We know how gold is an investment vehicle. But what is e-gold?

All over the world the commodity market is dominated by precious metals like Gold and Silver.

In India in year 2010, National Spot Exchange introduced E-Gold.

The biggest benefit of E-Gold is that it allows investors to invest in gold with much lower denominations than physical gold.

Physical gold is generally available in higher denominations than e-gold.

But E-Gold is available in denominations as low as 1 gram.

But the advantage does not ends here, e-gold is available as investment options in demat form.

For sure E-Gold is going to be a big hit with Indian Retail Investors very soon.

Why E-gold is preferred over physical gold? Unlike physical gold, one can buy e-gold with click of a button.

It is more convenient to buy and sell e-gold.

Like we buy physical gold from banks and shops we can buy e gold electronically on internet.

E-gold can be converted into physical gold at any moment of time. By using the National Spot Exchange we can buy e-gold.

National Spot Exchange started providing trading facility in commodities (like E-Gold) in year 2008.

The e gold that are bought from the website is in de-materialized form. E-Gold can be invested and traded in the market like shares.

The development of this financial instrument, E Gold, is very versatile. Both professional investors and common man can buy E Gold with complete ease.

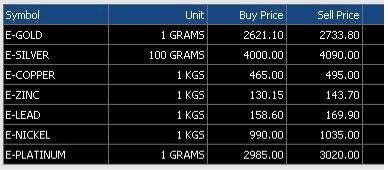

On National Spot Exchange not only gold, but other metals are also traded in electronic form. Recent price of popular e-metals are as below:

Till very recently gold investment option was limited to physical gold only. Then came the option of investing in gold in form of ETF or future contracts.

But now with advent of E Gold, investing in gold has become very convenient. In India, still gold market is not as organized as compared to stocks and funds.

But now E Gold will change the way gold investments is operated in India.

Gold in demat form will make it very popular.

The cost associated with physical gold in terms of its storage cost will be drastically reduced in case of E Gold.

Only a nominal fees like that of de-materialized shares will be paid by investors.

These days, professional investors has their own investing fundamentals and lot of them stay away from gold investment.

But E Gold may drive even them towards gold investment.

Why we should be optimistic about E-gold Investment?

If we will see the factors that pulls gold price up, we will realize why e-gold sparks optimism.

Today we have seen Indian Rupee falling from Rs45/dollar mark to Rs 66/dollar.

This weakening of Indian rupee is only going to increase demand for gold.

If Indian Rupee continues to stay weak, which is the case presently, e-gold is the most logical investment alternative.

Indian is also seeing a steady increase in crude oil prices.

This is further pushing the prices of products higher. Under this inflationary pressure, here can be no other safe investment heaven than e-gold.

In India demand for gold will only go up. Population of Indian is growing and Indian culture has a special place for gold.

Demand for gold as jewellery will never subside in India.

Moreover demand for gold during festival seasons grows dramatically.

This trend of surging demand for gold in India gives e-gold a great starting point.

Banks all over the world targets to increase gold reserves year after year. With huge amount of gold hoarded in central banks, demand-supply dis-balance is only widening.

This further puts pressure of market price of gold. With advent of e gold, gold trading has become very easy.

This will further boost gold demand as common man can now buy gold online.

If we say that price of e gold is only going to go up in next 25-30 years, it will not be wrong.

Exchange Commission has authorised following Depository participants (DP) who will allow retail investors to invest in E Gold:

- Geojit BNP Paribus

- Karvy

- IL&FS

- India Infoline

- Religare

- Aditya Birla Etc….

Common investors who wants to trade in E-Gold will be required to have online trading accounts (like shares). We can approach the above listed DP’s.

In case investors wants to exchange his units of E-Gold with physical gold he can do it easily.

He can do so by surrendering his units and physical gold will be delivered at not extra cost.

Initially physical gold delivery will be done only in major Indian cities like New Delhi, Bombay (Mumbai) and Ahmedabad only.

This network will be widened by National Spot Exchange very soon.

E-Gold will allow open pricing of gold across India. E-Gold will allow very convenient trading, online buying and selling made possible.

Gold investment has always been criticised because of its low liquidity.

But with now E-Gold trading made possible, low liquidity factor is now out of the door.

Comparison Between Gold ETF, E-Gold & Jewellery

Take Physical Delivery of Gold Against Units of E-Gold

If a person wants to take physical delivery of gold against the units of E-gold, it can be done. Physical gold is offered in denominations of 8gm, 10gm, 100gm, 1kg, and their combinations. It means that one must have at least 8 units of E-Gold before asking for its redemption. Moreover, if one has 9 units of e-gold, physic delivery is possible against only 8 units. The balance of one unit must be converted to cash.

Physical delivery is possible only in Delhi, Mumbai, Kolkata, Chennai, Ahmedabad, Indore, Kanpur, Jaipur, Hyderabad, Cochin, and Bangalore.

Forms:

- DIS: Delivery Instruction Slip (DIS) must be submitted to DP.

- SRF: Surrender Request Form (SRF) must also be submitted to DP.

By submitting these two forms, one is surrendering a specified number of units of e-gold to NSEL. In exchange for this surrender, one will be given an equivalent quantity of physical gold. DP will give an acknowledgment of the DIS slip to the unitholder.

Once this is done, DP will transfer the units to NSEL’s account.

The investor shall then submit the acknowledgment of DIS, and SRF to NSEL. This is done to indicate the location from where the investor intends to take physical delivery of gold.

NSEL will then indicate the charges to investors. These charges are for packaging, delivery, and VAT. The charges will be emailed to the account holder. The payment must be made by DD/Cheque in favor of NSEL.

Suggested Reading:

as this was an old article, can you please let me know the current E-gold investment assessment. Which is the best option, etc

Is the e gold buying possible after trading is suspended in Nsel

Hi,

This is one of the most useful and comprehensive article related to E-Gold. Thanks for all the effort.

I am a salaried person investing into various investment options. I want to allocate some part of my investments to Gold, say about Rs.5,000/- per month. Regarding this I want some more clarity

Few doubts and queries –

1. If there are certain expenses/charges for E-Gold, how can it be more economical than physical gold?

2. What are typical expenses / charges for E-Gold? Is there brokerage that has to be paid to DP?

3. From tax point of view i.e. wealth tax applicability and LTCG, it looks like Gold ETFs are better option.

4. Still need clarity what is best option among Gold ETF, Gold Mutual Funds and E-Gold.

I will be very delighted if I receive a response to my above queries