It sometimes puzzles me that why do credit cards offer rewards. Customers like you and me can pick and choose credit cards based on suitable rewards they offer. Once we have a credit card that offers rewards, we can go around swapping them in our purchases.

Suggested Reading: Utility of credit utilization ratio explained with examples.

Every time we swap a credit card we know that some reward points gets added to our account.

Over a period of time reward points gets accumulated.

These reward points can be exchanged for benefits when required.

For sure I feel happy when my credit card provides me benefits.

But I always ponder why do credit cards offer reward points.

Are these reward points affordable for them?

A large number of people in this world use:

- Master Cards,

- Visa Cards,

- Amex Cards.

These cards are issued by various banks.

One of the bank that is more famous for its credit cards is Citi Bank.

There are various cards offered by Citi Bank with diverse reward point program.

Reward Points…

Few of their most used credit cards offering reward points are:

- Travel Card,

- Shopping Card,

- Fuel Card &

- Lifestyle Card etc.

Many people I know use travel card. Travel cards have unique way of offering reward benefits.

When customers make payments using travel credit cards, air miles gets accumulated in card.

These air miles can later be used to buy air tickets.

Instead of paying money to buy air tickets, one can pay using air-miles.

If sufficient air miles are accumulated, people can buy air tickets at free of cost.

This is fantastic.

But coming back to our old question, why do credit card offer rewards points like air miles?

Are these reward points affordable for them?

#1. They Offer Rewards to Attract Customers

This one is quite obvious. This strategy really works.

Companies target customers to buy their credit cards by offering reward points.

For example, I am in a profession where I need to travel at least twice in a month.

I am doing this since last 8/9 years.

Psychologically I have become very sensitive to my travel spendings.

The credit card that I use allows me to save on my travel expense.

The savings are in tune of 75-80%.

The money I save on my personal travels gives me immense satisfaction.

For frequent travellers, I feel that it has been a tailor made product.

#2. They Offer Rewards to trigger overspending

Yes, it true. Reward points can trigger customers to overspend and then default

For a travel card user, important is that they save money on travel.

But for credit card companies, important is how users build reward points.

Reward cards allow people to earn points every time they swap the credit card.

In initial stages, when accumulated reward points are less, less swapping happens.

But when reward points starts to accumulate, people start becoming greedy.

Just for the sake of earning reward points, people start spending on useless things.

Why credit card companies issue such cards in first place?

Is there any noble cause? Absolutely not. They do it for their business sake.

Credit card motivates people to buy things they can’t afford.

To top that, if credit card also offers reward points, it is like an icing on the cake.

Psychologically user feel rewarded for their spending habits.

This behaviour initiates overspending.

Whenever there is overspending, in majority cases, people will default in payment of bills.

Full amount not paid within credit free period attracts huge interest charges.

This is what credit card company really wants.

#2.1 Banks earn high interest

Interest rates charged on defaulted value are in range to @3-3.5% per month.

This is the business model of credit card companies.

- First issue a card.

- Then offer rewards for spending’s.

- They they advertise. Distribute leaflets, telling what can be bought using credit cards.

- Then they offer EMI facility to people.

This EMI facility is another polite way of telling credit card users to PLEASE DO NOT PAY CREDIT CARD BILLS within credit free period.

#3. Rewards Points triggers frequent usage of cards

There is one type of credit card users who overspends and then pays high interest.

But there are some users who never default to pay bills on time.

Does these customers make no money for card companies?

If so then why do credit cards offer rewards even to such customers?

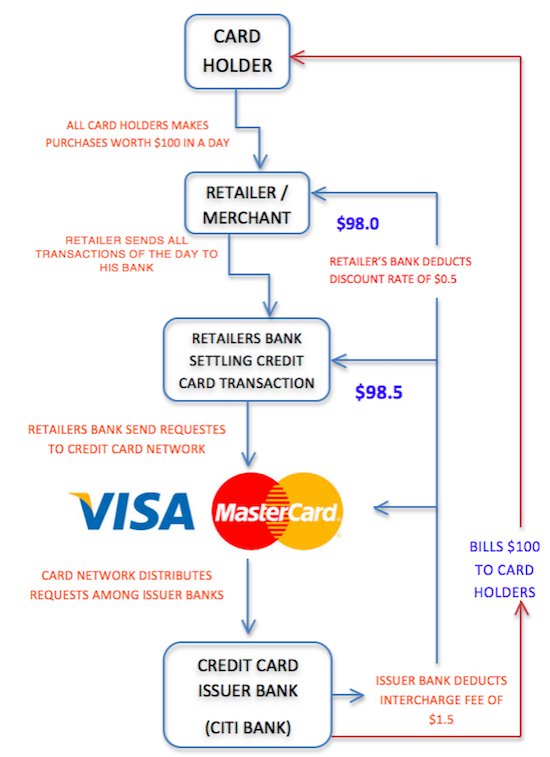

Credit card companies make money every time a card is swiped.

Credit Card issuing bank charge 1.5% on every transaction.

This charge is distributed between issuing bank and card network.

Merchant/Retailer side bank also charge 0.5% on every transaction.

All these charges (1.5% + 0.5%) is born by the retailer.

Credit card offer rewards to customers, which motivates customers to make all payments using credit cards.

This way credit card companies earn INTERCHARGE FEES on all transactions.