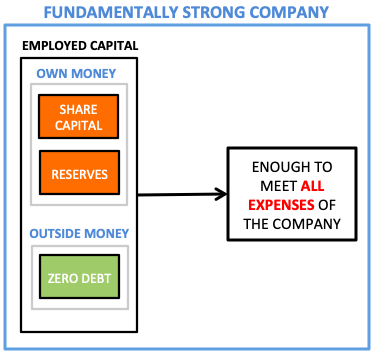

A Financially Independent Company

This brings us to the concept of financially independent companies. Companies which has virtually zero reliance on debt (to fund their business operations), are financially independent. These are companies that have enough money in their own pockets. They need not rely on external debt to meet their needs for cash.

If a company is able to fund its ‘total expense’ by itself, it can continue to operate indefinitely. Such companies are fundamental powerhouses. How?

Total Expenses can be financed from where? From the total capital.

For a company to be financially independent, it must reduce its dependency on debt. But only reduced debt dependency is not enough. They must do more.

The Concept of Cash Flow & Financial Independence

All companies which have managed to earn the tag of being ‘fundamentally strong’, have worked hard to manage their cash flows. How? Here cash flow is not only cash-out (payments to vendors etc) but also cash-ins (collection from customers). Emphasis is more on collection.

Complete reliance on “share capital and reserves” means two things for the company: (a) First is obvious, the company is using zero debt, (b) and the second is, that the company is collecting cash fast enough.

For a company to become financially independent, along with low debt dependency, it must also have faster cash in-flows. How fast cash flow helps?

- It ensures liquidity.

- Hence current liabilities can be paid on time.

- As current liability is taken care of, short-term debt can be eliminated.

Cash Flow Analysis

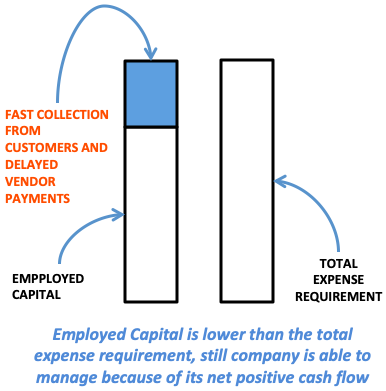

There are also companies that have lower employed capital compared to their ‘total expense requirement’, but are still fundamentally strong. How?

Because these companies collect money from their customers very fast. Hence, such companies can enjoy the luxury of keeping their employed capital lower than their total expense requirement.

Most of the companies operating in India, carry debt, but still, their total expense cannot be funded. Such companies are dependent on their sales collection to pay invoices/bills. Companies which has a very fast Cash Conversion Cycle are safe companies.

But companies that sell their products and services on long credit, pose a higher risk for investors.

Screening Fundamentally Strong Companies

Our stock screener uses the following parameters to filter fundamentally strong stocks from the ordinary. It uses the following algorithm (logic) to do the filtering:

Industry Leaders: There are about 195 number industries in our stock market. Each industry has a group of companies operating within it. We pick only the industry leaders. The choice is made based on their revenue. Top companies in the industry are selected. What is the logic? The logic is that the top company of an industry can be assumed as one with a wide moat.

Capital vs Expenses: As explained above, we also analyze the selected market leaders in terms of their capital base. We compare their total expense requirement vs their equity base and total capital. All companies that are not capital-starved are picked for further analysis.

At this stage, we have a list of only a few hundred companies. Now, we apply the following logic to generate a score for each of these companies.

Scoring Parameters

- Debt Dependency: We use two parameters to determine if the company has excess debt dependency. Low debt-to-equity ratio (D/E) and high-interest coverage ratio (ICR) is our pick. All companies that do not match our debt levels are screened out.

- Liquidity Position: This analysis is easy and quick. We check the current ratio, current asset vs current liability, and level of each company. All companies that are sufficiently liquid are given a higher score.

- Profitability Analysis: At this step, we check how well the company is using its capital to yield profits. We use two ratios, Return on Equity (ROE) and Return on Capital Employed (RoCE) to check the profitability levels. All companies that display a higher ROE and ROCE are given higher scores.

- 10-Year Return: A company that is fundamentally strong may not perform for its shareholders in short term, but in long term, they do deliver above-average returns. With this logic in mind, we check the last 10-Years returns of the companies. All companies that have not performed as per a minimum threshold are given a lower score.

Once the checks are done based on the above parameters, the algorithm scores each company based on a predefined weighted average method. The final score is displayed as the GMR score in our stock screener.

Conclusion

It is essential for retail investors to invest only in fundamentally strong companies. These companies are sufficiently funded and are run by able top managers. These are not only profitable companies, but they also maintain balanced debt and cash positions. Such companies are not too debt-dependent nor do they starve to manage their current liabilities. Moreover, these companies have maintained an optimal capital structure that is not only sufficient to fund the working capital but also their CAPEX requirements.

Handpicked Articles:

Do have an article on the GMR? What does it signify? How to value/interpret a GMR score? What does it mean? What do you mean by “internal score of the tool”? How does a GMR score of say 97.5 compare to another GMR of

say 96.5?

GMR Score is a theme based scoring method of companies (one such theme is “Fundamentally Strong Stocks”). For example, in a Penny Stock screening theme, GMR Score rates stocks focusing on parameters specifically applicable for penny stocks.

There is another score in the stock engine called the “Overall Score.” It is also a scoring method but its calculation is much deeper. It scores stocks based on six parameters: price valuation, growth, quality of management, profitability, financial health, and Moat.

GMR Score will vary from theme-to-theme for a stocks. While the Overall Score will remain the same.

Picking a small portfolio of good stocks could make one get excellent returns. There are certain parameters using which one can choose the best stocks. Fundamental strength is what really counts if you are a long term investor.

Nice info. thx

SIR, Greetings & Happy New Year ! I oftenly go through your site. It is very helpful. Kindly suggest few stocks in this high market whose price is still low and may go up in coming years.

regards,

cgopal

what is GMR score please? Thanks

Internal scoring of stocks by this blog

Great Article. Lots of useful information. Please explain how did you calculate NWG ?

Hi Sir, I am new to your website, just gone through few of the articles, it’s really very helpful.

I have few questions:

The excel prepared by you covers all the sectors stocks, each sector evaluate the fundamentals differently, eg: Banking and Pharma we can’t evaluate both these stocks fundamentals.

Another question every person has their own parameters to evaluate the stocks, eg: few says P/E and EPS, another person says Operation growth, ROCE, FCFE and reinvestment.

As your excel covers what kind of parameters, please. I am new to your site.

I’ll request you to read the limitation of the worksheet, you will get a good idea about what the worksheet can do and cannot do.

The worksheet does the fundamental analysis more by way of estimating the stock’s intrinsic value rather than relying on ratios. Though, ratios are also used to judge few delicate parts of business.

Dear Mani,

Excellent article. Really helped me to understand “How to evaluate company profile by myself”. Thanks a lot.

Thanks,

Harish

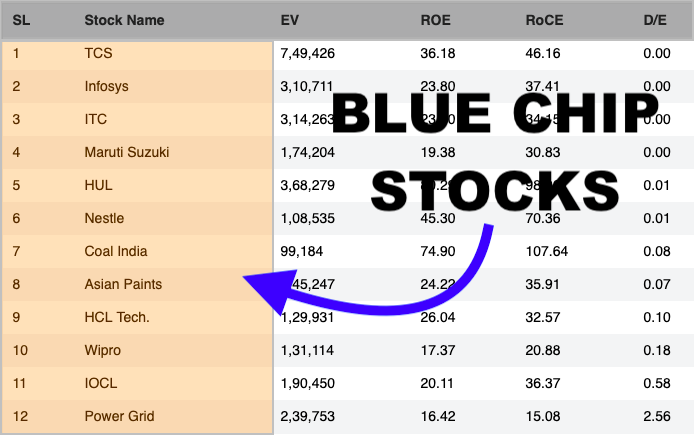

Hello Sir. I am shifting from trader to investor. I had taken small profits in many names of Blue chip companies those scaled sky height. Please comment on (1) LIC Hsg Fin (2) Raymond (3) Indo Borax (4) Dharamsi Moraraji Chem Co & (5) Cheviot Co Ltd.

With sincere ergards

Thanks

Rajesh

Hi Mani…great way of presenting articles….love reading….they are so quick and easy to understand for even non financial background people like me….. great job….love to see and read more…

Thanks

Dear Mr. Mani, I am reading your article for the first time. I must record that it is refreshingly different and highly educative. Keep it up. I am 68 yrs old and have an investible surplus of say Rs. One lakh. I am not afraid of taking risk. I want to invest in stock market only . What should be the ratio among large mid and small caps.

God bless you and all your avid readers.

Regards

Swaminathan

Thank you sir for your feedback.

In current market times, senior citizens can take some risk in equity. But upper limit of 20% (of portfolio size) shall be maintained.

Within the equity base, 65%-Blue Chips (non banking), 35%-Banks.

[I’ll prefer not to consider investment in terms of Market Caps]

Lot of clarity and education. Thanks. Keep doing it

hello sir, i am raghu. in your article fundamentally strong stocks 2020, u mention that hindustan zinc is fundamentally strong.my doubt is why do they have so much debt when they are cash rich

As reported on Mar’19, total debt of the company is at 2538 Crore. To make more meaning out of this number lets convert it into two ratios:

(1) D/E: 2538/33605 = 0.07

(2) D/Total Expense: = 2538/10512 = 0.242

Rule of thumb – D/E below “one” is acceptable. HundustanZinc’s D/E is 0.07. D/TotalExpense for Hindustan Zinc is 0.242. It means, out of the total expenses only 24.2% is financed using external loans. Balance is self financed. This is a good number.

For the first time I have come across such an educative piece of article which is described in simple and easy to understand language for a layman like me. Thank you so much. Look forward to read more such articles of yours.

Never invest on the basis of fundamentals only, always keep an eye on technical always. Better way to earn in the market is through technical analysis with support of fundamental fundamental.

When fundamental analysis is done in totality, it takes care of the “price valuation”.

A long term investor does not need to take care of the “effect of price momentum” while investing.

Thanks for your comment.

I am Prakash Modak from Pune.

Excellent explanation anbout fundamental kindly add me in your email for next post.

Very well explained! Many thanks for the same. Could you please suggest the site to check the updated fundamental parameters of companies and also for comparison.

Excellent article with practical approach.

I have to say its a good read but the stocks that you have selected under low cap stocks have very poor performance, some of them like Advanced Enzymes are near their 52 weeks low while some others have lost more than 20% within the month like Tejas Networks and it is in bear phase since at least 1 year where it has lost more than 50% of its value.

Thanks for posting your view.

“Poor performance” does not always guarantee that the underlying fundamentals of the stocks are poor. Price is not the indicator which can talk about stocks fundamentals.

I am very much impressed with the way matter is discussed. I am very much newbie and this is what the information I have been looking over the web for days. I am so much thankful to you.

I am very much interested in value investing. Please explain identifying fundamentally strong stocks and under valued stocks using their financials

I request you to explain them having a chronological balance sheet, cash flow statement, profit and loss ..etc

Waiting for your reply!!

Eye-soothing article, but reliable enough for Indian Market… the top rated ‘Vakrangee’ is the biggest loser of 2018.

Thanks for your comments. Indeed Vakrangee has probably orchestrated their own fall? I feel really sorry for the business model of Vakrange than for the company itself.

http://ourwealthinsights.com/vakrangee-share-price-analysis/

Nice Heading !! Its is very helpful !!

Thanks for sharing !!