Is there really any available alternative to savings account in India?

India has really evolved over the past 2-3 decades in terms of utilising investment options.

Earlier people used to know only fixed deposits, NSC, KVP, Endowment plans etc as their investment vehicles.

But now people do invest in stocks, mutual funds, real estate, gold bullions etc.

But even till date, a major chunk of public money still remains idle in bank’s savings accounts (or bank deposits).

Is there really an alternative to savings account?

Is it possible to park our money any where else other than savings account?

Why Savings Account is so popular?

There are several reasons for this. The most important ones are:

- Liquidity and,

- Safety provided on deposits.

Money can be withdrawn/paid from savings account by using following methods:

- ATM for cash.

- Debit Card for online payment.

- Internet banking for online payment.

- Cheque for offline payment.

- UPI for instant online payments.

What does it mean?

When money is kept in savings account, the cash is physically not in our hands. But the savings accounts still ensures sufficient liquidity.

These days, money in savings account is as good as cash in hand.

As if this was not enough, savings account also offers some interest (3.5% p.a.).

Deposits kept in savings account are also very safe. Why?

Because all deposits till Rs.100,000 are covered under deposit insurance.

If savings account (deposits) are so good, why we are seeking an alternative?

Why to seek for savings account alternative?

What is the inflation rate in India?

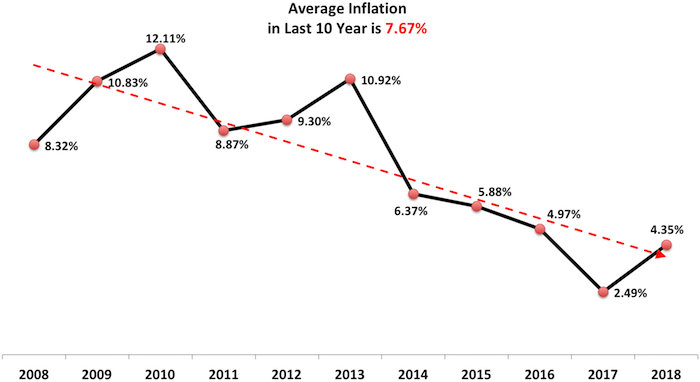

The trend of inflation in India in last 10 years has been shown in the below chart.

Average inflation for the last 10 year period (year 2008 – 2018) has been 7.67% p.a.

It is evident from the chart that the inflation-trend is falling.

What does it mean for investors who predominantly keep their money in banks (savings or deposits)?

The interest earned from savings and deposits will only fall in times to come.

To day savings account is giving 3.5% per annum and fixed deposits give 8% per annum.

Net of inflation returns on savings account is useless.

Net of inflation return of fixed deposits is close to zero.

This makes it mandatory for us to seek suitable alternatives of deposits in banks.

What is the alternative to savings account?

Mutual funds. But not any type of mutual fund.

These mutual funds fall in the below two categories:

- Liquid Funds.

- Ultra Short Term Funds.

These type os mutual funds can be the best available alternative to savings account.

These type of mutual funds gives better returns than savings accounts for sure.

Moreover they also ensure that the risk of price volatility (risk of loss) is also minimum.

#1. Liquid Funds.

Its listed here 4 liquid funds whose CRISIL rating has been 5 star.

Lets see the historic returns of these mutual funds:

| SL | Name | 3 Year | 5 Year | 10 Year |

| 1 | DHFL Pramerica Insta Cash Fund (G) | 7.30% | 8.03% | 7.88% |

| 2 | L&T Liquid Fund | 7.27% | 8.02% | 7.80% |

| 3 | Mirae Asset Cash Management Fund (G) | 6.97% | 7.64% | – |

| 4 | Indiabulls Liquid Fund (G) | 7.37% | 8.08% | – |

On an average, all mutual funds in liquid fund category has given a return of 7.5% p.a. in last 10 years.

Compare this with the historic returns of savings account (3.5% p.a.).

#2. Ultra Short Term Funds.

Its listed here 3 ultra short term funds whose VRO rating has been 5 star.

Lets see the historic returns of these mutual funds:

| SL | Name | 3 Year | 5 Year | 10 Year |

| 1 | BOI AXA Ultra Short Duration Fund | 8.24% | 8.84% | 7.90% |

| 2 | Franklin India Ultra Short Bond Fund – Super Institutional Plan | 8.81% | 9.40% | 8.81% |

| 3 | DHFL Pramerica Ultra Short Term Fund | 7.62% | 8.56% | – |

On an average, all mutual funds in ultra short duration fund category has given a return of 8.5% p.a. in last 5 years.

Compare this with the historic returns of savings account (3.5% p.a.).

#3. What about liquidity?

Money kept in savings account are super liquid.

The ease with which one can put-in and take-out money from savings account makes it unique.

What about the liquidity offered by “liquid funds” and “ultra short term funds”?

By using mobile apps like FundsIndia, the process of investing and redemptions becomes a piece of cake.

Investment Process: Like any other mutual funds.

Redemption process: The money gets credited to ones bank account within 30 minutes of sale.

Moreover, selected liquid/ultra-short term funds also provide the debit card facility.

Mutual fund investment platforms like FundsIndia, Scripbox offer debit card upon investing in selected liquid/ultra-short term funds.

These debit cards, linked to these funds can be used like any traditional debit cards.

- In ATM’s.

- For Purchases at POS (Point of sale).

#4. What about tax treatment?

Interest earned from bank deposits are called “interest income”. They get added to ones salary income.

But income (profit) from mutual funds are called “capital gains”. They do not get added to ones salary income. Their treatment is different.

Simply speaking, tax payment in case of mutual funds will be much lower.

This becomes particularly true for people who fall under 20% and 30% tax bracket.

#4.1 Interest Income

Interest income from savings account must be declared while filing income tax returns.

This must be done under the head “Income from other sources”.

But there is also an exemption of Rs.10K. Lets understand this with an example.

Suppose ones taxable income from salary is Rs.25 Lakhs.

In addition to this, the person also earned Rs.18,000 as interest from savings account.

In this case total taxable income for the person will be as follows:

- Salary income: Rs.12,00,000

- Interest from other source: Rs.18,000.

- Deduction u/s 80TTA: – Rs.10,000.

- Net taxable Income: 12,08,000.

[P.Note: Banks do not deduct TDS on interest earned on deposits from savings account.]

Net effective return, post inflation & tax, from savings account will be in huge negative.

Not worth.

#4.2 Capital Gain

In debt based plans (like liquid funds), Long Term Capital Gain Tax (LTCG) will be applicable if one stays invested for more than 3 years.

Tax treatment in this case will be as below:

- Tax @20% (with indexation benefit…read more about capital gain tax exemption).

- Tax @10% (without indexation benefit).

Net effective return, post inflation & tax, from debt funds will be close to 6.5% per annum.

Better to park money here.

Conclusion

If you are the one who consumes all money in savings account by end of the month, probably mutual fund alternative is not for you.

But there are people who manage to maintain a decent balance in ones savings account.

By decent balance I means excess cash.

This article aims to convey this information that, this excess cash can be parked in mutual funds.

For such excess cash, the best alternative to savings account will be liquid funds or ultra-short term funds.

These funds not only gives higher returns, but also ensures liquidity (see #3 above).

In fact, people who are big fans of fixed deposits can also opt for such liquid funds. Why?

Inflation adjusted & post tax returns of these funds are better than even fixed deposits.

Moreover, the money parked in liquid funds and ultra-short term funds (see #3 above) can be withdrawn using debit cards.

![Goal-Based Saving - Your Path to Financial Control [ A Method] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/04/Goal-Based-Saving-Your-Path-to-Financial-Control-A-Method-Thumbnail.png)

![Income Tax Slabs: Tax Liability Comparison Between 2020 and 2019 [Calculator]](https://ourwealthinsights.com/wp-content/uploads/2020/02/Income-tax-slabs-Image.png)

This is a great article. Helps a lot for the newbies !

For overall best interest rate, best coverage and best policy, one must take JEEVAN SHANTI pension policy of India.

http://licpolicychandigarh.com/blog/