Agrochemical companies in general, including UPL Limited, have recently encountered several challenges. Their biggest problem is global channel destocking. Channel destocking refers to the reduction of inventory levels across distribution channels. Agrochemical companies like UPL have witnessed this trend, impacting their revenue and sales.

Almost all companies operating in the agrochemical space are seeing tough times. Since the COVID-19 pandemic, these stocks do not seem to revive as their peer chemical companies. In the period between 2009 and 2014, companies like UPL Limited saw a similar stagnation. But between 2014 and 2020 (till covid collapse), their performance was stellar.

During this period, UPL Limited was even included in the Nifty 50 index. It is one of the better-managed Indian MNCs around. I like the way this company presents its annual reports and attends the analyst’s meetings. Their approach looks transparent.

It looks like a quality company that is currently running out of favors. Buying stocks of such companies during their tough times and then holding on to them for a long (like 10 years) is my way of investing.

However, I would like to accept that in the recent past, I have found my instincts not accurate with two companies (see my take on Future Retail and Paytm). But I’ve been building my stocks portfolio for more than a decade now. Such experiences are inevitable in this form of investing. But I thought to mention this to my readers before proceeding.

Before telling you about my take on UPL Limited, allow me to first tell you what kind of problems it is facing currently.

Destocking In Agrochemical Industry

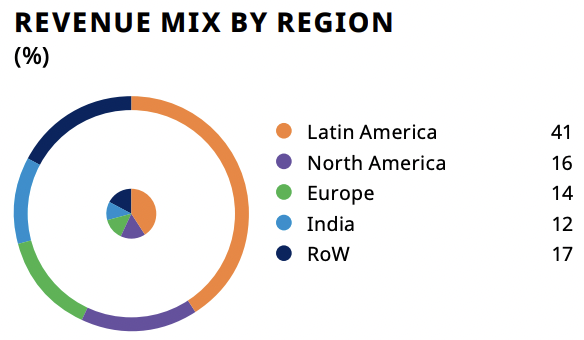

In 2023 and 2024, three situations emerged that caused Agrochemical companies (like UPL Limited) to face performance-related challenges. An influx of supplies from China flooded the global markets, leading to pricing pressure. UPL’s majority revenue is from exports (88%), only 12% domestically.

China’s oversupply of cheaper products majorly impacted the exports of companies like UPL Limited. Farmers across the globe are also facing the issue of water availability. The water scarcity has made the farmers cautious leading to restricted demand.

What is The Impact of Destocking?

Let’s understand how destocking affects the Agrochemical sector in general. Imagine a local agrochemical distributor who supplies pesticides and fertilizers to farmers. During normal times, the distributor maintains a healthy inventory of agrochemical products. They keep stockpiles of pesticides, fertilizers, etc to meet farmers’ demands.

The combined effect of China, lower exports, and water scarcity has caused a global economic downturn in the agrochemical industry. This has caused the distributor’s sales to drop significantly. With fewer sales, the distributor faces a revenue decline. Their stored inventory starts accumulating, leading to excess stock. The distributor needs to pay suppliers (like UPL Limited) for the agrochemicals they purchased earlier. However, with reduced sales, they struggle to generate sufficient cash flow. Financial strain sets in as there is unsold inventory and mounting debts.

The problems faced by the distributor’s side also reflect on the manufacturing companies like UPL Limited. The company has to offer discounts or promotions to clear excess stock. Selling products at lower prices erodes their revenue and profit margins.

Moreover, the excess inventory occupies valuable warehouse space. Agrochemicals have a shelf life, and prolonged storage can lead to product deterioration. There are additional costs involved for storage and maintenance.

Now you can understand, how destocking disrupts the delicate balance between supply and demand. It seriously affects the agrochemical companies’ financial health, profitability, and operational efficiency. It’s a tough challenge to face to remain in the market. During such times, the performance of the companies will continue to be weak.

Deeper Insights

Here the major concern is destocking and inventory management. Hence, during the recent analyst meet of UPL Limited, most of the queries were related to this subject only.

Following are the queries that the company answered in its Q3 FY2023-24 Analyst meet:

Queries Answered in Analyst Meet

How is the operating cash flow looking this quarter for UPL Limited? Is there any improvement in the company’s working capital?

The company stated that the operating cash flow this quarter is similar to previous quarters. UPL Limited expects it to remain stable. The company anticipates some improvement in working capital. This improvement means they might have more money available for their day-to-day operations compared to before.

Will there be any increase in operating cash flow, or will it remain steady?

The company indicated that there could be only a marginal increase in operating cash flow. UPL Limited mentioned that they are aiming for a debt reduction. This also might contribute to the increase in cash flow. However, they expect the increase to be minor. The company indicated that at present its focus is more on stability rather than a substantial rise.

What is the current market share of the company in Argentina? How is the market environment affecting it?

The company didn’t provide specific market share numbers for Argentina. But they mentioned that Argentina is one of their significant markets, following Brazil and Mexico. They highlighted that Argentina’s performance has been good due to improved productivity and investments in crop protection products by farmers.

Is the company’s manufacturing capacity back to normal? When do you expect it to reach full capacity?

The company stated that its manufacturing capacity is currently running at a lower level compared to the previous year. They expect a slight increase in production volumes for the next quarter. But they anticipate it to remain at a lower level than the previous year. They are in the process of planning their manufacturing capacity for the upcoming year. They will consider the market conditions and demand expectations in their production plan.

Is the cost of inventory decreasing? What is the percentage decrease in inventory value?

Yes, the company mentioned that the cost of inventory has decreased. They provided a figure stating that the inventory value is down by over $500 million compared to the previous year. It represents a significant decrease in inventory. Additionally, they stated that they have about $5 billion lower inventory compared to the previous year. This feat was established primarily by cost reductions rather than volume changes.

Are distributors also experiencing losses due to the current situation, or is the burden falling mainly on the company?

The company explained that the situation varies among distributors. Some distributors, particularly in Brazil and North America, are experiencing margin compression. It means their profits are being squeezed. This indicates that they are facing reduced profitability too.

However, the burden of the situation is not solely on the distributors. The company also mentioned that they are sharing some of the challenges faced in the supply chain and experiencing margin pressure.

So, both the distributors and the company are affected to some extent.

How are product prices behaving, especially for innovative products compared to generic ones?

The company mentioned that there is a noticeable difference in how prices are behaving for different types of products. Prices for innovative or differentiated products have remained relatively stable. The margins for such products are staying in line with historical levels. However, prices for generic or commodity products have seen a significant decrease over the past year. This means that the gap between prices for innovative and generic products has widened.

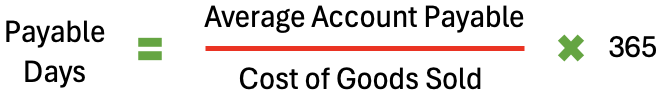

Why is the company paying suppliers earlier than before in these tough times?

The company explained that they were not essentially paying the suppliers earlier. It is the result of decreased activity. The company explained that with a drop in volume, which was around 5 to 7%, and prices coming down, there’s been a decrease in the level of activity. Consequently, they are seeing lower levels of payable days compared to what they had previously experienced.

Just for our general knowledge, how lower activity can cause lower payable days?

Payable days are the time it takes for a company to pay its suppliers for the goods or services it has received. Now, when a company experiences decreased activity, fewer business transactions are happening. This could be due to various reasons like a drop in sales, reduced production, or lower demand for products.

A company that’s not selling as much as before, will not buy as many goods from suppliers. Why? Because it doesn’t need as much inventory as demand is low. Since purchasing is not as frequent the average account payable (numerator) will fall leading to lower payable days numbers.

Though the company is maintaining the same credit period for its suppliers, in the payable days’ formula, it will show as a lower number (paying earlier than before).

To a new analyst, it might confuse why the company is paying earlier its suppliers when the company itself is facing tough times.

Is the company deferring any capital expenditure or postponing projects due to the current situation?

Yes, the company is indeed deferring some capital expenditures (CAPEX Plans). It is postponing projects due to the current situation. They have slowed down their capital expenditure plans and are focusing on projects that are more immediate or essential. This decision allows them to conserve financial resources and adapt to the current business environment more effectively.

Conclusion

UPL Limited faces both opportunities and challenges in the next decade. It can expand in new markets like Asia, Africa, and Latin America. Digital technology can help improve efficiency in farming. The company needs to focus on sustainability to meet environmental demands.

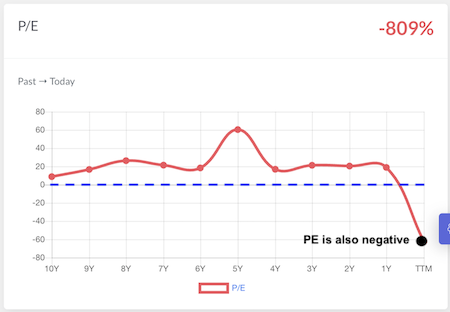

However, there are challenges like financial predictions indicating a decline in earnings. Changes in regulations and commodity prices can affect its business. Also, global tensions and currency fluctuations pose risks.

UPL must innovate and adapt its products to stay competitive. Investing in research and development is crucial for long-term growth.

UPL’s future depends on its ability to navigate these challenges. It must make strategic decisions, and maintain financial stability while embracing sustainability and innovation.

As an investor, I’ll closely monitor its performance in the FY 2024-25. I personally think that the UPL Limited share price is close to its bottom. Another 10% correction might bring it withing my margin of safety.

Have a happy investing.

Suggested Reading: