Summary:

- This article guides us on using credit cards wisely by paying bills in full, building a strong credit score, earning rewards without overspending, and treating the card as an emergency tool, all while debunking myths about interest payments. Jump to the conclusion

Introduction

You’ve got a new credit card in your wallet and you are thinking how to use it wisely. Credit cards can feel like a shiny new toy. They promise convenience, rewards, and that “I also have it” vibe when you swipe. But the same shiny credit card will become disadvantageous if not used wisely.

The credit card is only as good as how you use it. For a middle class person, using credit card wisely can make or break the financial health.

So, let’s talk about what it means to use your credit card the smart way without falling into a debt trap.

Ready? Let’s dive in.

Table of Contents

1. What Does “Using a Credit Card Wisely” Mean?

When I first got my credit card, I thought it was free money. It is definitely not free money. Instead, it can become one of the costliest loans you will ever take.

Using a credit card wisely means treating it like a tool, not a magic wand. It’s about paying your bill in full every month to avoid interest. It’s about using your card to boost your credit score, so banks trust you more when you apply for a home loan. And yes, it’s also about earning those sweet reward points on every purchase.

But there is a huge catch of using the credit card. If not used with clarity, it can really make you overspend.

You’ve got to stay disciplined. One missed payment, and you’re in trouble.

Sounds simple, right? Let’s get into more details how to think about credit cards so that it can be used wisely.

2. A Few Basics About How Credit Cards Function

Before we get to the “wise” part, let’s talk about how credit cards actually work. I wish someone had explained this to me when I started.

Every time you swipe your card, you’re actually taking a loan from the bank or card issuer.

It’s like taking a small loan for that new phone or dinner at your favourite restaurant.

But you don’t need to pay the interest on this loan right away. Along with this loan, the card issuer (the bank) also gives you a grace period (credit free period).

The credit free period can range from 10 days to 40 days depending on when you are using your card from your credit card billing date. All credit card have their own fixed bill generation dates. Credit free period is the time the banks give us to pay back the borrowed money without interest.

Once you get your bill, you have the following options:

- Pay the minimum amount (which is generally 5 to 10% of your total bill value).

- Pay part of it, or

- Pay the full amount.

Here’s where people get confused and start to take things easily.

Paying only the minimum or a partial amount might seem tempting, especially if you’re tight on cash. But it’s a trap. The unpaid amount starts piling up with interest, and trust me, you don’t want that.

When you take a personal loan, it will charge your about 14% per annum interest. But a credit card debt will cost you about 36% per annum.

So, wise usage means paying the full bill, every single time.

This habit will not only keep you debt free, but will also help you built a high credit score.

3. Where Things Start To Go Wrong With Credit Cards

We actually don’t plan to mess up with our credit cards, but life happens.

Maybe you overspent during Diwali or thought, “I’ll pay it off next month.” That’s when things can spiral. If you stop paying your bill in full, the bank slaps on interest, and credit card interest rates are no joke. They can cost you somewhere between 34% to 36% per year.

Let me put that in perspective. If you owe Rs.50,000 and don’t pay it off, that amount could double in just two years. An excellent multibagger stock can double every 3.5 years, but see credit card debt doubles even faster.

And it’s not just about the money. Missing payments or paying only the minimum hurts your credit score. A low credit score means banks see you as risky.

Now, when you want a car loan or a home loan, you’ll either pay higher interest or your loan application will get rejected.

So, where do we need to get wise? It’s simple, control your spending and never let your bill roll over with interest.

I know, it is easier said than done, but I’ve got some practical tips coming up. Continue reading.

4. Practical Ways to Use Your Credit Card Wisely

Now that we know the stakes associated with a credit card usage, let’s talk about how to actually use your credit card wisely. What I’m sharing here are things that I have read and also experienced in last 15 years of credit card usage:

- i. Overspending Alert: Before you swipe your card, ask yourself, “Can I pay for this with my debit card instead?” If the answer is no, it’s a red flag. It means you’re probably spending beyond your means. I used to justify buying fancy gadgets on my credit card, thinking, “I’ll figure it out later.” But, in reality, I didn’t have the money for it. If you can’t afford it with your debit card or UPI, maybe it’s time to rethink that purchase. And if you find yourself compulsively buying things on credit, its time to throw away your credit card.

- ii. Building Credit Score: Wise credit card usage will build your credit score. Do not use your credit card as if its your money. It is not, every time you swap your card, you’ve borrowed the money which you must pay in next 30 days. A better thought process should be, think about credit card as a tool that is helping you to build a good credit score. That’s it, it is a tool for you, not a money-bank.

- iii. Use It For Reward Points: Who doesn’t love freebies? Many credit cards offer points for every rupee you spend. You can redeem these points for flight tickets, gift vouchers, or even cashback. But in lure to earn more reward points, people can sometime overspend. I once bought an expensive pair of shoes just to hit a reward milestone. Guess what? On a Rs.20,000 purchase, I just got 200 points. Actually, the points weren’t worth the stress of paying off that bill. These days, I use my card for regular expenses like groceries or fuel. But always loop back to that debit card question (point #i) : Can I afford this?

- iv. Note All Expenses: Every month, grab your credit card bill and a highlighter. Mark all non-essential items, like Starbucks coffee, movie tickets, Amazon purchase. Add them up. If non-essentials make up more than 60% of your bill, it’s time to slow down. Aim to keep non-essential spending below 30%.

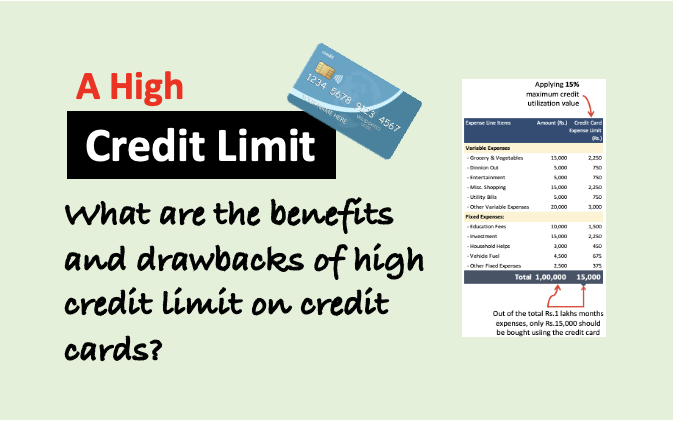

- v. It is Your Emergency Fund: Consider your credit card as a safety net, not a shopping spree enabler. Just because you have a Rs.15 lakhs credit limit doesn’t mean you should spend it all. Treat your card like an emergency fund. Use it only when you absolutely need it (for non-compromisable, unplanned expense).

5. Do You Need to Pay Interest to Keep Your Card?

I was chatting with a friend recently, and he said something that made me pause. “If I don’t pay interest, won’t the bank take my card away, someday? Why would they let me keep it if they’re not making money?”

I’ve heard this before, and it’s a big misconception. Let me clear it out for you.

Credit card companies make money even if you pay your bill in full. Every time you swipe your card, the merchant (like your grocery store vala) pays a fee, usually 1% to 3% of the transaction amount. This adds up fast.

For FY 2021–22, it was reported that the total transaction spend through credit cards was INR 11.5 trillion (more details here). That’s a lot of transactions, and banks are getting a cut of every one. Plus, they earn from annual fees, foreign transaction charges, and other services.

So, don’t worry, paying your bill in full doesn’t make you a “bad customer.” It makes you a smart one.

And it fits perfectly with using your card wisely because it frees you from the fear of “owing” the bank interest.

You’re already helping them earn (with every swipe of yours). Now, focus on helping yourself save.

Conclusion

Using a credit card wisely isn’t rocket science, but it takes discipline.

- Pay your bills in full and on time to avoid interest and build a strong credit score.

- Use your card for regular expenses to earn rewards.

- Don’t overspend just for points.

- Keep an eye on non-essential spending.

- Treat your card as an emergency backup, not a free pass to shop.

- And don’t fall for myths about needing to pay interest to keep your card, banks are making money off you anyway.

I’ve had my share of credit card mistakes, but I’ve also seen the benefits when I got it right.

A good credit score helped me with lower rate negotiation when I was buying my house.

Spending on essential purchases and earning reward points for that is like a bonus.

Got any credit card tips of your own? Drop them in the comments section below, I’d love to hear it from you.

Have a disciplined spending.