Recently I met a young investor who wanted to know what happened in 2008 with the mutual fund investors. In the 2008 market crash, caused by the subprime mortgage crisis in the US, equity mutual funds saw havoc. The market crash significantly impacted several equity mutual fund schemes. Allow me to mention a few prominent mutual funds and their general performance during the crisis. [Check here the performance of 25 mutual fund schemes in the 2008 crash]

The year 2008 is etched in the memory of many as a time of financial upheaval. For those involved in mutual funds, it was a period of challenges and opportunities. We will dive into the events that unfolded during the 2008 market crash. We’ll also explore its impact on mutual fund investors in India.

Before we delve into the happenings of 2008, let’s set the stage. In the years leading up to the crisis, the Indian stock market was booming. Infrastructure and banking stocks were all the rage, and investors were riding the wave of optimism. Mutual funds were quick to seize the opportunity, introducing new themed funds in an attempt to excite investors.

The promise of double-digit returns was the norm, and anything less was considered sacrilegious.

The Rush to Thematic Funds

During the euphoric period (before 2008), Asset Management Companies (AMCs) were launching new schemes through NFOs. Most of them were thematic funds whose focus was on three major themes: Infrastructure, BFSI, and International funds.

These themes were enticing, reflecting the narrative of India’s rapid growth and the allure of global opportunities.

In those days the stock market was a place where people gathered with dreams of striking it rich. People were filled with enthusiasm, and investment opportunities seemed boundless.

It was the AMCs who were mainly building this narrative. First, they created the hype and then they introduced the concept of thematic funds. These thematic funds came with big promises. Some told investors they could expect returns of 25% or more.

For beginners, these themed funds appeared appealing. But they also came with risks. Just as opportunities for growth existed, there were potential downsides. When the market took a downturn, as it did in 2008, these same funds were among the biggest losers.

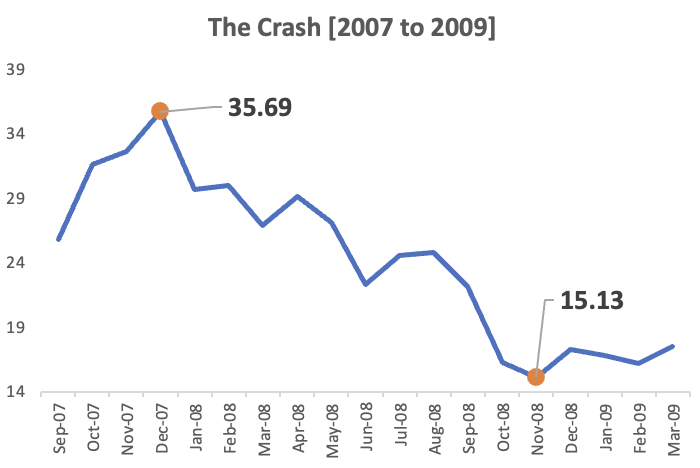

Let’s take the example of the ICICI Pru Infrastructure Fund. As of 21-Aug-2007, the NAV of the fund was at 20.85 level. By Jan-2008, the NAV rose to 35.69 levels (up by 70%). But post Jan-2008, the market crashed and in the next 14 months, the NAV of the fund sank to 15.13 levels (down by 52.83%)

Aftershocks of the 2008 Crash

The bubble burst by the end of Dec 2007 to January 2008. Sensex was at its peak at 20,200 levels at the end of Dec 2007. Then it kept falling till February 2009 until it bottomed at 8,900 levels. This was a fall of about 56%.

When the first bearish day hit the market, investors hopeful of a quick rebound, began to buy more to average down their losses. Market analysts were discussing sub-prime mortgage issues and reassuring investors that it was an excellent time to buy more.

By August 2008, the financial crisis had reached Indian shores. Indian investors also started to panic. Many chose to sell their holdings in fear of further capital erosion. The market hit its lowest lows, and they divested their mutual fund holdings.

As the market started recovering, the majority of investors opted for the safety of bank Fixed Deposits (FDs). It was during these times I myself was getting my first taste of equity fall.

The Psychology of Investing

The 2008 crisis revealed a fundamental truth about investing – the psychology of fear and greed.

Many investors sold at lower levels due to fear. Some entered at higher levels due to greed. Both of these types of investors suffered huge losses.

On the flip side, there were those who profited during this tumultuous time. These were people who held onto their mutual fund holdings with conviction and ignored the noise around them.

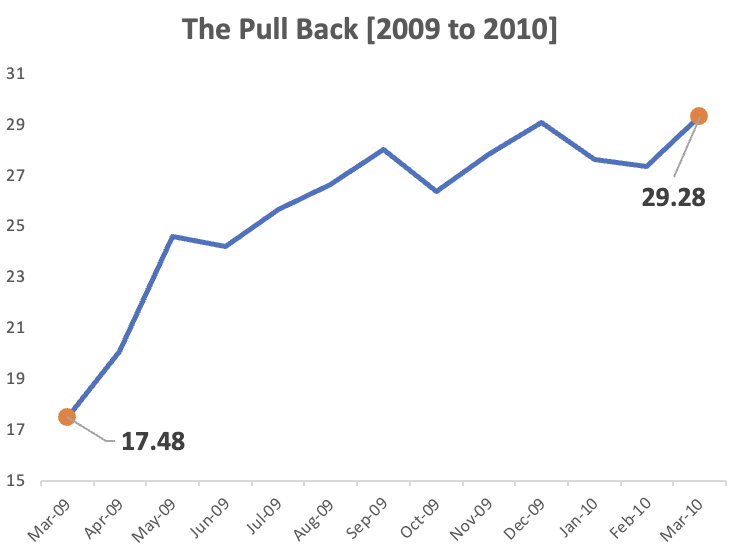

Let’s take the example of the ICICI Pru Infrastructure Fund again. On 10-Mar-2009, the NAV of the fund was at its rock bottom (15.1 levels). People who held on to their units during this time, saw the NAV soar to 29.28 levels in the next 12 months (up by 87% till Mar 2010).

Non-Equity Mutual Funds and Gold

Debt funds, including liquid funds, were relatively stable.

Liquid funds, in particular, served as a safe haven during the crisis, helping investors preserve capital.

Debt funds, on the other hand, experienced varying levels of performance, with short-term debt funds generally faring better than long-term ones.

Physical gold performed well during this period. It acted as a hedge against currency depreciation and economic turmoil. Investors turned to gold as a safe asset. Read: The best way to invest in gold.

Learning from History

2008-09 was a tumultuous time. However, it provided a wealth of knowledge that we can use to build a solid investment strategy.

Picture your investment journey as a long and winding road with its fair share of bumps. The 2008 market crash was a major pothole that we can learn from.

Here’s what it teaches us:

- Diversification: Imagine you have a basket of fruits. If you put all your apples in one basket and the basket tips over, you might lose all your apples. But if you distribute them across several baskets, even if one tips over, you won’t lose everything. Similarly, in mutual fund investing, diversification means spreading your money across different types of schemes. We shall never put all our money in a single stock or a single sector.

- Risk Assessment: Think of investing as navigating a ship through stormy seas. We need to assess the risks and prepare accordingly. In the stock market, understanding the risks associated with different investments is crucial. Some investments are like speedboats, offering high returns but also high risks. Others are like cruise ships, slower but steadier. We must keep the right mix of investments in our portfolio. The right mix depends on our risk tolerance.

- Long-Term Horizon: Imagine you’re planting a tree. It takes time to grow, but once it does, it provides shade for years. Similarly, investing with a long-term horizon means looking beyond short-term gains. If one had invested before the 2008 crash and held onto his/her investments through the turmoil, they would have made a fortune by today. Read: Time in the market vs timing the market.

Avoiding Knee-Jerk Reactions

Imagine you’re driving a car, and suddenly, a squirrel darts in front of you. If you panic and swerve too abruptly, you might cause an accident. In investing, sudden reactions to market movements can be equally harmful. When markets dip, it’s tempting to sell in a hurry due to fear. Conversely, when they rise, it’s tempting to buy hastily due to greed. Both actions can lead to losses.

The 2008 crash showed us that successful investors are those who stay the course, much like sailing through choppy waters. By keeping a steady hand, maintaining a diversified portfolio, and having a long-term outlook, investors can navigate the ups and downs, just as a skilled sailor guides a ship safely to its destination.

Performance of Top Mutual Fund Schemes in 2008-09 Crash

| SL | Schemes (Today’s Names) | Today’s Net Assest (Rs. Cr) | NAV Fall (%) Between Jan’08 and Mar’09 |

| 1 | HDFC Flexi Cap Fund | 39,794 | -51.02 |

| 2 | HDFC Top 100 Fund | 26,391 | -55.54 |

| 3 | UTI Flexi Cap Fund | 25,452 | -53.77 |

| 4 | ABSL Frontline Equity Fund | 23,815 | -51.08 |

| 5 | Nippon India Growth Fund | 19,247 | -60.75 |

| 6 | ABSL Flexi Cap Fund | 17,685 | -53.77 |

| 7 | SBI Contra Fund | 16,337 | -50.69 |

| 8 | SBI Long Term Equity Fund | 16,245 | -54.17 |

| 9 | SBI Large & Midcap Fund | 15,706 | -51.03 |

| 10 | Nippon India ETF Nifty 50 BeES | 15,268 | -46.52 |

| 11 | ABSL ELSS Tax Relief 96 | 14,174 | -54.17 |

| 12 | UTI Nifty 50 Index Fund | 12,597 | -51.08 |

| 13 | Franklin India Flexi Cap Fund | 12,141 | -53.77 |

| 14 | HDFC Large and Mid Cap Fund | 11,810 | -51.02 |

| 15 | HDFC ELSS Taxsaver Fund | 11,502 | -51.08 |

| 16 | UTI Large Cap Fund | 11,458 | -44.18 |

| 17 | ICICI Pru Long Term Equity Fund | 11,337 | -54.17 |

| 18 | ICICI Pru Technology Fund | 11,054 | -44.14 |

| 19 | Canara Robeco Flexi Cap Fund | 10,308 | -53.77 |

| 20 | HDFC Index Fund Nifty 50 Plan | 9,829 | -51.08 |

| 21 | ICICI Pru Large & Mid Cap Fund | 9,177 | -50.95 |

| 22 | DSP Flexi Cap Fund | 9,150 | -53.77 |

| 23 | DSP Equity Opportunities Fund | 9,112 | -51.02 |

| 24 | ICICI Pru Multicap Fund | 8,837 | -53.77 |

| 25 | Franklin India Prima Fund | 8,781 | -59.76 |

Conclusion

What happened in 2008 with the mutual fund investors was not easy. The crash was a testing time for mutual fund investors. It was a lesson in market volatility, the importance of a diversified portfolio, and the value of a long-term perspective.

While some investors succumbed to fear and greed, others stayed the course and reaped the benefits when the market eventually recovered.

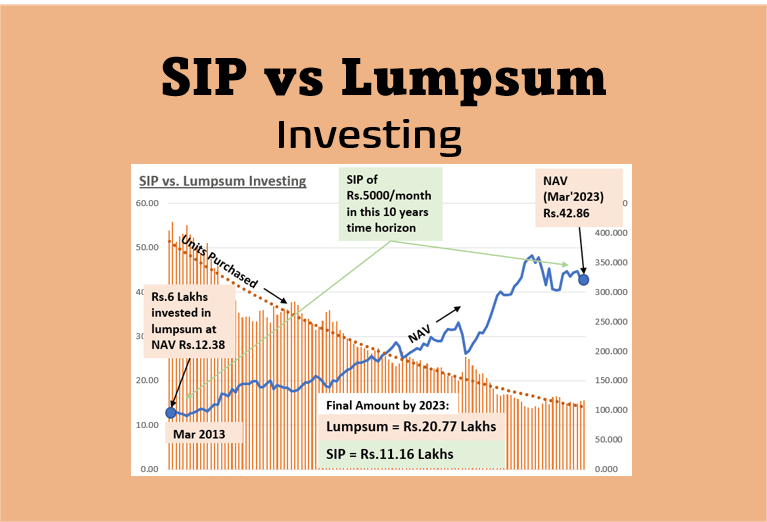

As an equity investor, it’s crucial to remember that market downturns are part and parcel of the investment journey. By embracing strategies like SIPs, staying informed, and maintaining a steady hand, we can navigate the ups and downs of the market.

The 2008 market crash was a challenging chapter in the history of mutual fund investments. However, it also offered valuable insights that we can observe closely and learn from the pattern.

Have a happy investing.

Suggested Reading:

Frank and excellent observations. Quite educative too. Thanks a lot

Thanks