Summary:

- In this blog post, I share the tough decision to sell my favorite Indian IT stock in 2025, revealing how emotional attachment clouded my judgment and the critical lesson I learned about staying objective in investing.

A Financial Calculator

Should You Sell Your Stock?

Introduction

As a long term stock investor, the stocks that’s there in our portfolio can stay there for years. For example, there are reports which say that Warren Buffett started accumulating Coca Cola since 1988. He still have that stock in his portfolio (35+ years). When something stays with you for so long, it starts to feel like more than just a money thing. In our mind, each stock becomes a story of its own.

My investment journey is not as long, but there are few stocks that’s there with me since a decade. One, such stock I sold in 2025. The decision wasn’t easy. It taught me a lesson I’ll never forget. Today, I want to share that story with you. It’s not just about one stock. It’s about how we make choices as investors.

The Stock That Felt Close

I first bought this stock in 2017. It was a well-known Indian IT company.

You think about it the lines of Infosys or TCS, but I won’t name it. Why? Because the lesson matters more than the name.

I’d been reading about India’s tech boom. The company’s earnings were solid. Its clients were global giants. I invested about Rs.45,000. It felt like a smart move.

Over the years, the stock grew decently. By 2021, my investment was worth Rs.80,000. I was proud. It wasn’t just the money. The company survived the 2020 and 2021 market crash. It even paid dividends.

I’d check its price during my lunch breaks. I’d smile when it hit new highs. Have you ever felt that way about a stock? Like it’s proof you’re doing something right?

The First Signs of Trouble

Things changed in 2024.

The Indian market was volatile. The indices was swinging wildly. Global interest rates were high. The US Federal Reserve kept rates at 5.5%. The RBI followed with a 6.5% repo rate.

Growth stocks, like my IT company, started to struggle. I noticed the stock’s price stalling. It wasn’t crashing. But it wasn’t climbing either.

Then came the company’s Q2 2024 earnings. Revenue growth was flat. Margins were shrinking. The management blamed “client budget cuts” in the US. I wasn’t too worried. Every company has a bad quarter, right? I told myself to stay patient.

Long-term investing is about holding through the noise. That’s what I’d always believed.

The Moment Doubt Crept In

By early 2025, the cracks were harder to ignore. The stock was down 15% from its 2021 peak.

I started digging deeper. The company’s debt had grown. It was borrowing to fund new AI projects. I read analyst reports. Some were downgrading the stock. Others were neutral.

I checked technical charts. The stock had fallen below its 200-day moving average. That’s a red flag for many investors.

I also looked at the broader market. India’s IT sector was under pressure. Clients were spending less on traditional IT services. They wanted AI and cloud solutions. My company was late to that game. Competitors were moving faster.

I began to wonder, Was this stock still the winner I thought it was?

The Hard Decision to Sell

In April 2025, I found a great company to invest in, but I had no spare cash.

The price of my holding stock suddenly started moving up (after the Trump’s 90 Day pause to the reciprocal tariff). It moved up by 14-15% in a matter of a week.

I needed this cash urgently because my new stock’s price was also moving up. My portfolio had other stocks. But this IT stock was under my negative radar due to all kind of noise related to this sector. I thought, selling it would cover the gap.

The idea made my stomach churn. How can I sell this stock, which for a long time was my favorite? After so many years of loyalty, I was very hesitant to sell it.

Hence, I spent more days analyzing.

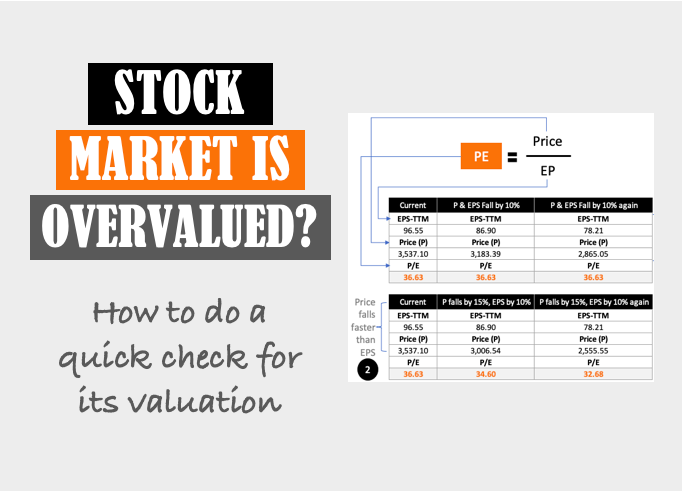

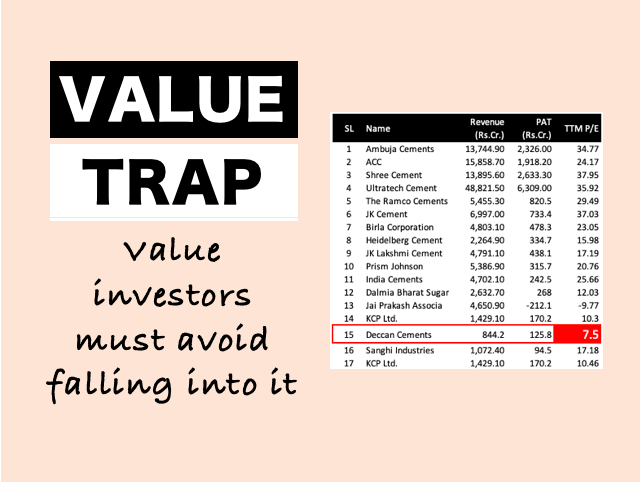

I compared the company’s fundamentals to its peers. Its price-to-earnings ratio was in the 30s. Competitors were at also in 30s range. Its revenue growth was 3%, but others were growing faster at 8%. The numbers weren’t lying. The stock wasn’t a leader anymore. Even my Stock Engines’ algorithm scores were not favouring this stock.

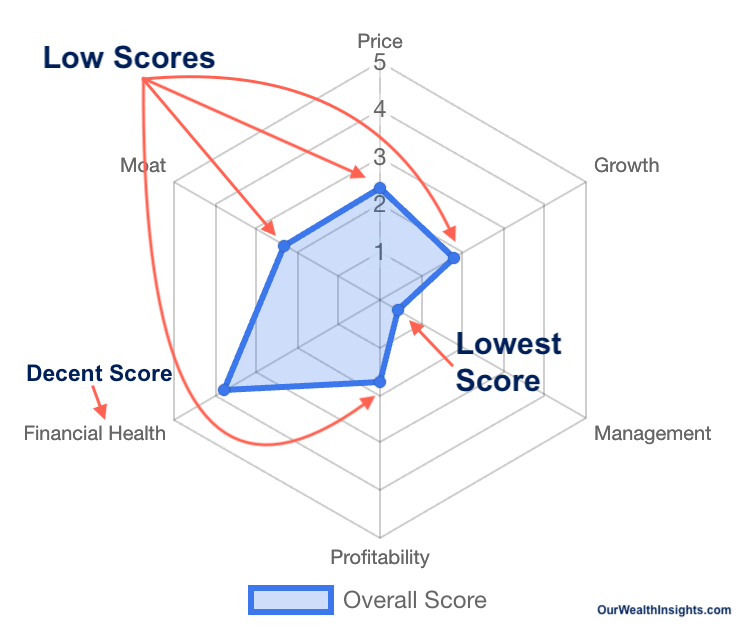

Its spider diagram was showing weak management calls (recently). Growth, price valaution, Moat, and profitability scores were also low. The only thing that was going in its favour was its financial health.

Emotionally, I didn’t want to let go. Logically, I knew I had to. I sold the stock in April, 2025. The price was at around Rs.1,450 levels. I made a profit. But it felt like a loss.

Have you ever sold something you loved, even when it was the right call? That’s how it felt.

What I Learned From Letting Go

Selling that stock taught me something important. Investing isn’t about falling in love. It’s about staying objective.

I’d held onto the stock too long. Why? Because I was attached. I ignored early warning signs. I let my emotions cloud my judgment. That’s a mistake I won’t make again.

The lesson isn’t just about selling. It’s about how we think as investors. Markets change. Companies change. We need to adapt.

In 2025, India’s market is full of opportunities. But it’s also full of risks. The Nifty 50 is at record highs. Valuations are stretched. Global uncertainty is real.

As investors, we need to ask tough questions. Is this stock still worth holding? Does it fit my goals? Am I holding it for the right reasons?

Applying the Lesson to Your Portfolio

Now, allow me to suggest you some things which are practical.

Look at your own portfolio. Pick one stock you’ve held for a while. Ask yourself, Why am I still holding it? Is it because of its performance? Or because you’re comfortable? Check its fundamentals. Look at its revenue growth, debt, and valuation.

Also, compare it to its competitors. If you want, you can also check the technicals. Is it above or below its key moving averages?

If the answers don’t add up, you can consider selling.

It’s not about giving up. It’s about making room for better opportunities.

In 2025, sectors like renewable energy, fintech, private banks are looking far better seeing 10 years hence. Maybe your money could work harder there.

The key is to stay disciplined. Don’t let emotions drive your decisions.

Stock Investors Should Maintain a Birds Eye View

This experience made me rethink my approach to investing.

In India, we often invest with our hearts. We buy stocks because of a brand’s reputation. Or because a friend recommended it. Or because it’s been good for years. That’s not enough anymore.

The market is more complex now. Global factors matter. Technology is changing industries. We need to stay informed.

I’m not saying you should sell every stock you love. Some deserve to be held for decades. But you need to test them.

Review your portfolio every quarter. Read company reports. Follow market trends. If a stock isn’t performing, don’t wait for a miracle. Act.

That’s what separates good investors from average ones.

Conclusion

Selling my favorite stock was tough. But it was the right move.

It freed up cash for my next quality purchase. It taught me to prioritize logic over emotion. It made me a better investor.

I hope my story helps you think about your own investments. Maybe you’re holding a stock you love. That’s okay. Just make sure it’s still earning its place in your portfolio.

What about you? Have you ever had to sell a stock you cared about? What did you learn? Tell me your story in the comments section below.