If you’ve been anywhere near the stock market today, you’ve probably seen the headlines screaming about IndusInd Bank. On Tuesday, March 11, 2025, the stock nosedived a jaw-dropping 27%, hitting a 52-week low of Rs 674.55. That’s the kind of drop that makes your stomach flip, whether you’re holding shares or not. And if you’ve been following my journey, you’ll know I dodged this bullet back in November 2024 when I sold all my IndusInd holdings. Today, I’m feeling validated about that call, and I want to declutter the today’s nose dive for you. What’s behind this dramatic crash, why I got out when I did, and what it might mean for anyone still eyeing this stock.

My IndusInd Story: A Slow Burn to a Clean Break

Let’s rewind a bit. I first started picking up IndusInd Bank shares between April 2021 and February 2022.

I was buying in at an average price of around Rs 850, nothing crazy, just a steady accumulation because I liked the look of this private lender. It had a solid reputation, decent growth, and I figured it’d be a reliable piece of my banking sector exposure.

For a while, it held its own, even climbing to a 52-week high of Rs 1,576 by April 2024. I was feeling good.

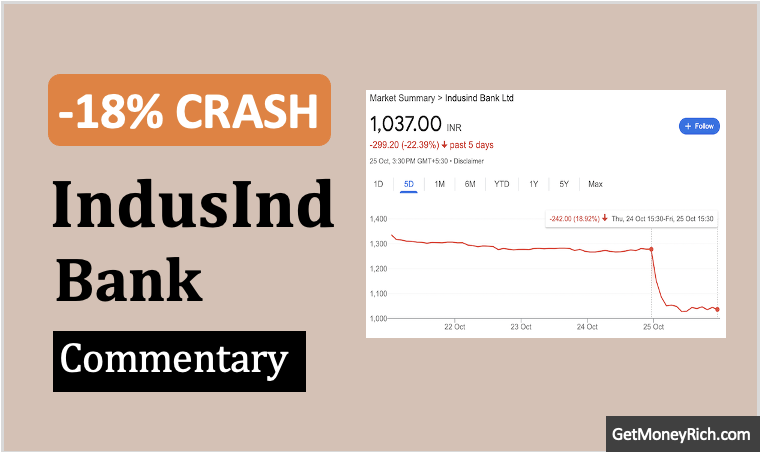

But then, something shifted. After January 2024, I started noticing a slow, creeping decline in the stock price. It wasn’t a freefall, not yet, but the trend was unmistakable. By October 2024, that downward slide became impossible to ignore. One day, out of nowhere, it tanked over 18%. That was my wake-up call. I’d been mulling over my portfolio for a while, wanting to trim my exposure to banks because, frankly, I’d gone a little heavy there.

Among my holdings, IndusInd was the one making me the most uneasy. The price action felt off, like the market was whispering something I couldn’t quite hear.

So, in November 2024, I pulled the trigger and sold every last share. It wasn’t an easy decision, I’d held this stock for years, but I couldn’t shake the gut feeling that trouble was brewing.

Fast forward to today -27% implosion, and I’m sitting here thinking, “Wow, maybe I actually timed that one right.”

What Just Happened to IndusInd Bank?

So, what’s the deal with this latest crash?

The news hit on Monday, March 10, when IndusInd Bank dropped a bombshell in an exchange filing, they’d found “discrepancies” in their forex derivatives portfolio. Read more about what it means by discrepancies in forex derivative portfolio here.

Yeah, that’s the kind of phrase that sends investors running for the hills. Turns out, an internal review revealed they’d underestimated hedging costs tied to old forex transactions. The damage? A potential hit of Rs 1,600-2,000 crore to their net worth, about 2.35% as of December 2024. That’s not pocket change.

This mess traces back to new guidelines from RBI rolled out in September 2023 (effective April 2024) on how banks should handle derivatives. IndusInd apparently didn’t get the memo, or at least didn’t adjust their books properly.

When they finally fessed up this week, the market didn’t just flinch; it bolted. Shares hit their lowest level since November 2020, and trading volumes spiked over 10 times the norm. It was a panic.

Analysts piled on fast.

- Emkay Global slashed their target price by 22% to Rs 875 and downgraded it to “Add.”

- Nuvama went darker, dropping it to “Reduce” with a Rs 750 target.

- Motilal Oswal shifted to “Neutral” at Rs 925.

The consensus? Weak internal controls and shaky governance could mean more pain ahead.

Oh, and here’s a kicker, just days before this news, the RBI gave CEO Sumant Kathpalia a measly one-year extension instead of the three years the bank wanted.

That’s not exactly a vote of confidence, and it had already shaved 4% off the stock on Monday.

Why This Crash Feels Personal

Look, I’m no financial wizard with a crystal ball, but today’s carnage feels like it’s been building for a while, stuff I was picking up on last year.

That slow price drip after January 2024? It wasn’t just random noise. The 18% drop in October? A warning shot.

By November, I was out because the stock’s behavior was screaming “unreliable.”

I didn’t know about derivatives or hedging costs back then, I’m not that plugged into the bank’s books, but I could feel the unease in the market. Turns out, my instincts weren’t wrong.

This isn’t just about me patting myself on the back (though I’ll take a small victory lap). It’s about what this crash says for anyone still in the game, or thinking of jumping in.

The bank’s claiming they can absorb this hit without a lot of suffering, pointing to strong profitability and capital adequacy. They’ve got an external agency double-checking the numbers, and they’ll book the loss in Q4 FY25 or Q1 FY26. Fair enough.

But here’s the problem, when a stock craters 27% in a day and analysts start tossing around phrases like “weak internal controls,” trust takes a bigger hit than the balance sheet.

Lessons From the Fall

This isn’t just an IndusInd problem, it’s a wake-up call for anyone playing the banking stock game.

The Nifty Bank index slipped 0.7%, and the Nifty Private Bank took a 1.3% hit, even as big players like ICICI and SBI held steady or climbed.

IndusInd’s woes are rippling out, shaking confidence in how well banks are managing risk. If a top-five private lender can fumble something as basic as derivatives accounting, what else might be lurking in the shadows?

For me, selling in November was about more than just IndusInd. It was about stepping back from a sector I’d overloaded on.

I still hold other bank stocks, I’m not swearing off the whole game, but IndusInd had become the weak link.

Watching it shed 56% from its April 2024 peak (Rs 1,576) and 66% from its 2018 high (Rs 2,037.90) only reinforces that call. My Rs 850 entry point looks like a distant memory now.

What’s Next for IndusInd, and You?

If you’re still holding IndusInd, you’ve got some thinking to do. The bank says this is a one-time thing, but analysts aren’t so sure. ICICI Securities warned that “heightened uncertainty” around microfinance challenges, leadership limbo, and this derivatives mess could keep the stock under pressure.

Motilal Oswal thinks the losses will dent Q4 FY25 earnings, and the market might not forgive that easily. At Rs 674.55, it’s tempting to call it a bargain, but bargains don’t always bounce back quick when trust is this shaky.

Me? I’m not buying it again. I took my lumps in November, probably sold lower than I’d have liked, but I’m not second-guessing it after this week.

If you’re in the market, maybe use this as a gut-check moment. Are your holdings giving you that uneasy vibe? Are you too deep in one sector? I ignored those whispers for a while with IndusInd, but when I finally listened, it paid off.

So, what do you think? Were you caught in this storm, or did you see it coming too?

Drop a comment—I’d love to hear your take.

And if you’re curious, check out my October 2024 post where I laid out my early worries about IndusInd.

Have a safe investing.