Buying stocks of a company makes one a proportional owner of it. Suppose there is a company whose shares you own. This company made about Rs.2,140 crore net profit in a financial year (FY). Let’s assume that this profit was also collected as cash in the same FY. If you are a majority shareholder of this company, what you will do with this cash?

This decision becomes more critical for profitable companies. Why? Because they are accumulating this cash year after year.

Generally, the company will like to use this cash. Meaning, they will not keep it idle in the bank account or fixed deposits. Why? They are using the same personal finance theory of making the money work. Cash can be used in four ways.

Use of Cash (4-Ways):

- Reinvestment: Reinvesting the cash back into the company.

- Acquisition: Using the cash for the purchase of a new company.

- Loan Prepayment: Using the cash to reduce the debt load

- Dividend: Cash transfer to the shareholders’ bank accounts as a dividend or buyback of the shares.

If one is a majority shareholder, he or she will be most likely on the company’s board of directors (BOD). The BOD takes a decision about the use of available cash every quarter. Decision one to three looks like a valid utility of cash. But the decision to distribute dividends will deplete the cash balance without the company’s operations or finances benefiting from it. Why the BOD will opt to lose its cash balance?

Future growth and upkeep of the financial health of a company are important. But rewarding shareholders with “immediate cash” will convince them to stay invested. Even if the dividend yield is not very high, the shareholders will take it with open arms.

Shareholders’ main focus is on capital appreciation in the long term. But the same shareholders’ can sell their shares tomorrow without any explanation. To manage such a mindset of the investors, a wise board would opt to pay dividends. Receiving a dividend, even if it’s small, gives immediate gratification. Shareholders of dividend-paying companies are less likely to sell their holdings.

Dividend vs Capital Appreciation

For shareholders’ the total return from stock holdings has two components. The first is capital appreciation and the second is dividends.

Looking at the income tax treatment of these two components, it looks like the government prefers capital appreciation over dividends. Let’s see it from the perspective of a long-term investor.

- Capital Appreciation: For capital gains below one lakh, no tax is payable. For gains above one lakh, a 10% tax is levied. Moreover, capital gains are not taxed unless the holding is sold.

- Dividend: The dividend is treated as a salary. Hence, income tax is charged as one’s marginal tax rate. If one falls into the tax slab of 20% or 30%, the tax rate applicable on the received dividends will also be 20% or 30%. Furthermore, if the dividend payable is more than Rs.5,000, the dividend will be paid after the deduction of TDS (10%).

Seeing these two tax treatments, it is clear that for people falling under a higher tax bracket, divided income is less tax-friendly.

When idea is to create wealth over the long term, even a 1% extra return makes a noticeable difference. With the present income tax setup, the capital appreciation model is more tax-friendly.

Unconsciously, the tax treatment of the two components of the total return has made capital appreciation more likable. The contribution to this likeness is from both sides. Companies share only minimal dividends with their shareholders. The shareholders prefers growth more than cash (dividends).

Example

| Growth of BSE-500 Index vs. It’s Dividend Yield Growth in 19-Years | |||

| Year | BSE-500 | P/E | D/Y % |

| 2022 | 23,638.84 | 22.73 | 1.31 |

| 2021 | 23,695.01 | 29.64 | 1.03 |

| 2020 | 19,601.95 | 31.48 | 1.11 |

| 2019 | 11,098.23 | 25.94 | 1.24 |

| 2018 | 15,304.57 | 24.7 | 1.19 |

| 2017 | 14,125.53 | 26.6 | 1.18 |

| 2016 | 12,631.90 | 24.28 | 1.27 |

| 2015 | 10,185.12 | 20.96 | 1.34 |

| 2014 | 11,048.75 | 17.97 | 1.24 |

| 2013 | 8,295.26 | 15.69 | 1.52 |

| 2012 | 7,084.96 | 18.4 | 1.55 |

| 2011 | 6,759.63 | 17.72 | 1.32 |

| 2010 | 7,437.26 | 20.82 | 0.94 |

| 2009 | 6,919.55 | 20.12 | 1.14 |

| 2008 | 3,523.53 | 15.42 | 1.45 |

| 2007 | 6,157.27 | 22.04 | 0.93 |

| 2006 | 4,955.39 | 19.28 | 1.29 |

| 2005 | 4,516.73 | 12.95 | 1.2 |

| 2004 | 2,734.66 | 2.98 | 0.36 |

| Growth | 12.4% | 11.6% | 7.2% |

In the period between 2004 and 2022 (about 19-Years), the BSE-500 index grew at a rate of 12.4% per annum. In the same period, P/E appreciation was at a similar rate of 11.6% per annum. But between 2004 and 2022, dividend growth was at a modest 7.2%.

When it is better to pay dividends?

For some companies, it is better to pay dividends. There can be two reasons for it:

- Shareholders’ Perspective: The dividends credited into the investor’s account can be further re-invested. The decision of reinvestment lies in the hands of the shareholders. But I agree, the problem here is the taxation of dividends in the hands of the shareholders. It is a bottleneck, first, you take the risk, and then you are taxed. Not fair. Yes, it looks unfair when dividends are treated at par with short-term capital gains.

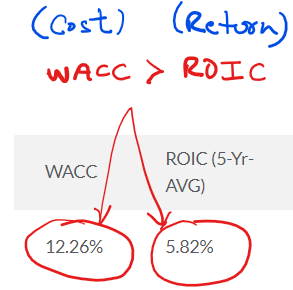

- Company’s Perspective: It is often hard for companies to judge their capital-allocation capabilities. Majority of companies do it poorly. It is for these companies who should pay dividends instead of retaining the profits. How companies can introspect this fact? There are two levels to it. First, they can check their competitive advantage. If the result is a narrow moat, they must distribute dividends handsomely. The second way is comparing the cost of capital (WACC) versus the return on invested capital (ROIC). If the WACC is greater than ROIC, it’s bad. It’s a hint of poor utilization of capital by the company.

The Dividend is Not Popular? Who is To Blame?

As shown in the above example, the company’s cost of capital was higher than the returns they are generating. These mostly happen to companies operating on a narrow moat. We as an investor should not have invested in such companies in the first place. But there is also an equal responsibility on the part of the Board of Directors (BOD) to take care of the shareholders’ interest.

A company capable of delivering only low returns shall be honest enough to accept this fact and stay light on capital. But they still retain it. Why? Because they can hide behind the prevailing trend related to dividend payments. What is the trend?

- First, the dividends are taxed at a higher rate. Hence, even informed investors are resistant to dividends. This fact is known to the company’s board. Good companies pay decent dividends anyways. But others retain their profits and generate only low returns.

- Second, the shareholders demand growth. To grow, companies need capital. They will use retained earnings to expand and modernize their facility (CAPEX). Even if the resultant growth is not at par with the capital invested, it’s still done. Companies hide behind the investor’s lust for growth and retain capital more than what’s actually necessary. Excess capital eventually gets wasted. This is not good.

What is the learning? The blame is on us investors. We should balance our demand for fast growth. If we’ll start buying more stocks of dividend-paying companies, it will start a new trend.

The Divindend Mindset

In my last 14-Years of investment learning, there have been two major crashes (2009 & 2020) and multiple corrections. When I was just out of my college, the world saw the tech bubble and then a crash (2000-2001).

Not so much during the correction, but the crash exposes weak companies. These are those companies that have a track record of poor capital utilization. First, they do not distribute dividends and then they utilize the retained capital poorly.

During recessions, such weak companies see maximum erosion of income, profit, and market capitalization. In our stock portfolio, such companies do creep in. When it happens, investors realize that had these companies shared reasonable dividends, it would have benefitted us both.

In the early years, there was double taxation on dividends. First, the company paid dividend distribution tax, and then the investors paid income tax. But the double taxation rule was removed in the year 2020’s annual budget (read). But enough damage is already done. Check the feeble dividend yield of the BSE-500 index in the last 19 years.

It will take time for the dividend mindset to return, both from the sides of the companies and the investors. If the demand for dividend-paying stocks will increase, the mindset will gradually evolve. Excess focus on growth is detrimental. Our government’s initiative can serve as a tipping point.

Dividends shall not be taxed, at least for those retail investors who have held on to their stocks for 3 or more years.

Currently, the dividend yields are too low. But a preference for dividend income from stocks will trigger a new era of dividend-focused investing. In this era, the investors will be rewarded for picking such stocks and continuing to hold them for the long term. This mindset will surely improve the dividend yields for the investors.

Call For Dividends

There are two components of the total return. We cannot let one component, the dividend, die its own death. Focusing too much on price appreciation is only pushing the companies, there are exceptions, to retained more capital even if they can use it only pooorly.

In stock price valuation theory, the most popular concept is the net present value of future cash flows. What is the cash flow? For companies, it is FCF (free cash flow) and for investors it is dividends.

For an investor, a company that is not paying dividends, its intrinsic value should be zero. Why? Because an investor must value companies in terms of real cash (dividends). This way we are telling the companies to be careful while allocating capital. If they will not have excess free cash flow, they will also use it prudently.

These days the “real cash” in the hands of the investors is negligible. Hence, we use FCF as a proxy for dividends in estimating the company’s intrinsic value. Warren Buffett has made use of FCF so popular in intrinsic value estimation. Why? Because his company Berkshire Hathaway pays zero dividends. But Buffett is unique, the majority of companies cannot allocate capital like Buffett.

What is our call?

- Government: Please make dividends tax-free for retail investors if stocks are held for the long term.

- Business: We do not want a share of PAT. But please make sure that the majority of your free cash flow is distributed to the shareholders as dividends. If for some reason they are not able to pay cash, at least buy back the shares from the market. Read – Shares issued at a premium.

Final Words

A dividend is important. Why? Because even if the companies want to grow fast, they can never outgrow the GDP growth of their economies in the long term. In the shorter periods that may report premium growth numbers.

A company that can carefully balance its free cash flow allocation, will see its share price soar. How? Better capital allocation will improve their return numbers (ROE, ROCE, ROIC, etc). Moreover, as the shareholders are satisfied with dividend distributions, they will hold the stock for very long periods. The combination of these two actions can make a stock perform like a rocket in the market.

Instead of focusing on growth, the company’s focus should be on widening its economic moat. They shall use the retained capital for this purpose. Improving moat will lead to faster growth of revenue and profit as a by-product. When the profit/EPS is growing, the share price will see new peaks year after year.

Let’s popularize the idea of dividend focused investing.

Have a happy investing.