Imagine you have a cricket team made up of both batsmen and bowlers. If during a match, you suddenly have too many bowlers and not enough batsmen, your team balance is off. This mismatch might reduce your chances of winning. Similarly, in investing, your portfolio is like a team of different asset classes – equity, debt, gold, real estate, cash, etc. Each need to stay at an optimum balanced to perform well. This balance is maintained through a process called portfolio rebalancing (see this 1 minute video on portfolio rebalancing).

Why is Balance Crucial in a Portfolio?

When you start investing, you decide on a certain mix of assets based on your goals and risk tolerance.

For example, you might want 60% in stocks and 40% in debt mutual funds. But over time, markets change—stocks might perform really well, and your portfolio could shift to 75% stocks and 25% debt mutual funds.

While this sounds great, it also means your risk has increased because stocks are riskier than bonds.

Just like a cricket team needs the right balance to win, a portfolio needs balance to protect us from unexpected losses.

How Rebalancing Helps Manage Risk and Boost Returns

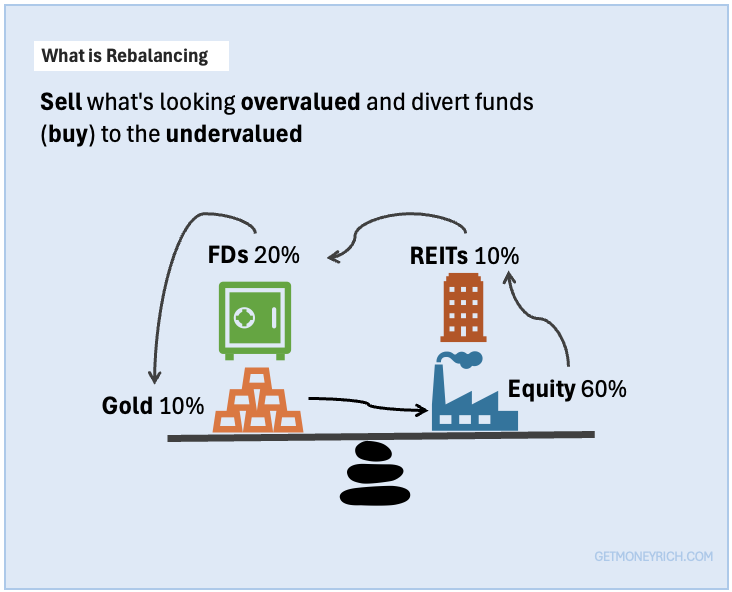

Rebalancing is like a reality check for your investments.

It involves selling some of the assets that have grown too much (overvalued) and reinvesting that money into the assets that are lagging (undervalued).

At first, this might feel counterintuitive – why sell winners? But this strategy helps you lock in profits and buy low, which can optimize your returns over time.

For example, during the COVID-19 market crash in 2020, stock prices fell sharply while gold prices soared. If you had rebalanced during that period, you’d have sold some gold at a high price and bought more stocks at lower prices.

When the stock market recovered, your portfolio would’ve grown faster than if you had done nothing.

Topics:

1. Definition of Portfolio Rebalancing

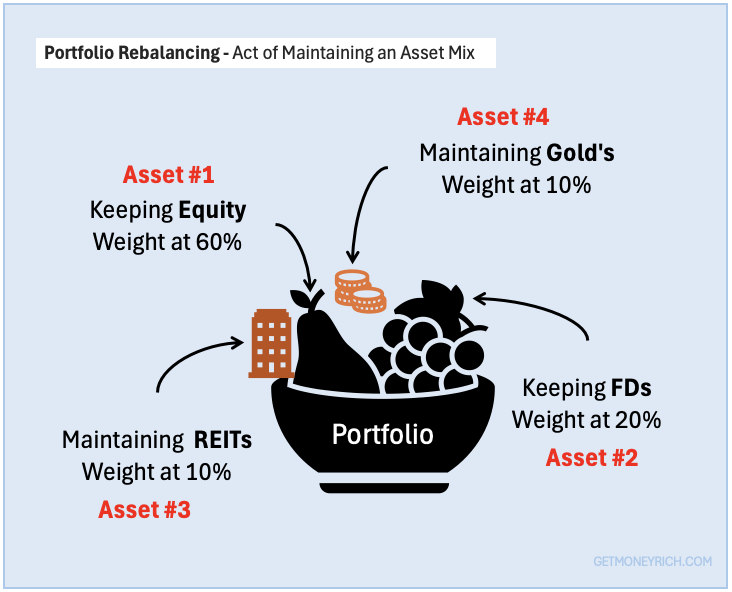

In investing, a portfolio is like a basket filled with different types of investments, stocks, bonds, gold, real estate, etc. Each of these investments has a specific role: stocks for growth, bonds for stability, gold for protection during uncertain times, and so on.

But what happens if the contents of your basket keep changing without your control? That’s where portfolio rebalancing comes in.

1.1 What is Portfolio Rebalancing?

Portfolio rebalancing is the process of adjusting your investments to maintain your original asset mix (also called asset allocation). Think of it like pruning your garden. Over time, some plants grow too much in size, and you need to tweak them to keep your garden healthy.

Similarly, as markets move up and down, the value of your investments changes, and your portfolio can become “overweight in some assets.” Rebalancing will help you get it back on track.

Let’s break it down with a simple example.

1.2 A Simple Example: The 60:40 Portfolio

Imagine you have a portfolio that consists of:

- 60% in stocks (shares of companies)

- 40% in debt (fixed-income investments like government bonds, bank deposits)

This 60:40 split was chosen because you wanted a balance of growth (from stocks) and safety (from bonds). But after a year, let’s say the stocks did poorly, and debt instruments did great. Now your portfolio looks like this:

- 50% in stocks

- 50% in debt

At first, this might sound fair – a 50-50 balance.

But here’s the catch: now, your portfolio is more defensive than you planned. Your exposure to stock market has come down, which might hurt your potential future returns.

1.3 Rebalancing in Action

To bring your portfolio back to the original 60:40 ratio, you would:

- Sell some debt instruments to reduce the risk-free component.

- Buy more stocks to increase the weight of the equity.

This process might feel counterintuitive (selling what’s doing well). But such rebalancing helps us lock in profits from debt unstruments and invest in stocks.

This is a way to make our portfolio more adaptable to the volatile investment universe.

2. Purpose of Rebalancing

Investing isn’t just about buying good assets and watching them grow.

Rebalancing is also about making sure those assets stay in the right balance to meet your goals. This is where portfolio rebalancing plays a crucial role. Rebalancing helps you manage risk and optimize returns – two key ingredients for successful investing.

Allow me to explain it in simple terms.

2.1 Risk Management

Think of your portfolio as a team of players, each with a specific role. In investing, the players are different asset classes, like:

- Stocks (high growth, high risk)

- Bonds (steady returns, lower risk)

- Gold (safe haven during uncertainty)

- REITs (cash cow)

When you start investing, you decide on a mix of these assets based on your risk tolerance. For example:

- If you can handle more risk, you might go for 70% stocks and 30% Others.

- If you prefer safety, you might choose 50% stocks and 50% Others.

But over time, the markets change, and your mix can drift. For instance, if stocks perform really well, your 70% in stocks might grow to 80%, while the weight in other’s shrink to 20%. This drift makes your portfolio riskier than you initially planned.

Why is This Risky?

Imagine riding a bike with one wheel suddenly getting bigger. It might feel exciting at first, but soon you’ll lose balance and fall. Similarly, when your portfolio becomes too heavy in stocks, a market crash could lead to bigger losses than you’re ready for.

Rebalancing helps you avoid this by selling some of the assets that grew too much (stocks) and buying more of the assets that lagged (others).

This keeps our portfolio aligned with our risk tolerance (read more about risk profiling).

2.2 Return Optimization

One of the golden rules of investing is to “buy low and sell high.” Rebalancing naturally encourages you to do this.

Here’s how:

- When an asset class like stocks does well, its value rises, and you sell some of it to rebalance. This means you’re selling high.

- You reinvest that money into assets that haven’t done as well, like bonds, which might be undervalued. This means you’re buying low.

Over time, this disciplined approach can boost your returns.

A Simple Example

Let’s say you started with Rs.1,00,000 in a 60:40 stock-to-debt portfolio:

- Rs.60,000 in stocks

- Rs.40,000 in debt

After a year, due to a stock market rally, your stocks grow to Rs.80,000, while your bonds remain Rs.40,000. Now, your portfolio is 67% stocks and 33% bonds.

To rebalance back to 60:40, you sell Rs.8,000 worth of stocks and buy Rs.8,000 worth of bonds.

Why does this help?

- If the market crashes, you’ve already locked in some stock profits.

- If bonds go up later, you’ve invested in them when they were cheaper.

This disciplined buying and selling helps you take advantage of market cycles.

So, important here is decide how much should be in equity (stocks, etc) and what should go to other equity. This is called asset allocation. Once the proportion get’s decided, the act of portfolio balancing gets easier (as explained in the above example).

3. Asset Allocation Basics

When it comes to investing, you’ll often hear the phrase “Don’t put all your eggs in one basket.”

This is exactly what asset allocation is about – we must always keep our monies spread across different types of investments. Why?

It is done to manage a balance between the risks and potential returns.

In this section, let’s declutter what asset allocation means, the different asset classes, and why balancing them matters.

3.1 What is Asset Allocation?

Asset allocation means dividing your investment portfolio among different types of assets, like equity (stocks, ETFs), debt (bonds, FDs), commodities (gold), and real estate (REITs). Ideally, our money must be spread across multiple asset classes to ensure diversification.

But for a beginner, who is just starting and has only so much funds, diversification within an asset class is also a good starting point. For example, having a mix of stocks from sectors like financials, technology, pharmaceutical, etc can ensure a decent diversification.

Th idea is to encourage people not to put all their money into one risky stock (for example).

Think of it like a balanced diet.

Just like our body needs proteins, carbs, and vitamins, your portfolio needs different investments to stay healthy.

If we’ll only invest in one type of asset, we risk losing big if that asset performs poorly. Spreading your money across various assets protects you from such risks.

Spreading our money across different assets is called asset allocation.

3.2 Benefits of Asset Allocation

Asset allocation is the backbone of your investment plan. It helps:

- Manage Risk: Different assets don’t all rise or fall at the same time. If one performs poorly, others might do well, keeping your portfolio stable.

- Achieve Goals: Whether you want quick growth or steady income, the right mix of assets can help you reach your targets.

- Stay Disciplined: A planned asset allocation keeps you focused and reduces emotional decisions like panic-selling during market drops.

3.3.Key Asset Classes and How They Work

Let’s look at some common asset classes and how they perform over time.

1. Stocks (Equities): What are they? When you buy a stock, you’re buying a small piece of a company. How do they perform? Stocks offer high growth potential but come with higher risk. Their prices can go up or down sharply, depending on the company’s performance and market conditions. Example: If you invested Rs.10,000 in a stock like HUL 10 years ago, it might be worth over Rs.40,000 today. But during a market crash, it could have temporarily fallen to Rs.6,000. Takeaway: Stocks are great for long-term growth, especially if you’re young and can handle some ups and downs.

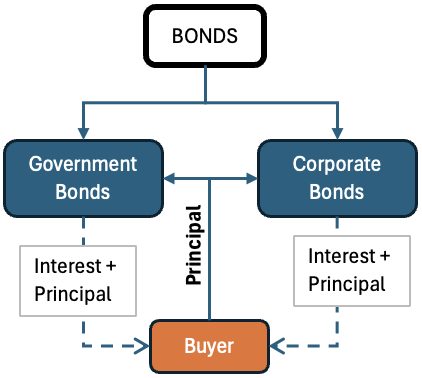

2. Bonds (Fixed Income): What are they? Companies & governments use bonds to borrow loans in return for regular interest payments. How do they perform? Bonds are safer than stocks but offer lower returns. They perform well when stock markets are down because investors look for safer options. Example: If you buy a government bond worth Rs.1,000 with 7% annual interest, you’ll get Rs.70 each year, plus your Rs.1,000 back after the bond term. Takeaway: Bonds add stability to our portfolio. They’re like the seatbelt that keeps you secure when markets are rough.

3. Commodities (Gold): What are they? Physical goods like gold, silver, oil, and agricultural products. How do they perform? Commodities can protect against inflation and perform well during economic crises. Gold, for example, is seen as a safe haven when markets are uncertain. Example: Gold prices surged during the 2008 financial crisis and the 2020 COVID-19 pandemic, protecting many investors from losses. Takeaway: For Indian investors, gold is both an investment and a tradition. A small percentage in gold can provide safety during market uncertainty.

4. Real Estate: What is it? Buying property or investing in real estate funds. How does it perform? Real estate offers steady income (rent) and long-term appreciation. But it requires large investments and isn’t easy to sell quickly. Example: A flat bought for Rs.30 lakhs in a growing city might be worth Rs.60 lakhs in 10 years. My View: Real estate is a great way to diversify but shouldn’t be your only investment. It’s like the big, heavy weight in your portfolio—valuable but not always flexible.

3.4 How Asset Classes Perform Differently Over Time

Each asset class reacts differently to market conditions. Here’s how they can affect your balance:

- During a Stock Market Boom: Stocks rise sharply, but bonds and gold may stay flat.

- During a Market Crash: Stocks fall, but bonds and gold might rise as investors seek safety.

- When Inflation Rises: Commodities like gold and real estate usually do well, while fixed-income returns may lose value. Read about stock market vs gold, and stock market vs real estate.

Why This Matters

Imagine your portfolio is 60% stocks, 30% bonds, and 10% gold. After a stock market boom, your stocks might now make up 75%. Your portfolio is now riskier than you planned. Asset allocation helps you rebalance, keeping your risk in check.

4. Rebalancing Methods

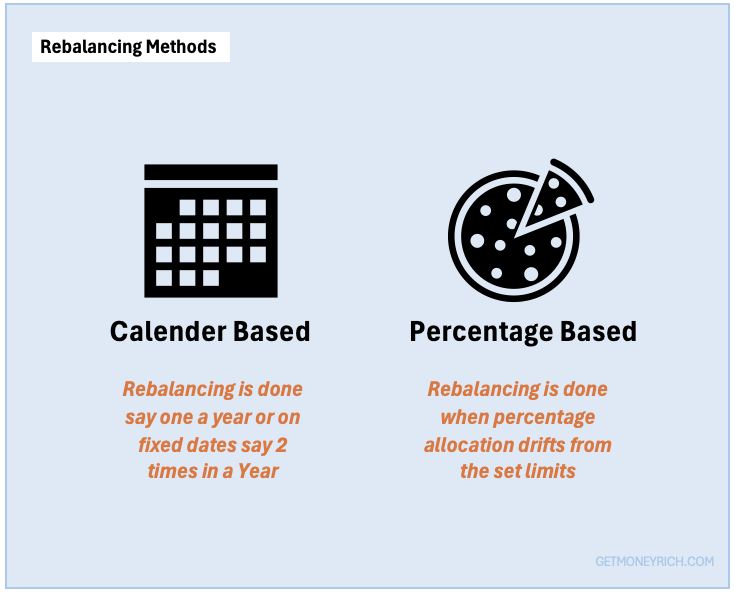

In investing, having a balanced portfolio is key to managing risk and achieving long-term growth. But once you set up your portfolio with a mix of stocks, bonds, and other assets, things don’t just stay balanced on their own. Rebalancing helps bring your investments back to their original mix. Let’s explore the two main methods of rebalancing: calendar-based and percentage-based rebalancing.

4.1. Calendar-Based Rebalancing

In calendar-based rebalancing, you adjust your portfolio at fixed intervals—like once a year, semi-annually, or quarterly. You don’t worry about how much your investments have changed; you just check and rebalance at these set times.

Example: Let’s say you decide to rebalance every January 1st. On that day, you check if your original 60:40 mix has drifted. If it’s now 65:35, you sell some stocks and buy bonds to bring it back to 60:40.

Pros:

- Simple and Easy: You know exactly when you’ll rebalance, making it easy to plan.

- Less Frequent Trades: Rebalancing once or twice a year minimizes trading fees.

- Good for Busy Investors: You don’t need to monitor your portfolio constantly.

Cons:

- Timing Issues: Markets may shift dramatically between rebalancing dates. You might miss opportunities or risk big losses.

- Rigid Approach: Doesn’t consider how much the portfolio has drifted—only the calendar date.

Calendar-based rebalancing works well for beginners. It keeps things simple and prevents you from overthinking. For most young investors, annual rebalancing is a good starting point.

4.2. Percentage-Based Rebalancing

In percentage-based rebalancing, you adjust your portfolio whenever your asset allocation drifts by a certain percentage—like 5%. Instead of waiting for a specific date, you act when your investments move beyond this set limit.

Example: Suppose you set a rule: if your 60% stock allocation grows to 65% (a 5% deviation), you rebalance immediately. This keeps your portfolio aligned with your risk tolerance.

Pros:

- More Responsive: You act quickly when your portfolio drifts, managing risk more effectively.

- Takes Advantage of Market Moves: Allows you to buy low and sell high, enhancing returns.

Cons:

- More Monitoring: You need to check your portfolio regularly, which can be time-consuming.

- Higher Costs: More frequent rebalancing can lead to higher trading fees and taxes.

If you have the time to monitor your portfolio, percentage-based rebalancing is great for staying on top of market changes. It ensures you’re always aligned with your target mix.

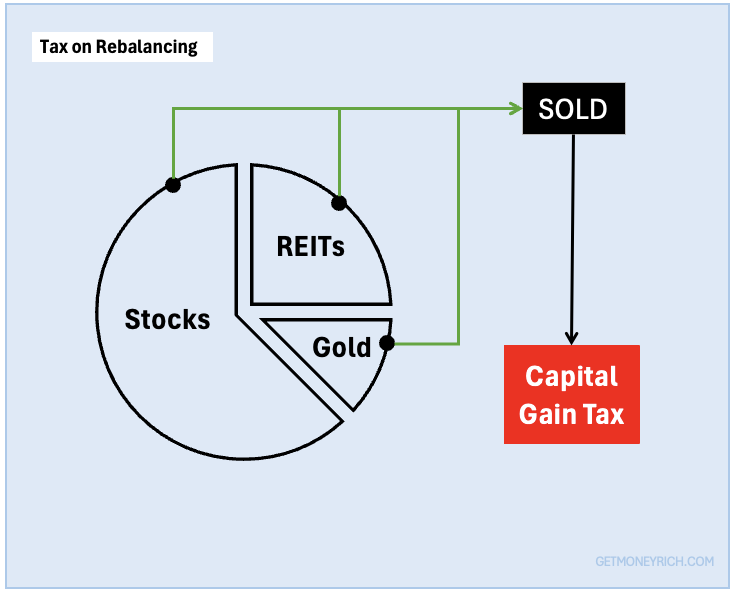

5. Tax Implications of Rebalancing

When you rebalance your portfolio, you sell some assets and buy others to maintain your desired allocation. But in India, this simple act of rebalancing can have tax consequences. Understanding these tax implications—and learning how to minimize them—can save you a lot of money in the long run. Let’s break it down.

5.1 How Rebalancing Triggers Capital Gains Taxes

When you sell an investment during rebalancing, the government considers it a taxable event. If the value of what you sold is higher than what you originally paid, the difference is called capital gains. These gains are taxed based on two categories:

- Short-Term Capital Gains (STCG): If you sell equity investments (stocks or equity mutual funds) within 1 year of buying, the gains are considered short-term. Tax Rate: 15% on short-term capital gains.

- Long-Term Capital Gains (LTCG): If you sell equity investments after 1 year, the gains are long-term. Tax Rate: 10% on gains exceeding Rs.1 lakh per financial year (without indexation benefits). Gains up to Rs.1 lakh are tax-free.

For debt mutual funds or bonds, the rules are slightly different:

- Short-Term Gains: If held for less than 3 years, gains are added to your income and taxed according to your income slab.

- Long-Term Gains: If held for more than 3 years, gains are taxed at 20% with indexation benefits (which helps reduce the taxable amount by accounting for inflation).

Example: Suppose you bought stocks worth Rs.1,00,000 and their value grew to Rs.1,50,000 in 18 months. If you sell Rs.30,000 worth of these stocks while rebalancing, you’ll have to pay 10% tax on the Rs.30,000 gain because it falls under long-term capital gains.

5.2 Strategies to Minimize Taxes When Rebalancing

To make sure you’re not paying unnecessary taxes every time you rebalance, here are some strategies that can help:

- Use Tax-Advantaged Accounts: Accounts like the Public Provident Fund (PPF), National Pension System (NPS), or Equity-Linked Saving Schemes (ELSS) offer tax benefits:

- PPF: Investments in PPF are tax-free under Section 80C, and the returns are also tax-free.

- NPS: You can claim tax deductions under Section 80CCD(1B).

- ELSS: Investments up to ₹1.5 lakh are tax-deductible under Section 80C.

- By rebalancing within these accounts, you avoid capital gains taxes because these investments have tax shields.

- Opt for Tax-Loss Harvesting: It means selling investments that are at a loss to offset the gains from other investments. This helps reduce your overall taxable gains. Example: Imagine you have a stock with a gain of Rs.50,000 and another stock with a loss of Rs.20,000. By selling the stock at a Rs.20,000 loss, your net gain becomes Rs.30,000 (Rs.50,000 – Rs.20,000). This reduces the amount of capital gains tax you need to pay.

In India, we can use short-term capital losses to offset both short-term and long-term gains, but long-term losses can only be set off against long-term gains.

6. Impact of Market Movements

Market movements significantly impact your portfolio’s asset allocation. When markets are volatile, the value of different assets like stocks and bonds fluctuates, causing your original allocation to drift. For instance, in a bull market (when stock prices rise), your equity investments might grow rapidly, increasing their proportion in your portfolio. If you initially planned a 60:40 equity-to-bond ratio, it may shift to 75:25, making your portfolio riskier than intended. This drift necessitates rebalancing to reduce exposure and maintain your risk tolerance.

Conversely, during a bear market (when stock prices fall), equities may lose value faster than other assets, causing their proportion to decrease. Your portfolio may shift from 60:40 to 45:55 in favor of bonds. This conservative tilt could limit your future growth potential. Rebalancing in such cases involves buying more equities while they are cheap to restore balance. By adjusting regularly, you ensure that market volatility doesn’t push your portfolio off track.

7. Rebalancing Strategy

For retail investors, a combination of calendar-based and threshold-based rebalancing tends to be the most effective strategy.

Rebalancing your portfolio once or twice a year (e.g., every 6 or 12 months) keeps the process simple and systematic. At the same time, monitoring your asset allocation for deviations (e.g., 5% to 10% from the target) helps you stay flexible during significant market shifts.

This combination ensures you’re neither rebalancing too frequently (incurring high costs) nor letting your portfolio drift too far, increasing risk exposure.

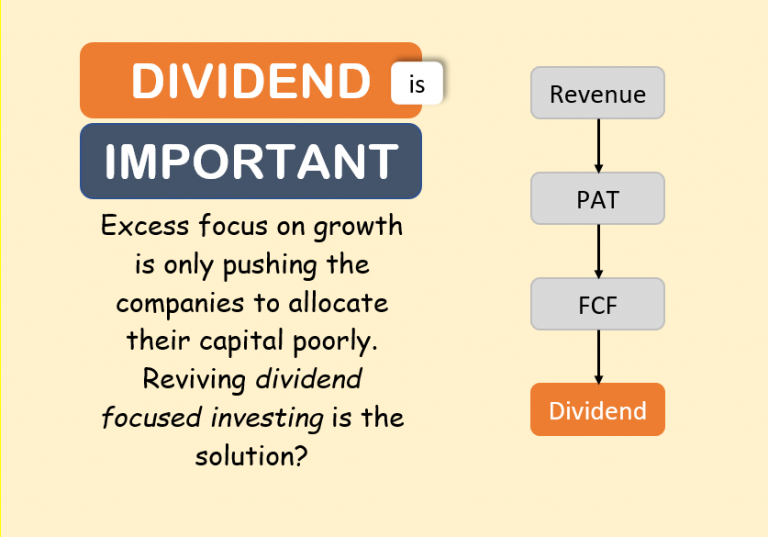

Use new contributions to rebalance. How? Two quick example that comes to my mind:

- If equities have grown too much in your portfolio, we can direct our next investments towards bonds or other assets. This avoids selling existing assets, helping you minimize capital gains taxes.

- A stock portfolio will also earn dividend income. We can divert this regular income towards buying more of REITs or keep them in fixed deposits.

8. Behavioural Finance Considerations

Behavioral finance plays a significant role in why investors struggle with rebalancing.

- One common bias is the reluctance to sell winners. When a stock performs well, we become emotionally attached, believing it will continue to rise. Selling it feels like losing out on future gains.

- Similarly, there is a fear of realizing losses when selling underperforming assets, as it feels like admitting failure.

These biases can lead investors to hold onto a skewed portfolio, increasing risk and drifting away from their long-term strategy.

To overcome these biases, discipline is key.

Rebalancing works because it forces us to sell high and buy low, even when it feels counterintuitive.

Creating a clear rebalancing plan and sticking to it helps. How? It reduces the emotional decision-making.

9. Measuring Rebalancing Performance

Measuring the success of our rebalancing strategy involves comparing our portfolio’s performance against specific benchmarks or target allocations.

A benchmark could be a relevant market index like the NIFTY 50 for equities or the CRISIL Composite Bond Fund Index for bonds.

After rebalancing, we can check if our portfolio closely mirrors our target allocation. For example, if our goal is a 60:40 equity-to-bond ratio. Now, if our portfolio stays aligned with this after rebalancing, we are effectively managing risk.

Additionally, we must track our portfolio’s overall returns compared to the benchmark over different periods (1 year, 3 years, 5 years).

Rebalancing aims to optimize returns while maintaining our risk profile. If our portfolio consistently outperforms or matches the benchmark while keeping volatility in check, our strategy is effective.

Suggestion: We can also try to calculate the Sharpe ratio of our investment portfolio. It measures risk-adjusted returns. Keeping track of the sharpe ratio will ensure that our portfolio isn’t exposed to unnecessary risk. Read more about Sharpe Ratio here.

Conclusion

Critics of portfolio rebalancing often argue that it may lead to missed opportunities, particularly when selling assets that are performing well. They believe that sticking to a fixed allocation may reduce potential returns by not fully riding the wave of strong market trends.

Some even suggest that the frequent transaction costs and potential tax implications could erode the overall gains, making rebalancing seem counterproductive.

However, in my view, rebalancing is a crucial discipline for long-term retail investors.

It helps keep emotions in check and ensures that our portfolio do not get too risky.

By systematically rebalancing, we take advantage of market volatility by selling high and buying low. This method over time can lead to more stable returns.

I’m also a buy and hold investor. But I prefer portfolio rebalancing. Let me tell you how I do it? When the stock market is at its peak, and I see very high PE stocks in my portfolio, I sell a part of them. The same funds I use to buy stocks that looks undervalued. I do not follow a fixed rebalancing schedule, I mostly do it when the market is at its peaks. How to know if the market has peaked?

Keep reading the news, when it happens, the chatter will start there.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.