Summary:

- Let’s explore whether you can live a normal life in India without a credit score, highlighting how daily expenses can be managed without one, but major goals like buying a house or traveling abroad often require a credit history for smoother, cost-effective outcomes.

Introduction

Why everyone keeps talking about credit scores? You’ve got your savings, your income is decent, and you’re managing just fine with UPI and debit cards. Why bother with a credit card or a loan, right? I used to think the same way, why build a credit history if I don’t need to borrow money? But the more I looked into it, the more I realized the system isn’t always kind to those without a credit score.

So, I thought to blog about it explaining what I personally think on this topic. See, what you can learn about debt from Robert Kiyosaki.

I’m not an advocator of living a life from one loan to another. I’ll preferably stay debt free, always. But we also need to think smart. As we need “emergency fund” it is equally important to maintain a credit rating for times if we need it.

So, let’s figure this out, Can we really live a normal life without a credit score?

1. What’s a Credit Score, Anyway?

Let’s start with the basics. A credit score is a number, usually between 300 and 900, that shows how reliable you are with money.

In India, CIBIL is the big name here, though there are others like Experian.

Banks and lenders use this score to decide if they’ll give you a loan or a credit card. The higher your score, the better your chances of getting good deals.

But there is a catch in our system? You only get a score if you’ve borrowed money before, like using a credit card or taking a loan.

If you’ve never done either, your credit history is blank. No score, no record. Sounds fine if you don’t want to borrow, right? Well, not always.

2. Day-to-Day Life Without a Credit Score

What’s your daily routine like?

You buy groceries online, order food on Zomato, book an Ola/Uber ride, or shop on Amazon. Most of these things don’t need a credit score. UPI is a game-changer in India. Paying through apps like Google Pay or PhonePe is quick and easy. Your debit card works too, whether it’s for movie tickets on BookMyShow or clothes from Myntra.

I’ve been there, paying for everything with my savings. It feels good to know I’m not in debt.

And honestly, for most small purchases, you don’t need a credit card. It is a fact.

Even big expenses, like a new phone or a laptop, can be covered if you’ve saved up (and that is also a preferable way manage your finances).

So far, so good. But life isn’t just about daily expenses, is it? It has more shades than salary, income, and expenses.

Let’s see what else we have in the shades of grey. A couple of examples where you will see how credit matters.

3. Buying a House – It’s A Big Dream

Consider this as an example.

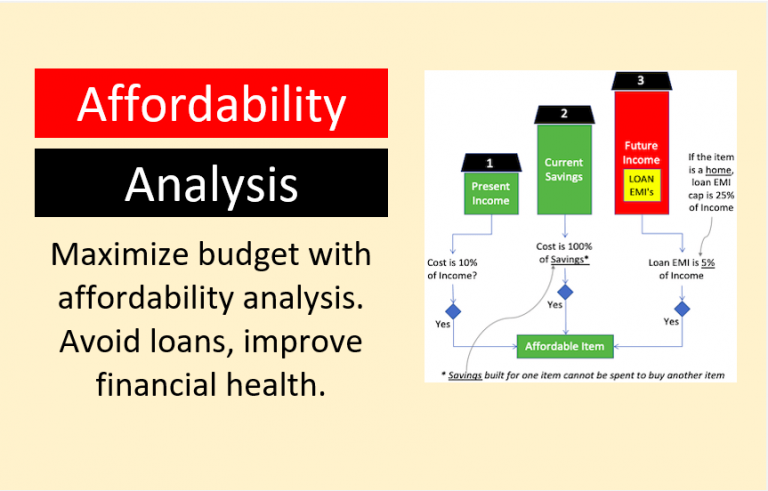

You’ve found the perfect flat in Mumbai. It’s got a great view, it’s close to work, and you can afford the monthly EMI. But there’s a catch, you can’t pay the full price upfront. You need a home loan. You will not like to delay the purchase as prices of flats in Mumbai are growing too fast. Moreover, you want to eliminate the uncertainity of living on a rented property.

This is where things get tricky.

Banks like SBI, HDFC, or ICICI rely on your CIBIL score to approve loans. No score? They don’t know if you’re trustworthy. Even if your salary is solid, they might reject your application.

If things go in your favour, they’ll approve your loan but charge higher interest rates as compared to your colleague whose credit score is 750 or higher.

This is a situation where you can see, a good credit score can save you lakhs on a home loan because you get lower rates. Think you are getting 8.5% instead of 8% that you colleague is getting because he has a good credit history. For a one crore home loan, for 20 years, at 8.5% interest, you will pay about five lakhs more than your colleague.

| Description | Your Colleague | You |

|---|---|---|

| Loan Amount | 1 Crore | 1 Crore |

| Loan Tenure (Years) | 20 | 20 |

| Loan Interest | 8% | 8.50% |

| Loan EMI | 54,369 | 56,409 |

| Total Interest Paid in 20 Yrs | 30,48,560 | 35,38,160 (~ 5 Lakhs More) |

Sure, some smaller lenders or NBFCs might skip the credit check and focus on your income. But their terms aren’t always great. Higher rates, more paperwork, bigger down payments. A better bet will be to maintain a credit score and life will look less hassle free. Read here about how to build your credit score from zero.

4. Traveling Abroad: A Reality Check

Now, let’s say you’re planning a trip to Dubai.

You’re excited, Burj Khalifa, desert safaris, and all other excitements. You load a prepaid forex card with dirhams and figure you’re set. After all, it’s like a debit card, right?

In most case, this Forex Card will work to pay your hotel bills, car rentals, local shopping, etc. I know about a about a forex card offered by BookMyShow it works well for established destinations like US, Europe, USE (Dubai), Australia, UK, etc. I’ve also heard about HDFC Bank’s Multi-currency Platinum card which works swiftly on big destinations.

These cards can also be used at ATM’s to withdraw cash if requried.

To loan these card with your preferred currency like Dhiram, USD, Euro, etc, you can do it from your linked bank account. The point it, in destinations where prepaid Forex Card are established, it works smooth without any issues.

But not very destination may have the payment system favouring a forex card. In such cases, it is better to pre-pay for your trips, activities, bookings from India itself, and carry the forex card as your back-up. You can also keep cash if you are not so sure. This will further lower your dependency on credit cards.

Consider this, when you are travelling abroad you are far away from your home country. In those destinations, things may not work as you have planned. In such times, having a Visa or Mastercard credit card in your wallet feels like an insurance. If something unexpected happens, like a medical emergency or a missed flight, a credit card gives you breathing room.

Your forex card is limited to what’s loaded, and debit cards can be unreliable in a few destinations abroad.

I’m not saying you can’t travel without a credit card, but it’s like walking a tightrope without a safety net.

5. Credit Scores Required In Other Placed

You’re not buying a house or traveling abroad. You’re just living your life in India.

Surely, you’re fine without a credit score, right? Even in our own country, there are some surprising places where a credit history matters.

- Renting High End Houses: These days, in metro cities like Delhi or Mumbai, renting a house may required your credit history. So owners will check your credit history before leasing the home to you. Though this trend is not so common in India. It’s more of a US and Europe thing, but as rental costs go up, this trend will pick-up. Landlords or platforms like Housing.com sometimes check your CIBIL score, especially for high-end flats. If you do not have a credit score, you might need to pay a bigger deposit.

- Insurance: Some companies are starting to use credit scores to set premiums for car or health policies. A better score could mean lower costs.

- Business Loan: Some business loans require a personal credit score. If you ever want to start a side hustle or a small company, banks will look at your CIBIL report. No history could mean tougher terms or no loan at all.

6. Why I Changed My Mind About Credit Scores

I’ll be honest, I used to think credit scores were a trap.

Why borrow money just to prove I can pay it back? But the more I looked into it, the more I saw the system isn’t built for cash-only folks.

Now I have realized that credit score is a good data point to maintain. Moreover, you don’t need to go into debt to build a credit history. It’s actually pretty simple.

Get a credit card. Use it for small things, like your monthly groceries or a Zomato order. Pay the full bill on time every month. No interest, no debt. Your CIBIL score starts to grow, and you’re showing banks you’re responsible.

It’s not about spending more; it’s about playing the game smart. If you have a control, maintaining a credit card, hence your credit history is a good thing.

I got my first credit cards from Axis Bank, and then from Citi Bank in 2006-1007. My Citi Bank card (which is now Axis Card) is still my primary card. This one card has my whole credit history on it. The older is your credit card, the better it serves your credit history.

7. The Cost of Skipping a Credit Score

Let’s get real for a second.

You can live without a credit score in India. Lots of people do, especially if they avoid big purchases or stick to smaller towns. Your savings and UPI keep you going for daily stuff. But the moment you want something bigger, a house, a smooth trip abroad, or even a fancy rental, you will hit a roadblock.

Without a credit score, you’re working harder than you need to. Higher loan rates, bigger deposits, rejected applications, they add up.

It’s not just about money; it’s about time and stress. Why make life tougher when you can build a score without owing a single rupee in interest?

8. So, What Should You Do?

I’m not here to push you into debt. But all I want to say that you need to build and maintain a healthy credit score.

You must see a credit score as a tool, not a burden.

It’s like a key that unlocks better options, cheaper loans, easier rentals, smoother travels.

You don’t have to use it every day, but it’s nice to have when you need it.

If you are not sure how to proceed, try this.

Apply for a basic credit card from a bank you trust. If they are not offering you the card, tell them that you are ready to take a fixed deposit linked credit card. Yes, go to this extent and take the card. Use it for small, regular expenses. Pay it off every month.

Now, check your CIBIL score after say 6 months, you’ll be surprised how fast it grows.

You’re not falling down the debt trap; you’re just making sure the system works for you, not against you.

Conclusion

So, can you live a normal life without a credit score in India?

Yes, you can, for the most part.

Your daily needs are covered, and your savings give you freedom. But normal doesn’t always mean easy.

The system rewards people with credit histories. Whether it’s for a home loan, or a trip to Dubai. Skipping a credit score pinch you during such times. I’ll say, if you can build your credit history without spending anything extra, why not try it.

I used to think I didn’t need a credit score. Now, I see it as a small step that makes life smoother. For me, my credit score is tool that I use to keep my loan-costs low if I need it someday.

What is your perspective about credit score? Please drop your comment below.