On August 5, 2024, the global stock markets experienced a significant correction, with the Dow Jones Industrial Average plummeting over 1,000 points. This downturn was primarily triggered by a dramatic selloff in Japan, where the Nikkei 225 dropped 12%, marking its worst day since 1987. This blog post aims to unpack the key factors behind this market correction and its broader implications.

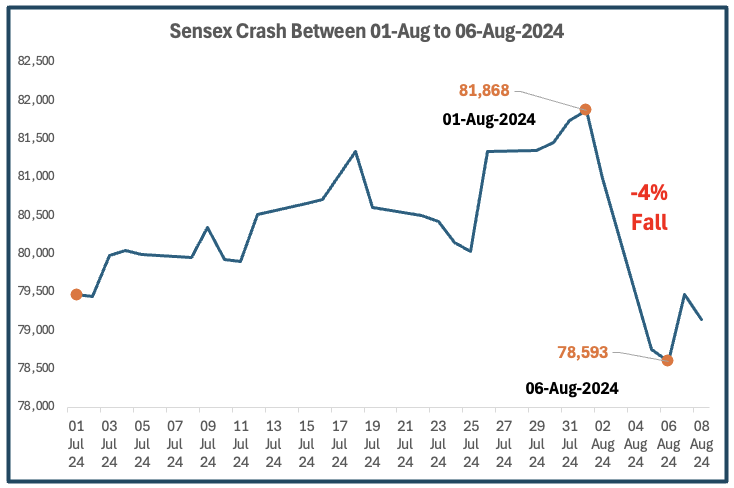

Even our Indian market (Sensex) corrected by about 3,270 points (-4.0%) between 01-Aug-2024 and 05-Aug-2024 (in just 5 days gap).

Topics

1. The Japanese Yen Unwinding

The main cause of the crash was Japanese Yen Unwinding. Allow me to explain it to you in a simple language. “Yen Unwinding” was the main cause that caused the sharp correction seen in Nikkei 225 and other major indices across the globe. In this section of my blog post, I’ll try to explain what is Yen Unwinding and why it caused the markets to correct.

Before today, I never heard the term “Unwinding” in the context of stock investing. Hence, I thought to learn about it first and then share my views for my readers.

So let’s jump into the topic.

To make the concept simple to understand, I’ll divide my explanation into the following three (3) sections:

- 1.1 Low Interest Rates in Japan & Borrowing

- 1.2 How This Trade is Executed

- 1.3 What is Unwinding of Yen

1.1 Low Interest Rates in Japan & Borrowing

For decades, Japan has maintained low interest rates to combat economic stagnation, deflation, and an aging population. This policy, known as quantitative easing, was adopted in the 1990s after the burst of Japan’s asset price bubble.

- Bank of Japan (BOJ): BOJ set interest rates near zero to stimulate borrowing and spending. For example, the BOJ’s key interest rate has been at or near zero since 1999.

- Deflation: Japan faced deflationary pressures, where falling prices led consumers to delay purchases, further stagnating the economy.

- Aging Population: It also contributed to economic challenges. The shrinking workforce and increasing dependency ratio (= Dependents / Working Population) put pressure on economic growth and government resources.

Despite these efforts, Japan’s economy has struggled to achieve consistent growth. It has lead to a prolonged period of low interest rates.

For traders, this created an attractive environment for trading. They borrowed in Yen at low rates and invested in higher-yielding assets abroad, particularly in U.S. Treasuries. The strategy is known as the carry trade. It involves borrowing in a currency with low-interest rates, such as the Yen, and investing in assets denominated in a currency with higher interest rates, like the U.S. dollar. After Covid, the interest rates in US have started to rise.

Traders take advantage of the interest rate differential. For example, a trader might borrow 1 million Yen at an interest rate of 0.1%. They will then convert this Yen to US dollars to purchase US Treasuries (government bonds). Currently, US bonds are offering a 2% yield.

The difference between the borrowing cost and the investment return generates a profit.

1.2 How This Trade is Executed

To execute this, traders typically use financial instruments such as forex swaps or forward contracts to manage exchange rate risk. These tools allow them to lock in the current exchange rate for future transactions, minimizing the risk of currency fluctuations affecting their profits.

In Japan, large financial institutions, hedge funds, and even individual investors have engaged in the carry trade. For example, the BOJ’s own data shows significant capital outflows into foreign bonds during periods when the Yen is weak, and global interest rates are more attractive.

This flow of capital into higher-yielding assets abroad has been a common practice, given Japan’s prolonged low-interest environment.

Simple Explanation of Forex Swaps and Forward Contracts

- Forex Swaps:

- Imagine you borrowed Rs.100 from Friend A, and you need to pay them back in euros in one month.

- You make a deal with Friend B today where you exchange Rs.100 for euros at today’s rate. In one month, you’ll swap back at the same rate.

- This way, you lock in the exchange rate now, so when you repay Friend A in euros, you know exactly how much it will cost you in dollars.

- Forward Contracts:

- Imagine you need to pay Friend A $100 in one month, but you only have Rupees.

- You make an agreement with Friend B today to buy $100 from him in one month at a set rate.

- This agreement ensures that when the time comes to pay Friend A, you know exactly how many Rupees you’ll need to get the $100, no matter how the exchange rates change.

In both these examples, these deals with Friend B (the forex swap and the forward contract) help you avoid surprises from changes in currency values. These trades enable you to know exactly how much you will need to repay Friend A.

1.3 What is Unwinding of Yen

The unwinding of the Yen refers to the reversal of these carry trades.

When Japan raises interest rates, borrowing costs in Yen increase. Assuming that the US Bond yields remains the same, increasing borrowing cost eventually leads to a reduced profitability of the carry trade.

In such a situation, traders start selling their foreign investments (in US Bonds) and convert the proceeds (sale amount in USD) back into Yen. These sale proceeds are then used to repay the loans.

This mass conversion, leads to increased demand for Yen, leading to a rapid appreciation of the Yen. This is called Yen unwinding.

The unwinding process can trigger significant market volatility. Why? Because when traders suddenly reverse their carry trades (selling off US Bonds and buying back the Yen), it can cause sharp fluctuations in both currency and US Bonds. This rapid shift can lead to drop in prices of US Bonds. It creates a ripple effect across global financial markets.

In short, Yen unwinding occurs when the conditions that made the carry trade attractive no longer exist. It forces the investors to exit their positions and leads to a sharp movement in currency and asset prices.

2. The Catalyst: Rising Japanese Interest Rates

Recently, Japan also started raising its interest rates to counter the persistent devaluation of the Yen.

This move was unexpected and caught many investors off guard. The higher interest rates aimed to curb inflation and stabilize the Yen. But they also made borrowing in Yen more expensive.

When interest rates suddenly start to rise, demand for Yen-linked-bonds will also rise. This will result in Yen’s rapid appreciation. It will then lead to significant currency exchange losses for those engaged in carry trades.

Hence, such traders opt for Yen Unwinding (as explained above).

3. The Danger of US Market Crash Due To Japanese Yen

A sudden appreciation of the Yen will force the investors to sell their holdings in US Bonds.

They will try to liquidate their positions to cover their losses. This will lead to a massive selloff of the US Bonds (which indirectly means selling in USD).

As the USD are getting converted back to Yen to repay loans, the demand for US Bonds will decrease. This push the price of bonds down and yields up. As USD is the global currency, any weakness in it makes people worry about the world economy. The investors tend to lose confidence and start selling their dollar-linked investments and they put the money in alternative investments like gold, real estate, or even Crypto.

The sell-off may spread like a panic and disturb the balance of the market worldwide. In simple terms, Yen strengthening can cause a domino effect and may the world market to crash.

Conclusion

The Nikkei’s 12% crash on August 4, 2024, can be attributed to the sudden unwinding of Yen carry trades. It was was triggered by rising Japanese interest rates. As Japan raised its rates to combat inflation and stabilize the yen, borrowing costs in Yen increased. This led traders to sell their foreign investments, particularly US Bonds, and convert the proceeds back into yen to repay their loans.

The mass conversion increased demand for yen, causing its rapid appreciation. While this should have caused a more pronounced impact in the U.S. market, the immediate effect was felt in Japan. This was due to the abrupt withdrawal of capital from Japanese markets. It significantly shook investor confidence and led to the dramatic selloff in the Nikkei.

The global financial system heavily relies on the stability and attractiveness of US bonds (& USD). The US dollar is the world’s primary reserve currency. If international investors start selling off US bonds in large volumes, it can lead to a decrease in bond prices and an increase in yields. This will create fears of a broader economic slowdown. A weakening dollar can undermine global economic stability, causing panic and selloffs in various markets.

The Sensex crash on August 4, 2024, was similarly linked to the yen unwinding process.

Related Topics:

What was Japanese Asset Price Bubble of 1990s?

In the 1980s, Japan was booming. The economy was strong, and everyone was optimistic. People believed that the prices of real estate and stocks would keep rising forever. Because of this, many borrowed money to invest in these assets. They were thinking they could easily pay it back as prices soared. Banks were also eager to lend, offered easy credit, and this only furthered pushed the bubble.

But by the early 1990s, things took a turn. The government, worried about the overheating economy, decided to raise interest rates to cool things down. This move made borrowing money more expensive, and suddenly, people could no longer afford to buy real estate or stocks.

Prices started to fall.

As prices dropped, panic set in. People rushed to sell their assets. It caused prices to drop even further. What was once seen as a surefire way to make money turned into a financial disaster. The bubble burst, and Japan’s economy suffered greatly.

Many people lost a lot of money, and the banks, which had lent out so much, were left with bad loans.

The Japanese economy struggled for years after, facing a period known as the “Lost Decade.” In this period, Japan’s growth was slow, and the country dealt with the consequences of the burst bubble.

This period serves as a reminder of what can happen when speculation and easy credit go unchecked.