Where to invest money in India? There are more than 100 investment alternatives available in India. Here in this blog post, I have compiled it all in one place.

I’ve challenged myself to indicate 100+ ways of investing money. There can be a plethora of ways to invest money. But unfortunately, we know only a handful.

Knowledge of all investment alternatives is good

Financial independence should be our number priority in life. To achieve this goal one must invest in profitable assets. A variety of assets will provide an advantage of portfolio diversification.

The stock market mostly trades at overvalued levels. In such a situation investors should not buy stocks. If one knows an alternative, money can be parked there (instead of stocks).

Generally, people invest in stocks, mutual funds, real estate, or gold. But there are hosts of other ways to invest money. I agree that it is not easy to convince people to invest elsewhere. But such a comprehensive list in one place may help.

For our grandfathers, investment meant buying an insurance plan. If they went a step further, they will buy a PPF, NSC, or KVP – no more.

Why it was so? Not because they could not take risks, they simply did not know about other investment options.

Here I have tried to indicate as many ways of investing as I could recall. I have also provided useful links, which can be used to know more details about that investment vehicle.

Let’s start our journey of 100+ Investment alternatives. I have also segregated them into groups so that the information becomes more scannable.

A. Our Banks:

- 1) Invest money in savings account offered by banks.

- 2) Invest money in recurring deposits offered by banks.

- 3) Invest money in fixed deposits offered by banks.

- 4) Tax saver fixed deposits offered by banks are good investing vehicle. Read more about income tax planning.

- 5) Sometimes it’s not such a bad idea to keep liquid cash parked safely in current account.

B. Government of India Plans:

- 6) Invest money in national pension system (NPS) with selected banks. Read more about NPS.

- 7) Investing money in public provident fund (PPF) offered by banks & Post offices for retirement benefits.

- 8) Government of India (GOI) Bonds are also decent investment option (example: 8% Govt. of India Savings Bonds – 2003). Read more about how to buy government bonds.

- 9) There are also other Bonds for investment like listed bonds (of IFCI), capital gain bonds (of RECL & NHAI).

- 10) Kisan Vikas Patra (KVP) offered by Indian Post Office is also considered decent investing vehicle.

- 11) Invest money in National Savings Certificate (NSC) of Indian Post Office.

- 12) Invest money in National Savings Scheme (NSS) of Indian Post Office.

- 13) Invest money in Government securities (Treasury Bills > T-bills)

- 14) Invest money in Government securities (Cash Management Bills – CMBs).

- 15) Invest money in Dated Government Securities (like fixed rate bonds, floating rate bonds, capital indexed bonds, bonds with call/put options, zero coupon bonds).

- 16) Invest money in Government securities (State Development Loans – SDLs).

- 17) Invest money in Municipal bonds in India.

- 18) First time investors can invest in equity through Rajiv Gandhi Equity Savings Scheme (RGESS).

C. Post Offices:

- 19) Invest money in Post Office’s Monthly Income Plan (MIP). Read more about PO MIP here.

- 20) Post Offices also offer recurring deposit (RD) scheme for public

- 21) Invest money in Post Office savings account.

- 22) Invest money in Company Fixed Deposits.

- 23) Invest money in corporate bonds.

- 24) Corporates offer convertible debentures which is a great investment scheme.

- 25) Corporates also offer non-convertible debentures.

- 26) Invest money in Annuity plans for income generation. Read more about what is annuity.

- 27) Invest in tax free bonds.

- 28) Invest in inflation indexed bonds.

D. Retirement Plans:

- 29) Invest money in senior citizen savings scheme (SCSS) offered by Indian Post Office, SBI etc. Read more about SCSS and Vaya Vandana Yojana.

- 30) New Pension Scheme (NPS) is also a decent retirement linked investment. Read more about NPS vs EPF.

- 31) Invest money Monthly Income Plan (MIP) offered by mutual fund companies. Read more about how to generate monthly income.

- 32) Investing in pension plans offered by Insurance companies can also be a good retirement linked investment vehicle.

- 33) Invest money in Voluntary Provident Fund Scheme (VPF).

E. Insurance Plans:

- 34) Tax Saving Plans: Invest money in tax savings insurance plans. Buy life insurance plan. Buy health insurance plan for complete family including dependent parents.

- 35) Unit Linked Insurance Plans (ULIP’s) gives dual benefit of insurance plus capital appreciation. UPI Vs Mutual funds – which is better.

F. Mutual Funds & ETF’s:

- 36) Invest in tax saver equity linked savings scheme (ELSS). Read more about ELSS Funds here.

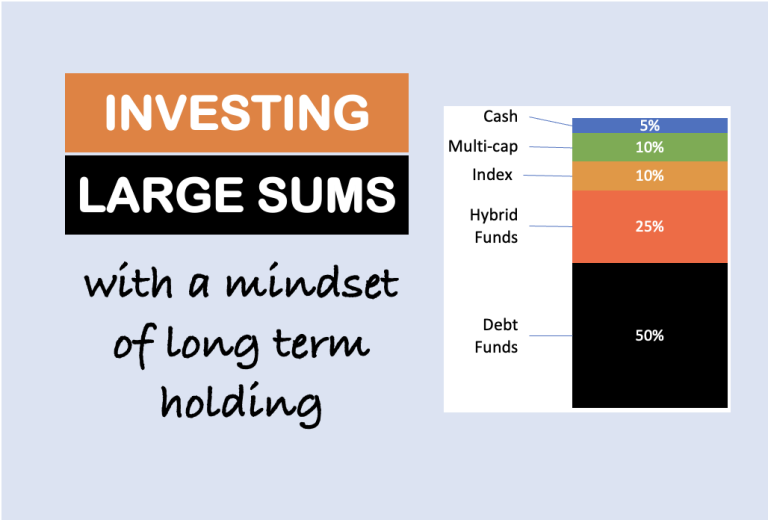

- 37) Invest money in lump sum, in equity linked mutual funds. Read more about types of mutual funds in India.

- 38) Invest money in lump sum, in debt linked mutual funds.

- 39) Invest money in lump sum, in balance mutual funds.

- 40) Invest money in lump sum, in Liquid mutual funds.

- 41) Investing systematically (SIP) in diversified equity mutual funds can give huge long term returns. Read more about SIP Plans.

- 42) Close ended mutual funds are also a reliable investment option. Normally, all mutual funds are open ended funds.

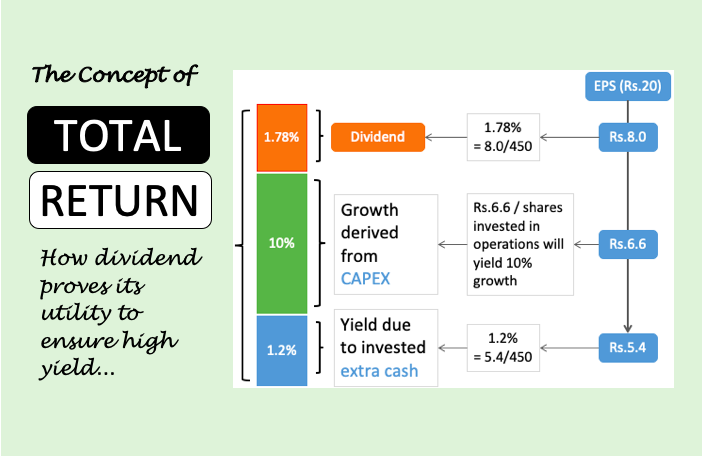

- 43) Investing in dividend paying mutual funds can also be a good idea. Read more about dividend paying mutual funds.

- 44) Hedge Funds is one of the most preferred investing vehicle of super rich. Read more about hedge funds for common man.

- 45) It’s also not a bad idea to invest in mutual funds that invests in global infrastructure companies.

- 46) One can also invest in mutual funds that allocate its funds to buy high yielding bonds globally.

- 47) Investors prefer to buy debt linked mutual funds of emerging markets like Brazil, Russia, China etc.

- 48) One can also invest money in mutual funds which allocates funds in emerging market’s stocks.

- 49) Gold ETF is one of the most preferred investing vehicles in India (example: Birla Sun Life Gold Exchange Traded Fund). Read more about ETF in India.

- 50) Invest money in Index linked ETF (example: SBI Sensex ETF).

- 51) Invest money in PSU bank ETF (example: Kotak PSU Bank ETF).

G. Real Estate:

- 52) Residential Property: Invest money in residential real estate property. Read more about how to buy house property in India.

- 53) Commercial Property: Investing in commercial real estate property can be considered of the best investing strategies. Read more about Embassy REIT.

- 54) Invest money in Real Estate Investment Trusts (REITs) – yet to come in India but its very useful for common investors. Read more about REIT India here.

- 55) Invest money in real estate property during pre-launch stage.

- 56) Invest money in real estate property which assures minimum rental income. This guarantee is given by the builder who is developing that property. The builders themselves maintains the property. In this case calculation of ROI for investors becomes easy. Read more about whether to live on rent or buy a house.

- 57) Invest money by purchasing land in upcoming areas of development. Immediate outskirts of metropolitan cities is one good example.

- 58) Invest money by buying an old property which is running out of favour. Such properties are located in prime locations but still available at discounted price. Such property can be renovated to earn higher rental yield or capital appreciation.

- 59) Buy new properties in prime locality developed by world class builder. Super rich do invest in such properties.

H. Commodity & Collectibles:

- 61) Physical Gold: Accumulating physical gold in form of coins or bars is also a good investment option. Read more about whether gold is a good or bad investment.

- 61) Accumulating physical silver in form of coins or bars is also considered decent investment.

- 62) Invest money in piece of art, collectibles, antiques, vintage automobiles etc.

- 63) High net worth investors also invests in options like wine, coins, paintings, antique furnitures etc.

- 64) Buy commodities in demat form. This can also be a good investing vehicle. Read more about E-Gold here.

- 65) Futures contracts are also investing for experts of technical analysis. Futures contracts are mainly linked with commodity market. Other futures contracts can be stock market and forex linked.

- 66) Rich people also invest their money in antique watches and classic musical instruments.

I. Stocks:

- 67) Dividend Stocks: Invest money for long term, in dividend paying stocks.

- 68) Growth Stocks: Invest money for long term, in growth stocks (quality small and large cap stocks). Read more about stocks of fastest growing companies.

- 69) Invest money in stocks in IPO stage. Read more about oversubscription in IPO.

- 70) If one is an expert of technical analysis, then trading stocks can also be a great investing option. Read more about technical analysis for long term investors.

- 71) Preferential shares of company earns fixed dividend for shareholders. This is also a good investing vehicle.

- 72) Invest money in foreign stocks by using trading platforms like Kotak Securities etc. Read more about how to buy stocks of overseas companies.

- 73) Investing in quality Penny stocks can also be a good investing option for high risk tolerance investors. Read more about penny stocks.

- 74) Invest money in Futures & Options market. These are equity derivatives.

- 75) India’s super rich also like to buy Large cap stocks of United States of America.

- 76) Practicing value investing in stocks. Experts like Warren Buffett & Ben Graham have made fortunes out of it. Read more about what is value investing.

- 77) Investing in blue chip stocks when stock market bottoms can be a good idea. Read more about Indian blue chip stocks.

J. Like Rich:

- 78) These days banks offer Portfolio Management Services (PMS) for high net worth account holders in their respective banks.

- 79) Invest money by starting a new business. There cannot be a better investment than this. But the driver should be the business plan. Read more about why build a business to become rich.

- 80) Becoming a member of social clubs, evening clubs can also be treated as an investment. Socialising will allow you to build a circle with successful people who know how to make money. Poor and middle class often do not like spending money in socialising.

- 81) Rich people also become a partner of venture capital firms. Venture capital firms invests in companies like MakeMyTrip, Just Dial and make hue long term profits.

- 82) Private equity investment is also one of the preferred investment option of super rich’s.

- 83) One can also invest like Warren Buffett. He prefers to buy complete business instead of buying its few stocks. Read more about Warren Buffett’s 3 Rules of Investing.

- 84) One of the best ways to invest money will be to open a firm and hire experts who can advice others how to invest money. A company which can make money or save tax for others will automatically see huge success.

- 85) Invest time and money to develop a product that will sell like hot cakes. Products like Windows, Iphone, Ferrari, McDonalds, Coca Cola, Internet etc should be our motivation. Even if product is not so big, but sheer uniqueness or usefulness of a product can make huge money for the developer.

- 86) Rich people also invests directly in emerging companies. Recently Ratan Tata bought stocks of SnapDeal & Xiaomi.

K. Giving Away:

- 87) Providing education to near and dear ones can also be treated as an investment.

- 88) Taking excellent care of aged parents can also be treated as noble investment as that is what your child is going to learn while he is growing up.

- 89) Invest money online for needful people of society through source like micrograam.com

L. Fitness (Mind & Body):

- 90) Spending money for gym can also be treated as an investment. Healthy mind and body can generate much more wealth than an unhealthy one.

- 91) Spend money to learn how to save money. This is one of the rarest of rare skill people posses. Knowing how to save money can make more money than than any other investment option. Read more about tips and tricks to save money.

- 92) Buy games like monopoly or cash flow for your child. If your child leans how to make money, probably he can make you doubly rich. Read more about 17 ways to become financial genius.

- 93) Spend money to learn how to become financially independent. This will be one of the most priced investments of all. Read more about how to become financially independent.

- 94) Start spending money to buy and read books about financial intelligence. A book may cost you 1,000 odd rupees. But if it strikes the right chord, the returns could be in lakhs. Shortcut will be read books on Warren Buffett. Read eBooks on Investment and Finance.

- 95) Attending seminars conducted by experts on investment skill development can be treated as investment.

- 96) Take a course to learn how to calculate intrinsic value of stocks. A person who knows how to estimate intrinsic value can become really affluent with money making. Use my stocks analysis worksheet to estimate intrinsic value of stocks.

M. Become Debt Free:

- 97) Prepay Loans: Making prepayments on home loan is also a good investment option. Buy a property and pay it off quickly by making prepayments. Read this guide on home loan prepayment.

- 98) Become Debt Free: Clear all outstanding loans like credit card debt, personal loan, education loans etc. Target is tp become debt free. Read more about why to become debt free.

N. Miscellaneous:

- 99) Buy a privileged credit card that offers reward points. Such cards charge an annual fees. Make all budgeted purchases using this credit card. Let reward points accumulate as your returns. Read more about why credit card offer reward points.

- 100) Though FOREX trading is risky but people with very high risk tolerance can play this gamble. Read more about Prepaid Forex Cards.

- 101) Lending money to people we know can also be considered as investment. The best part of this type of investment is that our money is comparatively at lower risk. The borrower is know and reliable. Borrowed money may not earn outstanding returns but it should yield at least a percentage points less than interest charged by banks on personal loans.

i also looking to to invest in India and this article helps me thanks for posting. i got lot of investment idea . i will suggest this article to everyone

I was here to read about how to invest money in India, as I was reading through the strategies I was really content as I reached the bottom of the article.

While most blogs write on making money, this(Mani) guy is an allrounder, amazing I really appreciate the efforts you take.

As a matter of fact, my name is Mani too….

Please start taking live or online classroon session on topics like stock investing, Analysis and many more or write a book on above topics. All you articles are eye opener for me. Please do write one book stock investing.

Thanks for the suggestion and feedback.