Choosing from a list of the best FMCG stocks for the long term depends on various factors like financial health, market trends, and company strategies. Historically, giants like Hindustan Unilever Limited (HUL) and ITC have shown resilience and consistent growth. HUL has a strong portfolio of brands, while ITC diversifies into various sectors, providing a cushion against market fluctuations. [For a broader perspective, check out our guide on Top Stocks to Buy in India.]

Keep an eye on emerging players too, as the FMCG landscape is dynamic. Companies like Marico or Dabur have demonstrated innovation and adaptability.

But my favorite from the FMCG space is Nestle India.

So let’s dig deeper into these companies. We’ll conduct thorough research before deciding on our final list of FMCG stocks.

Why FMCG Stock are Best Long-Term Compounders?

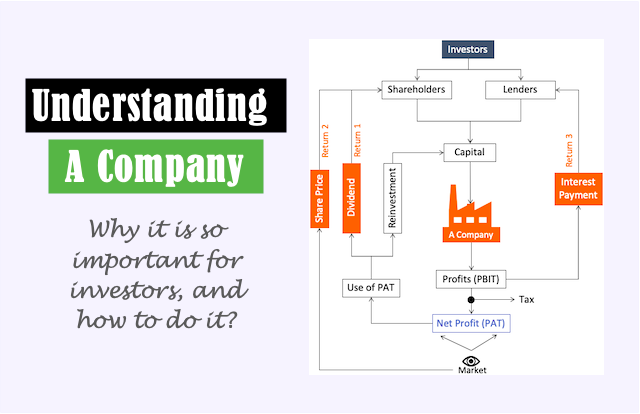

Picking quality FMCG stocks for the long term is grounded in strong investing principles. Firstly, these companies often have a strong brand following. They have become big only after years of brand-building campaigns they have run for decades. That is how they have built their consumer trust and loyalty.

This kind of brand awareness and following gives them a stable revenue stream, shielding investors from the volatility that can plague other sectors.

Moreover, FMCG companies, operate in essential and often non-cyclical industries. The consistent demand for everyday products like food items, household essentials, toiletries, etc ensures a reliable market even during economic downturns.

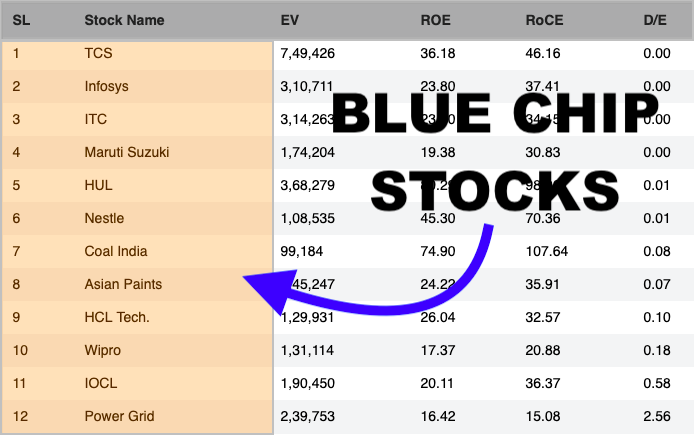

Quality FMCG firms tend to demonstrate prudent financial management. They maintain healthy balance sheets and sustainable profit margins. This financial stability not only cushions against market fluctuations but also facilitates consistent dividend payouts. This way they can also offer investors a reliable income stream.

The timeless nature of FMCG products contributes to a predictable and steady growth trajectory. Consumer preferences may evolve, but the fundamental need for these goods remains constant.

Companies that adapt to changing trends and consumer demands within the FMCG space position themselves for long-term success. Such companies make an attractive candidate for extended holding periods. In this article, we’ll discuss such five companies.

#1. Hindustan Unilever Limited (HUL)

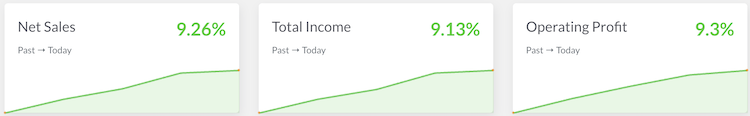

HUL stands as the premier choice among FMCG stocks. There are several compelling reasons for picking HUL as my first choice. Firstly, the company exhibits remarkable financial stability. It is one company that can boast about its consistent sales and profit growth over time. This financial resilience positions HUL as my secure and reliable long-term investment.

The diverse and iconic brand portfolio further strengthens HUL’s standing. With household names like Lux, Dove, and Surf, HUL ensures a broad consumer base. It fosters adaptability to changing market conditions. This diversity not only bolsters brand loyalty but also mitigates risks associated with fluctuations in specific product categories.

Market leadership in multiple FMCG segments grants HUL a unique competitive advantage. This leadership not only translates into pricing power but also reflects a robust distribution network reinforcing its long-term potential.

Investors favor HUL for its stability and impressive growth trajectory, underpinned by the company’s ability to adeptly respond to evolving consumer preferences.

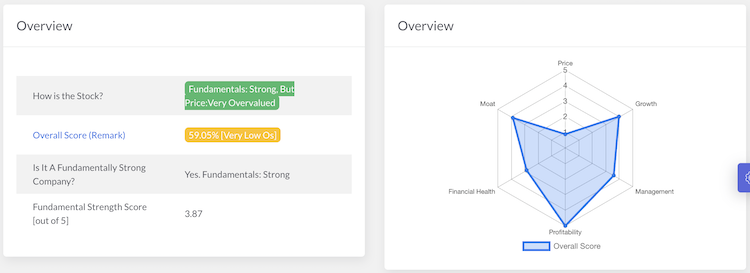

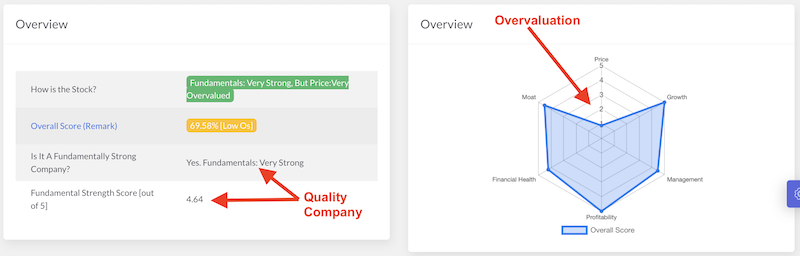

Would you like to know how my Stock Engine, rates the company in terms of its overall performance as a stock? You will get an impression of the company by seeing this spider diagram.

You can see, the stock scores highly in all parameters except pricing. It is obvious that such quality companies trade at expensive price levels. But the algorithm of my Stock Engine helps me get a sense of its price valuation by estimating its intrinsic value.

But such quality stocks hardly come near their intrinsic values (except in crashes). Hence, for such stocks, I would anyways increase my holding whenever their price falls by 7-8%.

#2. ITC Ltd.

ITC Limited offers its investors a unique and diversified investment proposition. ITC has a prominent presence in the FMCG sector. Nevertheless, ITC’s strategic business model also includes tobacco, hospitality, and agri-business. This provides a distinctive hedge to ITC against sector-specific risks.

The company’s commitment to innovation positions it at the forefront of consumer trends. This is reflected in products like Aashirvad, Sunfeast, Bingo, Classmate, etc. This adaptability ensures ITC’s relevance in a rapidly evolving market. It is a quality highly valued by investors seeking long-term growth.

ITC’s resilience is further emphasized by its strong distribution network. It further amplifies the market reach contributing to its stability.

Diversification across multiple industries reduces the impact of market fluctuations, making ITC an attractive choice for those seeking a well-rounded and stable investment.

Investors are drawn to ITC’s ability to balance stability with growth potential. The company’s strong financial performance and focus on innovation, coupled with its diversified interests, make it a compelling choice in the FMCG sector.

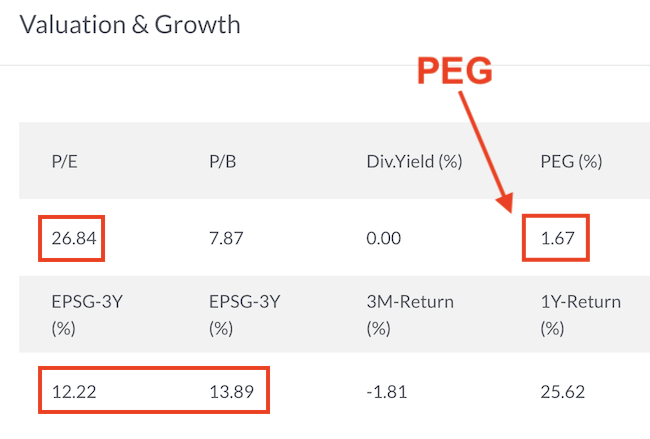

Considering that ITC is a company that operates in the FMCG, Hospitality, and Tobacco space, I personally think that it trades at reasonable PE and PEG levels. But ITC is not a typical FMCG company, some might even consider a PE of 26 as a high multiple. So, like my HUL strategy, I would increase my holding whenever its price falls by more than 7-8%.

#3. Marico Limited

Marico is our typical FMCG stock. It has a strong track record of success. When I’m saying success, it is not only about its financial performance but also its stock price. In the last 10 years, it has been one of the fastest-growing stocks of the Indian stock market.

The company’s presence particularly in the health and wellness segment, aligns seamlessly with evolving consumer preferences. Market-leading products like Parachute, and Saffola exemplify this.

Marico’s international footprint enhances its growth prospects. This Indian MNC is not dependent on a single market. It has an added layer of diversification that appeals to savvy investors.

The company’s ability to adapt to changing consumer preferences, evident in its introduction of Ayurvedic products, positions Marico as a forward-thinking and resilient player in the FMCG sector.

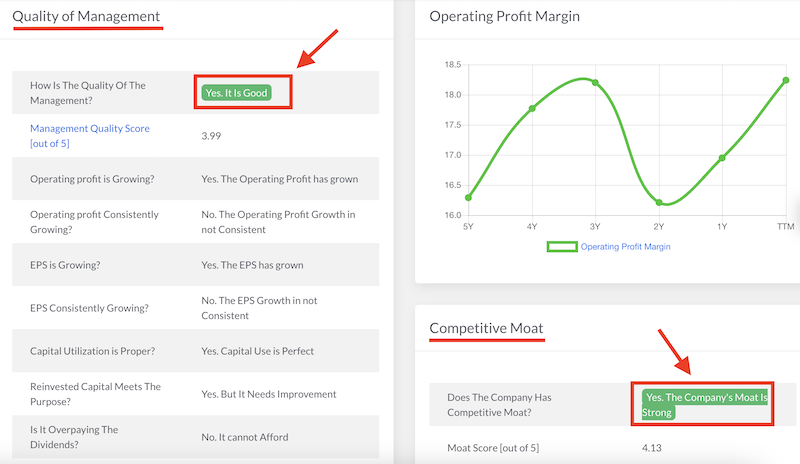

One aspect that I like most about this company is the combination of high scores for its quality of management and competitive moat. My Stock Engine’s algorithm is strict when it comes to scoring companies on these fronts. Marico is one of the leading companies.

#4. Dabur India

Dabur has emerged as one of the best FMCG stocks in the Indian market. It is distinguished by its emphasis on Ayurveda. The company also has a global presence and a diversified product portfolio. The company’s commitment to Ayurveda and natural products aligns seamlessly with the escalating demand for health-conscious offerings. It positions Dabur as a frontrunner in the wellness segment.

Dabur’s global presence is a significant strength, reducing its dependency on the Indian market alone and providing investors with exposure to diverse market dynamics. This global footprint enhances revenue resilience, mitigating risks associated with regional market fluctuations.

The extensive product portfolio, spans healthcare, personal care, and food products. This showcases Dabur’s versatility and provides investors with comprehensive exposure to the FMCG sector. Investors are drawn to Dabur’s commitment to sustainable and ethical practices, resonating positively with the growing segment of conscious consumers.

A few brand names that give traction to the company are Dabur Chawanprash, Honey, Real Fruit Juice, Dabur Meswak, Dabur Read, Dabur Babool, etc. In fact, its product line is so impressive that it can place this indigenous company matching the might of HUL’s and Nestle’s.

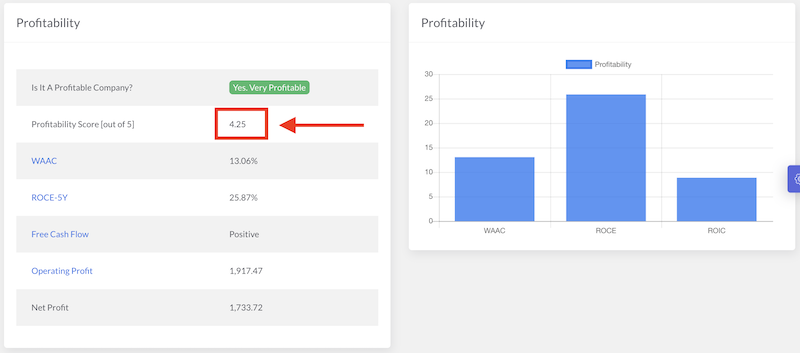

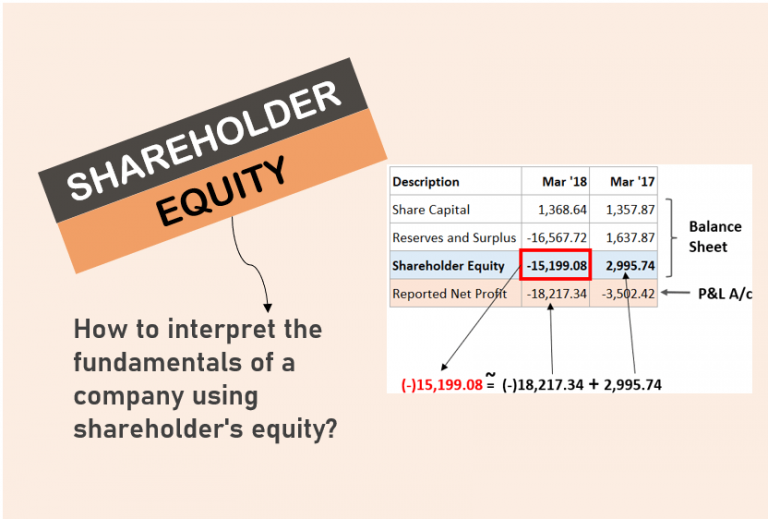

The best thing I like about the company is its profitability score. Considering the kind of product volumes it deals in, the differential between its WACC and ROCE is worth appreciating.

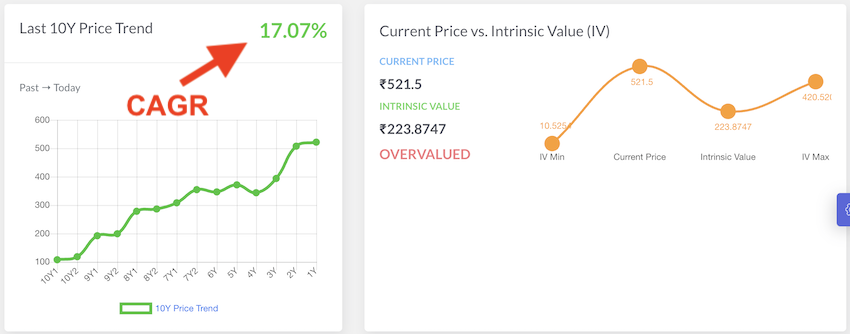

#5. Nestle India

The last, but it is still my all time favorite. So, why do I put it at number five? Because of its price valuation. This stock trades at such high PE multiples that it scares me to buy one. In normal days, I’ll never buy Nestle India. But in a crash or major correction, this is always among my first few picks.

Nestle is a global leader with an illustrious history. It stands as one of the best FMCG stocks in the Indian market. The company is driven by a combination of strong brand presence, consistent financial performance, and a commitment to innovation.

The company’s diverse and iconic brand portfolio encompasses household names like Maggi, Nescafe, Kit Kat, Infant Nutrition products, Dairy Products (a+), etc. It has established and robust market presence and fosters unwavering consumer loyalty.

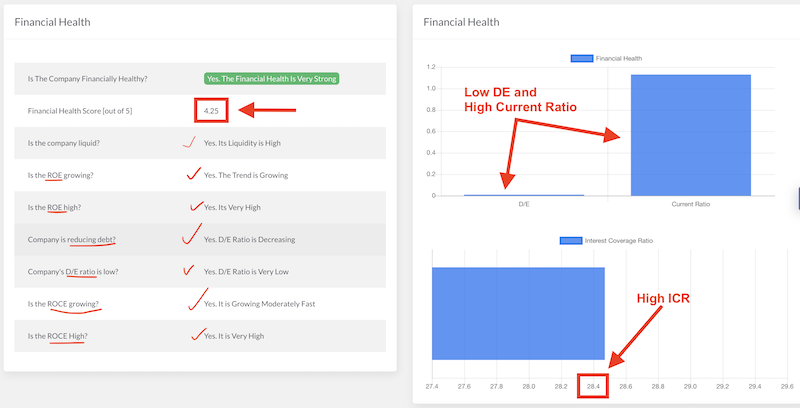

Nestle India is one of those companies that is among the financially healthiest companies listed in the Indian stock market. Generally, my Stock Engine’s algorithm does not give a high score to companies on the parameter of financial health. But Nestle India scores well, always.

Consistent financial performance underscores Nestle India’s reliability as an investment choice. The company’s adaptability to changing market dynamics and commitment to innovation is evident in its diverse product range. It addresses a wide spectrum of consumer preferences.

Their ability to stay ahead of trends and consistently deliver value contributes to Nestle India’s long-term appeal.

Have a happy investing.

Suggested Reading: