If you want to know what is working capital or its basics, I’ll request you to check this blog post. But here, in this article, you will see the practical side of working capital. We’ll see examples of real life companies and see what constitutes their woking capita. To get a clearer perspective of working capital of companies, we’ll also see which costs are not includes in the scope of working capital. This way, we’ll exactly know what is working capital and what is not.

Do you know what is Working Capital of a company? I’m not talking about its formula (WC = current assets – current liabilities). What I’m asking is in terms of its utility for real companies.

Imagine you’re running a small food stall, right? Working capital is basically the money you need right now to keep that stall running smoothly, day-to-day. What daily costs are involved to run a typical food stall:

- It will include buying raw materials like vegetables, spices, etc.

- Paying the helpers, and

- Keeping a bit extra cash for maybe to cover unexpected expenses like a sudden price increase in tomatoes.

- Paying utility bills, etc.

Working capital is the fuel that keeps a business engine running. Without enough working capital, a business will not be able to buy supplies, can’t serve customers, and the food stall will grind to a halt. Even if you have a great recipe and lots of hungry customers, without working capital the business cannot operate.

Now, that you’ve got a rough idea about what working capital looks like, lets take specific companies and discuss their working capital constituents.

Table of Contents

- 1. Working Capital Example #1: JSW Steel

- 2. Working Capital Example #2: Bajaj Finance

- 1. Working Capital Example #3: Tech Mahindra

- 4. Working Capital Example #4: Britannia Industries

- 5. Planning For Working Capital is a Continuous Process

- 6. How To Interpret Working Capital?

- – 6.1 Hypothetical Example: A Juice Stall

- – 6.2 Hypothetical Example: River Analogy

- 7. The Higher is the Working Capital The Better?

- Conclusion

1. Working Capital Example #1: JSW Steel

Here’s how an integrated steel plan will use its working capital:

- Raw Materials (Iron Ore, Coal, lime, etc.): This is HUGE for JSW Steel. Imagine the sheer volume of iron ore and coal they need to keep those blast furnaces burning. They need working capital to buy these raw materials constantly. The prices of these materials fluctuate a lot, so they also need to manage their working capital carefully to buy when prices are favorable. They must have enough in stock to avoid production halts if prices suddenly spike. Think of it like stocking up on Diwali supplies before the prices go crazy!

- Energy Costs (Electricity, Fuel): Running a steel plant is incredibly energy-intensive. A significant chunk of their working capital goes towards paying for electricity and other fuels. Again, these costs can fluctuate, impacting their working capital needs.

- Salaries and Wages: They have a large workforce, from engineers to plant operators. Paying salaries on time every month is a critical use of their working capital.

- Maintenance and Repairs: Steel plants are complex and require constant maintenance. Working capital is needed for spare parts, repairs, and ensuring the machinery is running smoothly. In case of a breakdown and a planned shutdown, these spares will be required for repair and restart.

- Inventory of Finished Goods: Once the steel is produced, it needs to be stored and then sold. The working capital is tied up in this inventory until it’s sold and they get paid. They need to balance producing enough steel to meet demand without holding too much inventory, which ties up their cash.

- Receivables (Money owed by customers): JSW Steel sells to other businesses (auto companies, construction companies, etc.). They often give these customers credit terms (e.g., 30 or 60 days to pay). This means JSW Steel has to wait to get paid, and that money is essentially “stuck” in receivables. Managing these receivables efficiently is crucial for their working capital. They want to get paid as quickly as possible.

Steel companies like JSW Steel operate in a cyclical industry. Demand for steel goes up and down with the economy. Managing working capital effectively is especially important during economic downturns.

Remember, working capital is not only cash, it is also raw-material inventory, finished good inventory, and spares inventory. These are all non-cash items. Woking capital management deals with buying just enough raw-materials and spares to ensure an optimum stock of finished good inventory (as per demand).

The cash component of working capital is necessary to pay salaries, bills, and for the purchase of inventories.

1.1 Other Costs of JSW Steel which are not in the scope of Working Capital

Here are some costs crucial to JSW Steel’s business that fall outside the scope of day-to-day working capital:

- Capital Expenditure (CAPEX): This is the big stuff. Building a new steel plant, upgrading existing equipment, or acquiring another company. These are long-term investments that require significant upfront capital and are not part of their day-to-day operational expenses. Think of it as buying a whole new food stall instead of just buying vegetables for the existing one.

- Debt Repayment (Principal): While interest payments on short-term debt might be considered a working capital expense, the principal repayment of loans is a long-term financial obligation. This is money going towards paying down the original loan amount, not towards running the daily business.

- Research and Development (R&D): Developing new types of steel, improving production processes, or finding more efficient ways to reduce emissions – all these require long-term investment in research and development. This isn’t about keeping the lights on today; it’s about future growth and competitiveness.

- Land Acquisition: Buying land for future expansion or for setting up new facilities is a long-term investment.

- Environmental Compliance: While some environmental costs might be ongoing (like waste disposal), major investments in pollution control equipment or remediation efforts are long-term capital expenditures. They might need to invest in technology that reduces emissions. This is a long-term project.

- Long-Term Investments: JSW Steel might invest in other companies, infrastructure projects, or even renewable energy projects (to reduce their carbon footprint). These are strategic, long-term investments aimed at diversification or growth.

2. Working Capital Example #2: Bajaj Finance

Bajaj Finance is a completely different business compared to JSW Steel.

Here’s how working capital plays out for them:

- Disbursements of Loans: This is the biggest use of their working capital. Bajaj Finance’s primary business is lending money. When they approve a loan (personal loan, auto loan, business loan, etc.), the money they disburse is their working capital being put to work. The faster they can disburse loans to credit-worthy customers, the faster they can generate income (interest). This is their business model.

- Operating Expenses: This covers the day-to-day costs of running their vast operations. Think of salaries for their thousands of employees (loan officers, customer service representatives, tech staff), rent for their branches, marketing and advertising expenses, and the costs of maintaining their IT infrastructure.

- Collections and Recoveries: Working capital is used in the process of collecting loan repayments. This includes the costs associated with sending reminders, managing payment systems, and the costs of pursuing legal action against defaulters. The more efficient they are at collecting repayments, the healthier their working capital cycle.

- Maintaining Liquidity: Bajaj Finance needs to have enough cash on hand to meet its own obligations. This includes paying back depositors (people who have fixed deposits with them), paying their own debts, and covering any unexpected expenses. A strong working capital position ensures they can meet these obligations without any hiccups.

- Short-Term Investments: Bajaj Finance might invest some of its excess cash in short-term, liquid investments (like treasury bills or commercial paper) to earn a return while keeping the money readily available.

- Provisioning for Loan Losses: Based on their assessment of risk, they need to set aside a portion of their profits as a provision to cover potential loan defaults (NPAs). While not a direct cash outflow, provisioning impacts the amount of working capital available for lending.

For a finance company like Bajaj Finance, working capital management is all about managing risk and liquidity.

They need to strike a delicate balance between lending (aggressively to grow their loan book) and maintaining enough cash (a conservative approach to ensure they have liquidity to cover potential losses and meet their obligations).

Their Net Interest Margin (NIM) is the biggest indicator of how well they are managing their working capital. This is because it is the difference between the interest they earn on loans and the interest they pay on their own borrowings. A higher NIM generally indicates better working capital management and profitability.

Keep track of their Gross NPA and Net NPA numbers to understand the riskiness of their lending practices.

2.1 Other Costs of Bajaj Finance which are not in the scope of Working Capital

Let’s look at the costs Bajaj Finance incurs that are not directly related to their day-to-day working capital:

- Capital Expenditure (CAPEX): While not as significant as in a manufacturing company like JSW Steel, Bajaj Finance still has CAPEX needs. This would include:

- IT Infrastructure: Investing in new software, hardware, and cybersecurity systems to manage their vast loan portfolio and customer data.

- Branch Expansion: Opening new branches or renovating existing ones.

- Office Equipment: Furniture, computers, and other equipment for their offices.

- Investments in Subsidiaries or Joint Ventures: Bajaj Finance might invest in other financial services companies or form joint ventures to expand their product offerings or reach new markets. These are long-term strategic investments.

- Brand Building and Marketing (Long-Term Campaigns): While day-to-day advertising is a working capital expense, large-scale brand building campaigns (like sponsoring major events or launching national advertising campaigns) are more like long-term investments. They are designed to build brand awareness and customer loyalty over time.

- Mergers and Acquisitions (M&A): Acquiring another finance company or merging with a competitor would be a major, non-recurring expense.

- Training and Development (Large-Scale Programs): While ongoing employee training is a working capital expense, large-scale training programs focused on developing leadership skills or introducing new technologies would be considered a longer-term investment in human capital.

- Regulatory Compliance (Major Overhauls): While routine compliance costs are part of working capital, major overhauls to comply with new regulations (like implementing new data privacy measures) would be a significant, non-recurring expense.

3. Working Capital Example #3: Tech Mahindra

Let’s break down their working capital components:

- Employee Salaries and Benefits: This is a massive component of their working capital. Tech Mahindra is a people-driven business. They need to pay competitive salaries to attract and retain skilled software engineers, consultants, and other professionals. Delays in salary payments can lead to employee dissatisfaction and attrition, which can hurt their project delivery and reputation.

- Operating Expenses: This includes the usual suspects: rent for their offices (which can be significant in major cities), utilities, communication costs, and travel expenses for consultants working on client projects.

- Receivables (Money owed by clients): Tech Mahindra provides services to clients and then invoices them. The time it takes for clients to pay these invoices is a critical factor in their working capital cycle. Efficient billing and collection processes are essential. Delays in payments from large clients can strain their working capital.

- Short-Term Project Costs: Many of their projects require upfront investments in software licenses, cloud computing resources, or specialized equipment. They need working capital to cover these costs until they are reimbursed by the client.

- Marketing and Sales Expenses: Attracting new clients and securing new projects requires investment in marketing and sales activities. This includes attending industry events, running online advertising campaigns, and maintaining a sales team.

- Vendor Payments: Tech Mahindra often partners with other companies or uses third-party services to deliver projects. They need to pay these vendors on time to maintain good relationships and ensure smooth project execution.

For Tech Mahindra, managing receivables efficiently is absolutely critical. They need to have strong contracts with their clients that clearly define payment terms. They should have robust processes for tracking invoices and following up on overdue payments.

For such companies, I’d also want to know how diversified their client base is. Over-reliance on a few large clients can create significant working capital risks. If those clients delay payments or decide to switch to a competitor, the company will be in problem.

3.1 Other Costs of Tech Mahindra which are not in the scope of Working Capital

Let’s look at the costs Tech Mahindra incurs that fall outside the realm of day-to-day working capital:

- Capital Expenditure (CAPEX): While Tech Mahindra isn’t a manufacturing company, they still have CAPEX needs, including:

- Data Centers: Investing in building or upgrading data centers to support their cloud and infrastructure services.

- Office Buildings: Purchasing or renovating office space for their growing workforce.

- Software and Hardware: Investing in the latest software development tools, servers, and networking equipment.

- Research and Development (R&D): Developing new digital solutions, AI platforms, or innovative service offerings requires ongoing investment in R&D. This is crucial for staying ahead of the competition.

- Mergers and Acquisitions (M&A): Tech Mahindra often acquires other companies to expand their service offerings, enter new markets, or acquire specialized talent. These are major, strategic investments.

- Investments in Startups: They might invest in promising technology startups to gain access to new technologies or innovative business models.

- Brand Building (Long-Term Campaigns): Similar to Bajaj Finance, while day-to-day marketing is a working capital expense, large-scale brand building campaigns are longer-term investments.

- Employee Training and Development (Strategic Programs): While routine training is a working capital expense, large-scale programs focused on upskilling employees in new technologies (like AI or blockchain) are strategic investments in human capital.

4. Working Capital Example #4: Britannia Industries

Britannia Industries! This is a classic FMCG company. Let’s look at what constitutes the working capital works for these types of companies:

- Raw Materials (Wheat, Sugar, Milk, etc.): This is a huge part of their working capital cycle. Britannia needs to buy massive quantities of raw materials to produce its biscuits, bread, and dairy products. Managing these purchases efficiently, negotiating favorable prices with suppliers, and ensuring a steady supply chain are crucial.

- Packaging Materials: Biscuits need wrappers, bread needs bags, and dairy products need cartons. These packaging materials are a significant expense and a key part of their working capital.

- Manufacturing Costs: This includes the costs of running their factories, including electricity, labor, and maintenance.

- Distribution and Logistics: Getting their products from the factory to the stores is a complex and expensive operation. They need to manage a vast network of distributors, warehouses, and transportation vehicles. Optimizing their logistics network is key to minimizing working capital needs.

- Marketing and Advertising: Britannia spends a significant amount on marketing and advertising to promote its brands and drive sales. This includes television commercials, print ads, online advertising, and in-store promotions.

- Inventory Management: Managing inventory is critical for an FMCG company like Britannia. They need to ensure they have enough products on the shelves to meet consumer demand, but they also need to avoid holding too much inventory, which ties up working capital and increases the risk of spoilage or obsolescence.

- Receivables (from distributors and retailers): Britannia sells its products to distributors and retailers, who then sell them to consumers. They need to manage the credit terms they offer to these distributors and retailers and ensure they are collecting payments on time.

For companies like Britannia, efficient supply chain management and inventory control are absolutely essential.

They need to have a very good understanding of consumer demand patterns and be able to adjust their production and distribution accordingly. The more efficiently they can manage these processes, the lower their working capital needs will be.

I would also want to see that they are investing in technology to improve their supply chain visibility and optimize their inventory levels. They should be using data analytics to improve efficiency and optimize pricing.

5. Planning For Working Capital is a Continuous Process

This about it, How companies plan for their working capital? I mean, How they source funds? Do they need to plan for the working capital for the whole year or they do in daily, weekly, monthly, quarterly, etc basis?

Working capital planning is a continuous process, not a one-time event.

A company’s CFO will operate on rolling forecasts. They will typically review their cash flow projections on a weekly and monthly basis, with a broader annual outlook tied to the budget.

Working capital funding sources are a mix.

- Ideally, company will use internally generated cash flow from sales.

- However, depending on growth plans or seasonal fluctuations, they might tap into a revolving credit line with their banks. It acts like a safety net for short-term needs.

- For larger, more predictable working capital needs (like a major inventory build-up for the festive season), companies negotiate short-term working capital loans.

6. How To Interpret Working Capital?

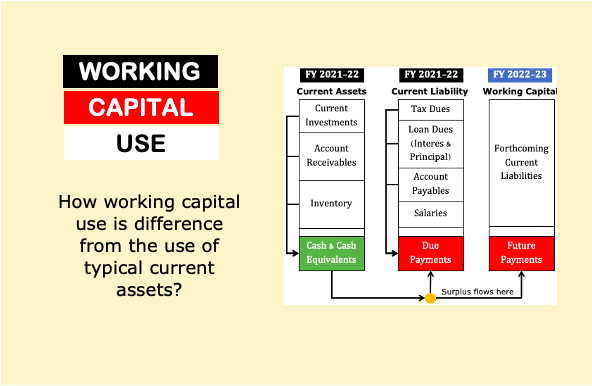

Working Capital = Current Assets – Current Liabilities.

Because the formula for working capital is such, people often interpret working capital wrongly. They think, after paying for all current liabilities, the “current assets” (which can be inventory, cash, account payables) that are left with the company is called working capital, right?

Not quite right. It’s a common misconception. After paying off all your current liabilities, what is left with are still just current assets (cash, inventory, receivables). Working capital is the net figure you get before paying those liabilities, calculated as Current Assets minus Current Liabilities.

Working capital is more of an indicator of financial health than a specific leftover pile of current assets.

6.1 Hypothetical Example: A Juice Stall

Imagine you have a juice stall in a market place. Below are the details of your business

- Current Assets: You have Rs.5,000 worth of lemons, Rs.2,000 worth of sugar, Rs.1,000 cash in your cash box. People also owe you Rs.500 for lemonade they bought yesterday (accounts receivable). This way, your total Current Assets = Rs.8,500

- Current Liabilities: You owe your mom Rs.1,500 for borrowing her table. You have also to pay your little brother Rs.500 tomorrow for helping you set up the stand (accounts payable). Total Current Liabilities = Rs.2,000

Applying the Formula:

Working Capital = Current Assets – Current Liabilities

Working Capital = Rs.8,500 – Rs.2,000 = Rs.6,500

How To Interpret This Working Capital?

You’re thinking that after you pay your mom Rs.1,500 and your brother Rs.500 (your current liabilities), the remaining lemons, sugar, cash, and receivables are your working capital. But that’s not quite the right way to see it.

The Rs.6,500 working capital figure represents the cushion you have to work with before you pay those liabilities.

It tells you how much “extra” liquid resources you have available to keep buying lemons, sugar, and running your business.

We must differentiate between the formula of working capital what working capital actually represents. Think of it like this:

- The formula simply calculates how much money would be available to run the business in the short term if the company converted its current assets to cash and paid off its short term debts.

- While, the working capital is a calculation that tells you about the company’s short-term financial health before those liabilities are paid.

6.2 Hypothetical Example: River Analogy

Think of a business as a river.

- Water Flow (Sales): The water flowing into the river represents your sales revenue.

- Obstacles (Costs): Rocks and dams in the river represent your costs (raw materials, salaries, etc.).

- River Depth (Working Capital): The depth of the river at any point represents your working capital.

What Working Capital Tells Us?

A deep river (high working capital) means the river will flows smoothly, even with some obstacles. A high working capital business can easily buy more supplies, pay the employees, and handle unexpected expenses without disrupting the flow of business.

A shallow river (low working capital) means the river flow is to susceptible to the obstacles. Even small obstacles can cause disruptions. The business might struggle to buy enough supplies, pay the employees on time, or handle unexpected expenses. Here, as the working capital is too low compared to the obstacles (cost of operation), it can slow down the business and even cause it to dry up.

Negative working capital is like a dry riverbed. Here, the business owes more in the short term than it has readily available (current assets). This is a dangerous situation that can quickly lead to financial problems.

7. The Higher is The Working Capital The Better?

Generally speaking, a reasonable level of working capital is important for smooth operations. But there’s a point of diminishing returns. Beyond that point, excess working capital becomes a drag on performance.

Suppose a company has a huge pile of cash in its bank account. The cash pile is so high that, though the net profit margin of the company is high (say 65%) but its return on asset is only 1%.

For such companies, the working capital number will be very high, right? But the bigger question is, is it a good business indicator where a company has huge cash (large working capital), high margins, but ROA is too low?

This business is not necessarily in a good position. Here’s why:

- Idle Cash is a Drag: Cash sitting idle in a bank account is not generating returns. While it boosts working capital and current ratio, it’s a missed opportunity. The company is essentially being inefficient with its assets. It’s like having a powerful race car sitting in your garage instead of on the track.

- Low Return on Assets (ROA): This is the key indicator. ROA measures how efficiently a company is using its assets to generate profit. A low ROA, despite high profit margins, suggests the company is not effectively deploying its assets (including that huge cash pile) to create value.

- Working Capital is Artificially Inflated: The high working capital is primarily due to the massive cash balance, not necessarily due to efficient management of inventory, receivables, and payables. It’s a distorted picture.

Why This Might Be Happening (and what it suggests):

- Lack of Investment Opportunities: The company may be struggling to find attractive investment opportunities to deploy its cash. This could be due to a mature industry, limited growth prospects, or a conservative management team.

- Inefficient Capital Allocation: Management may be hoarding cash instead of investing it in profitable projects, acquisitions, or R&D. This could be a sign of poor capital allocation decisions.

- Potential for Misuse: A large, unmanaged cash pile can attract unwanted attention and potentially lead to inefficient spending or even misuse of funds.

- Missed Opportunities for Shareholder Value: The company could be using the cash to buy back shares, pay dividends, or reduce debt, all of which could increase shareholder value.

Is This a Good Indicator?

No, it’s not a good indicator in isolation. While the company is financially stable, it’s likely underperforming its potential. Shareholders in such companies should ask the management what are the company’s plans for using the cash? Why they are sitting on such pile load of cash? If there are not able to employ that capital in its business, better will be return it to the shareholders as dividends.

In this example, a high working capital and current ratio are misleading indicator of a healthy business. Such companies are often low-growth companies.

Conclusion

Working capital, the difference between a company’s current assets and liabilities, is often misunderstood.

While a healthy level ensures smooth operations by covering immediate expenses like raw materials, salaries, and loan disbursements, “higher is better” isn’t always true.

Excessive working capital, particularly driven by large cash reserves as shown in the above hypothetical example can mask inefficiency.

Companies should look beyond the working capital formula and identify if the company is hoarding cash instead of the reinvesting it in potentially profitable projects. A company with huge pile of cash may lead to lower return on assets (ROA).

Instead, companies should strive for optimal working capital. It is the level that balances short-term needs with long-term growth, efficient operations, and maximized shareholder value.

Have a happy investing.