Why poor people stay poor? This is because poor do not know how manage money to become richer.

Poor thinks that, only making ‘more’ money makes one rich.

But this is not correct. One must attain financial independence first.

Only after achievement of financial independence one can start getting “richer”.

The difficult part is, the achievement of financial independence itself.

But once the person becomes financially independent, money-making shifts to auto-pilot.

Hence forth, the person only gets richer and richer.

It will not be an exaggeration to say that dependency on monthly paycheck keeps one poor.

Getting rich is not easy.

It is specially difficult for middle class people like me and you.

When income is limited and expense is sporadic, becoming rich is only a dream.

More importantly, what middle class people do in their day-to-day life is what’s keeps them poor.

Poor people also work very hard, but still they continue to be poor.

The main reason is ‘paycheck dependency’. This is the root cause.

Paycheck dependency is like a bad habit. This keeps poor people the way they are.

Dependency on paycheck “must” be reduced. This is step one.

But how to do it?

There are two ways of doing it.

- Become debt free first.

- Build a large portfolio full of income generating assets.

The income generated from this portfolio should be sufficient to maintain the standard of living.

Even when there is no paycheck, income from this investment portfolio should be sufficient to support the livelihood.

The path from being a poor to financial independence is tough.

It is tough because we DO NOT KNOW how to get there.

In fact most of us do not know what is financial independence.

Our teachers, our parents, our friends did not know it either.

So its not a surprise that we are also ignorant about the philosophies of financial independence.

A poor man wants to get rich, but he know nothing about financial independence.

Such a person can never become rich.

A person getting quick-rich by winning a lottery, eventually falls back to zero.

If only he knew the concept of financial independence, he could have only grown richer.

This is the reason why becoming rich is so difficult for a common man.

But as soon as one realises the importance of financial independence, his journey towards riches starts.

It is very interesting to see ones transformation from being a poor to a financially independent person.

There could be several road blocks ahead. But the pleasure & excitement of this transformation keeps one going.

Imagine yourself trapped in a dark cave for years. Suddenly you see a very thin ray of light and you travel in its direction.

You travel with a hope to see the clear sky.

Financial independence is our ray of hope.

It will eventually lead us to the clear sky (objective of becoming rich).

Every small step (growth of income from investment portfolio) will take us closer to our clear sky.

The more assets one accumulate in the portfolio, the closer will be the financial independence.

And once we reach financial independence, nothing can stop us from “Getting Richer”.

Start your journey towards financial independence today.

The starting point will be to recognise factors that justifies why poor people stay poor.

Eliminating these factors should be the immediate priority.

#1) The spend more…

Yes this is the simple answer. They spend more than rich people.

Surprise? But this is a fact. Rich spend less and poor spend more. We actually believe the opposite.

Rich people actually spends much less. But poor people spend beyond their means.

But How?

Proportionally, rich spend much less than poor.

Suppose a person “A” earns $30,000 a year. This income is not too small, but still he is poor, why?

This person “A” stays poor for the way he treats his income.

If this person spends $29,500 out of his total income, he will remain poor all his life.

While, if another person “B” who earns exactly same as “A” can pave his roads towards riches. How?

By saving more money.

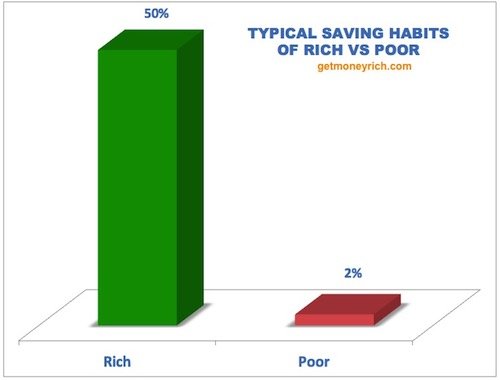

Percentage savings for “A” is less than 2%.

While an average rich person saves more than 50% of his income.

Yes its true, this level of saving money makes a person rich.

Irrespective of the fact that rich spends several times more than poor people, but they still save more income in percentages terms.

Higher savings, year after year can make poor get richer every day.

Lower savings is the reason why poor people continue to stay poor.

Low saving is common among poor and middle class people.

First we overspend, and then to make up for these over spending’s we dig deeper into our whatever small savings.

The result is, we are left with virtually zero savings.

There are people who save more than 3%, but they ultimately spend even those trivial savings on useless things.

This makes the whole hard work (to save money) go in vain.

As if this was not enough, once we exhaust our savings, we start using credit cards.

How many times it has happened that you bought a smart phone from your credit card just because you did not have enough savings?

Do not panic, most of us are like this.

This habit of eroding our savings justifies why are poor people poor.

Careful analysis of one’s financial needs is essential.

Ones we know our financial needs, we have to save and spend accordingly.

Saving and spending planning is called budgeting.

Sticking to our budget no matter what comes in life is the key to become rich.

#2) They do not plan for emergency

Rich people handle emergencies better than poor.

No one can forecast emergency, but we can be prepared.

At least the money-part can be planned.

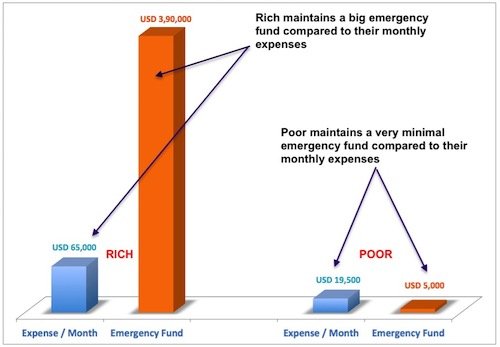

The thumb rule says, one shall have a emergency fund big enough to manage 3 months expenses.

How many of us maintain an emergency fund this big? Rich does it very judiciously.

The richer a person is, bigger is the emergency fund.

I once met a person who had an emergency fund as big as 6 times his monthly expense.

The person had $65,000 as his monthly expense.

As if this was not sufficient, he also maintained $390,000 as his emergency fund.

If something unplanned happened in his life, he had close to a quarter of a million to fall back upon.

Here important is not that how big is the emergency fund.

Important is, it is “6 times” of your present monthly expense or not.

Poor people really fair bad in handling emergencies because they maintain virtually zero emergency fund.

Decent people at least plan and keep the following:

- Life insurance,

- Medical insurance,

- Auto insurance,

- Property insurance etc

These they keep as a back-up support.

Even such people must maintain an emergency fund worth 3 times their monthly expenses.

This emergency fund is like a liquid-reserves in bank.

Any expense which insurance cannot cover, should me managed from this fund.

Rich keep replenishing this fund time and again.

Poor do not plan like this.

Ultimately the result is, they end up eating their own savings when emergency strikes.

It is this regular erosion of savings that keeps poor people poor.

#3) They carry high debt

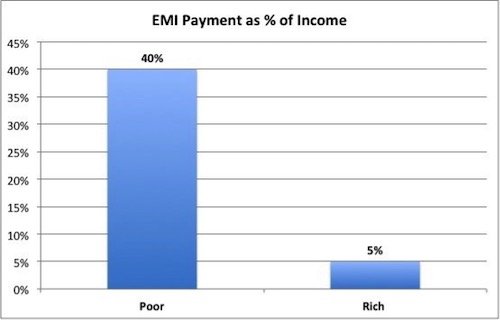

Capability of rich people to pay debt is high. But they prefer not to avail debt.

This is what poor people must learn from rich.

Debt is never good for ones financial independence.

On an average, a poor person pays 35-40% of their income to payback debt.

This percentage for rich is much lower. Poor overspend by taking loan.

Things that they cannot afford, they buy using debt.

This is why these days everything in market can be purchased with EMI.

Mobile phones, Television, furniture’s etc, everything is available on EMI.

But debt is not good.

Who buys these products on EMI? Rich people do not buy it with debt.

But poor people, who cannot afford, then buys it with easy EMI’s.

This is one of the bad habits of poor people.

When temptation to buy soars high, poor people opt for bank-loan.

ut this is a wrong way to manage requirements.

Better option is to plan & save for requirements.

If we know today that after 1 year, I need a new mobile phone, start saving from now.

In the name of false necessity, poor people often take loans (like education loan) to pay for essential like education fees.

Pre planning can save us huge amount of money.

Debts makes purchasing easy but they are costly.

Careful analysis of one’s financial needs is the key.

The more we plan less dependent we are on debt.

#4) They do not preach financial independence

Rich people keeps improving their degree of financial independence regularly.

But on other hand poor people do not know what is financial independence..

This is one factor that makes a huge difference between rich and poor.

Financial independence is the first milestone in becoming rich.

Achievement of financial independence takes long time.

Its better to realise the importance of financial independence as early as possible in life.

A rich person of today, started his journey towards financial independence years back.

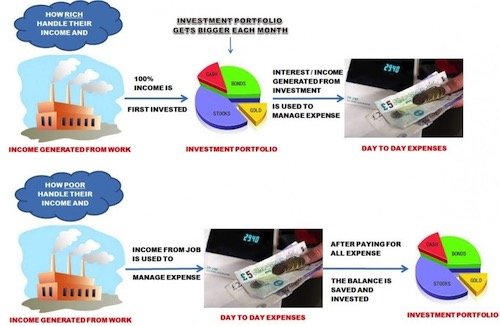

How rich handle income & expense is very interesting.

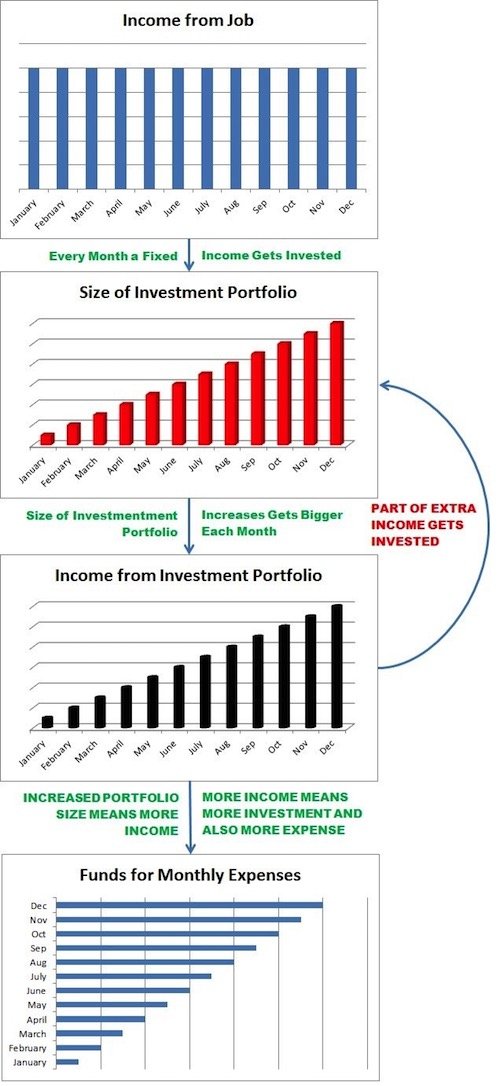

Please see the below pictorial representation of how rich and poor’s handle income & expense differently.

A rich man earns money and uses his income to build an investment portfolio.

The income generated from investment portfolio is used to manage day-to-day expenses.

On the other hand, poor person first spends his income and balance what is left (if at all) is used for investment.

The path that is followed by the rich person assure his financial independence in the fastest possible time.

And the best part is, a financially independent person gets richer each day.

Not only he is able to afford more expenses (luxuries of life) but his personal asset also appreciates.

How this happens is represented in the flow chart:

#5) They do not invest money

Rich people are better investors and than poor people.

Poor people follows panic investing, while rich people are more observant.

This makes a lot of difference.

Lets see few examples what makes poor people bad investors.

– (a) When rich buy stocks, poor people are selling them.

When poor people buy stocks, rich are selling them.

– (b) Rich buy those stocks which show strong fundamentals.

While poor people buy stocks blindly.

– (c) Rich people buy stocks which are undervalued.

Poor people does not know how to value stocks.

– (d) Rich people invests in real estate property during project launch.

Poor people buy second or third resale property which are already expensive.

– (e) Rich people buy multiple property for rental income.

Poor people buy just one property for self occupation.

– (f) Rich regularly buy gold as a inflation hedge.

Poor people buy gold only during festival seasons as a jewellery.

– (g) Rich keeps bare minimum free cash.

Poor people keeps all saving parked in savings account.

– (h) Rich buy investments not to use that money for next decade. Poor buys investments and breaks it the next month.

Conclusion

So what we can learn from the mistakes of poor people.

The biggest learning is, to avoid habits that due to which poor people stay poor.

What needs to be done?

Following the below principles as if they are lines from the bible:

- The path to get rich is to get financially independent first

- Income/expense shall be budgeted

- Decrease reliance on debt by planning future needs

- Maintain emergency fund and keep growing it

- Increase your passive income

- Invest wisely like rich

How much can you save .companies paying only after calculating cost of living . children education & medical expenses will vanishing all our savings .

Manishsir your thinking level is the best …the way you present is ausumn…I like it …

your blog is very super.my eys open for mutiple ways thank you