Summary Points:

- Saving money enables future investments.

- Retirement savings ensure financial independence.

- Emergency funds cover unforeseen expenses.

- Debt and overspending hinder wealth creation.

- Budgeting and tracking boost savings.

- Investing locks savings for growth.

- Self-discipline drives effective saving habits.

- Simple practices build substantial savings.

- Debt management saves long-term costs.

- Tax planning maximizes salary savings.

Introduction

Experts write billion words about investment. But it is surprising that how little is written about how to save money (comparatively).

In fact, it is hard to find a comprehensive guide about “savings” on internet.

But on the other side, the topic of investment is widely covered.

It is true that investment of money is more important than savings. But it is also true that, without savings there will be no investment.

Hence, I’ve decided to publish this detailed guide on saving money.

Table of Contents

- 1. Why to save money?

- 2. How to Start Saving Money?

- 3. What Prevents Wealth Creation?

- 4. Importance of Locking The Savings (Investing)

- 5. Tips on How to Save Money in India From Salary

- – 5.1 Save Money: By Self Discipline

- – 5.2 Save Money: By Simple Practices

- – 5.3 Save Money: By Managing Debt

- – 5.4 Save Money: By Investing

- Conclusion

1. Why to save money?

We must save because we cannot spend every dime of our salary. Why?

Because in addition to current needs, future financial goals are also a priority.

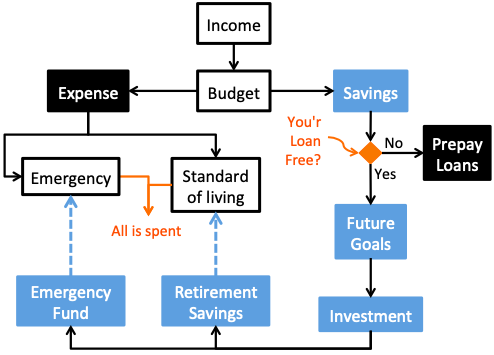

Check this flow chart. What will happen if you’ll not save?

There will be no loan prepayment, no future goal management, no investment, no retirement savings, and no emergency fund creation etc.

Building retirement savings and emergency fund creation is a necessity of life, which one cannot missed.

To build these future-funds, one must first save money and then invest it.

This is the only way to do it. If not done, retired life will be tougher.

[Note: I’ve retired from my job at the age of 40 and living my dream. All this happened because of saving and investing]

2. How to Start Saving Money?

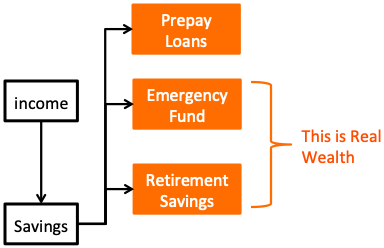

One must start saving money with an objective. What’s the objective?

Generally speaking, saving and investment of money is required for long term wealth creation.

But wealth creation is a goal which is too broad (it’s not specific). Hence better will be break it down into two components:

- Retirement Savings: What is retirement saving? It is that fund which will support your expenses (standard of living) even when there is no job/work. The bigger is the retirement savings, the more financially independent is the person. Read: How to be financially independent?

- Emergency Fund: What is emergency fund? It is that fund which takes care of unforeseen future expenses. Main components of emergency fund consists of cash and insurance. Read: About emergency fund.

So, start saving money with an overall objective of wealth creation.

How to create wealth? By building retirement savings and emergency fund. Read: How much is enough to retire?

But before one can build wealth, it is good to be aware of a precondition (kind of a limitation).

3. What Prevents Wealth Creation?

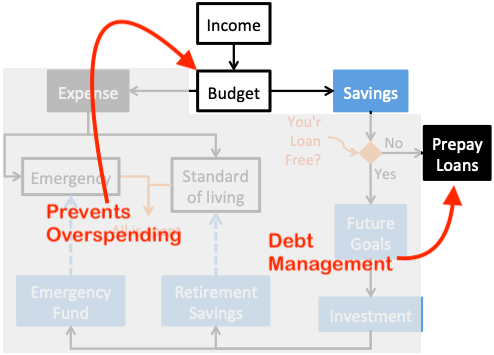

The biggest deterrent of wealth creation is “debt“ and “overspending“. How to manage it?

Use these two simple logics:

- Debt Management: Suppose your monthly loan EMI is Rs.30,000. Pay at least 10% of your EMI (Rs.3,000) as a prepayment. From where the money will come for prepayment? From savings. Read: Loan prepayment to reduce EMI.

- Overspending: Why people overspend money? This is mainly done in ignorance. If people can realise that they are overspending, they’ll stop it. How to make oneself realise the mistake of overspending? By resorting to budgeting and expense tracking. [Read: 50 30 20 Rule of budgeting, and Track expenses in Excel.]

These two rules at tandem work like a magic. How?

Budgeting and expense tracking churns out more savings. These savings can then be used for prepayment of loans.

When there will be no loan left for prepayment, all savings can then be used for building retirement savings and emergency fund.

[Suggested Reading: How to get out of salary dependency?]

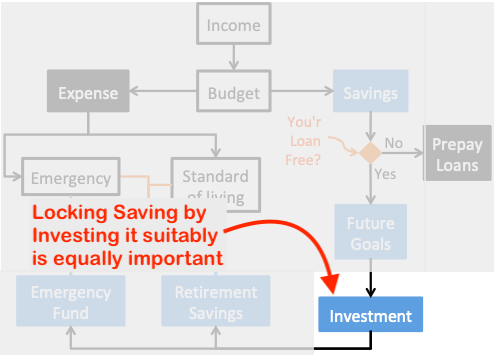

4. Importance of Locking The Savings (Investing)

Managing ownership of Rs.5,000 is a lot easier than of Rs.100,000. How?

Understanding this small phrase will explain a lot about saving management.

Saving Rs.5,000 is easier: It is easy not because the value is small, but because we cannot do much with an amount like Rs.5,000.

But by the time we accumulate Rs.100,000 or more as savings, we start getting new ideas of spending it.

Saving Rs.100,000 is tougher: We start getting ideas of why the new iPhone-10 is the best phone ever. How that new LED TV will change our lives….

The point I am trying to make is this, starting to save is easy, but hurdle comes later.

“The main challenge is to keep those savings intact.”

How to do it? By Investing the money. This locks our savings.

Investment keeps our money away from us. This way, it does not get spent on trivial things.

Investment also yields returns (@ 7% p.a. from Bank Deposits).

So now we know that, a combination of saving and investment is essential.

Now it’s time to see the real saving tips which can change our lives.

5. Tips on How to Save Money in India From Salary

Frankly speaking, there are no limitations of ideas when it comes to saving money.

People use their own unique ways to save money in day to day lives. I will list down here few of my person ways of saving money.

So let’s start with my tip number one:

#5.1 Save Money: By Self Discipline

More money can be saved by keeping oneself self disciplined.

Yes, it is true. Just because we do not have control on our spending urges, we save less.

Here are few saving tips which I have personally used to greatly benefit from it:

- #1. Pay Yourself First: As company’s pay salary to their employees, just like that, you can also pay yourself each month. As soon as the salary is credited into your account, transfer a portion of it to your savings account. Suppose you have budgeted 15% of your income as savings. Pay yourself this amount on first date of every month. Read: The concept of pay yourself first.

- #2. Give Yourself Pay Rise: Your salary rise should also reflect on “Pay You Self First” amount. When we get a pay rise, a proportional rise in standard of living (expenses) is understandable. But a proportional rise should also reflect in ‘pay yourself first’ column. Say your last year salary was $100, and your were paying self $15. If your salary grew by 20% (to $120) then you must also increase the “pay yourself” to $18. This will further add to our savings. Suggested Reading: The concept of passive income.

- #3. Pay Yourself Hypothetical Loan EMIs: Even though you are not buying a home today, practising EMI payments can be a good idea. How to do it? Generally speaking, a person can pay EMI’s equivalent to 30% of income. Suppose your net income per month is Rs.100,000. In this case you can consider Rs 30,000 as your EMI. Start paying this EMI to yourself. Keep paying EMIs to self till you really buy a home. This exercise has several benefits. The best is, it prepares you for future real EMI’s outgo. Further more, paying these hypothetical EMI’s is building a corpus for the future down payment of home. Read: What to do when EMI is too high?

- #4. Have a Personal Cash Flow Report: Buy things you can afford. But often we overspend. We overspend in ignorance. By being aware of our affordability, overspending can stop. Generally, when it comes savings, nothing seems to work for people. But this concept of cash flow report works. Example: I decided to buy a new refrigerator at Rs 49,000. I asked to myself “Is it affordable“? I checked my cash flow report. In ‘miscellaneous shopping’ row I found the money. But at the same time, I was running out of cash for my child’s school fees (Rs.35,000). Fee payment is an uncompromisable expense. Hence I decided to borrow money from ‘miscellaneous’ a/c. As a result, refrigerator purchase got delayed. But a bigger priority was managed. This kind of clarity of cash flow is possible with a cash flow report. Read: How to build a personal balance sheet?

- #5. Lock Money Forever: How to do it? Generally, what we keep as savings is very liquid. This money can get spent easily. Savings account, recurring deposit, fixed deposits are good saving options but it does not “lock” the money. How to lock it forever? Idea: Suppose one has a home loan. Use the savings to make prepayment of loan. Once the prepayment is made, that money can never be spent elsewhere. Find your own unique ways to “lock” your savings “forever”. Read: How to build assets?

- #6. Allocate Extra Funds to Fixed Cost Expenses: What is this? Set an expense budget and give more funds to line items like: Bills payments, Subscriptions, Grocery, Fees, Loan EMIs, Premium payments etc. What is common in them? All of them are near fixed expenses. Suppose your home loan EMI is Rs.30K/month. Will it increase the next month? No. This is why, the allocated additional funds to EMI will never be spent. It’ll remain idle in your bank account. Read: Where people spend money in India.

#5.2 Save Money: By Simple Practices

Saving money is not a rocket science. But it becomes lot tougher if we do not follow a simplified approach.

Here we will see few ideas which are simple, but still has capacity to build substantial savings.

Lets’s start with the simplest of all:

- #7. Keep a Piggy Bank at Home: We always need money to spend on something or the other. It can also be on expensive items like vacation, car etc. Spending on entertainment and luxury cannot be avoided. It is only human to ask for it. But there must be a control. We must understand that it is better to pre-plan for expensive purchases. Planning means, giving oneself a distant date, and then start saving for it. The whole family should contribute to the savings. This type of exercise can also makes the family realise the value of expensive purchases. Read: About recurring deposit.

- #8. Build Small Saving Habits: Small-small saving over a period of time becomes handful. Small saving habits mainly works on the principle of ‘delaying gratification”. Lets see some small savings habits that we can implement in our day to day life:

- Driving a small car (more fuel economy, less maintenance & insurance cost etc).

- Bulk Grocery Purchase: Buy groceries in bulk from places like D-Mart. It can save at least 10% of the bill.

- Use Library: If you are a book-worm, subscribe to a library. This will drastically reduce your cost of new books.

- Reduce Electricity Bill: Identify items in your house which has maximum wattage. Make a plan about how often you can keep this items switched-off in a month. Also, make sure not to leave any electrical appliances on standby.

- Do Bulk Purchases on Sale: Example: Purchase clothes where there is a SALE.

- Reduce Cost on Health: Try to jog early morning in open air instead of spending on gym subscriptions. This will also reduce medical bills in long term.

- Cash Purchase: Try to make all payments by cash. Read: Cards subconsciously trigger people to overspend.

- #9. Save Money for Celebrations: Always keep money aside for Birthday’s & Anniversaries. Not saving for them does not mean that those expense will not happen. Hence, better is to save for it, and enjoy the day when it comes. Try to save for it from at least 12 months prior to the expense date. If you have 4 members in a family, save for all the four heads. Read: How to spend on holiday trips?

- #10. Skip Grocery Purchase: Skip a grocery purchase once every two months. This may sound like a foolish suggestion, but it is effective. All households maintain unnecessary inventory. Funny thing is that, we are not even aware that we maintain it. Sit with your spouse and try to identify extra items. Idea is to push yourself to “consume the accumulated inventory” before it gets stale. How to do it? Do not buy grocery once a while. Suggested Reading: How to stop overspending?

- #11. Buy a day of Financial Independence: How? Suppose ones annual expense is Rs.6,00,000. Divide this by 365. The value that we have now is Rs.1,644 (600,000/365). This is the daily cost. This value (Rs.1,644) can be used to trick our mind, and motivate it to save more. How to do it? Try to save Rs.1,644 in bits and pieces. When Rs.1,644 is accumulated, lock it in a bank deposit. Reward yourself by saying this, “thank you for buying a day of financial independence”. Every Rs.1,644 in savings means, a days worth of savings. Tip: give yourself a target to build savings worth 180 days of expense. Read more on how to trick your mind to save more money.

- #12. Let Parents Save For You: This idea may sound childish, but its effectiveness is almost guaranteed. With our parents, the money will be safest. They will do everything to keep our money as safe as possible. One of the better ways to save money with parents is the form of gold coins and silver. Read: About gold as an investment option.

I will suggest you to device your small-saving strategy. Once you have found one, do not delay. Start right away.

#5.3 Save Money: By Managing Debt

Minimising the cost of debt (interest) is also a way to save money.

In a long term, proper debt management can save loads of money for you.

Let’s see how we can manage debt to save more money:

- #13. Keep Debt Below 50%: Take bank loan, but self contribution should be more than 50%. Use this strategy for bigger expenses like home purchase, car, higher education for child etc. Suppose you decide to buy a car using auto loan. When to buy it? Buy when you have at least 50% in down payment. How to do it? Start a mutual fund SIP and keep contributing till the value is reached. You can also do similar exercise while buying a house. Read: About systematic investment plans (SIPs).

- #14. Prepay Loans: Majority carry personal or home loans. Prepayment of these loans can save interest. Prepayment can not only save interest expense, but can also close loan in half the tenure. There was a stage in my life when I was diverting all of my ‘pay yourself funds’ towards my loan prepayment. Home loan prepayment is a very realistic way of saving huge sums of money. Read: Home Loan Prepayment Calculator.

- #15. Keep increasing Loan EMIs: Increase Home Loan EMI by 5% each year. This is a safe and effective way to save money. We prepay our home loans, right? How we do it? We accumulate money & then make prepayment. The other way is, do not wait for the money accumulation. Straight away approach your bank and ask them to increase the EMI. Let the EMI increase be only Rs.300 per month. Let the compounding of savings do its job. It has been observed that, this way, people tend to pay back their home loans in half the original tenure. Read: Whether to reduce EMI or tenure of home loan upon prepayment.

#5.4 Save Money: By Investing

Investing the saved money is another way to practice savings.

Let’s see where we can invest money as a part of a good ‘saving practice’:

- # 16. Accumulate Precious Metals: Buy gold & silver as part of saving habit. Why purchase gold/silver? Because of its ability to lock funds. Add a column in your expense budget. Name it ‘investing expense on gold/silver’. Keep a target of buying at least 5 gm of gold (or equivalent silver) every year. Presently 1gm gold will cost approximately Rs.3,900. This is equivalent to what we end up spending on weekends, right? Every month save Rs.1,500. This will be sufficient to buy a 5 gm gold coin at the end of the year. Read: About E-Gold as an investment.

- #17. Use High Interest Savings A/c: If you have cash in bank, park it in accounts which pays maximum interest. You will agree that the easiest way to save money from salary is by opening a savings account. Having a savings account and keeping a minimum balance in it is compulsory. But those savings offers low interest. How to deal with it? Open a savings account which can pay the best interest rates. Here are the interest rates offered by few banks on savings accounts:

| Deposit Type | Name of Bank | Interest Rate |

| Saving | DBS | 6.0% |

| Saving | RBL | 5.5% |

| Saving | Kotak, Yes Bank | 5.0% |

| Saving | IDFC, IndusInd, Bandhand | 4.0% |

- #18. Plan Taxes: Our target is to save every bit possible from our salary. Saving our income tax outgo is one such way of doing it. Tax saving avenues that we all must explore are the following:

- U/s 80C – Overall tax exemption is Rs 150,000/year. Example: Investment in ELSS, PPF, NSC, LIC, Home Loan Principal etc.

- U/s 80D – Over all exemption is Rs 50,000 (Self: Rs.25K, Parents: Rs.25K). Example: Health insurance for Self, family, dependent parents.

- U/s 80E – 100% interest on education Loan is exempted from Income Tax. Example: Education loan taken for higher studies of self, spouse, children.

- Read: About income tax planning.

- #19. Buy a MIP: Use your savings to generate monthly income. How to do it? Buy a MIP (Monthly Income Plan). MIP’s are debt linked investments. Hence they are absolutely safe. No need to worry about possibility of loss. Investing in a MIP will serve two purposes. First, It helps you to save money (no risk involved). Second, it motivates to save more as it generates monthly income. Higher will be the fixed income more enthusiastic the saver becomes. Read: About monthly income from investments.

Conclusion

We save money to make our future more secure (like after retirement). Moreover, to deal with the emergencies of life money is essential.

How to manage the priority of financial security and emergencies? By building savings.

Living without savings is like living in a house which weak walls. When emergency (or needs) strikes, the walls will collapse.

This will leave you unguarded.

On an average, a person can save upto 30% of their take home salary. How much you can save (maximum)?

Evaluate your income and expense balance. Prepare a cash flow report for yourself.

Once the report is ready, you’ll exactly know how much you can save. This is a great starting point.

You can then use the #19 tips shared above to maximise your saving potential.

Have a happy saving and investing.

![Goal-Based Saving - Your Path to Financial Control [ A Method] - Thumbnail](https://ourwealthinsights.com/wp-content/uploads/2025/04/Goal-Based-Saving-Your-Path-to-Financial-Control-A-Method-Thumbnail.png)

Great work. simple, easy & well-articulated for layman’s understanding. keep up the good work.

Thanks

Build Small Saving Habits: Small-small saving over a period of time becomes handful. Small saving habits mainly works on the principle of ‘delaying gratification”.this is awsm sir. small savings are the biggest helper.

Money saving tips

I like your article very much. I have explained it very closely to you. Similarly I have read from another website. I love bo too article

I have read many articles of money saving, but this is the best

Thanks for your feedback

I think saving money for future is an important aspect for job based individuals.

But don’t you think that future value of money would be less than current.

E.g. : 1 Lac in 2010 is way more than 1 Lac in say 2030.

So I think we need to keep future value in mind while saving or investment.

Nevertheless, this is a great article

You are right.

To ensure that FV remains intact (net of inflation), investment of savings in a suitable option is essential.

Thanks for sharing great article. I got clear idea about saving my money and how to manage my saving account. I really love this article.

Great in depth article on saving money. I learn a lot from this article. Thanks again!

Thanks for the feedback

Thanks for sharing this growth hacking terms of save money, it’s would be reliable for all individuals.

Yup, this was the goal of publishing this post. Thanks