You’ve probably noticed the downward spiral in Gensol Engineering. Once a darling of the solar EPC world, this stock has gone from a twelvefold wealth creator to a jaw-dropping -70% crash from its peak in just a year. What happened here? I dug into a few recent news articles to get the full scoop, and honestly, it’s a story packed with lessons we can all learn from. Whether one is a seasoned investor or a beginner into the market, there is a lesson for all of us. So, allow me to declutter the Gensol story for you.

The Rise and Fall of Gensol

A couple of years ago, Gensol Engineering was the stock to watch.

From March 2022 to February 2024, its share price soared, turning a modest investment into a small fortune. Revenue? Skyrocketing from Rs.75 crore in FY20 to Rs.904 crore in FY24. The company was riding high on its solar EPC business and dabbling in trendy ventures like EV leasing and manufacturing.

Investors were buzzing, and it felt like Gensol could do no wrong.

Now we are in March 2025, and it’s a different story. The stock’s down 70% over the past year, hitting a 52-week low of Rs.276 on the NSE today (12-Mar-2025).

In just 30-days, it wiped out 54% of investor wealth. Credit ratings are tanking, and the company’s drowning in debt. What went wrong?

Let’s understand the mess the company has put itself into step by step.

Trigger #1: Credit Rating Downgrades

Consider this, you’re a lender, and the company you’ve loaned money to starts missing payments.

That’s exactly what happened with Gensol. Both ICRA and CARE Ratings downgraded the company’s credit ratings to “D” (default) in early March 2025. Why? Delays in servicing term loan obligations.

- CARE slashed ratings on Rs 639.7 crore of long-term bank facilities from BB+ (Stable) to D,

- ICRA pointed to liquidity mismatches and even alleged falsified documents on debt servicing, claims Gensol denies and says it’s investigating.

For investors, this was a gut punch.

A downgrade to “D” isn’t just a slap on the wrist; it’s a neon sign screaming, saying, this company’s in trouble.

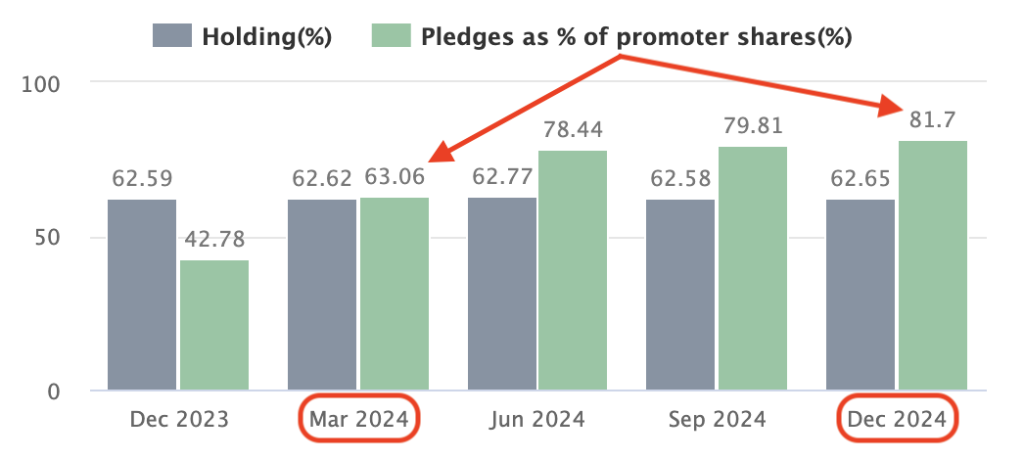

And it wasn’t just the downgrades, ICRA noted that promoter share pledges jumped from 63.06% in March 2024, to 79.8% in September 2024 to 85.5% in February 2025.

That’s a lot of stock tied up as collateral. It is a strong signal that there is a serious cash flow strain.

No wonder the stock hit the 10% lower circuit at Rs 335.35 on the BSE, dragging its market cap down to Rs 1,274.41 crore.

Trigger #2: Promoter Moves That Raised Eyebrows

Now, let’s talk about the promoters, because their actions have been a hot topic.

On one hand, they infused Rs.29 crore into the company by converting warrants into 4,43,934 equity shares at Rs 871 each. Sounds like a vote of confidence, right? But hold on, they also sold Rs.9 lakh shares (2.37% of equity) earlier in March, netting some liquidity they say will be reinvested into the business.

The catch? The market didn’t buy it. The stock kept sliding, hitting a 5% lower circuit at Rs 290.55 on the NSE the next day.

Some of those shares sales were forced margin calls by lenders, not strategic moves as Gensol framed them.

Margin calls happen when you’ve borrowed against your stock, and the value drops so much that lenders demand cash, or they sell your shares for you.

That’s not a good look. Even with a 59.7% stake still in their hands, these mixed signals left investors wondering, do the promoters believe in Gensol’s future, or are they just trying to stop the bleeding?

Trigger #3: A Debt Bomb Waiting to Explode

Here’s where things get really messy.

Gensol’s growth wasn’t cheap, it came with a mountain of debt.

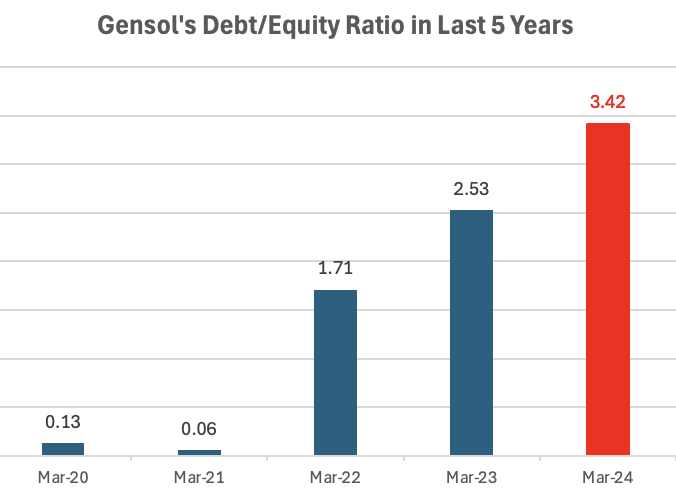

In FY21, its debt-to-equity ratio was a comfy 0.06. By FY24, it ballooned to 3.42. In FY 2020, long-term debt of the company was only Rs.5.52 crore which ballooned to Rs.857 crore in FY 2024. In the same period, the total debt zoomed from Rs.7.71 crores to Rs.1,396 crores.

That’s a lot for a company with inconsistent cash flows.

Check this out: in FY24, cash flow from operations was a negative Rs 98 crore, despite EBITDA (earnings before interest, taxes, etc.) hitting Rs 230 crore. Translation? They’re making money on paper, but it’s not turning into cash they can use to pay bills.

The interest coverage ratio, how easily they can pay interest on that debt, dropped to 1.7 in FY24 from 3.6 in FY22. Anything below 2 is a red flag. It means they’re barely keeping their head above water.

Pair that with a venture into EV leasing (think 8,300 vehicles by Q3 FY25) that’s now being scaled back because it piled on even more debt, and you’ve got a recipe for disaster.

The Red Flags We Should’ve Seen

- There were also allegations of stock manipulation tied to the Mahadev betting app scandal. That was very sketchy, right?

- Overpromising revenue, like Rs 1,200 crore for FY24 when they only hit Rs 960 crore? Disappointing.

- 30,000 EV pre-orders hyped at the Bharat Mobility Expo 2025? Turns out they were just “expressions of interest,” not binding orders, and Gensol’s manufacturing capacity couldn’t even handle that volume.

- Then there’s the diversification mess. Jumping from solar EPC to EV leasing and manufacturing sounded exciting, but it stretched them thin.

- Frequent equity dilution and promoter stake sales didn’t help either, holdings dropped from 71.2% in March 2022 to around 60% now. Each move chipped away at investor trust.

What’s Next for Gensol?

The company’s not throwing in the towel yet.

On March 13, 2025, the board’s meeting to discuss a stock split, making shares cheaper for retail investors. The is also a possible fundraising through equity or foreign currency convertible bonds coming.

Could this turn things around? Maybe. But with the stock down 70% from its 52-week high of Rs 1,124.90 to Rs 308.80, and a P/E ratio crashing from over 100 to 13, it’s a tough sell.

Is it a value trap? it looks cheap, but the underlying rot (debt, governance issues, execution failures) makes it risky.

Lessons for Small Investors Like Me and You

So, what can we take away from Gensol’s meltdown? Here’s my two cents:

- Debt Matters: Growth fueled by borrowing can be a ticking time bomb. Always check the debt-to-equity ratio and cash flow numbers—not just the shiny revenue headlines.

- Watch the Promoters: If they’re selling big chunks or pledging most of their shares, it’s a sign of stress. Actions speak louder than words.

- Don’t Buy the Hype: Pre-orders, diversification into “hot” sectors, lofty revenue goals, none of it matters if execution’s shaky or the numbers don’t add up.

- Credit Ratings Aren’t Just Noise: A downgrade to “default” is a massive warning. Dig into why it happened.

- Cheap Isn’t Always Good: A low P/E might tempt you, but if the company’s a mess, it’s not a bargain, it’s a trap.

Conclusion

Gensol Engineering’s fall from grace is a wild ride.

I’ve been there, caught up in the excitement, ignoring the cracks until it’s too late. This time, I’m watching from the sidelines, but it’s a reminder to stay sharp and skeptical.

If you’re thinking of jumping in now, ask yourself, can they climb out of this debt hole? Is the management trustworthy?

For me, the risks outweigh the rewards, for now, at least.

What do you think? Have you followed Gensol’s journey, or seen something similar with another stock?

Drop your thoughts below, I’d love to hear your take.

Have a safe investing.

Jaggi saheb has a different take on the stock. He has already infused over 25 crore immediately, selling the shares at a rock bottom price and converted warrants at 871 a piece. i am sure he will inject more capital into the company converting other warrants too. Once cash comes into the books, debt repayment should not be an issue. His EV diversification is a big drag on the stock and Jaggi saheb has already taken the call to get out of the mess, rightly so under the circumstances. Plus the other diversification bets proved to be futile exercises, so he will get out of those also, to save the sinking ship. All in all, a good stock with growth potential has become a dead horse virtually, beaten mercilessly by the Stock Market. This is a wake up call, and if he wants to revisit the stock market with his other bets–i am told he is planning IPOs for all the four babies that he was nursing so far including Blue Smart—he needs to save Gensol, putting his heart and soul into the company. An army man imbued with nerves of steel and muscles of iron, i am sure, he will overcome all these problems sooner than expected. The market cap has come to 1000 cr and with additional capital infusion, the stock should recover. Gimmicks like stock split will not work, unless he carries out a rectificational exercise with dedication and commitment. You cannot fool everybody in the street all the time with such gimmicks. Even a bonus issue will not work. He needs to repay the debt urgently and the day this happens, the stock will begin to dance.

Thanks for sharing your views. Great (and deep) point.