The Business Today news portal today reported about IndusInd Bank. It wrote that the bank’s share have the possibility of attracting $300 million in passive inflows. At first glance, this might seem like another piece of technical financial news, but its implications are quite practical for investors. Such inflows could significantly influence the bank’s stock performance. Hence, I thought, why not blog about it and declutter the matter with a bit more clarity. Just for your information, in Oct 2024, IndusInd Bank shares crashed by about -18%, to know about it, read this article.

In this context, Passive inflows refer to automatic investments made by funds that track specific indices. One such index is MSCI (Morgan Stanley Capital International). When a stock’s weight in these indices changes, the mutual funds that replicate them adjust their holdings accordingly. For IndusInd Bank, this adjustment could lead to substantial buying activity, creating temporary demand for its shares. If you want to know the weight of IndusInd Bank’s weight in Nifty 50 index, check this article.

But why is this important for investors like me & you? These passive inflows could impact IndusInd Bank’s stock price in the short term. It is like an opportunity, or a risk, for traders and long-term investors alike. It’s also a reminder of how global factors, like index reviews, can passively influence stocks price.

Let’s explore the reasons behind this buzz to see what it means for IndusInd Bank and its shareholders.

What Are Passive Inflows?

Passive inflows are a unique kind of investment that many individual investors may not be aware of. Unlike active investors who pick and choose stocks based on their preferences or analysis, passive inflows happen automatically due to changes in market indices. To understand this better, let’s break it down step by step.

At the heart of passive inflows are large institutional investors, like mutual funds or Exchange Traded Funds (ETFs). These funds are designed to track the performance of specific indices, such as the MSCI Index. The MSCI is a widely followed index that includes stocks from various countries and sectors. It is one of the most important benchmarks for global investors. Many funds are built to mimic MSCI’s performance.

Now, indices like MSCI periodically review and adjust the weight of stocks in their portfolios.

Weight adjustment is based on factors like market capitalization, liquidity, and other criteria. When a stock’s weight in an index increases (for example, due to stronger performance or rising market share), the funds tracking that index must buy more shares of that stock. This is because these funds aim to replicate the index as closely as possible.

This automatic buying of stocks, driven by changes in index weight, is what we call passive inflows.

It’s called “passive” because the funds are not actively choosing the stock, they’re simply following the changes in the index. These inflows can have a significant impact on a stock’s price.

Why Is IndusInd Bank Set to Receive Passive Inflows?

The prospect of IndusInd Bank receiving around $300 million in passive inflows can be attributed to two key factors: (i) the reduction in Foreign Institutional Investors (FII) stake and (ii) a potential MSCI weight adjustment.

Let’s dive deeper into why these factors are so important for the bank and its shareholders.

1. FII Sell-Off and Increased Headroom

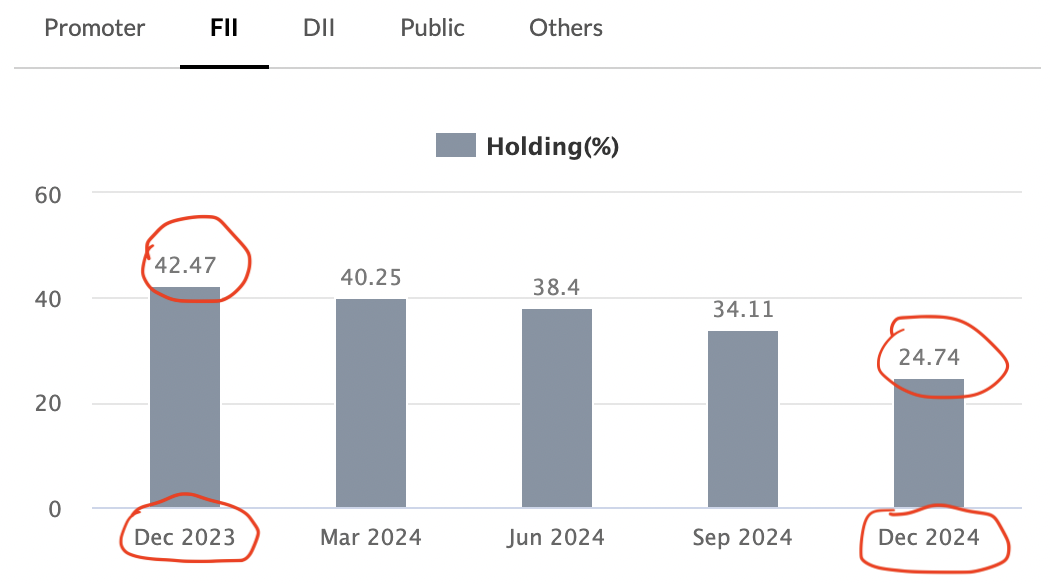

In the December 2024 quarter, the FIIs decided to reduce their stake in IndusInd Bank, from 42.47% to 24.74%. While this may sound like bad news at first, it actually created something called “headroom.”

Let me explain this in simpler terms. Headroom means there’s now more room for foreign investors to buy shares of IndusInd Bank.

Earlier, foreign ownership was close to the regulatory limit that restricts how much foreign investors can own in Indian companies. When that limit is nearly reached, the stock’s potential for attracting more foreign investment becomes limited.

This is where MSCI comes in.

MSCI includes stocks in its index based on how many shares are available for foreign investors. To calculate this, they use something called the “float factor,” which reflects the proportion of shares accessible to foreign buyers.

Previously, because IndusInd Bank had little headroom, MSCI applied a “half-float factor,” giving the stock a smaller weight in their index. Now, with FIIs reducing their stake, there’s more headroom, meaning foreign investors can buy more shares. MSCI can switch to a “full-float factor,” effectively doubling the stock’s weight in its index.

This change makes IndusInd Bank more appealing to institutional investors who follow MSCI indices, potentially attracting more investment into the stock.

2. MSCI Weight Adjustment

MSCI periodically reviews its indices (stock’s additions, deletions, weights, etc)

The review is done to to adjusting the weight of each stock based on various factors, including market performance and changes in foreign ownership.

The analysts believe that, based on the recent changes, IndusInd Bank’s weight in the MSCI Index could double in the February 2025 review.

What does this mean for the bank? When MSCI increases a stock’s weight, funds that track the index, like mutual funds and ETFs, automatically buy more of that stock to maintain the correct weight in their portfolio.

In this case, the increase in IndusInd Bank’s weight could lead to a surge of $250–300 million in passive inflows. This is because the funds that track the MSCI Index would be required to purchase more shares of the bank, potentially pushing up its stock price temporarily.

The Big Picture

While these passive inflows are primarily driven by changes in the index, they are significant for the stock. The process is automatic, and large sums of money entering the stock could create short-term demand, affecting the stock price.

However, for long-term investors, this news is just one factor in the broader picture of IndusInd Bank’s performance. By understanding the mechanics of these inflows, we investors can better assess the impact of such news on the stock’s future performance.

Basically, interpreting such news flows can help us time the market more accurately.

What Does This Mean for IndusInd Bank’s Share Price?

When institutional investors, such as mutual funds or Exchange Traded Funds (ETFs), start buying a stock in large quantities due to an index change, it creates a surge in demand. Since these funds are required to adjust their portfolios according to the new weight of the stock in the index, they automatically purchase more shares. At this point, these funds do not think about price valuations. They just blindly buy the target shares.

This influx of buying activity can temporarily drive the stock price up, as the demand for shares outpaces the available supply.

For IndusInd Bank, the anticipated $250–300 million in passive inflows will likely result in such a surge in demand, pushing up its stock price. The analysts suggests that this increased buying activity could impact the stock for about 3-5 trading days.

During this period, investors may see a short-term spike in the stock’s price, driven by the automatic buying from institutional funds that track the MSCI Index.

However, it’s important to note that such price movements are usually temporary. Once the buying pressure stabilizes, the stock may return to its regular trading pattern.

Will I Act on This News?

The news of passive inflows into IndusInd Bank due to the potential MSCI weight increase is sounding exciting. But it’s also important to remember that such short-term price movements should not be the primary reason for making investment decisions.

For long-term investors, focusing on the company’s fundamentals is far more crucial. These fundamentals give a clearer picture of a company’s true potential, especially when looking at it from an investment perspective over several years. To understand how fundamental analysis of stocks are done, read this article.

For IndusInd Bank, factors like the improvement in its deposit franchise, its ability to manage microfinance stress, and efforts to grow its lending portfolio are more significant.

- Improving the deposit base is important for a bank’s stability, as it enhances liquidity and lowers borrowing costs.

- Managing microfinance stress and boosting the lending portfolio are vital for future profitability.

[Note: The bank’s lending segments, like retail loans and vehicle finance, have faced some challenges recently.]

So, while the passive inflows may temporarily boost the stock price, I as a long-term investor, will keep my eyes on how the bank is improving its core operations.

Conclusion

Passive inflows are an interesting example of how global factors, such as index changes, can influence even a domestic bank’s stock like IndusInd Bank.

These trends are driven by institutional investors who track indices like the MSCI. They can lead to noticeable short-term movements in the stock price.

For retail investors, understanding these trends can help them stay informed about potential price fluctuations and market movements.

However, it’s essential to align such trends with our long-term investment goals. A stock’s short-term performance, driven by external factors like passive inflows, might not necessarily reflect the company’s long-term growth prospects.

If you’re tracking IndusInd Bank, the February MSCI review could provide an opportunity to monitor how the stock behaves during the inflow period.

However, any investment decision should be based on a comprehensive analysis of the bank’s fundamentals, such as its growth strategy, risk management, and financial health. Ultimately, focusing on long-term fundamentals will offer a more reliable path to building wealth through stocks.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.