Investing in the stock market can be both exciting and risky experience. One of the things that we can do to lower our risks is to try to time the market. We must know the right time to buy stocks. One of the misconceptions among new investors is the belief that the best time to buy stocks is when the market is reaching new heights. However, experts of the stock market (long term investors) will do the opposite of it when the markets are bullish.

Remember, how the market is perceived by day-traders and momentum investors are very different from long term investors. Real money can only be made by buying stocks for the long term. How we can actually practice this strategy, we’ll discuss it in this article.

Seasoned investors understand that buying stocks, when the markets are high, often leads to disappointment and subpar returns. Instead, the ideal time to buy stocks for long-term holding is during market downturns when prices are lower and opportunities for growth are greater.

Topics:

The Purpose of This Article

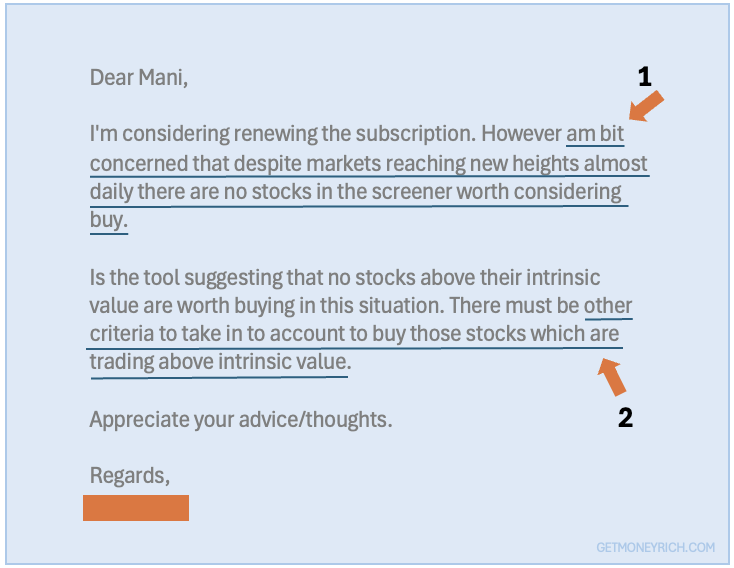

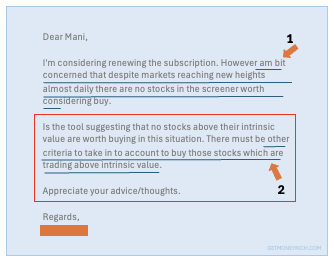

Recently I received an email from one of my subscribers highlighting the fact that my Stock Engine is not pointing towards any stock worth considering a buy. So he wrote an email to me asking for my views on it.

There were two parts of his email. The first says, “…am bit concerned that despite markets reaching new heights almost daily there are no stocks in the screener worth considering buy.” I’m writing this article mainly to answer this part of his email.

The second part of the email says, “..there must be other criteria to take in to account to buy those stocks which are trading above intrinsic value.” I will also answer this question. But let me tell you that though the question looks straightforward, but its answer is not simple.

Post COVID, the retail (individual investors) participation has increased in the stock market. There is a big population who have started investing post March-2020 market crash (beginning of 2021). These people have mostly seen a growing market, hence for them buying at any price makes sense. This is where my concern lies.

Earlier, there were hardly any source for retail investors that can compare for them current price with the intrinsic value. A tool like Stock Engine does this job for its subscribers. But I’m assuming that a lot of post-covid investors do not believe in the concept of intrinsic value. They see stocks just as a tool whose price gyratr between highs and lows. This is not how long term stock investing works. My Stock Engine is for long term investors.

More Deeper Point

But the above email also has a deeper point about stock investing. Suppose we want to buy stocks like HUL, Nestle, Britannia, Zomato, Jio Finance, etc which invariably trades at very high PEs.

What strategy one shall use to buy such stocks.

This is where the second part of email find its relevance. What “other criteria” we must take into account to buy such stocks?

The Stock Engine algorithm is so coded that the it will perhaps never trigger a favourable “Recommendation for these stocks.” Why? Because most of these stocks trade at a very high premium to their estimated intrinsic value. So does it mean that we can never buy these stocks?

There is a way and I’ll share my thoughts in this article at the end. It is a short-cut (read here)

But before that, allow me to share the my thoughts on “ideally what is the right time to buy stocks for long term holdings”

Point #1: Understanding Market Cycles

The stock market operates in cycles. They are characterized by periods of growth (bull markets) and decline (bear markets). These cycles are driven largely by investor sentiment. “Over-optimism” pushes the prices up during bull markets and “fear and pessimism” drive prices down during bear markets.

Understanding these cycles is crucial to be able to time the market and taken an informed bet.

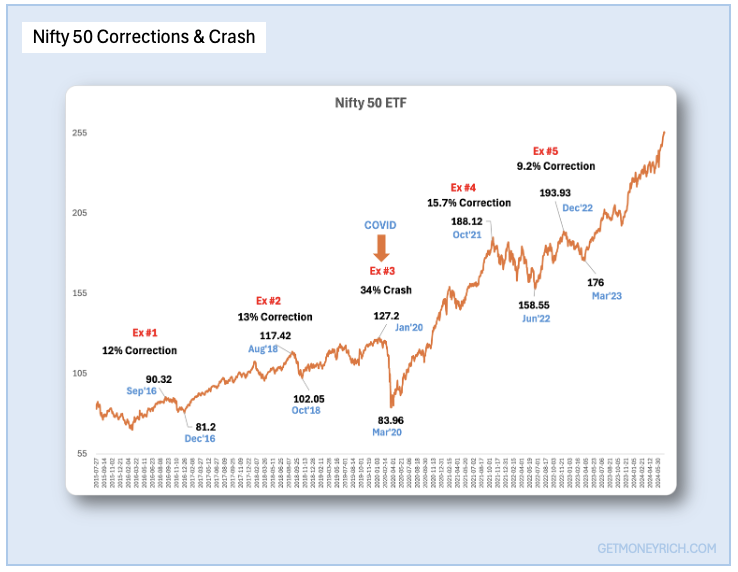

In the last 10-Years (between 2015 and 2024), there have been at least 5 major corrections and a crash:

- Example#1: Sep’16 to Dec’16: Nifty ETF corrected from Rs.90.32 to Rs.81.2 (-12% fall)

- Example#2: Aug’18 to Oct’18: Nifty ETF corrected from Rs.117 to Rs.1022 (-13% fall)

- Example#3: Jan’20 to Mar’20: Nifty ETF crashed from Rs.127 to Rs.84 (-34% fall)

- Example#4: Oct’21 to Jun’22: Nifty ETF corrected from Rs.188 to Rs.158 (-15% fall)

- Example#5: Dec’22 to Mar’23: Nifty ETF corrected from Rs.194 to Rs.176 (-9% fall)

In a bull market, stock prices rise, often fuelled by optimism and strong economic indicators. Conversely, in a bear market, prices fall, usually due to economic slowdowns or negative investor sentiment.

While it might seem counterintuitive, bear markets present some of the best buying opportunities for long-term investors. This is because stocks of fundamentally strong companies often become undervalued. Some high-quality stocks may not come down to undervalued levels, but they see a substantially correction from their peak PE levels.

This is where we get a chance to purchase them at a discount. Read more about understanding investment cycles by Howard Marks.

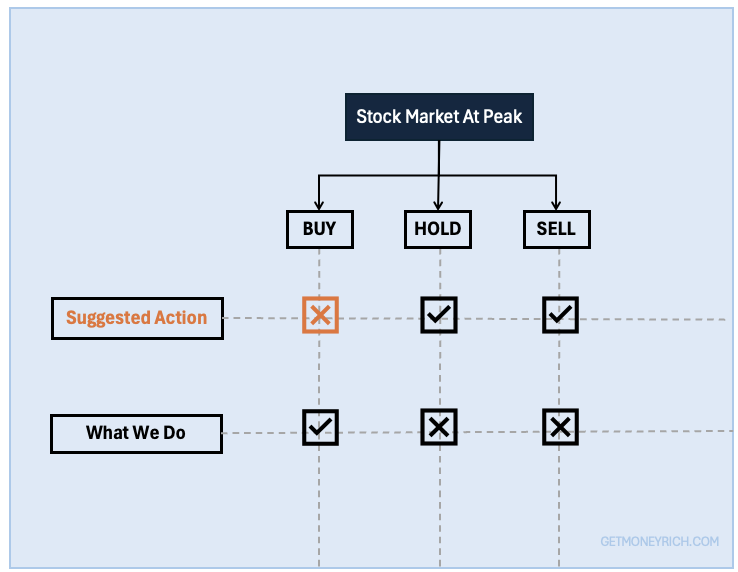

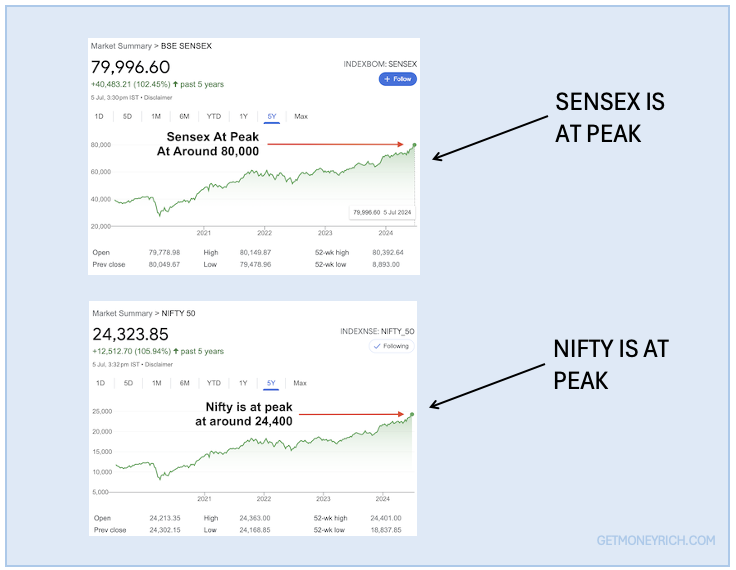

Point #2: The Fallacy of Market Peaks

Buying stocks in a rising market (when index is near its peak) is a common mistake among investors. People think that that is the moment to buy stocks. Probably people draw an analogy that as everyone does shopping during Diwali, Dussehra and Christmas, buying during market peaks is a tradition. But it is not a correct analogy for investing.

At these times, stocks are often overpriced, and hence the potential for future gains is limited.

The risk of a market correction or trend reversal is also higher, which can lead to significant losses if one buy at inflated prices.

Historical examples prove that whenever retail investors have bought during market peaks faced poor returns or even losses. For instance, those who invested heavily during the dot-com bubble of the late 2000s have not returned back to the stock market. Even during the sub-prime mortgage crisis of 2008 investors saw substantial losses when these bubbles burst.

These examples highlight the dangers of buying into the market hype. It is important for stock investors to be extra cautious during market highs. Market highs are not the time to invest, it is the time to either hold or sell.

Point #3: The Value of Buying During Market Downturns

Contrary to buying at market peaks, investing in a falling market can be highly beneficial for long-term investors. During these periods, stocks of solid companies often trade at lower prices due to overall market pessimism. The price fall is not because of any fundamental issues with the companies themselves but due to external factors.

For example, during the financial crisis of 2008-2009, many high-quality stocks were trading at significant discounts. Between Jan’2008 and March’2009, the prices of almost all stocks came crashing down to rock bottom levels. But this price fall was not because these companies were fundamentally weak. It happened because of the mortgage crisis in the US (banks).

Investors who recognized these opportunities, bought into quality companies. What are quality companies? Companies with strong balance sheets, robust business models, and competitive advantages. Buying such companies during such times offer handsome rewards when the market starts to recover. It is important to remember that the market moves in cycles, what will go up will come down and vice versa.

The key is to focus on the intrinsic value of companies and not be swayed by short-term market fluctuations.

Point #4: Estimating Intrinsic Value

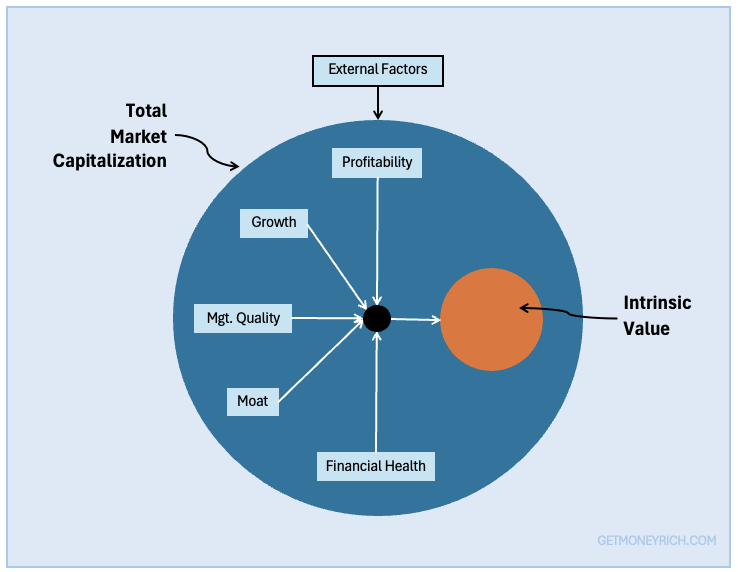

There is a difference between market price and intrinsic value of stocks. Market price is derived from the company’s market capitalization. Intrinsic value is derived from the business fundamentals of the company.

Factors like profitability, growth, economic moat, financial health, and quality of management builds a company’s intrinsic value. Read about the Overall Score of stocks (algorithm).

Though market capitalization is also dependent of these metrics, but it is also influenced by external factors like market sentiments, state of economy, political stability, demand etc.

For long term investors, it is essential to learn to differentiate between market capitalization and intrinsic value of companies. Why? Because very often, the market capitalization of quality companies stay at inflated levels due to external factors.

Ideally speaking, a company’s market capitalization should be very close to its intrinsic value. But as external factors (which companies cannot control) are also at play, the market cap remain at over-inflated levels.

Hence, we must learn to distinguish between how the market is valuing a company (market capitalization) and its actual true worth (intrinsic value). For example, my Stock Engine points than an Indian company’s price is more than twice its estimated intrinsic value (see below).

How to estimate the intrinsic value of stocks? There are various methods to assess intrinsic value. One common approach is the discounted cash flow (DCF) analysis. DCF estimates the present value of a company’s expected future cash flows.

Simply speaking, the right time to buy stocks is when it is trading at a price below its intrinsic value. Then there is also a concept called margin of safety. As a rule of thumb, in today’s world, maintaining at least a 10% margin of safety from our estimated intrinsic value is suitable.

But here comes a practical catch, price of most quality companies might never fall to their intrinsic value levels. What a retail investor should do in such a situation? Are there “other criterias” to buy such stocks which invariably trade at a high P/E multiples?

Yes there is a way. This is the point where I’ll talk about the second part of the email query I received from one of my subscribers.

Point #5: Other Criteria to buy Stock [Other Than Intrinsic Value Method]

If you are new investor, it is essential to enter the market (start building a stock portfolio) at a right price. This is an uncompromisable requirement. We must avoid starting at levels where the market is already at or near its peak. What is the problem with peaks?

Stock price is always volatile, but the chances of experiencing price falls is maximum at peaks. Let’s understand it using an example. Suppose a new investor bought a few stocks when the Nifty50 or Sensex is at peak. Soon, there will be temporary moment when the index start falling. When the index falls, price of almost all stocks also falls.

When a new investor will see the prices of his stocks falling by 15-20% from their buy-levels, they will panic and start selling at loss. This will induce a negative experience about stock investing in their minds. Such investors often do not return back to the stock market. They will find solace with mutual funds etc.

What is the better way?

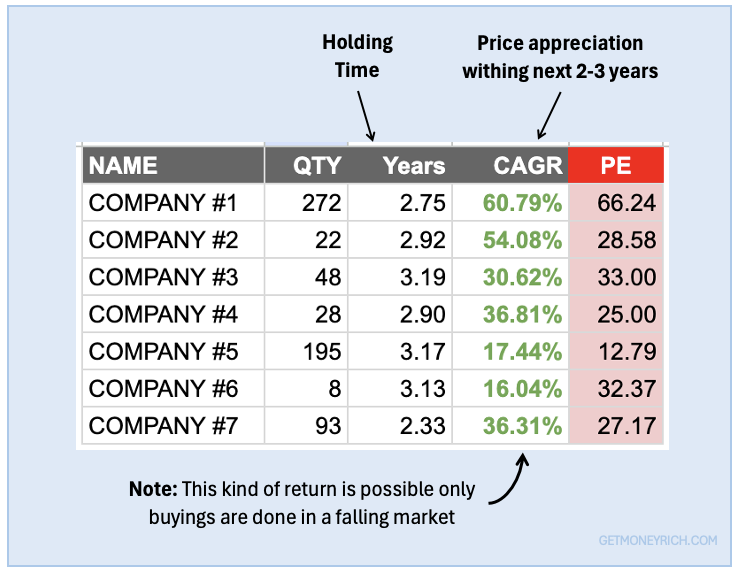

If one is starting, start when the index (Sensex, Nifty) has already corrected by about 10%. At these levels, buy some blue-chip or quality lower market cap stocks. Once these stocks are in the portfolio, hold them for next 2-3 years.

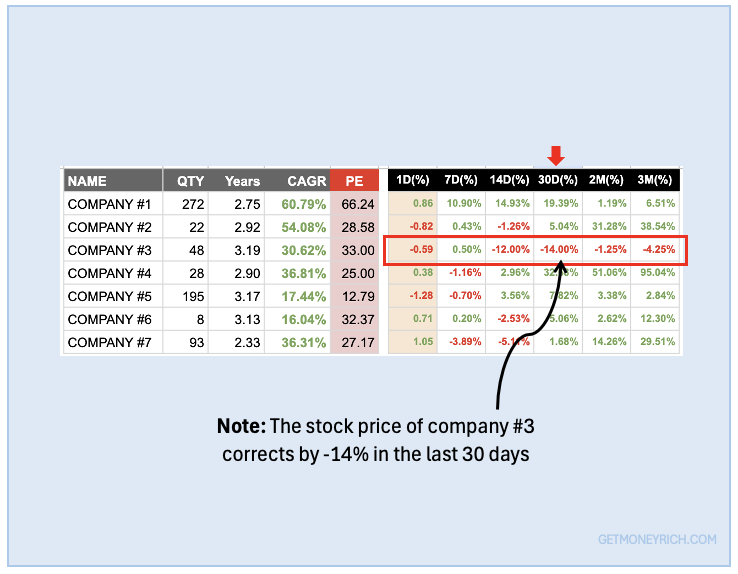

For example, suppose you have purchase seven stocks in your portfolio and its composition looks like shown below. In 2-3 years, as quality companies are bought during a falling market, their CAGR growth numbers will look as shown in the below image.

When your portfolio is already showing the above kind of gains, even if the market corrects by 20-25%, it will not trigger a panic reaction. Instead, when the price falls, it will motivate you to buy more.

Allow, me to suggest you additional step to practice stock buying during market falls.

Suppose there is a situation, where the the price of one stock in your portfolio falls by say 14% in the last 30 days. You stock’s price report chart shows price corrections as below:

If you have access to such a price chart report, instead of panicking you will realize that it is a moment to buy more and not to sell. So the question is, from where to get such a price report?

My Stock Engine app can give such a report for a selected few stocks.

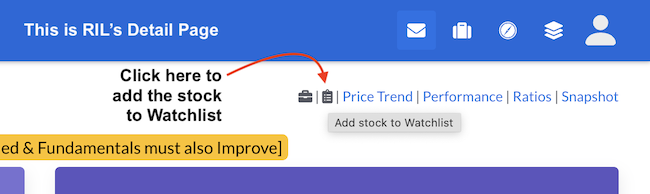

Go to the detail page of an individual stock (say RIL). Add that stock to your Watchlist. Repeat this step till all stocks that you desire get’s added to your watchlist.

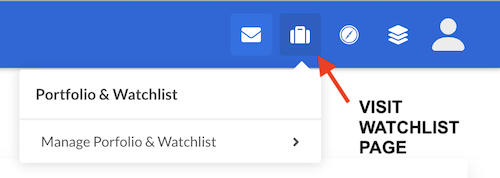

After all stocks get added to the Watchlist, visit the Watchlist Page. You can navigate to the watchlist page from here (see below):

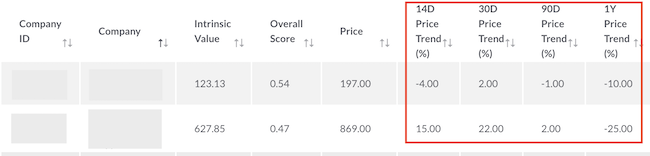

There in the Watchlist page it will show in a tabulated form how much the stock has corrected in the last 14-Ddays, 30-Ddays, 90-Days, and 1-Year. The report will look like this:

Conclusion

The best time to buy stocks for long-term holding is not when the market is reaching new heights, but rather during market downturns. At these times we can pick a few quality stocks when prices are lower, thereby offering a better opportunity for growth.

By understanding market cycles, evaluating intrinsic value, and maintaining a long-term perspective, investors can build a strong portfolio.

Remember, patience and discipline are key to successful investing. Stay focused on your long-term goals and be ready to seize opportunities when the market offers them.

Additional Resources:

For further reading and tools to assist in your investment journey, consider the following resources:

- Books: “The Intelligent Investor” by Benjamin Graham, “Common Stocks and Uncommon Profits” by Philip Fisher, and “One Up On Wall Street” by Peter Lynch.

- Articles: Reasons to buy stocks for long term by US Bank.

- Tools: Stock analysis tool – Stock Engine.

Happy investing!

Excellent read… Investment in stocks for long term profits is perfectly addressed in the article!

Thanks