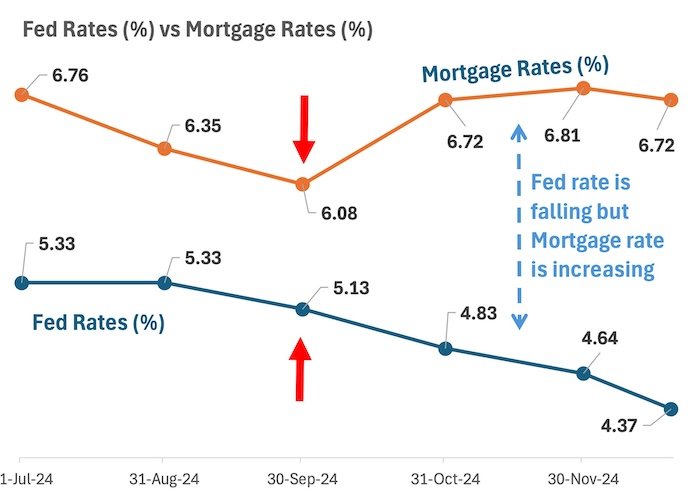

The US Federal Reserve (Fed) has made headlines for its efforts to control inflation. The central bank has been aggressively cutting interest rates since August’2024. But there’s a puzzling twist: mortgage rates in the US are still rising. Yes, it’s happening and that is what’s strange. Despite the Fed lowering rates to stimulate the economy, mortgage rates (home loans rates) are climbing higher. So, what’s going on? What we (in India) can learn from this situation in the US. How this piece of news is relevant for us are looking to invest in stocks or buy a property?

Let’s read more about it.

The Fed’s Role in Setting Interest Rates

The Fed is lowering the interest rates, but the mortgage rates in the US are still rising. Why? To understand this paradox, let’s first break down the role of the Federal Reserve (Fed).

The Fed controls short-term interest rates, which influence how much banks charge each other for borrowing money overnight (like India’s Repo rate). These rates are crucial for controlling liquidity thereby controlling inflation, growth, and overall stability of the economy.

When the Fed lowers interest rates, it’s trying to make borrowing cheaper, encouraging consumers and businesses to spend and invest more.

However, the Fed’s influence is mainly on short-term borrowing costs.

The mortgage rates, on the other hand, are closely tied to long-term bond yields, particularly the 10-year US Treasury bonds. These are long-term government debt instruments that investors buy and sell.

When investors think inflation will rise, they demand higher returns (higher yields) on these bonds.

As bond yields rise, mortgage rates tend to follow suit, even if the Fed is cutting short-term rates.

Why Mortgage Rates Aren’t Following the Fed’s Cuts

Imagine you’re buying a home, and you’re taking out a mortgage. When the Fed cuts rates, you might expect your home loan to become cheaper. But mortgage rates in the US have been rising, even with these Fed cuts. Why?

Before we answer that, we must know two things about bond yield and MBS.

- What are mortgage backed securities (MBS): MBS are investments (in US) made up of home loans bundled together and sold to investors. When homeowners make their monthly mortgage payments, the investors receive a portion of those payments as returns.

- The returns earned from MBS are not so high but are always higher than government bond’s yield. For example, currently, the ’10-Yr US Government Bond Yield’ is 4.4% and ‘Yield To Maturity of MBS’ is 5.3% (source).

- Why the Yield of MBS is higher than the bond’s yield? The key reason lies in the risk factors associated with mortgages. Mortgages are considered riskier investments than government bonds. Why? (a) Because, with US Government bonds, the US government has a near-zero chance of defaulting. But homeowners can and do default on their loans. (b) Additionally, homeowners can also refinance their loans anytime. It introduces another level of uncertainty for investors in mortgage-backed securities. When homeowners refinance, investors in mortgage-backed securities face the risk of losing expected future interest payments.

So, now we know that in the US, home loan (mortgage) is not just a loan, it is also part of an investment vehicle called Mortgage Backed Security (MBS) on which investors expect returns.

The expectation of these investors can also influence the interest rates of the mortgage (in Indian only banks have the control on the home loan rates).

Now, this will explain why even when Fed rates are falling, the mortgage rates are still increasing.

When the Fed cuts rates, mortgage rates can rise if investors in mortgage-backed securities demand higher returns due to perceived future risks like inflation, prepayment, or economic uncertainty. To meet this demand, mortgage issuers raise interest rates on new loans.

So, even though the Fed is lowering short-term rates, the bond market (and consequently mortgage rates) remains tied to the broader economic conditions (which at present in inflationary).

Why Investors in MBS are Expecting Higher Returns?

The Fed has slashed interest rates multiple times this year, yet mortgage rates have continued to climb. Why is this happening?

There are several factors are at play:

- Inflation is Still High: Despite the Fed’s efforts, inflation has barely budged. Investors are still nervous about rising prices and the value of their investments, which is why bond yields are increasing.

- Stronger Economic Growth: The US economy has shown resilience, and stronger economic growth tends to push up interest rates. When the economy grows faster, inflation risks increase, leading to higher yields on long-term bonds.

- Government Debt Concerns: The US government is facing mounting debt and deficits. It is raising the questions about the future of its fiscal health. Higher government debt leads to greater concerns about inflation, prompting investors to seek higher returns to compensate for potential risks.

- Prepayment Risk in Mortgages: The housing market has been volatile. With elevated mortgage rates over the past few years, investors in mortgage-backed securities are more worried about prepayment risk. This uncertainty further drives up mortgage rates.

What Can We Indians Learn From This?

You might wonder, “Why should I, as an Indian investor or homebuyer, care about what’s happening with mortgage rates in the US?”

The answer lies in the lessons we can draw from the situation.

- Inflation Control and Loan Rates: In India, inflation is a constant concern. The RBI adjusts interest rates to keep inflation under control, like the US Fed. However, RBI’s rate cuts don’t always guarantee lower home loan rates. Other factors, like inflation expectations or the performance of Indian bonds, can still keep loan rates high. For instance, if inflation remains stubborn, banks may not lower home loan rates despite the RBI’s actions..

- Bond Market Influence on Loan Rates: Indian home loan rates are also closely tied to bond market movements. Home loan rates are linked to bond market movements because banks often use bond yields as a benchmark to determine their lending rates. When bond yields rise, banks tend to increase home loan interest rates, and vice versa. If inflation remains high banks may hesitate to lower rates on loans. For example, if US bond yields are rising, FIIs will start diverting funds from Indian bonds to US bonds. To keep FIIs in India, corporate bonds will have to offer higher returns. To compensate for this, the banks may in-turn increase the home loan interest. Understanding these connections helps us anticipate the market movements (inflationary concerns) better.

- 3. Balancing Risk and Return: In the US, mortgage rates are higher because investors want compensation for the risk of lending to homeowners. Similarly, in India, higher returns often come with higher risk. For example, a corporate bond offering 10% return may be riskier than a government bond offering 6%. Whether investing in bonds or equity, we must always know the risk-return balance of our investments. For example, an investment which is as safe as a bank FD will not give your 20% CAGR return for next 5 years.

- Market Uncertainty and Investment Decisions: Global economic factors, like inflation, government debt, and economic growth, affect investments in India, too. For instance, if global inflation is high, it may push Indian bond yields up, affecting everything from home loans to investment returns. We must learn to read not only Indian economics but also the world order.

While this situation is unfolding in the US, the principles of inflation control, bond market influence, risk-return balance, and market uncertainty are just as relevant for Indian investors and homebuyers. Indian economy is much more closely related to the US than we think. So, better be informed about what is happening in the US.

Conclusion

I believe it’s crucial to stay focused on long-term trends rather than short-term fluctuations.

The rise in US mortgage rates, despite Fed cuts, is a reminder that there’s more to the economy than what central banks do.

While rate cuts might seem like a cue for lower borrowing costs, the bond market and investor expectations play a major role.

This is a good lesson for we Indian to get a picture of the broader economic picture.

Whether we are looking to buy a house, invest in bonds, or build a portfolio of stocks, we must always keep an eye on inflation, government debt, and the risks involved in any investment.

If you found this article useful, please share it with fellow investors or leave your thoughts in the comments below!

Have a happy investing.

Nice article

Thanks