Gold has long been a symbol of wealth and prosperity in India, and its allure as an investment transcends generations. The price of gold is subject to a myriad of domestic and international factors, making it a complex and dynamic commodity to analyze.

In this article, we will delve into the key drivers that affect the price of gold. Only a couple of days back, India celebrated the festival of Diwali. For an Indian, on this day, the value of this precious metal transcends beyond its monetary worth. On Diwali, people buy this metal perceiving it as a blessing from the Goddess Lakshmi. People across most financial spectrum buy gold in their comfortable denominations.

For India, possessing gold is a symbol of wealth and prosperity. Hence, on Diwali, people tend to buy gold in the form of jewelry, coins, bars, etc. This is a practice, that we can say is India’s way of practicing gold investment.

In this blog post, I’ve discussed the best way to invest in gold. At this time, there are several forms of gold available for investing. Forms like digital gold, ETFs, gold mutual funds, physical gold, bonds, etc. But out of these, which form can give the best returns? This blog post answers this question for its readers. Go ahead and read it, please.

Here, in this article, we will discuss a few factors that affect the price of gold in India.

#1. Geo-Politics

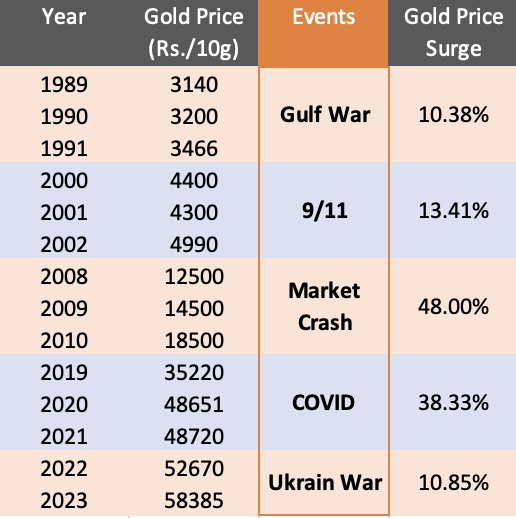

Geopolitical instability, marked by events that shake the global political landscape, can profoundly affect the price of gold. To understand this, let’s look at real-world examples.

Take the Gulf War (Year 1990), for instance. As tensions escalated in the Middle East, global investors sought refuge in the safety of gold. The demand for gold soared, not just internationally but also within India. Individuals, investors, and governments turned to gold as a reliable store of value during uncertain times.

Similarly, the tragic events of 9/11 (Year 2001) in the United States sent shockwaves through financial markets worldwide. In the aftermath, gold witnessed a surge in demand. Investors sought a safe-haven asset and gold was their pick.

More recently, the Ukraine crisis (Year 2022) serves as another illustrative example. As geopolitical tensions flared up, global markets experienced increased volatility.

In such times, gold’s status as a safe-haven asset becomes particularly pronounced. Investors turned to gold as a dependable sanctuary for their investments. Events like these can lead to a surge in demand and subsequently drive up gold prices.

#2. Rupee Depreciation

Understanding the relationship between the Indian Rupee and gold price is fundamental for investors. The value of gold is intricately tied to the strength or weakness of the major currencies of the world.

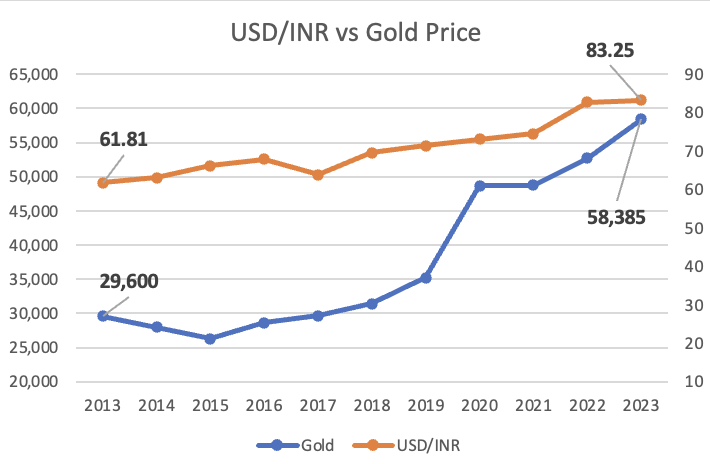

For example, during periods of Rupee depreciation, such as the episode in 2013. During that year, the Rupee reached an all-time low against the U.S. Dollar (61.81), hence the cost of importing gold rose significantly.

Let’s take an example: if 10 grams of gold costs $500, and the exchange rate is ₹55 for every dollar, the cost in Indian Rupees would be ₹27,500. Now, if the Rupee weakens to ₹61.81 per dollar, the cost in Rupees would become ₹30,905 for the same amount of gold.

As shown in the above chart, over the last 10 years (2013 to 2023), Indian Rupee has only devalued against USD (61.81 to 83.25). Hence, following this trend, the gold price in India has also been rising in this time horizon.

Recognizing the impact of Rupee movements on gold prices is a crucial aspect for investors. It emphasizes the importance of keeping an eye on currency trends to anticipate potential fluctuations in gold prices.

#3. Gold Purchases by Central Banks

Gold holdings of the central banks around the world affect the price of gold. The actions of central banks have far-reaching effects. The central banks of all major economies of the world are net buyers of gold, and when they buy, they do it in big bulks.

For instance, countries like Russia and China, have substantially increased their gold reserves in the last 2 to 3 years.

| Country | Unit | Reserves 2021 | Reserves 2023 (Sep) | Increase |

| China | Tonnes | 1948.31 | 2191.53 | 243.22 |

| India | Tonnes | 676.64 | 806.65 | 130.01 |

| Poland | Tonnes | 228.66 | 333.71 | 105.05 |

| Singapore | Tonnes | 127.40 | 230.25 | 102.85 |

| Thailand | Tonnes | 153.96 | 244.16 | 90.20 |

| Japan | Tonnes | 765.22 | 845.97 | 80.75 |

| Brazil | Tonnes | 67.36 | 129.65 | 62.29 |

| Uzbekistan | Tonnes | 332.49 | 383.81 | 51.32 |

| Iraq | Tonnes | 96.42 | 132.62 | 36.20 |

| Russia | Tonnes | 2298.53 | 2332.74 | 34.21 |

| – | – | – | – | 936.10 |

Between Jan-2021 and Sep-2023, the Central Bank of China bought about 243 Tonnes of Gold. This purchase increased China’s gold reserves to 2191.53 tonnes.

In the same period, the Reserve Bank of India (RBI) bought about 130 tonnes of gold. This purchase increased India’s gold reserves to 806.65 tonnes.

Other countries like Poland, Singapore, Thailand, Japan, Brazil, Uzbekistan, Iraq, and Russia also increased their gold reserves notably.

On average, the above ten countries alone bought an additional 936 tonnes of gold between Jan’2021 and Sep-2023.

These large-scale purchases create a two-fold impact. Firstly, they signal to the global market that gold is considered a reliable and strategic asset. Hence, it influences the investor sentiments worldwide. Secondly, these purchases directly affect the overall supply and demand dynamics, leading to potential shifts in gold prices.

#4. Inflation

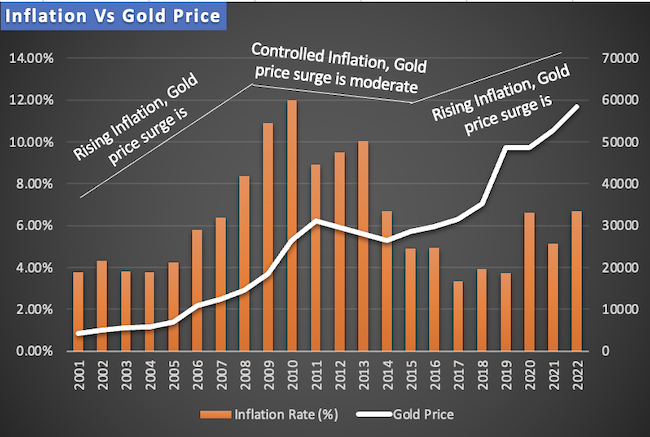

Gold’s role as a hedge against inflation has been a consistent and well-documented phenomenon. In times of elevated inflation, investors turn to gold as a reliable store of value. Gold acts as a safeguard against the eroding effects of rising prices.

The economy does not like rising inflation rates. When inflation is high or rising, the government and the investors buy more gold. This phenomenon is visible in the above inflation vs gold price chart. Between the years 2001 and 2010, inflation was on the rise. So gold price saw a steeper growth trajectory.

Between the years 2010 and 2013, inflation was very high, but the downward trend was starting. So, the gold price was more stable. But after 2017, inflation has been rising again. Between 2017 and 2023, the gold price has grown very fast.

Understanding this historical trend is vital. Gold’s ability to act as a hedge against inflation provides a tangible benefit during economic downturns. It assures investors that their wealth is protected from the erosive impact of inflation (and weakening currency).

#5. Exchange Traded Funds (ETFs)

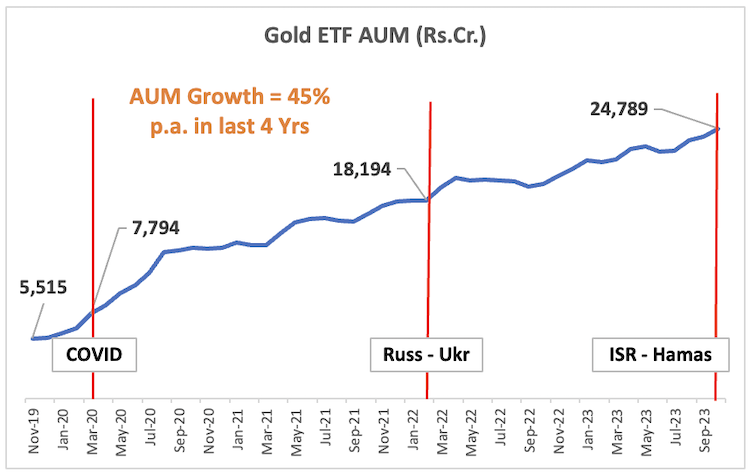

The advent of ETFs has transformed the landscape of gold investments. It is able to influence both investor behavior and the gold price. ETF is a financial instrument that is backed by physical gold. It is an efficient and convenient way to gain exposure to the precious metal without the need for physical ownership of gold coins, jewelry, or bars.

The gold demand has increased with the inclusion of ETFs. Traditionally, Indian investors used to buy physical gold. When ETFs came into existence, they brought with them a new type of gold investors. These are those internet-savvy investors who do not prefer going to banks or jewelry shops to buy gold.

This act is evident from the AUM (Asset Under Management) data of the ETFs. Between Nov-19 and Oct-23, the AUM of gold ETFs has seen a growth of 45% per annum (from Rs.5,515 crore to 24,789 crores).

During this period, these geo-political events happened (Covid, the Russia-Ukrain war, and the Isreal-Hamas war). Each of these events has caused a surge in gold investments triggering a phenomenal AUM growth.

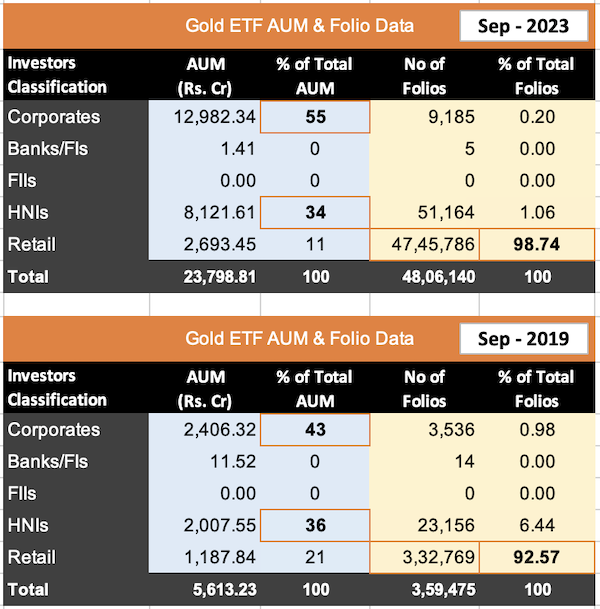

AMFI Data

I’ll give you another evidence of the popularity of ETFs among Indian investors. Here is the AMFI data related to the change in ‘AUM’ and the ‘number of folios’ of Gold ETFs between Sep-2019 and Sep-2023

Just look at the following figures:

- AUM: In the Sep-2019, corporates contributed Rs.2,406 crore to the AUM of the gold funds. In Sep-2023, this value surged by 5.49 times to Rs.12,982 crores. Similarly, the HNIs contribution has also gone up by nearly 4.05 times in the same period.

- Folios: In the Sep-2019, the total number of folios of retail investors in gold ETF was 3.32 lakh. In Sep-2023, the number of folios has jumped by 14 times to 47.45 lakhs.

These two examples are clear evidence of the increasing penetration of Gold ETF into the Indian investor’s portfolios. This increased demand for gold (through the ETF route) is one big cause of the surge in gold prices across the globe.

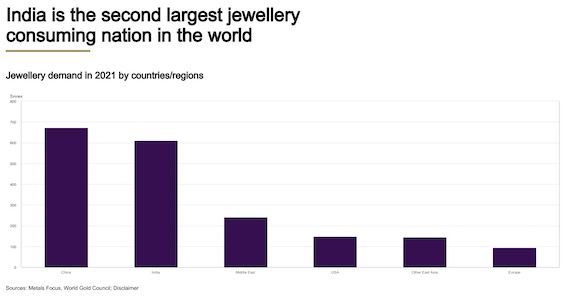

#6. Gold Demand for Jewellery

According to the data published by the World Gold Council, the demand for gold Jewellery in the year 2023 (Q1) was about 478 tonnes. Out of this, China contributed to 197.7 tonnes (41%) of the gold demand for jewelry. The second on the list is India which accounted for 78 tonnes (16%).

China and India’s Jewellery market alone consume about 57% of the world’s gold. Other regions that are also major gold jewelry consumers are the Middle East, North America, East Asia, and Europe.

The demand for gold as Jewellery stays volatile from quarter to quarter. But over a 7-10 year time horizon, it grows significantly. Moreover, as the purchasing power and aspirations of people in China and India grow, the demand for Gold Jewelry will rise further.

Future Outlook

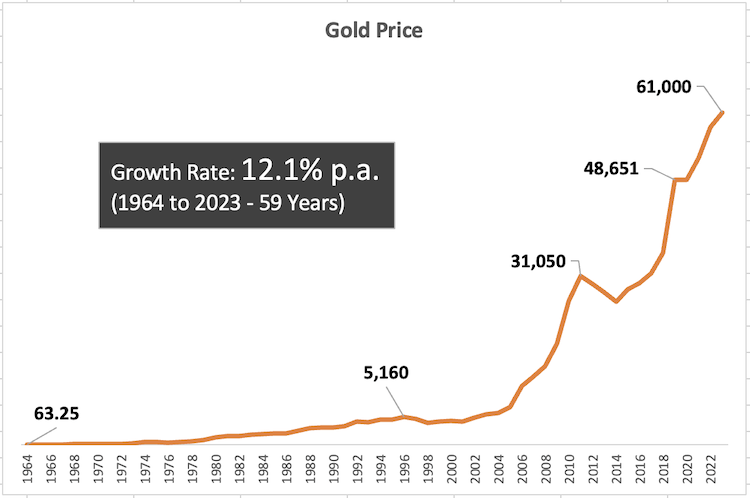

In the last 59 years, the gold price has grown at a rate of 12.3% per annum. In the last 10 years, the gold price surge was at the rate of about 7.7% per annum.

I feel that the current gold price levels at Rs.61,000 / 10 grams have reached that level because of the festival mood of the investors (mainly Diwali). Over the next 6 months, experts suggest that there are chances of the price cooling down to Rs. 57,000 levels.

I’ll personally increase my exposure to gold only if the gold price cools down to below 57,000 levels. Otherwise, I’ll stick to my stocks, equity funds, and FDs (read more about stock investing).

Conclusion

The price of gold is influenced by a multitude of factors. Whether it be geopolitical events, currency fluctuations, central bank actions, inflation, ETFs, or jewelry demand. Each element contributes in its own way to affect the price of gold in India and globally.

Understanding these factors is crucial for investors. Investors who can extrapolate the collective influence of these factors on the gold price become the winners. However, this skill is not easy to execute, but over time and practice, forecasting the gold price trend becomes possible. The key is to keep observing the above six factors listed in this article.

Have a happy investing.

Suggested Reading:

Gold prices have been all over the place lately. Anyone else notice how quickly market conditions and demand shifts can shake things up? It’s always fascinating to see how global factors, like currency rates or geopolitical events, can cause those unexpected spikes or drops. I’d love to hear your thoughts—what’s been influencing gold prices in your opinion? Are we headed for a steadier phase, or should we expect more ups and downs with the Gold Price Trend continuing to evolve?