A Zero depreciation car insurance cover is a type of policy that will cover the entire cost of replacing the parts of an accident vehicle. Generally, even in a comprehensive cover, the insurance company does not remit the full cost of replacement. But in a zero depreciation cover, the full amount is payable.

Why I’m writing a blog post about it? In India, the middle class was used to buying and maintaining Maruti’s, and Fiat’s for decades. Their cost of purchase and maintenance is affordable. But now, the take-home salary of people is rising. They can certainly afford premium cars. Hence, they are now buying BMWs and Mercedes.

But many among these lot get a surprise when they experience the cost of maintenance of these cars. If I’m not wrong, compared to non-premium cars, the maintenance cost of these cars is about five (5) times higher.

How to isolate oneself, as far as possible, from such escalated costs? Zero depreciation car insurance policy is the way out. How? This article will explain a few details.

Suggested Reading: Check this car affordability calculator

Introduction

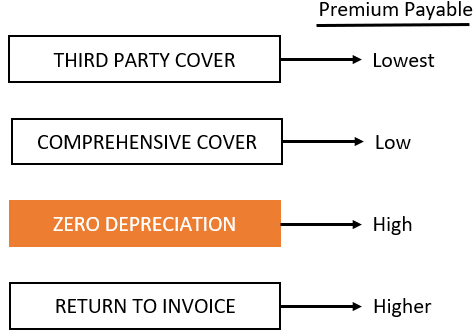

The premium payable on a third-party (TP) liability cover is the minimum. Comprehensive cover’s premium is higher than TP cover because it covers both TP and OD (Own Damage) risks. Zero depreciation car insurance is an add-on cover to a comprehensive policy. Hence, a zero depreciation car insurance cover is expensive compared to a basic comprehensive policy.

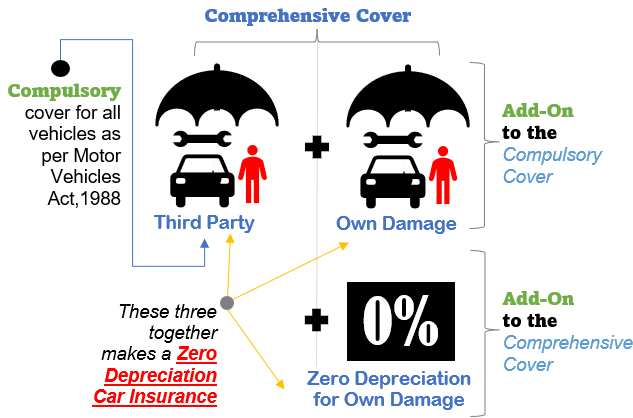

If one is driving a vehicle, having a motor insurance cover is compulsory. It has been made mandatory as per the Motors Vehicles Act, of 1988. It is the primary reason why people buy car insurance. Had it not been compulsory, car insurance sales would have been lower.

There is always a tendency among people to avoid car insurance. But the government has made it mandatory to have at least third-party cover. Why? It is our government’s way to ensure that the victims of road accidents are taken care of. The insurance company compensates the victim without adding a financial burden on the accused.

Zero Depreciation Car Insurance is Expensive?

Yes, zero depreciation insurance coverage is expensive. The premium payable for a zero-dep cover is higher than the third-party and comprehensive covers. The reason is that the risks covered under the Zero-Dep policy are much wider.

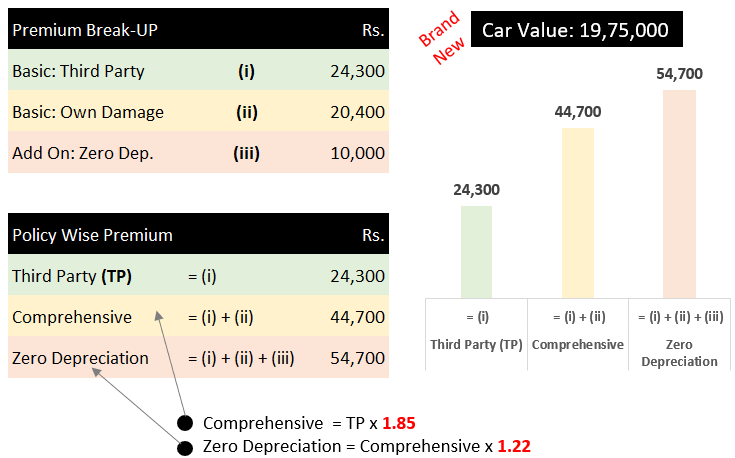

For example, here are the premium values for a car worth approximately Rs.20 Lakhs. I’ve considered three types of insurance covers, third party, own damage, and zero depreciation. A package zero depreciation cover has three components, third party, own damage, and an add-on in the form of zero-dep. Check the premium break-up shown below.

To drive the vehicle on the road, a third-party cover is mandatory. So, a person can buy only this cover and fulfill the legal requirement. Buying a comprehensive cover or zero-dep cover is not mandatory. But if the car owner desires, he/she can buy additional covers.

As compared to the third-party (TP) cover, the premium of:

- A comprehensive policy will be about 85% higher than a third-party cover. See the costs shown in the above infographics.

- A zero-dep policy will be about 20-25% higher than a comprehensive cover.

So, we can see that comprehensive and zero-dep covers are expensive. Hence, there must be justified reasons to opt for the extra cover. In this article, we’ll see who should buy Zero Depreciation car insurance.

The Extent of Cover

From the cost point of view, we can see that a Zero Depreciation car insurance policy is expensive. The cost difference is caused mainly by the extent of the risks covered by each type of policy.

There are good articles available on the internet that will elaborately explain the difference between these policies. So, I will not go into the details of explaining its scope. This article will mainly focus on the suitability of Zero Depreciation car insurance. It will highlight its utility for people-specific.

From the details that we’ve seen till now in this article, for sure, zero depreciation cover is not for everyone. For whom it is more suitable? As the cost of a zero dep cover is higher, it must justify the protection it provides.

Please note that a Zero Depreciation cover is applicable only for the “own damage” portion.

Let’s understand the extent of cover provided by the three policies pictorially.

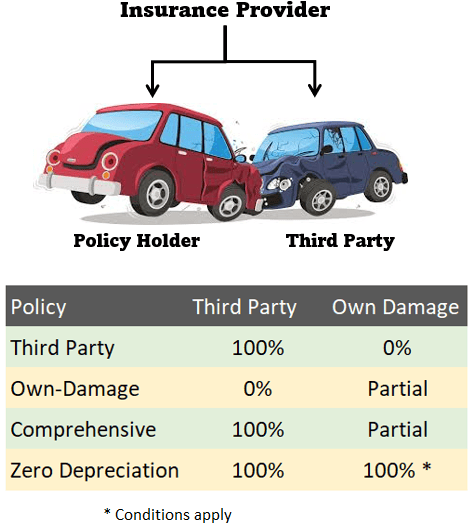

What does the above infographic explain?

- Third-party cover: If the policyholder (you) has this type of car insurance, then the damages done to only the third party’s vehicle (if applicable) will be covered. But why your policy should cover the damages done to the third party’s vehicle? Yes, this will happen when the policyholder (say you), was the cause of the accident, and the third party so claims it. The damages incurred on the policyholder’s vehicle are not covered in this policy. The policyholder must pay for the damages to his/her car from their own pocket.

- Comprehensive cover: If the policyholder (you) has this cover, then the damage inflicted on self’s and third party’s cars (if applicable) will be covered. But here the depreciation factor comes into play. Hence 100% cost of damage (full settlement coverage) is not payable by the insurance company. Suppose, your vehicle had an accident and its door got damaged. It needs replacement. The cost of a new door is Rs.10,000. But the insurance will cover only the depreciated value of the door, which is Rs.8,000. In this case, your insurance company will pay only Rs.8,000, and the balance (Rs.2,000) shall be paid from your pocket.

- Zero Depreciation cover: Theoretically, zero depreciation insurance covers everything. That is why it is also called bumper-to-bumper insurance. No cost of damage is to be borne by the policyholder upon an insurance claim. There is no depreciation applicable. Even damages to plastics, glass, etc are 100% covered. The zero depreciation insurance policy is actually a no-worry, cover-all policy. But if it is so, why everyone is not buying it?

This is what we are trying to answer in this article. Please continue reading.

Depreciation Rates

Just for your information, as the car ages, the depreciation rates applicable are shown below:

| Car’ Age | Depreciation (%) |

|---|---|

| 0 to 6 months | 5% |

| 6 months to 1 year | 15% |

| 1 year to 2 years | 20% |

| 2 years to 3 years | 30% |

| 3 years to 4 years | 40% |

| 4 years to 5 years | 50% |

Moreover, some vehicle parts depreciate faster than other parts:

| Car Parts | Depreciation (%) |

|---|---|

| Rubber, Plastic, and Nylon Parts; Batteries | 50% in the 1st year. |

| Fibre Parts | 30% in the 1st year. |

| Wooden Parts | 5% in the 1st year and 10% in the 2nd year |

Limitations of zero depreciation policy

One of the limitations of zero depreciation insurance that we have already discussed is the cost. The premium payable for zero depreciation cover is usually 20-25% higher than a normal comprehensive cover.

But this is not all. There are other limitations of zero depreciation cover.

- Age of Car: Most insurance companies offer zero depreciation coverage only for cars less than five years old. So if one has a car that’s more than five years old, one shall buy either a comprehensive or a third-party cover. Read FAQs for more clarity.

- Cost of Car: As the premium payable on zero depreciation plans is higher, sometimes it is not worth paying it. How? Suppose you are a very good car driver, live in a non-crowded city, and prefer to drive your Maruti Alto most of the time. Which car insurance policy is better suited here? Comprehensive. Why? Because the occurrence of accidents is less. Moreover, the cost of parts of Alto is anyways inexpensive. Hence if a person is driving a low-cost car, zero depreciation cover may not be necessary.

But if one is driving an expensive premium car, like a BMW, zero depreciation insurance will be a value for money. Why? Because the maintenance costs of these cars are very expensive.

- Number of Claims: As a zero depreciation plan covers 100% cost of damage, it may lead to reckless driving. It may also lead to frequent insurance claims by the policyholder for even minor repairs. Hence to prevent any such claims, insurance companies have kept a limit on the number of claims that can be filed in a year, in case of zero depreciation policies. Only two claims per year. In the case of normal comprehensive policies, one can file any number of claims in a year. Suggested Reading: When to avoid claiming car insurance coverage.

- Only For Private Cars: Zero depreciation insurance cover is provided only for private cars. Taxis and commercial vehicles like trucks & buses are not provided with zero depreciation covers.

If you fall in any of the above categories highlighted above four limitations, your zero-dep car insurance becomes avoidable.

Comparison: Comprehensive Vs Zero Dep Plan

| Parameters | Comprehensive | Zero Depreciation |

|---|---|---|

| Nature | A standalone policy | An add-on cover to the comprehensive policy |

| Risk Cover | It offers cover for third-party liability and Own Damage cover. The own damage cover can be of these types: accidents, fire, transit, etc. It also provides protection against theft or damages beyond repair. | It is a comprehensive policy plus covers depreciation. |

| Repair Costs | Only a portion of the entire claim is settled (like 70%) | The Entire claim is settled. |

| Premium | Higher than a third-party liability (TP), but lower than zero-dep | Higher than TP and comprehensive policies |

| Age of Vehicle | All vehicles irrespective of their age can be covered under this policy | Vehicles older than 5 years are not covered. |

| No. of Claims in a Year | Unlimited | Only Two |

Conclusion…

Let’s try to see a zero depreciation car insurance policy from a car buyer’s perspective only. Suppose you have bought a new car Hyundai Creta 2022 model. Along with this car, you have bought a standard comprehensive car insurance policy. If everything goes normally, probably you will file for an insurance claim once every 1.5 years. For this type of car, the average cost of damage due to minor road mishaps can range from Rs.30,000 to Rs.40,000.

The cost bifurcation between you and the insurance company will be generally 25%-75% respectively. Hence, your out-of-pocket expense will be Rs.7,500 to Rs.10,000. How do these values sound to you? If it is high, better go for a zero depreciation cover.

Anyways, the premium of such a plan will be high but will give you a piece of mind. How? In the back of your mind, you are sure that, any type of damage is fully covered by your insurance plan. Our mind handles known costs (Premium) better than unplanned costs (like forced expenses post accidents).

There is one more side to look at…

Till the repair costs are only due to minor accidents, zero depreciation insurance plans look compromisable. But in case of major accidents, the cost of car repair can go very high. In such cases, out-of-pocket expenses for the policyholder will be very high. In such examples, zero depreciation policies come as a huge savior.

For people who self-drive cars in metro/big cities like Delhi NCR, Mumbai, Kolkata, Chennai, Bangalore, etc, the risk of minor damage to cars is high. Zero Depreciation car insurance, for expensive cars, might prove more economical for them.

FAQs

Zero depreciation insurance is an add-on cover to a comprehensive car insurance policy. Because of this add-on, the claims are settled without deducting any depreciation. For example, suppose your car is 3.5 years old. The car door gets damaged on road. The total cost of replacement is Rs.7,000. In a comprehensive cover, the insurance company will pay only Rs.4,200 after applying 40% depreciation charges. But in the case of zero dep cover, the full Rs.7,000 will be paid by the insurance company.

Zero depreciation policy and Nil depreciation policy are the same.

IDV is Insurer Declared Value. The IDV reduces every year. In case one needs to bridge the difference between the IDV and car purchased value, a separate add-on cover shall be purchased called “Return To Invoice (RTI).”

The cover provided by zero depreciation car insurance is the same as comprehensive insurance. But where zero dep cover supersedes a comprehensive policy is in the depreciation deduction. In a zero dep cover, the claims are settled without deducting the depreciation. Among standard car parts, all metal parts, paints, rubber parts, glass, fiber parts, etc are covered under zero dep car policy.

Engine, Tyres, Bearings, Clutch Plates, and other common wear and tear parts are not covered under zero dep car insurance cover.

Zero dep insurance is especially useful for people driving luxury cars. As the spare parts of such cars are expensive, carrying a zero dep cover is useful. People whose daily driving is very high shall also consider buying zero dep insurance.

Generally, Zero dep cover works only for cars below 5 years old. But some insurance companies do provide zero dep cover for cars older than 5 years. Interested people can enquire from companies like Royal Sundaram, GIC, Edelweiss GIC, and IFFCO Tokio. For cars older than 10-Years, the Zero dep policy is not available in India.

Yes, they are covered. That is why Zero dep cover is also referred to as a bumper-to-bumper cover.

The Tyres are covered if it gets damaged in an accident. But if the Tyre gets damaged due to standard wear and tear, it will not be covered under the zero dep policy. One can buy a Tyre protection cover add-on to include Tyres damage due to normal wear and tear.

Yes.

Only twice in a financial year.

This blog delves into the considerations surrounding zero depreciation car insurance. In the comments, readers exchange perspectives on whether this type of coverage is suitable for them, creating a valuable discourse for individuals navigating the complexities of car insurance policies.

Article on ‘zero depreciation car insurance’ was informative. Thanks.

Thanks