Summary Points:

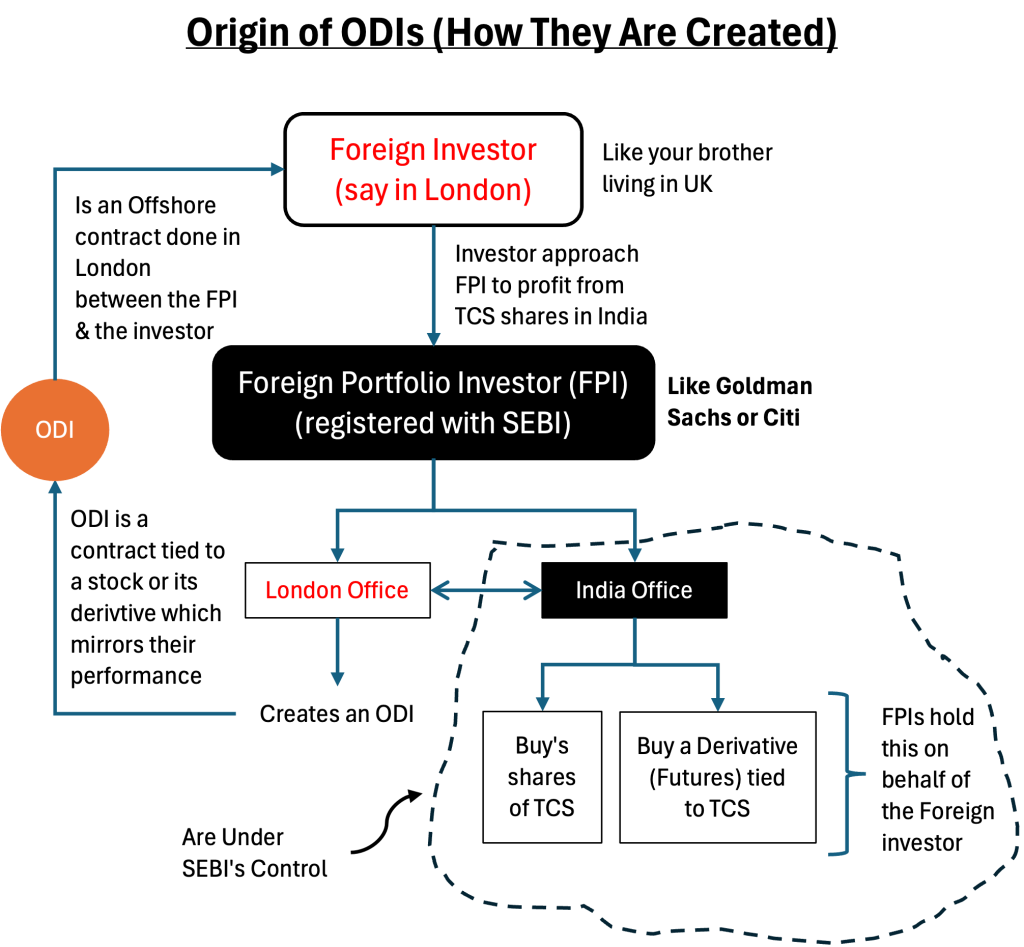

- ODIs let foreign investors bet on Indian stocks.See the flow chart #1

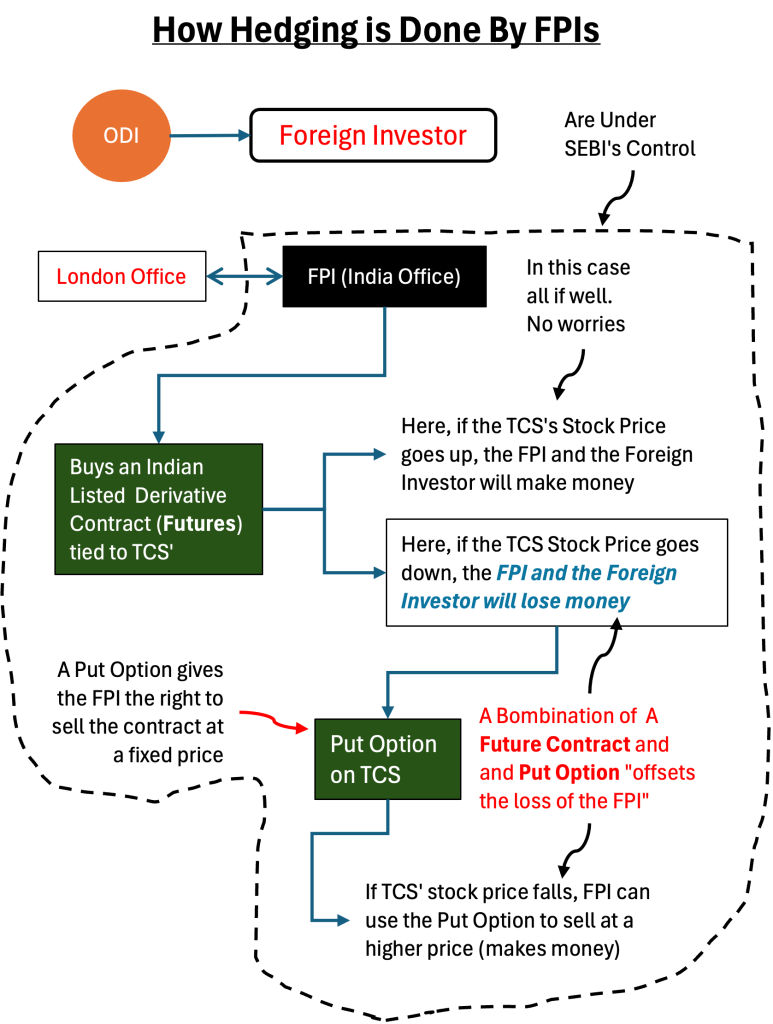

- FPIs used derivatives to create and hedge ODIs. See the flow chart #2

- SEBI’s new rule bans derivative-based ODIs for FPIs.

- FPIs must now use actual stocks, not derivatives.

- Big ODI users need to disclose more details.

- This might reduce FPI activity, impacting market volatility.

- Transparency could build trust, but rupee may weaken in short term. Read the conclusion

Introduction

There has been a SEBI’s circular issued on December 17, 2024. The circular was titled “Measures to address regulatory arbitrage with respect to Offshore Derivative Instruments (ODIs) and Foreign Portfolio Investors (FPIs) with segregated portfolios vis-à-vis FPIs.” You can read the SEBI’s original circular here.

Sounds like a sentence full of jargons, right? Don’t worry, I’ll declutter it down for you and also explain the significance of it for we small retail investors.

So, as the topic is complicated, I would take a step-by-step approach to clear the topic. I’ll first explain the basics related to Offshore Derivative Instruments (ODIs) and Risk Hedging. When these concepts become clear, I’ll explain what the SEBI’s circular is saying (or controlling).

Finally, I’ll also share my views on how this SEBI circular is effecting our whole stock market in general and also individual stocks.

So, stay put. This might look like a boring topic to start with, but if you read it through, I’m sure you will certainly learn a lot of new things in this one single piece. Let me also assure you this, my explanations will be simple and easy to understand.

1. What are Offshore Derivative Instrument (ODI)?

Let’s see how a typical Offshore Derivative Instrument (ODI) comes into being.

First up, the ODI deal happens across borders (not in India – Offshore).

Consider a foreign investor who is someone based in London. Say, he wants to tap into the Indian stock market but doesn’t want to get into the hassle of directly buying shares on the NSE or BSE. Maybe they want to avoid the registration formalities, directly paying taxes, or the paperwork that comes with investing in India as a foreigner. This is where an FPI (Foreign Portfolio Investors) steps in.

FPIs are global financial players, already registered with SEBI, who are allowed to trade in Indian markets. They know the SEBI rules and SEBI knows them. These FPIs are often a big bank or investment firm like Goldman Sachs or Citi, with offices in and outside India.

The story starts when a foreign investor approaches the FPI (say in London). The investor says, “I want to profit from Indian stocks say TCS, but I don’t want to own them myself.”

The FPI agrees and creates an ODI, which is essentially a contract or certificate. This contract promises to mirror the performance of specific Indian assets. This asset can be either TCS stocks directly, or a derivative contract like futures tied to the TCS stock.

In the next step, FPI goes to the Indian market (their Indian Office), buys the underlying assets (say, TCS shares or futures), and holds them on behalf of the foreign investor.

Now, this is that part that I would like you to read carefully and remember for future reference. The foreign investor doesn’t own any shares or derivatives, only the FPI has the holding in India. The ODI is issued offshore, meaning it’s a deal struck outside India. It is governed by the laws of that foreign country, not India directly. They do not fall under the ambit of SEBI.

Now, the investor pays the FPI for this ODI. In return, they get the financial outcome – profits if the stock rises, losses if it falls. Recall, they are able to get this without ever touching the Indian market themselves. So they are not bothered about how FPIs (In India) are managing these investments. They only know or are bothered about, whether they have made money from ODI or not. If they make money they may invest again or else say bye-bye to the FPI.

Whereas, in India, FPIs are not ok to loose money in their ODI contract. So they get creative and they use “other derivatives” to protect their ODI linked derivatives from any potential loss. This is what is called hedging.

Again remember this point, in all this derivative transactions happening in India (related to derivatives), the originator of these activities (the Foreign Investor) is sitting in London whose identity is under the wraps.

Now we have reached a state where we must know the next intricate part of this complex story, hedging.

I would like to remind you that all I’m explaining you here are related to the SEBI’s new circular. To understand its implications we must first know these basics.

2. What is Hedging?

Let’s understand how FPIs use “other derivatives” to hedge their “derivatives tied to the ODI” and limit their risks.

Imagine an FPI issues an ODI based on a derivative, like a futures contract on TCS stock. The FPI buy this future contract in India.

This futures contract promises the FPIs (and hence the foreign investor) the gains is TCS price goes up and losses in the price goes down.

But here is the problem. The FPIs are ready to pass on the loss to the foreign investor, but they want themselves to stay protected (in some case they can also offer this capital protection to their foreign investor). How to get the protection?

If the TCS’ price drops, the futures contract will also lose value. To protect themselves from this loss, the FPI use “other derivatives” as their hedge.

They will buy another derivative called an options contract. For example, they might buy a “put option” on TCS, which gives them the right to sell TCS shares at a fixed price. If TCS’ price crashes, as FPIs has also bought a Put-Options, they can sell their contract at a higher pre-defined fixed price. This gain from the Put-Option will offset the loss from the futures contract.

[You can ask, what happens to the Put Options if the TCS’ price goes up? The FPI won’t exercise their right to sell at the fixed price since the stock price is higher, so the put option contract expires worthless, without causing any additional loss to the FPI beyond the premium they paid for the option.]

This balancing act of using one derivative (the put option) to counter the risk of another (the futures), is called hedging. It limits the FPI’s risk of loss in case the price acton of the stock is not as expected.

3. What The New SEBI Circular, dated December 17, 2024, is Saying?

This circular has brought the following main changes:

- First, FPIs can no longer issue ODIs based on derivatives like futures or options.

- Instead, must use actual stocks.

- They also can’t use derivatives to protect (or hedge) their ODIs anymore. They have to hold the exact same stocks as the ODIs, one-to-one, all the time.

- Next, FPIs issuing ODIs need a separate registration just for that, with “ODI” in the name.

- FPIs can’t mix their own investments in that account.

- If big ODI users hold too much in one Indian company group (over 50%) or have a huge stake in the Indian market (over Rs.25,000 crore), they must share more details about who they are and what they own.

- FPIs are getting one year, until December 16, 2025, to follow these new rules if they’re already using ODIs with derivatives.

SEBI is doing this to stop tricky loopholes, make the market fairer, and keep a closer eye on foreign money coming into India.

4. How This SEBI’s New ODI Rule Could Effect The Indian Stock Market?

The new shift could reduce the overall activity of FPIs in the Indian market.

Why? Because ODIs with derivatives were a flexible, low-cost way for foreign investors to bet on Indian stocks without directly owning them. Removing this option might make India less attractive for some FPIs, especially those who relied on derivatives for quick, speculative trades.

If fewer FPIs participate, the market could see less foreign money flowing in. This might lead to lower trading volumes and liquidity in the overall market. Lower liquidity often means more volatility, stock prices could swing more wildly because there are fewer buyers and sellers to balance things out.

There could also be effects on individual stocks, especially those with derivatives like futures and options (example, HDFC Bank, Reliance, TCS, etc)

Before this circular, FPIs could issue ODIs based on derivatives of these stocks. They could also hedge their risk using other derivatives (like a put option) on Indian exchanges.

This created a lot of trading activity in the derivatives market, which often influenced the underlying stock prices in the cash market as well due to sentiments (Read this article to know the difference between cash market and derivative market).

With the new rules, FPIs can’t use derivatives for ODIs anymore. Now, they have to buy the actual stocks. This might reduce trading in the derivatives segment for these stocks. This could make their futures and options less active.

Less activity in derivatives can lead to wider bid-ask spreads (the gap between buying and selling prices), making it costlier for traders to take positions. This could further dampen speculative trading, potentially stabilizing the stock prices in the short term. But on the downside, it will also reducing the overall buzz around these stocks.

5. It Will Build Trust In The Stock Market

The SEBI circular will also bring transparency. It requires FPIs with large stakes (over Rs.25,000 crore or more than 50% in one corporate group) to disclose more details. This type of step might build trust in the market over time.

If FPIs have to hold actual stocks instead of derivatives, their investments might become more long-term and less speculative. It will reduce sudden sell-offs that crash stock prices.

However, in the short term, as FPIs adjust to these rules by December 2025, some might choose to exit or scale back their positions, especially if they find the new requirements too cumbersome. This could put downward pressure on stock prices, particularly for large-cap stocks where FPIs have big stakes, like those in the Nifty 50 or Sensex.

6. Effect of the ODI Rule on Indian Rupee

If FPIs sell off stocks to comply with the new rules, they’ll convert rupees to dollars. This will increase the demand for foreign currency (say USD, Euro, etc). Such high demand for a foreign currency could also could weaken the rupee.

What is the impact of a weak Rupee? It will make imports costlier and adding inflationary pressure.

In an inflationary market, stock prices get hurt ultimately dampening the economic growth.

Conclusion

Is it a good step or a bad step.

On the face of it, it looks like a very positive step. But Honestly, it’s a mixed bag.

- On one hand, I like that SEBI’s trying to make the market more transparent. When foreign investors play by clearer rules, it’s less likely we’ll see sudden shocks, like a big FPI dumping stocks because of some hidden derivative mess. That’s good for us small investors who just want a stable market to grow our savings.

- But on the other hand, I wonder if this might scare off some foreign money. More rules mean more paperwork, and not every FPI might want to deal with that hassle. India’s been a hot spot for foreign investment, will this cool things down? Only time will tell.

While SEBI says ODIs with derivatives were barely used (just Rs.75 crore in mid-2023), so why make such a big fuss now? Maybe they’re just getting ahead of a problem before it grows. Or, there are things that they do not want us to bother about but anyways want to fix the issue. For example, recently there has been allegation of stocks prices staying artificially inflated. Maybe, SEBI has found out it has something to do with ODIs (I’m only speculating).

For us, the takeaway is simple, we only know the stock market from the perspective of “cash market.” But much more trading happens in the derivative market. Moreover, there is also something called ODIs which are operate remotely using both stocks and derivatives as their instruments.

I hope I was able to explain the topic in a simple way to you. If did like my effort, may I request you to kindly post your feedback in the comment section below.

Have a happy investing.