Recently a person told me that his credit card company is offering a higher credit limit to him. He asked about the benefits of a high credit limit on credit cards. He was doubtful whether a high limit is beneficial or otherwise. I think many people face a similar dilemma. Hence I thought to write a blog on it.

What is the Credit Limit? A credit limit is the highest amount of credit a lender or creditor will lend you. The credit limit can vary depending on your credit score, income, and other financial information. It’s common for credit limits to be set on credit cards.

The credit limit on a credit card is the maximum amount of money one can borrow from the card issuer. When one uses a credit card to make a purchase, the amount of the purchase is deducted from the available credit limit. If one repays the amount they’ve borrowed, the available credit limit increases again.

If one exceeds the credit limit, the company may charge fees or penalties. It can also negatively impact the user’s credit score. It’s important to be mindful of one’s credit limit and avoid exceeding it at all times.

A high credit limit on a credit card offers several benefits. Some of them are increased purchasing power, the ability to earn more rewards, etc. It can also improve the credit utilization ratio, which is an important factor in determining your credit score.

However, it’s important to use your credit responsibly and avoid overspending.

Now, let’s discuss the benefits and drawbacks of having a high credit limit on credit cards.

Greater Purchasing Power

A high credit limit can provide greater purchasing power by allowing you to make larger purchases than you would be able to with a lower credit limit. With a higher credit limit, you can make big-ticket purchases such as home appliances, electronic devices, or airline tickets without having to worry about maxing out your card.

- Examples: A high credit limit can be helpful in many situations. It can be useful in emergencies, when one may need to make an unexpected and costly purchase. It can also be beneficial while planning a big trip or a long vacation. If the credit limit on the card is high, one can use it for all payments, big or small, making it a cashless and convenient experience.

- Peace of mind: Having a high credit limit can provide peace of mind. It gives financial flexibility to the cardholder as it can help to handle unexpected expenses. Carrying a high credit limit credit card can also give a sense of financial stability. It is especially true while managing rare or out-of-ordinary situations.

A high credit limit can give you the purchasing power you need to buy big-ticket items, whether you’re taking advantage of a sale or dealing with an unexpected expense.”

– Erin Lowry, author of “Broke Millennial Takes On Investing”

Improved Credit Utilization Ratio

This is my favorite benefit of having a high credit limit on credit cards. When I first realized this benefit, I was rather pleasantly surprised.

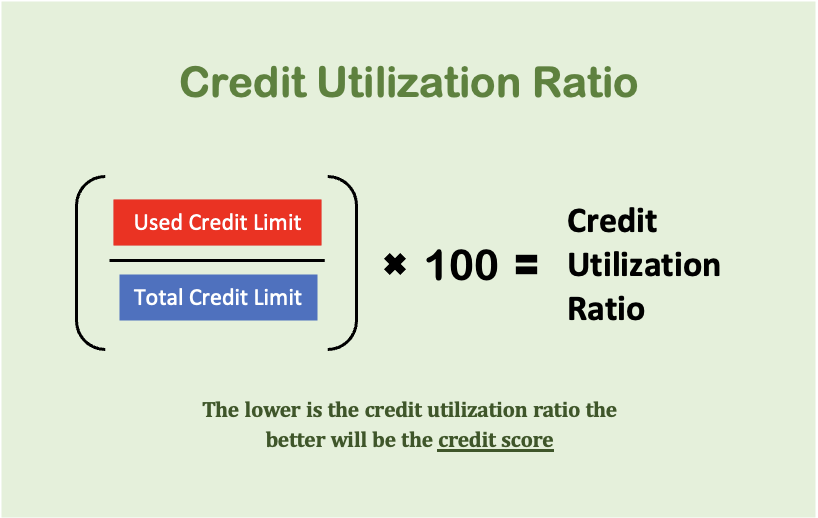

A credit utilization ratio is the amount of credit you are using compared to the amount of credit available to you. It is calculated by dividing your credit card balances by your credit limits. A high credit utilization ratio can negatively impact your credit score, as it indicates a greater risk of default.

- Credit Utilization: high credit limit can improve your credit utilization ratio by increasing the amount of available credit you have. If you have a higher credit limit and continue to use the same amount of credit as before, your credit utilization ratio will decrease. For example, if you have a credit card with Rs.5,00,000 credit limit and you purchase items worth Rs.45,000 each month using this card. In this case, your credit utilization ratio is only 9%. Now, if your credit limit is increased to Rs.10,00,000, the credit utilization ratio will further drop to 4.5%.

- Credit Score: The potential impact on your credit score is positive. A lower credit utilization ratio can lead to an improvement in your credit score. This is because it shows that you are using credit responsibly and not overextending yourself. A high credit limit can, therefore, indirectly contribute to a better credit score by helping to maintain a healthy credit utilization ratio.

As a general rule of thumb, it’s recommended to keep the credit utilization ratio below 30%. However, the lower your credit utilization ratio, the better will be the user’s credit score. I personally try to keep my credit utilization ratio below 10%.

“Your credit utilization ratio is a powerful indicator of your financial health, and a low ratio shows lenders that you know how to manage credit responsibly.”

– Beverly Harzog, credit expert and author of “The Debt Escape Plan”

Increased Flexibility

A high credit limit can provide increased flexibility in managing finances. With a high credit limit, you have access to more credit, which can be useful in a variety of situations. Here are a few examples:

- Emergency expenses: A high credit limit can provide flexibility in case of emergency expenses, such as medical bills or home repairs. You can use your credit card to pay for these expenses and then pay off the balance over time.

- Travel: A high credit limit can be helpful when traveling, as it can allow you to book flights and hotels without worrying about hitting your credit limit. It can also provide a safety net in case of unexpected expenses during your trip.

- Shopping: A high credit limit can provide flexibility when shopping for big-ticket items, such as electronics or furniture. You can use your credit card to make these purchases and then pay off the balance in the upcoming billing cycle.

- Business expenses: If you’re a business owner or freelancer, a high credit limit can provide flexibility in managing cash flow. You can use your credit card to cover business expenses and then pay off the balance when you receive payment from clients.

It’s important to use your credit card responsibly, even if you have a high credit limit. This means paying off your balance in full each month and not using your credit card to make purchases you can’t afford.

Using your credit card responsibly can help you maintain good credit and avoid falling into a debt trap.

Potential For Better Reward Points

Some credit cards in India offer higher rewards for users with higher spending limits. This means that if you have a high credit limit, you may be eligible for better reward points, such as cashback, discounts, etc.

Examples of reward programs that offer higher rewards for high credit limit users in India include the following:

- HDFC Bank Diners Club Black Card: It offers higher reward points on travel and dining for users with a high credit limit.

- American Express Membership Rewards Credit Card: It offers higher rewards for users who spend more than a certain amount in a given period.

The potential value of these rewards can be significant, especially if you use your credit card for everyday purchases and pay off your balance in full each month.

For example, if you earn 2% cashback on all your purchases and spend Rs. 20,000 per month on your credit card, you could earn Rs. 4,800 in cashback rewards over the course of a year.

However, it’s important to note that the value of rewards programs can vary, and it’s important to choose a credit card with rewards that align with your spending habits and financial goals.

Drawbacks of Having A High Credit Limit

While having a high credit limit on your credit card can have its benefits, there are also risks and drawbacks. One of the main risks is the potential for overspending and accumulating debt that you may be unable to pay off. It will not be wrong to refer to the high credit limit on credit cards as a double-edged sword.

- Overspending: It’s important to use your credit card responsibly and avoid overspending. The interest rates charged on credit cards are huge. If a normal personal loan costs an interest rate of 12% per annum, the credit card will charge 36% per annum on the unpaid balance. Hence, it’s also important to avoid missing payments or making late payments.

- Negative Credit Score: High credit limit may trigger overspending. Due to this, the cardholder may be unable to clear all dues within the credit-free period. This can negatively impact the credit score. Lower scores will make it harder to get approved for loans in the future.

How To Manage The Risks Associated With High Credit Limit?

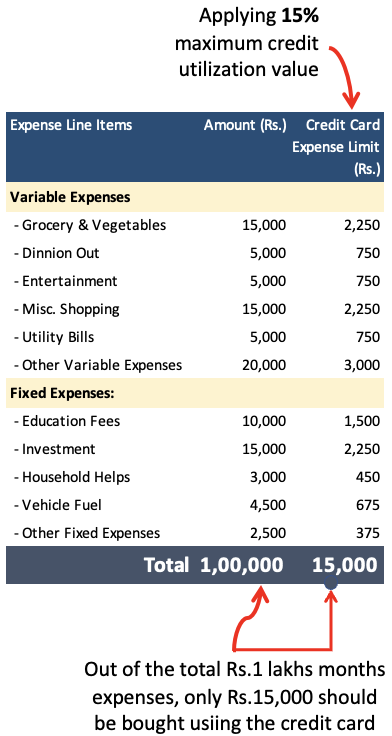

To do this effectively, one must monitor their monthly spending on credit cards with respect to a budget. How one can do it? Write your expense budget for a month. Suppose your total budget is say Rs.1,00,000 each month. Note this value, we will use it later.

Now, supposing you have a credit card whose credit limit is Rs.1,50,000. The idea is to keep the credit utilization ratio below 10%. It means, in a month you cannot spend more than Rs.15,000 using your credit card.

We have two numbers now. First is your monthly expense budget of Rs.1,00,000 and the second is the maximum spend limit on a credit card which is Rs.15,000. It means you cannot use your credit card for more than 15% of your total monthly expenses. This becomes your maximum credit utilization value.

Now, let’s use this 15% maximum credit utilization value to help us manage the risks of having a credit limit. Assuming, the break-up of your monthly expense looks like this:

Out of the total Rs.1 lakhs monthly expense, only Rs.15,000 should be bought using a credit card. Furthermore, the credit card usage limit of Rs.15,000 is proportionally allocated to each expense line item. Like in our above example, on the expense head of groceries and vegetables, you can spend only Rs.2,250.

This is a way of linking credit utilization with your monthly budget. Using this thumb rule, if the expense budget is well made, there are near zero chances of overspending no matter how high is one’s credit limit.

Conclusion

Having a high credit limit on your credit card can provide many benefits, including greater purchasing power, improved credit utilization ratio, increased flexibility, and the potential for better rewards. However, it’s important to use credit responsibly and avoid overspending.

It is important to ensure that you can manage your credit card debt. If you are somebody who has less control over the overspending urges, better is to keep the credit limit as low as possible. Even better will be to use debit cards instead of credit cards.

But for people who have good control over their spending habits, the benefits of a high credit limit on their credit card are a blessing in disguise.

A lower credit utilization ratio will keep improving their credit scores. Higher credit scores will continue to fetch them even higher credit limits. It becomes a chain reaction that goes on fuelling your credit limit and credit scores over and over again.

Have a happy investing.

Suggested Reading:

![Home Construction Loan: What is The Process To Get Such Loans [India]](https://ourwealthinsights.com/wp-content/uploads/2013/08/Home-Construction-Loan-image.jpg)