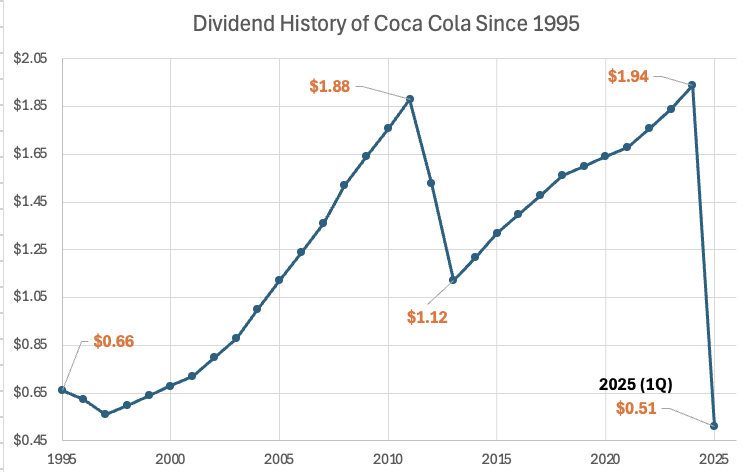

When it comes to dividend-paying stocks, few companies can match the reliability and consistency of The Coca-Cola Company. For income-focused investors, Coca-Cola isn’t just a household name synonymous with refreshing beverages, it’s a financial powerhouse. It has a dividend track record that’s hard to beat. With a history of steady payouts stretching back decades, Coca-Cola has proven itself a top contender for anyone looking to build wealth through dividends.

Let’s dive into why this iconic company deserves its crown as the best dividend-paying stock, using its impressive dividend history since 1995 as evidence.

| SL | FY | Dividend |

| 1 | 1995 | $0.66 |

| 2 | 1996 | $0.63 |

| 3 | 1997 | $0.56 |

| 4 | 1998 | $0.60 |

| 5 | 1999 | $0.64 |

| 6 | 2000 | $0.68 |

| 7 | 2001 | $0.72 |

| 8 | 2002 | $0.80 |

| 9 | 2003 | $0.88 |

| 10 | 2004 | $1.00 |

| 11 | 2005 | $1.12 |

| 12 | 2006 | $1.24 |

| 13 | 2007 | $1.36 |

| 14 | 2008 | $1.52 |

| 15 | 2009 | $1.64 |

| SL | FY | Dividend |

| 16 | 2010 | $1.76 |

| 17 | 2011 | $1.88 |

| 18 | 2012 | $1.53 |

| 19 | 2013 | $1.12 |

| 20 | 2014 | $1.22 |

| 21 | 2015 | $1.32 |

| 22 | 2016 | $1.40 |

| 23 | 2017 | $1.48 |

| 24 | 2018 | $1.56 |

| 25 | 2019 | $1.60 |

| 26 | 2020 | $1.64 |

| 27 | 2021 | $1.68 |

| 28 | 2022 | $1.76 |

| 29 | 2023 | $1.84 |

| 30 | 2024 | $1.94 |

| 31 | 2025 | $0.51 |

A Legacy of Consistent Dividend Growth

Coca-Cola’s dividend history is a masterclass in reliability.

Since 1995, the company has not only maintained its dividend but consistently increased it. In the last 31 Years, the company has paid dividends in all those years.

No doubt, it has earned the status as a Dividend Aristocrat. It is a title reserved for companies that have raised dividends for at least 25 consecutive years.

Looking at the data, Coca-Cola’s quarterly cash dividend has grown from $0.66 in FY-1995 to $1.94 by FY-2024. Without considering stock split, the dividends have grown at a rate of 3.54% in 30 years.

Since 1995, the company has split its shares twice in 1996 and 2021 in 2:1 proportion.

After considering all splits, In 1995, the stock was was trading at a price of $13.69 per share. Assuming a person who bought shares in 1995, went on to hold Coca Cola shares till FY-2024, his dividend yield alone as of today will be close to 14%.

Take a closer look at the progression: in 1995, shareholders received $0.66. Which climbed to $1.12 by 2005, $1.32 by 2015, and $1.94 by 2024. This isn’t erratic growth, it’s deliberate and sustainable. This dividend payout is mirroring the company’s ability to balance profitability with shareholder rewards.

Even during economic downturns, like the 2020 COVID crisis when the dividend rose from $1.60 (2019) to $1.64 (2020), Coca-Cola stayed the course. In 2008 financial crisis, the dividend payout rose from $1.36 (2007) to $1.52 (2008) and to $1.64 (2009).

Yield That Keeps Investors Coming Back

While dividend growth is key, yield matters more to the shareholders.

Coca-Cola’s last years payout was $1.94 (as of Dec-2024). At the current price of $71.35, it amounts to a dividend yield of about 2.71%.

For a company with Coca-Cola’s stability, this is a sweet spot: high enough to attract income seekers, yet low enough to signal the payout is sustainable rather than overstretched.

Compare that to the S&P 500 average yield, which typically floats around 1.5% to 2%, and Coca-Cola’s edge becomes clear. It’s not just about the yield today, it’s the promise of tomorrow. That $0.66 payout in 1995, has the investors reinvested it to buy more shares, would have further compounded significantly by now.

Stability You Can Sip On

What sets Coca-Cola apart isn’t just the numbers, it’s the business behind them.

The company’s global brand dominance ensures a steady cash flow, fueling those reliable dividends. With a portfolio spanning over 200 countries and a product lineup that’s adapted to changing tastes (think Coke Zero and plant-based drinks), Coca-Cola isn’t resting on its laurels. This adaptability has kept its revenue robust, supporting dividend hikes even as consumer preferences evolve.

The data backs this up: between 2016 and 2025, the dividend rose from $1.40 to $1.94, a 38% increase over nine years.

That’s not a fluke; it’s a reflection of Coca-Cola’s ability to generate consistent earnings.

Unlike flash-in-the-pan growth stocks, Coca-Cola’s dividends are backed by a fortress-like balance sheet and a business model that thrives in both boom and bust cycles.

Dividend Increases Outpace Inflation

One of the biggest threats to dividend income is inflation eroding purchasing power.

Coca-Cola tackles this head-on. From 1995 to 2025, U.S. inflation averaged about 2-3% annually, yet Coca-Cola’s dividend growth often exceeded that.

For instance, the jump from $1.76 in 2010 to $1.94 in 2024, shows a commitment to keeping shareholders ahead of the curve.

Over 30 years, the dividend has more than doubled, turning a passive investment into an inflation-beating machine.

Why Coca-Cola Reigns Supreme

So, why is Coca-Cola the best dividend-paying stock? It’s the whole package: relentless consistency, a yield that rewards without risking sustainability, and a growth rate that protects against inflation.

This performance is underpinned by a business that’s as dependable as its iconic silver cans.

The data tells the story: from $0.66 in 1995 to $1.94 in 2024, Coca-Cola has delivered for shareholders quarter after quarter, year after year.

For investors seeking a stock that pays, and keeps paying, Coca-Cola isn’t just a contender; it’s the gold standard.

Whether you’re building a retirement nest egg or simply want a reliable income stream, this is one investment that’s as refreshing as the drink itself.

Have a happy investing.